Markets At The Open

Judge Rules XRP Is Not A Security - Sources

Blackrock Refiles

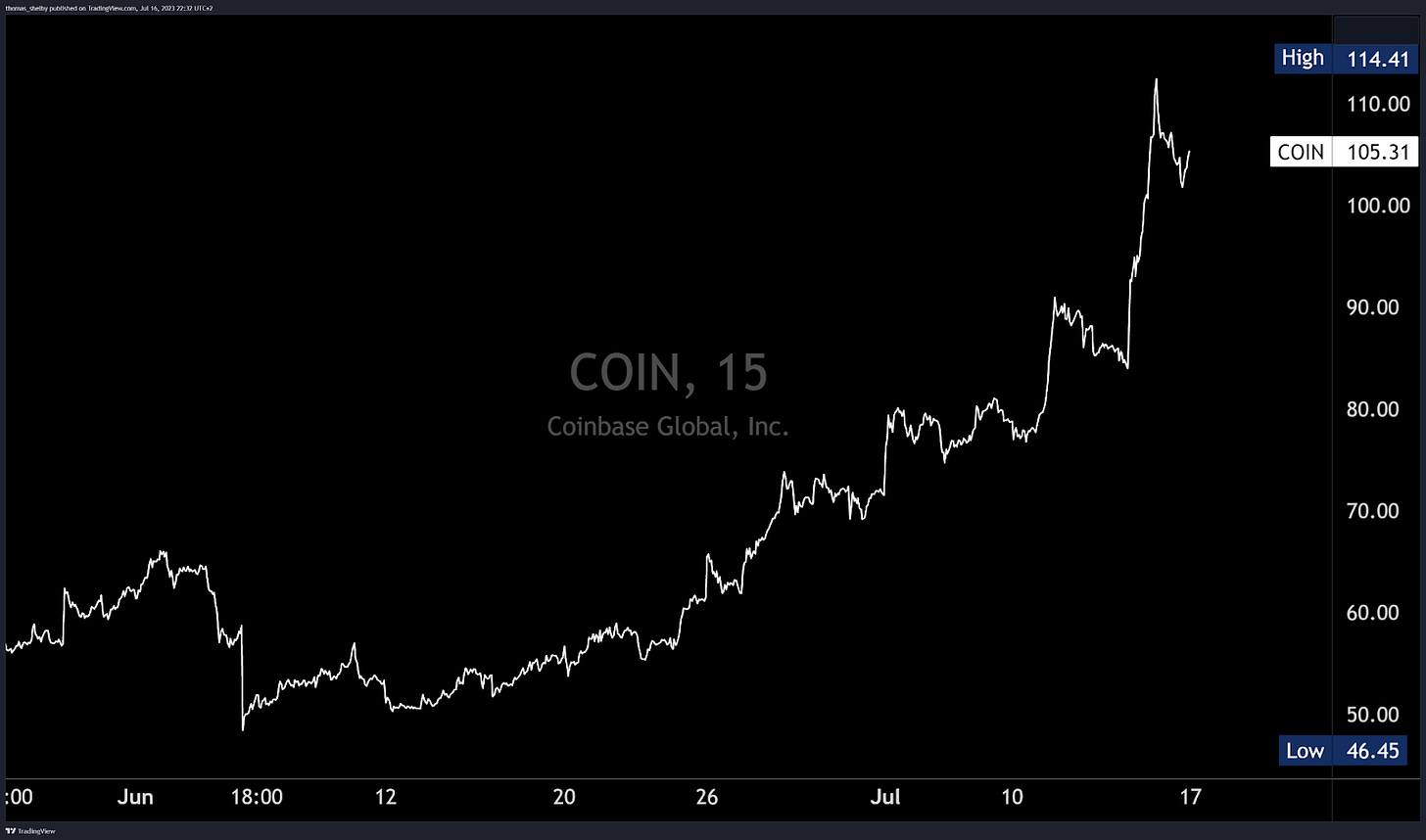

Earlier last week, Blackrock refiled an amended application for the Bitcoin spot ETF, stating that it will also be establishing a bilateral surveillance sharing agreement (SSA) between Coinbase and Nasdaq. However, the Bitcoin rally took a breather, lacking the same immediate impact as when the world's largest asset manager first revealed its intentions to file for a spot ETF on June 15th.

Other major players in the asset management industry, such as Valkyrie Digital Assets, also joined the trend by confirming their partnership with Coinbase for the surveillance sharing agreement (SSA) related to their spot ETF filing. Valkyrie, which already operates a Bitcoin futures ETF on the Nasdaq with the ticker BTF, adds to the growing list of companies naming coinbase as their collaborator.

CEO of BlackRock, Larry Fink, who has long been skeptical about Bitcoin and cryptocurrencies in general, turned some heads during a midweek appearance on CNBC. Fink briefly discussed BlackRock's recent filing for a spot Bitcoin ETF and highlighted their good ETF approval track record. He also emphasized their commitment to working closely with regulators.

He expressed a lot of enthusiasm for the tokenization of real world assets and securities, and the potential for making Bitcoin more cost-effective and accessible. He even compared it to Gold - calling BTC an ‘International Asset’.

While Fink's previous concerns about illicit activities are well-known, he now appears to be embracing the underlying blockchain technology.

