Markets At The Open

June 5th - June 11th

This week was significant for the crypto markets as on Monday June 5th, the US Securities and Exchange Commission (SEC) filed lawsuits against two major cryptocurrency exchanges; Binance and Coinbase. The SEC alleges that both exchanges violated US security regulations by offering non registered securities.

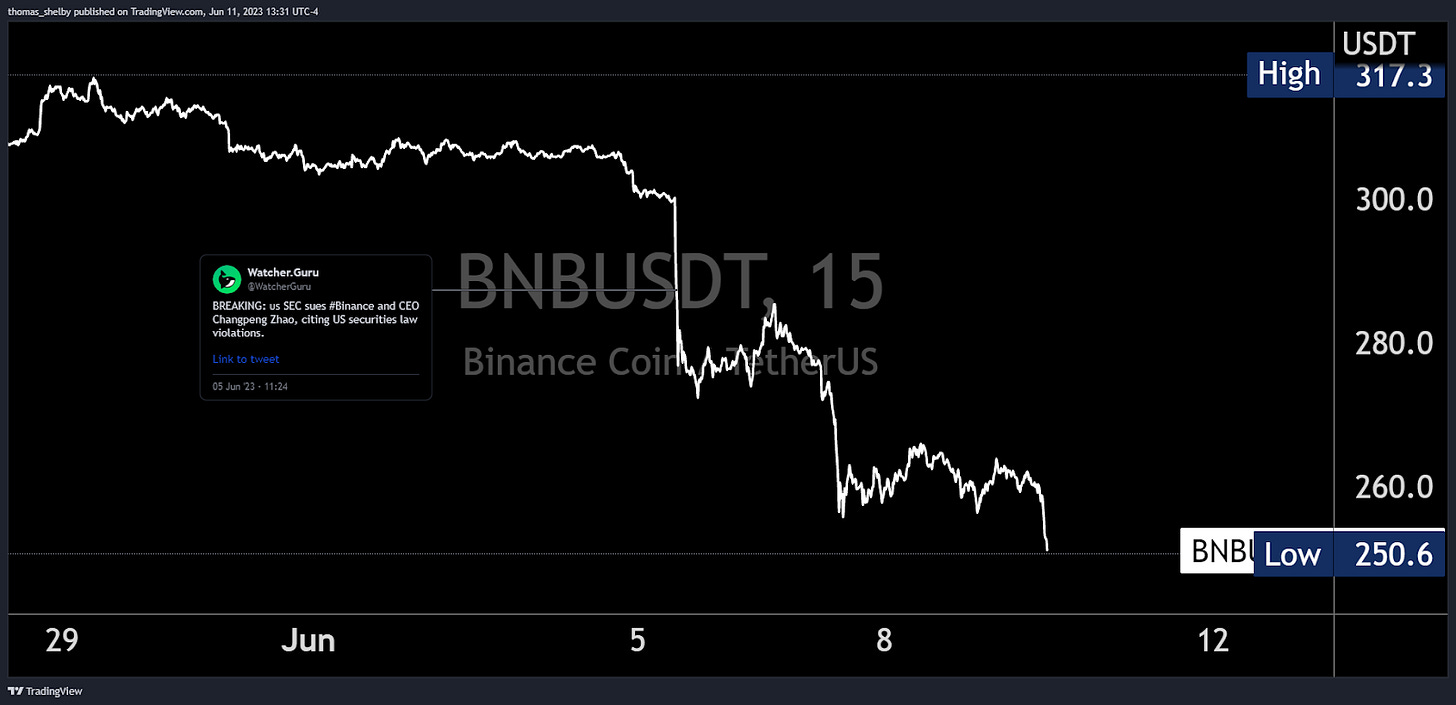

Binance

In the Binance lawsuit, the SEC identified both the native BNB token and BUSD as securities. As a result, the price of BNB dropped by 10% from the time of the headline to reaching a daily low of $253.39.