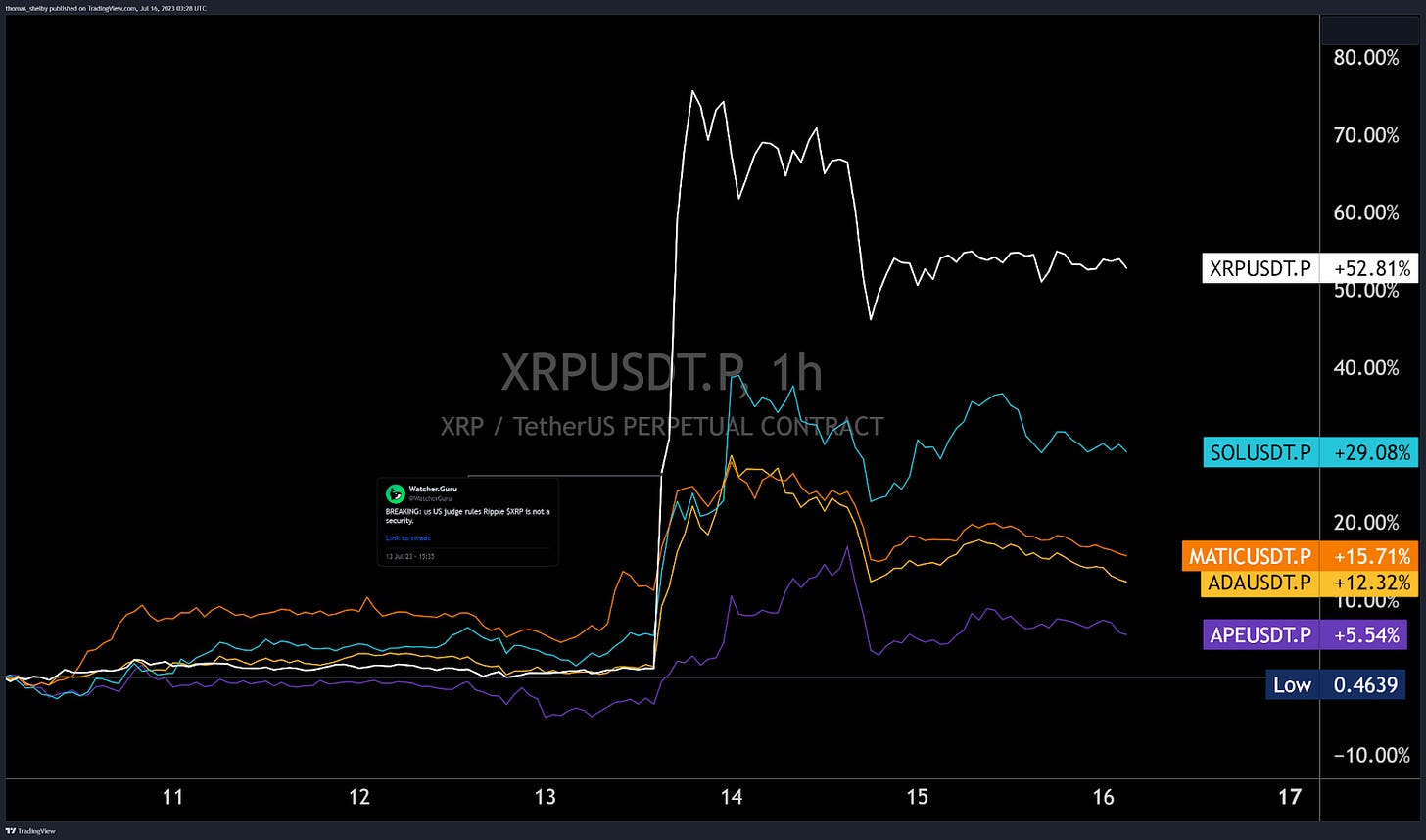

XRP’s Landmark Win

On July 13, 2023, U.S. District Judge Analisa Torres ruled that the sale of Ripple's XRP tokens on exchanges and through algorithms did not constitute investment contracts. This is because these sales did not represent an investment in the success of Ripple. However, the institutional sale of the tokens did violate federal securities laws, and Ripple is liable to pay disgorgements of up to $624 million. The exact amount will be determined in the near future.

The ruling was a landmark victory for the crypto industry, as it provided a much-needed clarity on how cryptocurrencies should be regulated in the United States moving forward. XRP’s price surged over 100% through the day following this news.

In addition to the ruling, many US based exchanges relisted XRP following the newfound clarity. This includes major exchanges such as Coinbase, Kraken, and Gemini. The relisting of XRP is likely to increase buying pressure on the token, as market makers have to buy back inventory to be able to market make, which they had gotten rid of during the SEC investigation/XRP delistings from major exchanges.

SEC “Security Coins”

As mentioned earlier, the market experienced a widespread shift towards risk-taking, after the judge ruled Ripple's $XRP as not being a security. Apart from the notable surge in value for XRP and its fork XLM, traders jumped on the next opportunity and showed consistent demand which appeared relatively stronger, compared to other conventional cryptocurrencies. Several coins that were previously considered securities by the SEC, namely SOL, ADA, MATIC, and APE, emerged as prominent leaders during the market’s bullish shift. It comes as no surprise that this event sparked a renewed appetite for risk and new narratives, particularly amongst traders who had missed the initial long trade opportunity on XRP.