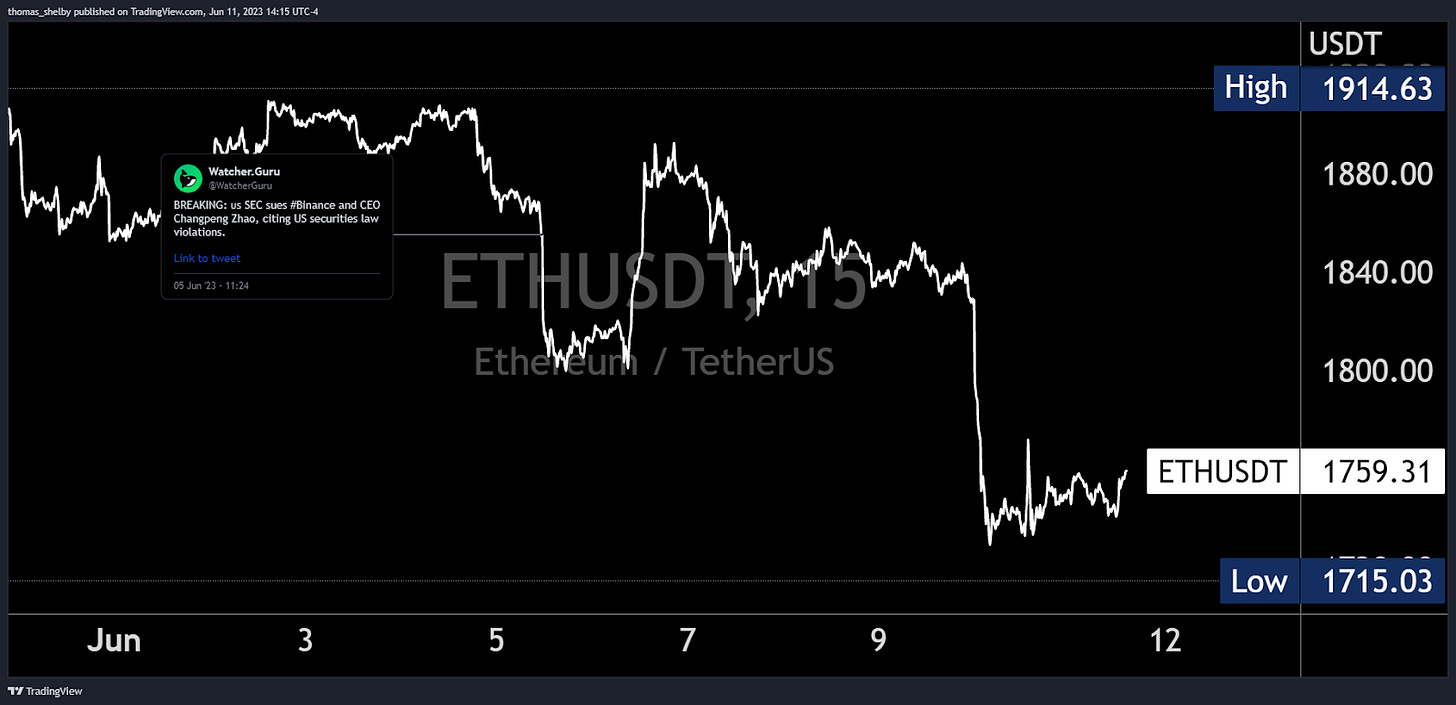

The SEC also categorized other cryptocurrencies, including SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI as non registered securities. Although these tokens aren’t directly tied to Binance, this filing provided the market with some clarity on what the SEC deems non registered, and as such these tokens also experienced a ‘sell the news’ event. Leading cryptocurrencies, Bitcoin and Ethereum, experienced intraday falls. Bitcoin dropped from $26,800 to $25,400, and Ethereum from $1867 to $1775.

WatcherGuru

Furthermore, the US subsidiary of Binance International, Binance US, announced that they will temporarily be a crypto-only exchange, meaning that there will be no access to USD withdrawal/deposits, i.e fiat on/off ramps.

Coinbase

Less than 24 hours after the Binance lawsuit, the SEC targeted Coinbase for selling unregistered securities. The SEC also issued a cease and desist order specifically related to Coinbase's staking offerings. The SEC identified a group of coins falling under the securities category, including SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO. This additional enforcement increased the sell pressure of these coins specified by the SEC.

These lawsuits represent a new phase in the ongoing efforts of governments to regulate the cryptocurrency industry, and more clarity is expected to emerge in the upcoming weeks.