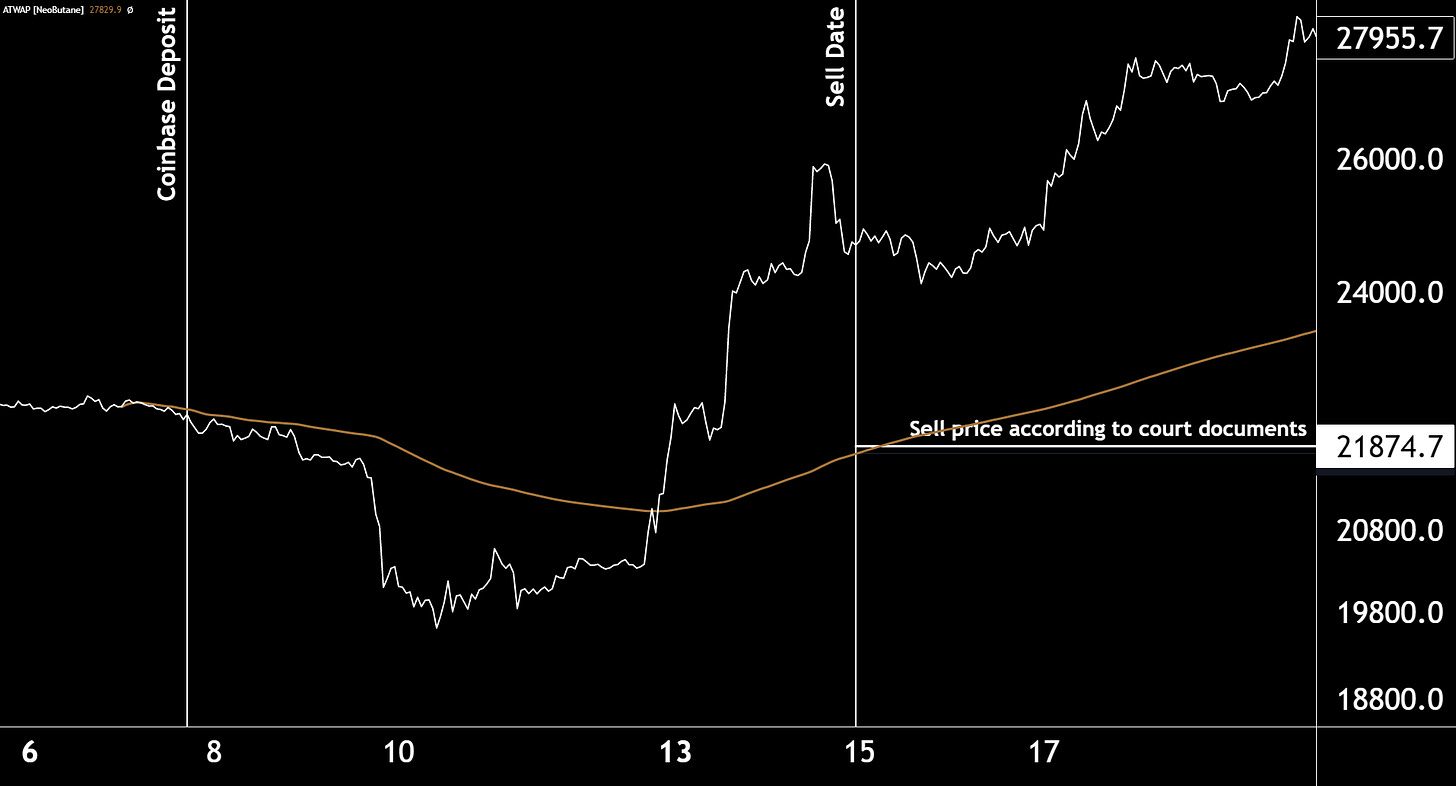

Following The DOJ Trail

On July 12th, at 1:26 PM UTC, 506.55 seized Silk Road Bitcoins were moved. Twelve minutes later, another transaction was initiated for 9318.73 BTC. This amount matched the amount specified in court documents meant to be sold off in 5 batches, totalling approximately 50k BTC. However, as these transactions were with Replace-By-Fee (RBF) enabled, many news outlets and on-chain platforms couldn’t pick them up before they were confirmed. Additionally, these coins weren’t being sent directly to Coinbase which resulted in the news being partially shrugged off and the initial sell off being corrected.

Nevertheless, despite the bulk of this BTC being split into dozens of smaller wallets, for discretion or logistical reasons, the evidence was concrete that they ended up in exchanges to be sold over the next week(s). It’s impossible to list all of the transactions in a succinct manner so we’ll just include a few transactions and exchange addresses for you to confirm the trail if necessary.1

Coins are ending up in Coinbase, Binance and Kraken. Our best guess is that the DOJ struck a deal with an OTC firm to liquidate the BTC on their behalf, and they are using multiple venues to do so. The previous time government coins were moved to an exchange, the batch was sold off using a TWAP( time weighted average price) mechanism, over a 7 day period.

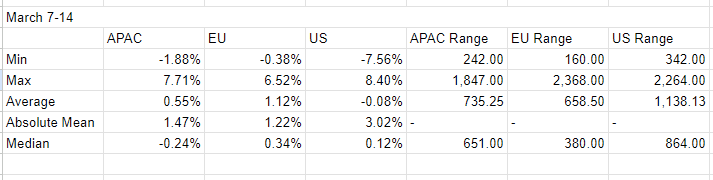

Therefore, we should in theory see approximately $44m worth of Bitcoin to be on the offer every weekday until July 19th. Ceteris paribus, this should make the US session feel heavier and more volatile, whereas the EU session will remain favoring longs. Data from the respective March week seems to support this case.

There’s a caveat though; the US relative weakness and EU outperformance were much more prevalent after the declared sale date of March 14th. Therefore, we are not ruling out the possibility of the sale being conducted on paper (based on the 7d TWAP) and then, over the following days, the OTC desk proceeding to liquidate the coins during US hours. In fact, data and court documents’ wording point to this scenario being the most likely. That said, both scenarios remain viable options for now, and will have to be discerned over the following week, more specifically after July 19th.

Binance Shenanigans

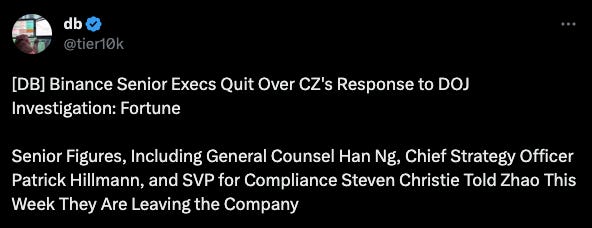

Fortune reported last week that senior Binance executives, including general counsel Hon Ng, chief strategy officer Patrick Hillmann, and SVP for compliance Steven Christie, informed CZ that they will be resigning from the company due to their dissatisfaction with his management of the regulatory investigations.

The Price of BNB dropped by ~3% after the news came out.

Bitcoin and Ethereum

For the past three weeks, BTC has been consistently ranging between $29,500 and $31,800. The majority of its value remains concentrated between $30,000 and $30,900, with both buyers and sellers predominantly agreeing on $30,300 as a fair price.

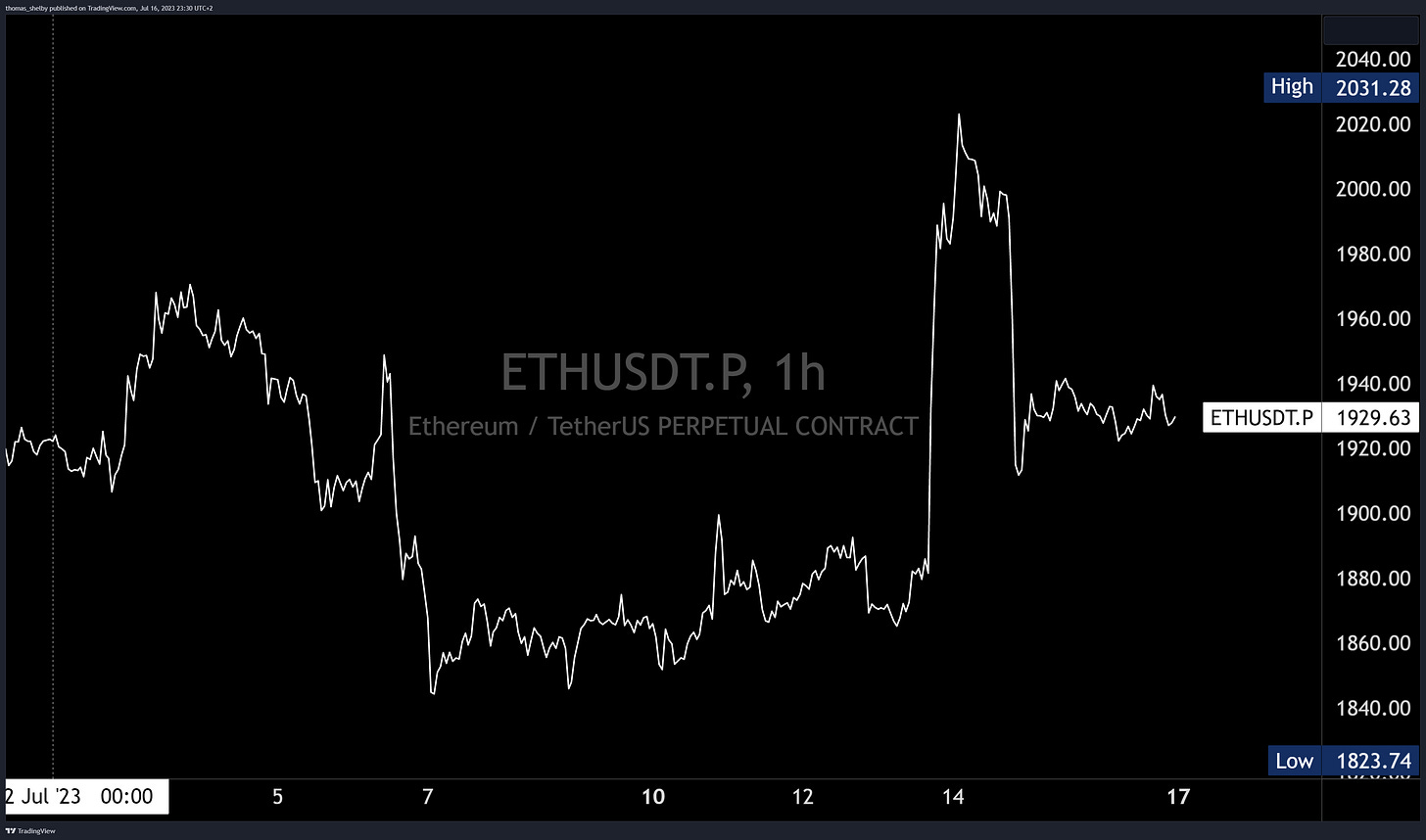

ETH has managed to reclaim its losses from the previous week and is currently trading around weekly highs, around the $1940. The news about XRP was seen as broadly positive for alts, and teleported ETH to trade as high as $2,030 across various exchanges. However, some of these gains were turned over the following day. The current weekly value now lies between the $1850 and $1950 for the market.