Robinhood

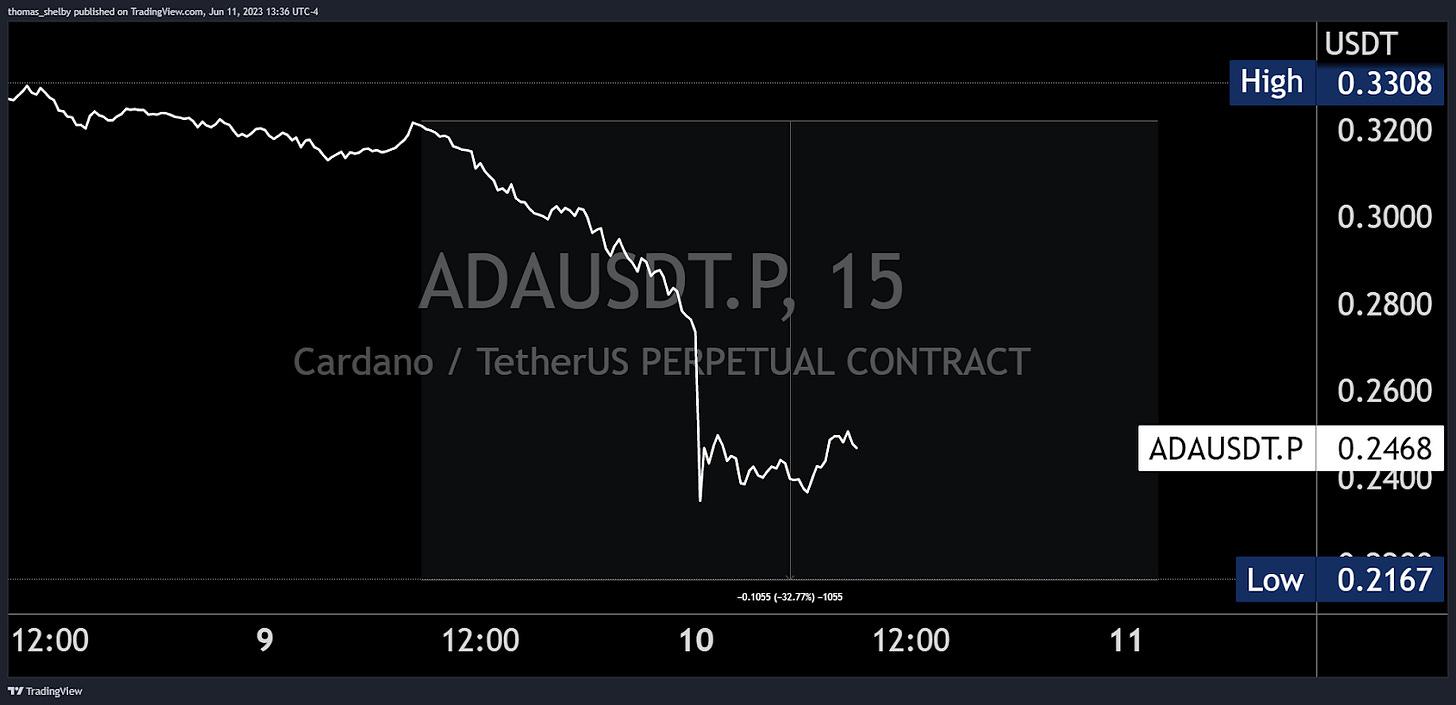

Followed by the SEC move, Robinhood decided to end support for several crypto assets including SOL, ADA, and MATIC.

Despite the lawsuit against Coinbase, Bitcoin made an equal low, and then proceeded to rally 7.8% to new weekly highs. Bitcoin traded within the range of $27,500 and $25,300 for the week, and Ethereum traded between $1914 and $1712.

Weekend Sell-Off

The SEC actions triggered a tricky environment for crypto markets going into the weekend, and players decided to cut their risk which caused a massive sell off on Saturday across the board. Numerous coins were down over 25% just hours after the daily open, and BNB was trading at $225 at the lows. Total liquidations on Binance perpetual products were approximately $300mm. A couple minutes after the heavy altcoin sell off, BTC and ETH fell to $25,400 and $1720 respectively. It is no surprise that following the Robinhood announcement, MATIC, ADA and SOL had some of the biggest % down moves out of all the altcoins during the Saturday liquidation event, each falling over 20% in that hour.

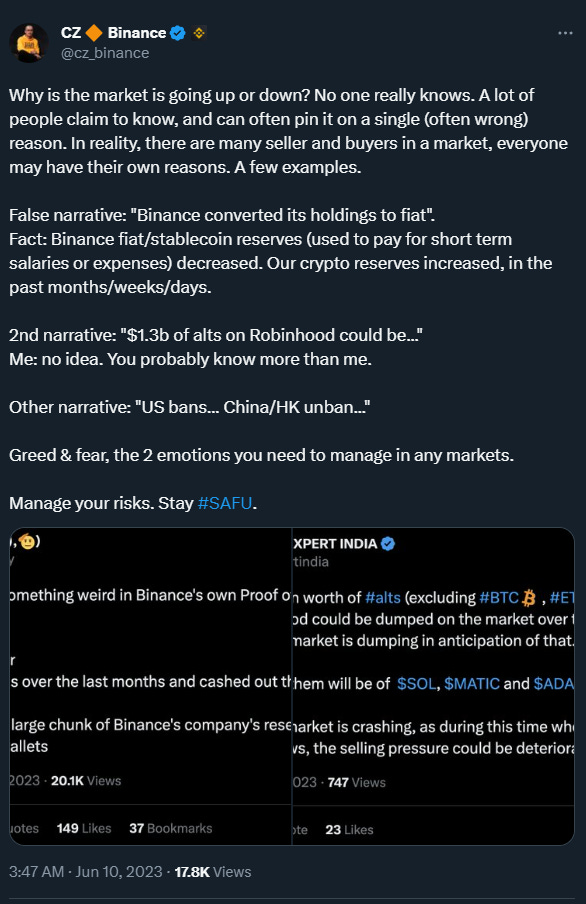

At the time of the dump, CZ ended up tweeting about the possible narratives of the move. The market found some stability at the lows following his tweets:

CZ on Twitter

More CZ takes on Sunday before the CME futures open:

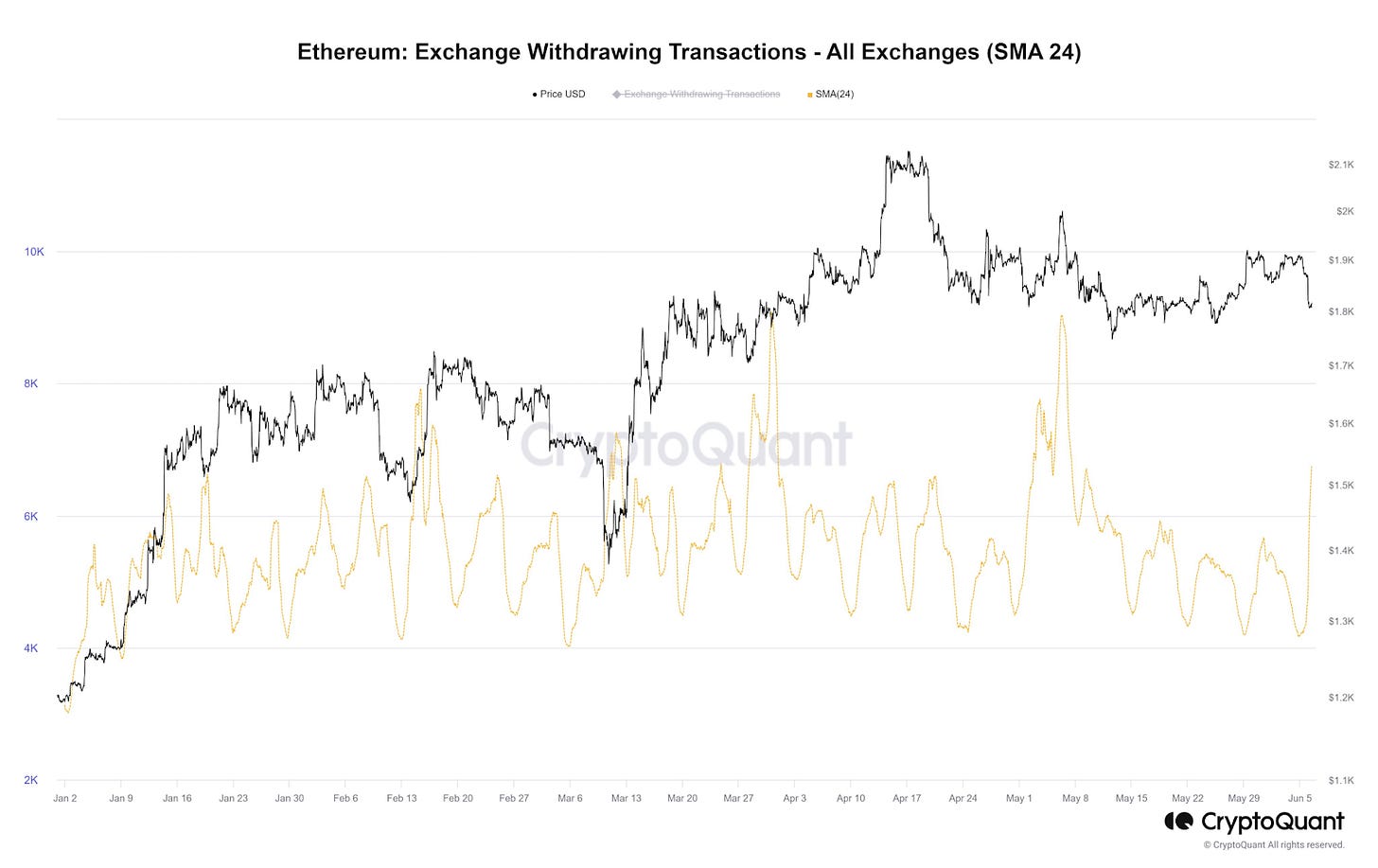

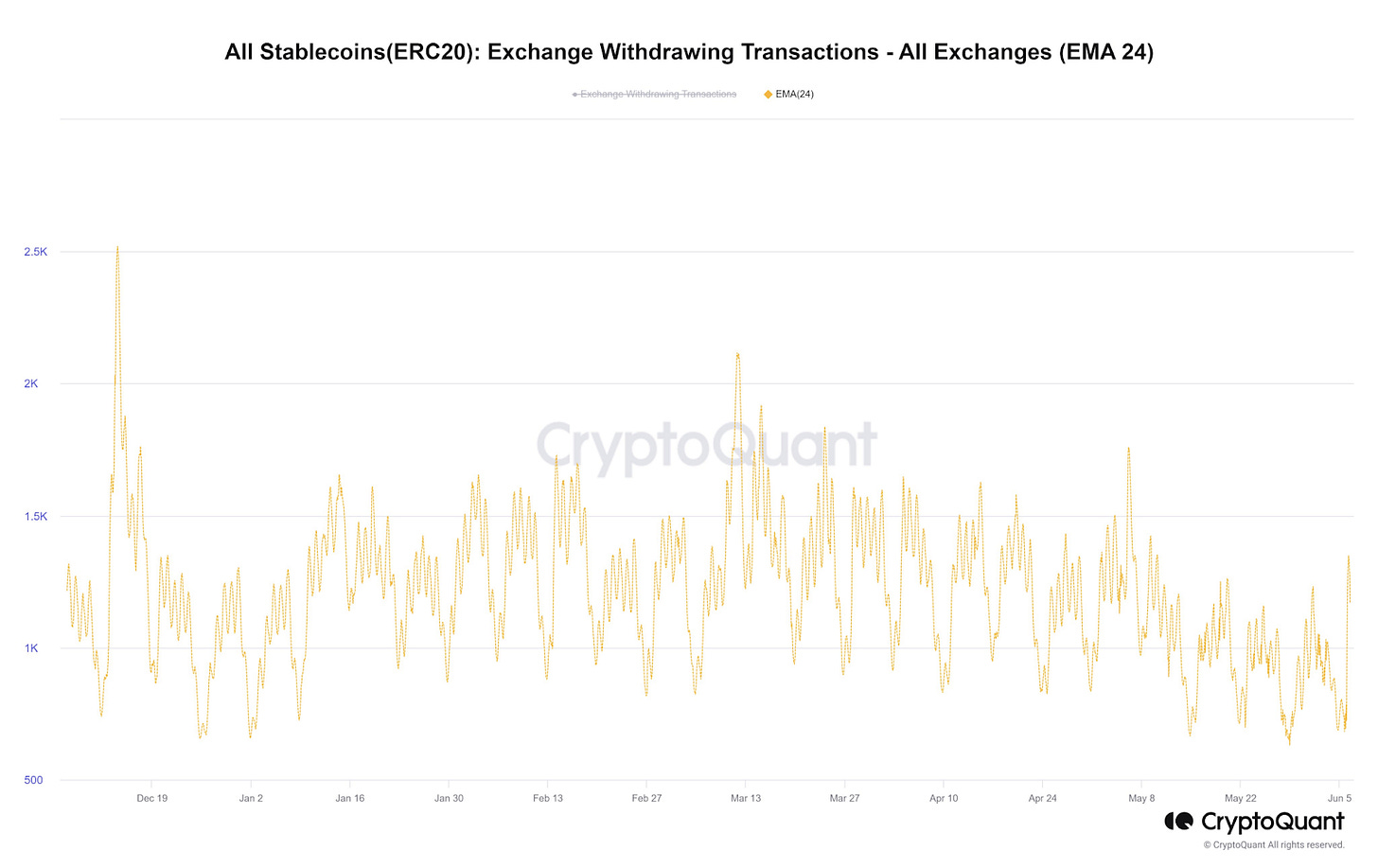

As mentioned above, the SEC actions had a strong impact on the market, but Binance didn’t experience significant fund outflows aka a “bank run,“ like the market had seen in the past during the FTX collapse. The Binance outflows as per CZ in the first 24 hours were $392m, which indicates that market players weren’t worried or concerned about Binance securing their funds. Current client assets on Binance are worth roughly $55.69 billion.

Bullish Headline

A narrative that managed to come out of the onslaught of regulatory news was the support for the cryptocurrency industry by Soros Fund Management, the investment arm of billionaire investor George Soros, at a recent Bloomberg Investment Summit.

Although this is a bullish narrative, it wasn’t enough to outweigh the SEC impact all week.

Render Network/Metaverse and the Apple WWDC23

The market was waiting for the Apple developers conference in hopes of a meaningful market impact to the related sectors, specifically metaverse (in anticipation of the highly expected VR product launch) and the Render Network. Market participants were positioned speculating that Render could have its product ‘Octane X’ mentioned in the new OS version.

However, the event didn’t meet expectations. ‘Octane X’ workspace was presented in one of the slides without any mention or logo appearances. On the ‘Vision Pro VR’ product launch, the Apple team announced 100% on-device rendering, which proceeded to accelerate the RNDR selloff. It’s worth noting that the metaverse related coins experienced bearish price action before and after the event.