Altcoins

MATIC Rebranding to POL

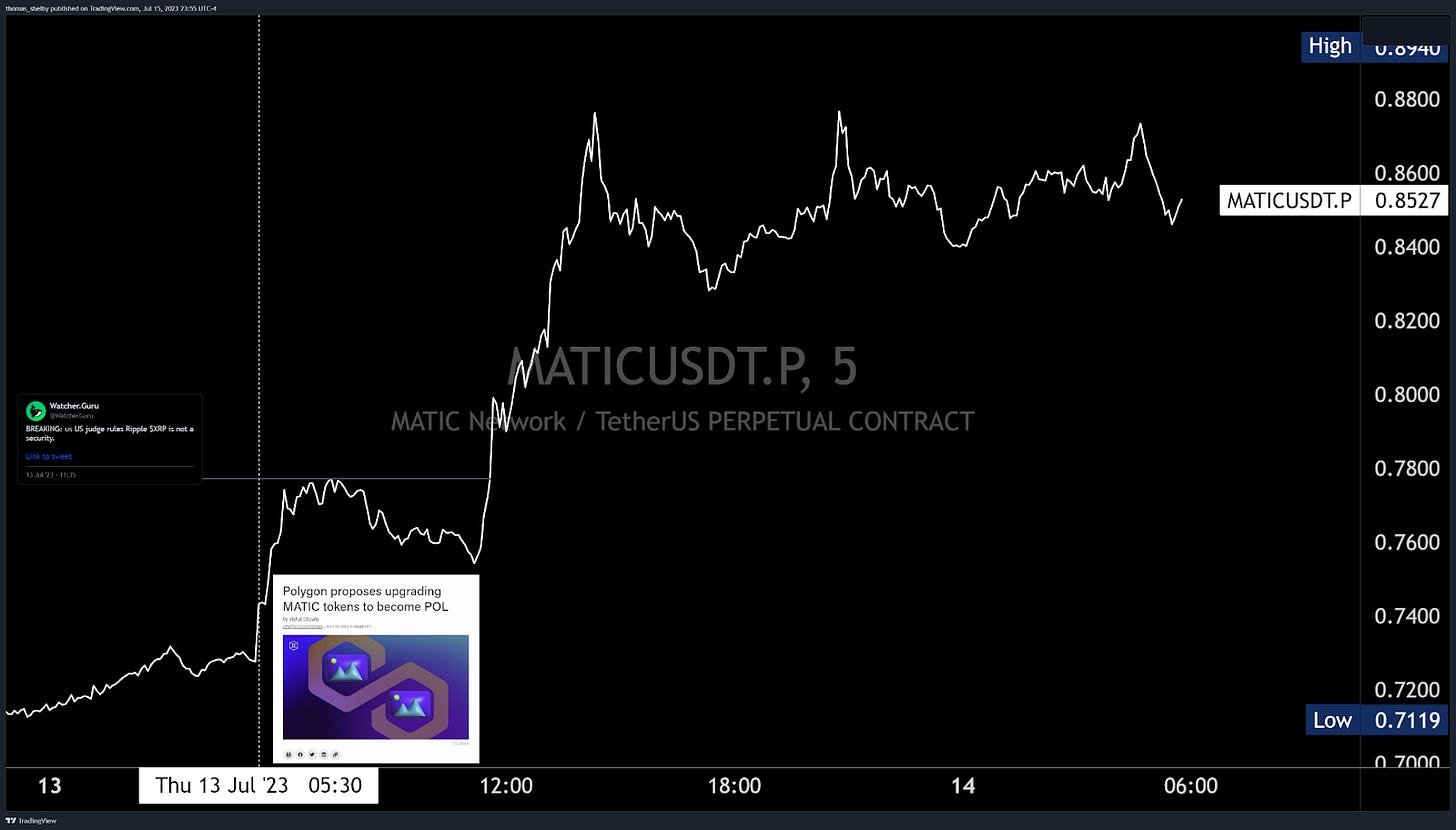

In a move to enhance the functionality of Matic, Polygon team presented a technical proposal to convert and rebrand the current native Matic tokens into a more versatile token, POL, as part of its migration to Polygon 2.0. Upon community approval, the proposed POL token will take the place of MATIC at a 1:1 exchange basis. This upgrade is tailored to empower the community members to validate transactions across multiple chains and engage in various roles, thereby broadening their opportunity for rewards.

After Polygon proposed upgrading MATIC tokens to POL, MATIC jumped 7% in the following 15 minutes and just as the price started coming back down, the XRP news came out and lifted the entire market, sending MATIC another 18% higher. As mentioned earlier, MATIC was a token considered as a security by the SEC, and the XRP ruling brought a bullish sentiment to all “security coins” explaining the strong bid throughout that day on MATIC.

The Block

Multichain Hack

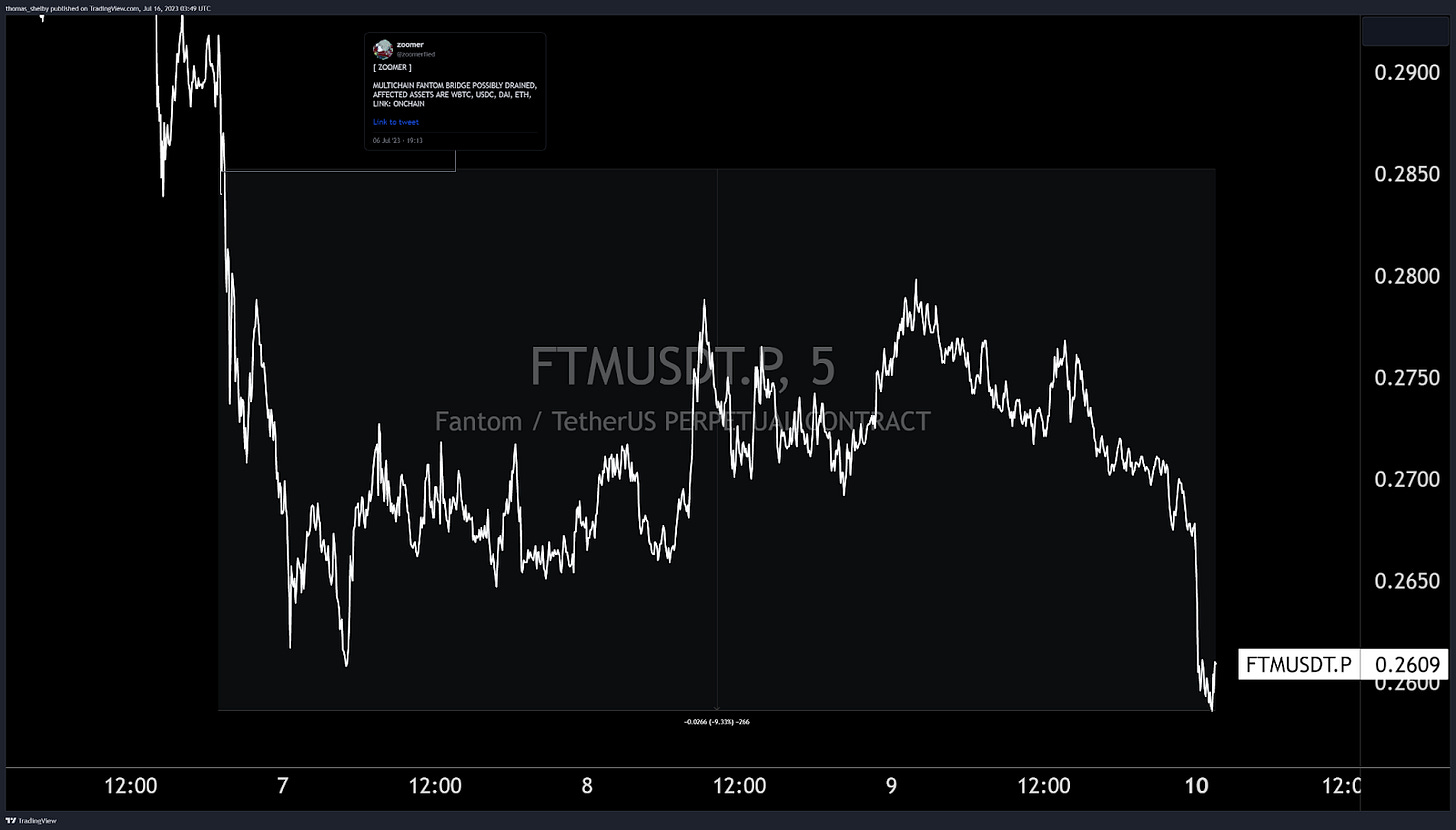

On the 7th of July, approximately $127M of locked assets on Multichain were atypically moved to 6 different addresses. Upon investigation by the multichain team, they seemed to be unsure of what had happened, but immediately stopped services and bridge transactions. Fantom, Moonriver and Dogechain bridges were exploited through Multichain, and this led to a strong sell-off for the tokens involved, with FTM depreciating by 7.55% in the 2 hrs following the news.

On July 14th, Multichain disclosed that their CEO, Zhaojun, and his sister are being detained by Chinese authorities, leading to the revocation of all operational access keys to Multichain's MPC servers, and the team has been compelled to suspend all operations. They are currently endeavoring to inform their users about this situation and are imploring GoDaddy to halt services on their domain. Concurrently, Geist Finance announced they are closing their doors.

Zoomer

Lookonchain

EDUcate

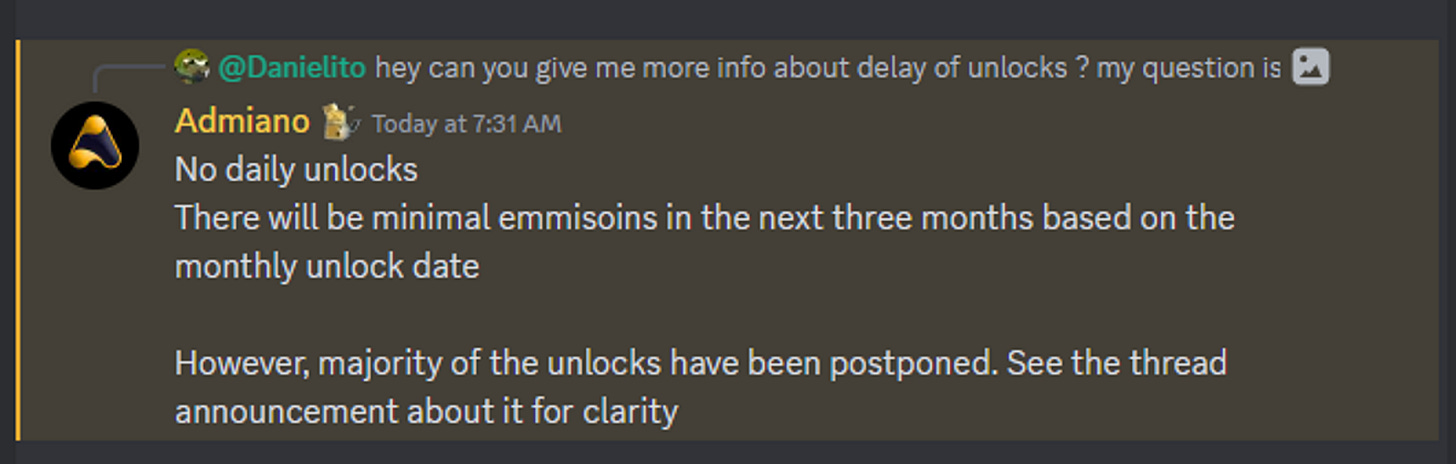

Last week, EDU (Open Campus) announced that they are going to postpone their unlocks for the next three months. This however does not mean 0% emissions, but they will be significantly reduced compared to before.

The price of EDU reacted with a 20% rally, but due to the heavy market conditions, sellers took control and the price fully retraced back to its pre-announcement levels. Although the supply release for EDU has been slowed down, It is yet to be determined if there will be on going interest from participants for this token.

MDT : Future of E-mail?

Measurable Data Token introduced the "future of email," an AI language model-powered email. It took 2 minutes for the price to react, but the market eventually pushed the price by 56%, followed by a nasty 27% dump in less than an hour. During the following days, MDT continued slow bleeding to lower levels.

It is worth noting that this pattern was seen recently with many coins (such as ARPA) in which DWF Labs is involved as a market maker (MM).

TradFi/Macro

Economic Data

We had very solid inflation data from the US, both measures climbed 0.2% m/m and less than economists forecasted, with 3% y/y in headline and 4.8% in core also the lowest since 2021.

The Fed's favorite inflation gauge ‘supercore,’ which measures services excl. housing and energy printed the smallest increase since 2021 at 4%. Only grocery prices and medical care services saw little changed from last month.

University of Michigan survey unexpectedly ticked up on Friday, dimming the sentiment somewhat. 1 year forward expectations were up 3.4% from 3.3% prior and 3.1% expected, as well as longer term expectations with sentiment for all groups rising to its highest since September 2021 (probably a result of a surging stock markets and tight labor).