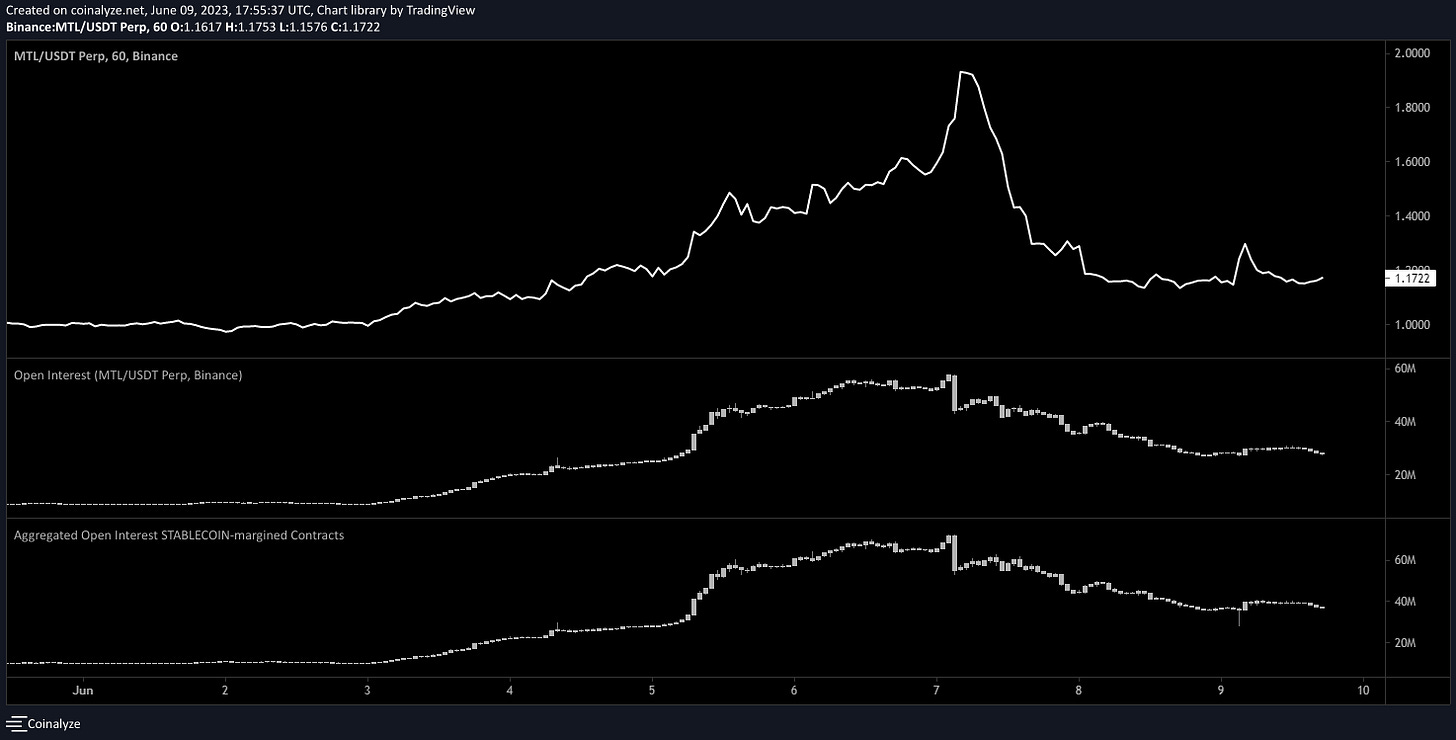

MTL Squeeze + Blow Off

In the early week there was a steady increase in volume on the MTL/KRW pair, going from 48 million to 250 million KRW in a span of only 2 days on the Korean exchange Upbit. Recently, these sharp volume and open interest spikes have led to massive short squeezes and eventual blow of tops, which occurred on Tuesday and Wednesday with MTLUSDT.P.

The pair started to increase from $1.50 to $2.30 in roughly 4h, squeezing approximately $15m in short open interest. The spot market for MTL on Binance traded at $2.80, which caused an inefficiency in the ‘mark vs. last’ traded price. Binance capped funding at -2% every 8 hours (~2100% annualized). Evidence that this squeeze was a combination of the OI drop, along with high negative funding, which led to a full retrace the next day to around $1.10.

Past Week In The Traditional Markets

Economic Data:

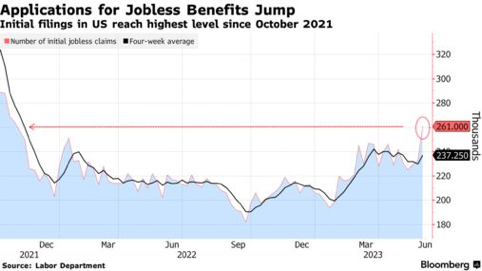

It was a quiet week with little to no data from the US hence the suppressed volatility (Vix 3-Year low). Monday’s Service ISM and Thursday’s Jobless Claims indicated for the first time that the economy entered full contraction with Jobless claims spiking to the highest levels since October 2021. This however is nothing dramatic as these numbers can be revised, seasonally adjusted, or volatile in general, but is something to keep in mind if the next few weeks show similar prints.

Stock & Bond Markets:

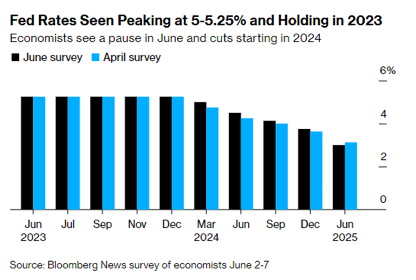

The bullish market sentiment and subsequent stocks rally on Fed pause and Soft-Landing narrative got disturbed on Wednesday after the Bank of Canada surprisingly hiked rates 25bps (seen as potential proxy for FOMC). The consensus rebounded on Jobless Claims and is now skewed towards a pause in June, a 25bps increase in July, while cuts are getting priced out for 2023.

Friday started to show increasing bullish market positioning towards 4400 on the SPX with the Vix still suppressed with a put/call ratio of 5, indicating no fear or stress in the market yet. This was supported by the fourth weekly streak in gains in regional banks.

Noticeable however was the capital rotation into value on Wednesday. This didn’t materialize fully, indicating that a cooling job market is seen more bullish for growth stocks.

As of now, high unemployment means the Fed is forced to go slower on hikes and QT, or cut earlier. This in turn is bullish for the Nasdaq.

Outlook/Market Moving Events For Next Week:

Central Banking:

The Fed is currently in Blackout Period and is not allowed to comment, though several speakers and Nick Timiraos (the ‘Fed whisperer’) signaled a pause. Unless Tuesday's CPI or Wednesday's PPI surprises are meaningful to the upside (>30bps above estimates), this sentiment towards pausing should continue.

What markets might mis-price here though is a hawkish tone from Powell to placate the hawks in the committee. The hawks are worried about inflation not coming down quickly enough, along with disappointing NFP data from last week.

The ECB meeting on Thursday, with an expected hike of 25bps, should not bring any surprises. With sticky core inflation across the Eurozone, the ECB still lags behind all other central banks in their tightening cycle. An unexpected pause would cause a plunge in EURUSD, but chances of that pause are currently low as Lagarde repeatedly has been saying that there is no evidence of a peak in underlying inflation.

The Bank of Japan meeting on Friday is the second most important event of the week to watch out for. Japan's inflation started to surge, and a tweak of YCC would cause turmoil in the US bond market as foreign money would head back home and foreigners would reduce buying bonds, auctioned by the Treasury. No major shift, however, is currently expected. Analysts argue that the door may close for making adjustments after other big players stopped their tightening.

This upcoming week will also see inflation related data and therefore an important factor for future monetary policy decisions by the Fed. They will most likely take them (CPI/PPI) into account for the decision on Wednesday.

CPI on Tuesday

CPI m/m: est +0.2% vs 0.4% prior

Core CPI m/m: est +0.4% vs 0.4% prior

PPI on Wednesday

PPI m/m: est. -0.1% vs 0.2% prior

Core PPI m/m: est +0.2% vs 0.2% prior

Retail Sales on Thursday

Retail Sales m/m: est. -0.1% vs 0.4% prior

Core Retail Sales m/m: est. +0.1% vs 0.4% prior

Quarterly options expirations on Friday

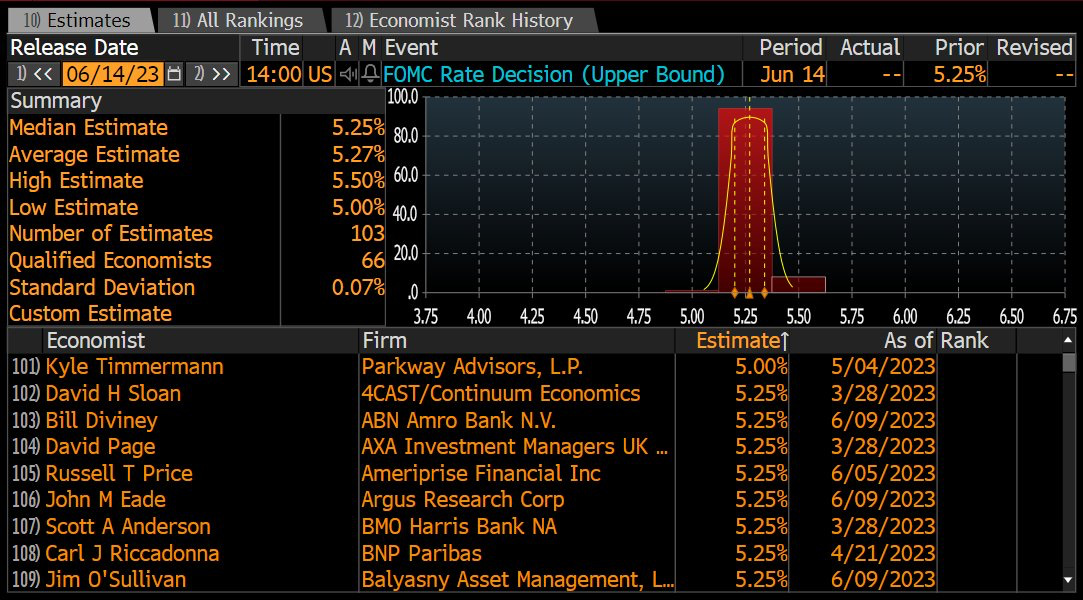

FOMC Cheat Sheet Wednesday June 14th

2 p.m EST press release / 2:30 p.m. EST press conference

What is priced in right now?

Inflation coming gradually down, labor market and service sector start to show some cooling and some Fed members favor a skip for June.