Stock and Bond market

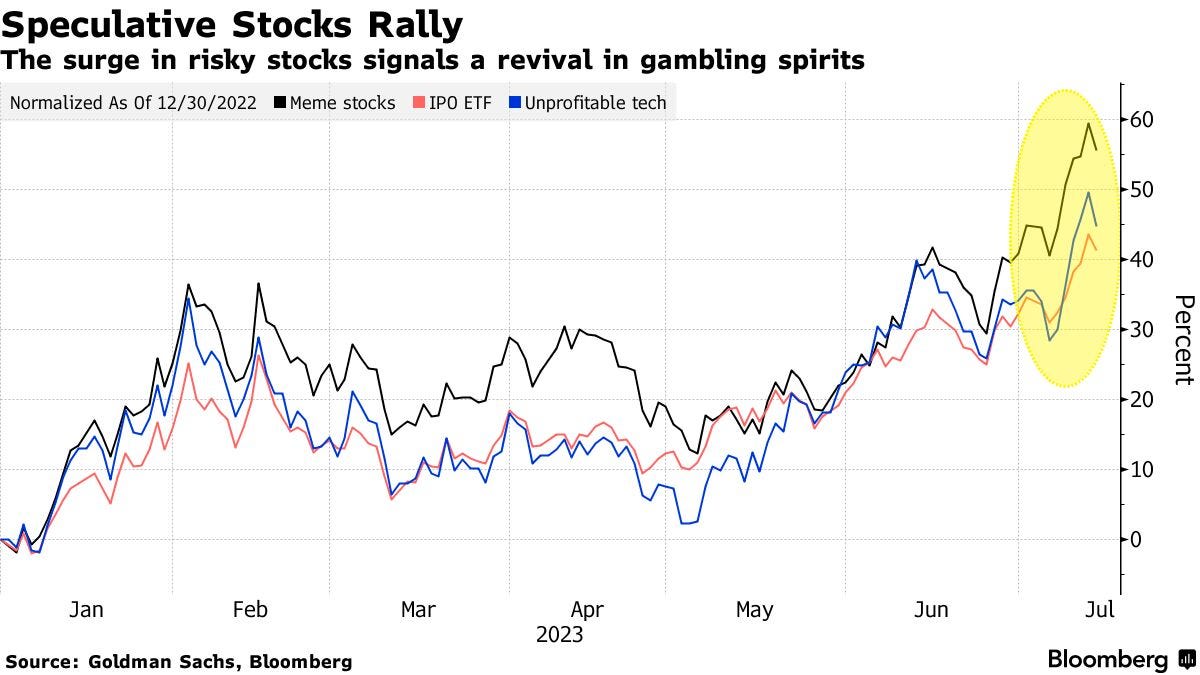

As a reaction to cooling inflation, yields plummeted and markets kicked off an ‘everything rally.’ Global stocks finished with the biggest weekly gains since November. This reinforced bets that the hiking cycle will soon end, which was also supported by a weak US Dollar, which lost 2% of its value and sank the most since November last year in only 5 sessions.

Retail investors started to come back as the meme stock index rallied about 8% led by crypto related stocks.

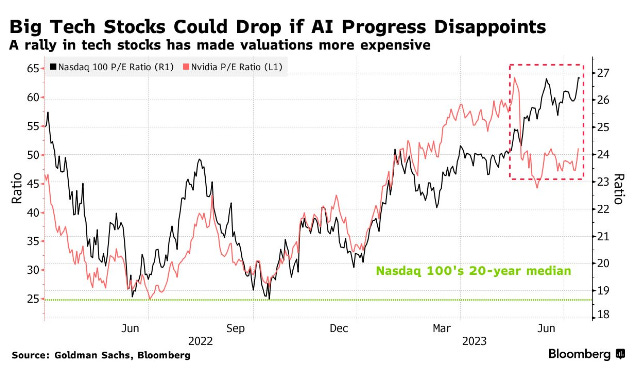

We are now starting to see parallels to 1999/2000 and 2021 where gambling spirits and sentiment dominate fundamentals and everyone slowly enters the same boat.

Biggest Inflows

-Global stock funds $11.6 billion dominated by tech

-Bond funds $12.1 billion

Biggest outflows:

-European equity funds seen outflows the 18th week at $3 billion

Central Banking

In contrast to markets, Fed speakers kept warning this week that it is too early for policy makers to declare victory against inflation. Mary Daly said on Thursday it is too soon to say they have done enough, while Fed governor Waller came out with even more hawkish comments later on saying he expects two more rate hikes to bring inflation back to its target.

Markets currently price only 50% chance for hikes after July and at least 6 cuts throughout 2024.

Outlook for next week

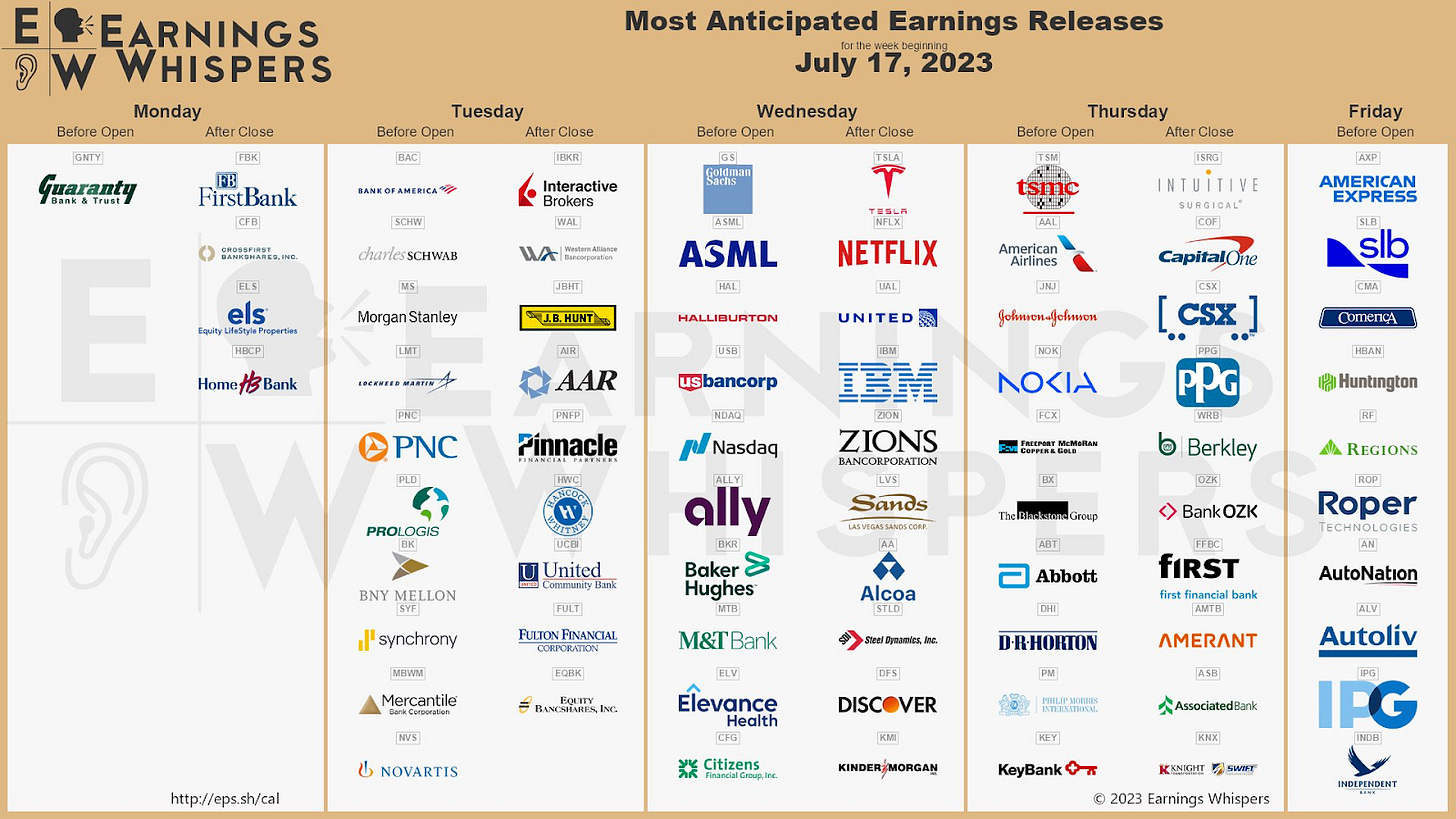

Q2 earnings season got kicked off on Friday with Blackrock, Citi, JPM & Wells all beating estimates but not enough for a sustainable rally after cash open, which brings the question of how much steam is still left for further price gains.

Valuations keep pricing a ‘Goldilocks’ scenario, and from our point of view only strong beats will result in a continuation, while small misses will lead to sharper sell offs.

Monday & Tuesday is covered by retail sales from China and the US, Big Tech starts reporting on Wednesday with big names like Tesla, Netflix, IBM and TSMC.

Q2 earnings are particularly important as cooling inflation and strong labor kept fueling the rally across all markets but could also backfire and lead to slower growth as it erodes profit margins. Consumers won’t accept higher prices anymore while labor costs stay elevated.

Traders will focus mainly on the development in the AI sector and whether the enthusiasm can sustain.

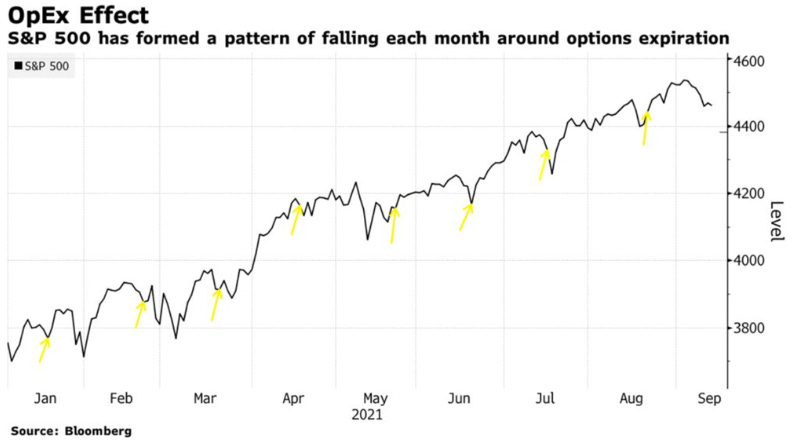

Note

Keep in mind that markets enter a window of weakness where steady buybacks at the end of the day flatten the more we move towards monthly options expiry on Friday. After ‘Mopex’, bears will get another shot as constant bidding for stocks by market makers are taken out of the market and Vanna/Charm flows go on vacation.

Because we are in vacation season and summer trading usually brings less activity, we will be releasing our newsletter every 2 weeks, instead of the standard weekly publish, till the end of the summer.

Good luck, stay safe.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @cryptoalle @FoftyOerney @ahoras_ @Wassie2835 @SmartGamblinggg @MeDeity @betsizing @audy_xbt

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

[1]First initial split https://mempool.space/tx/804387823628e0734f3925ffc29e7d3208a8ee2f898dd7ae0b784b79cc9d8979

[2]Binance deposit thats trails back to [1]

https://mempool.space/address/19aaLsPkiJuFZck7U4mryKFiUg633UJDhm

[3]Kraken deposit that trails back to [1]

https://mempool.space/address/3E2adcep2NRRpriLnWn1AvW3AHKqBx2mMr

[4,5]Transaction chain from [1] to Coinbase

https://mempool.space/tx/aa7b8f20ce56fa5bb2efd579937244cfe5ad03f0b498b63c14cc5469fcd7ec6e

https://mempool.space/tx/19c180b3ab1ef93fe0e690c8a0faeccedb20befcb7055307abc0b3c69625ba85

thanks for your work