Fed Fund Futures price 70% odds for a pause, which is not a safe bet unless it reaches > 85%, therefore a tiny bit of tail risk and uncertainty remains (watch out for any comments/hints Nick Timiraos tweets out as he often leaks Fed's decision prior to FOMC on Twitter so as to not cause panic in the market, in case of an unexpected outcome).

Swap contracts price 5.31% for July (another 25bps at July meeting) and 5.07% for December (one cut of 25bps by end of year).

Another important/key factor, being this is a quarterly FOMC, will be the dot plots in Feds Summary of Economic Projections. These represent the view of each policy member for the rates target range and is expected to come in at 5.1% for the end of 2023. Everything above 5.1% would mean trouble for risk assets.

Market consensus and what analysts/banks expect

1 is expecting a cut of 25bps

8 expect a hike of 25bps

94 and therefore the majority expect a skip/unchanged Fed Fund Rate

Ripple Case - June 13th

Unraveling the SEC vs. RIPPLE Showdown

In December 2020, the SEC filed a lawsuit against Ripple for selling XRP as an unregistered security under section 51 of the Securities Act. There are three criteria in the Howey Test to determine if an asset is a security:

Investment of money: The asset must involve the contribution of capital.

Common enterprise: The investment should be part of a shared enterprise.

Expectation of profits from the efforts of others: Investors anticipate returns generated through the efforts of a third party.

Ripple has argued that it did not meet the Howey Test because there was never a written contract between Ripple and its investors stating that “Ripple will use the investor's capital to further the business in order to increase the profits.” Ripple also argued that there was no expectation of profits from the efforts of others, as XRP is a decentralized cryptocurrency that is not controlled by Ripple.

The SEC has argued that XRP does meet the Howey Test because investors in XRP expected Ripple to use its resources to promote and develop the XRP ecosystem, which would in turn increase the value of XRP. The SEC also argued that Ripple's executives, including Chris Larsen, have made statements that suggest Ripple is developing its ecosystem which will help increase the value of XRP.

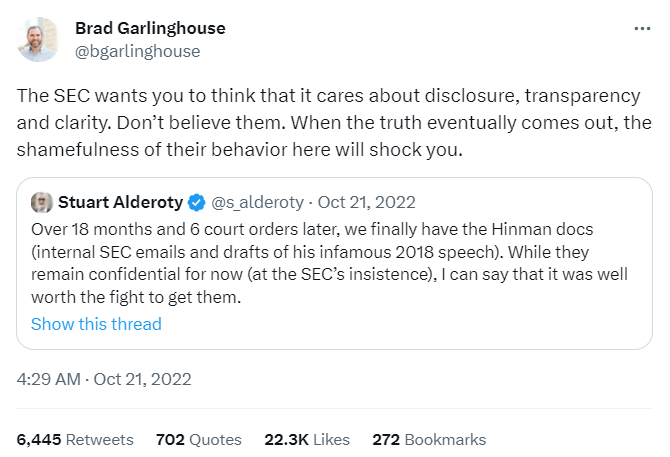

Contrary to popular belief, Ripple’s attorneys already received the Hinman documents last year but these documents were not made public. Ripple has only used the Hinman documents in its ‘Fair Notice Defense’ and not in the Section 5 violation. Moreover, Ripple has argued that instead of the Judge, a Jury should decide the case, which implies that the Hinman documents just shed light on the predatory nature of the SEC and their attempt to pursue companies without any precedent or just cause.

Brad Garlinghouse

The outcome of this case will have a significant impact on the cryptocurrency industry. If the SEC is successful, it could set a precedent making it more difficult for other cryptocurrency companies to raise money and/or operate in the US. Furthermore, it will give the SEC unparalleled power over every cryptocurrency operating in the US, including stablecoins. However, if Ripple is successful, it will bring clarity to the industry making it easier for other US companies to operate in this space.

The three possible scenarios for the outcome of the case:

Scenario 1: It is difficult for the Judge to give a ruling on this complicated issue because she doesn't understand the underlying technology, and finds a factual dispute to send the case to a Jury trial.

Scenario 2: The judge rules partially in favor of the SEC, ordering that Ripple has offered XRP as an unregistered security up until 2018 but after the ODL launch it can no longer be considered as a security. This allows a disgorgement of up to $772,294,294.17 and a fine.

This would be a positive ruling for Ripple as XRP would no longer be a security, could be listed on US exchanges, and continue operating in the US. It should be noted that in May 2023, Ripple unlocked 1 Billion XRP from escrow which is worth around 500mm (at current price). Ripple also has more than $500,000,000 cash on hand at the time of this writing.

Whale Alert

SEC

Scenario 3: The Judge rules in favor of the SEC and states “if a company promotes, upgrades or talks about its asset on social media, in an interview, or in any conference, then it will be considered as a security.”

This would be bearish for crypto capital markets, as most crypto assets would now fall under the SEC category of a security.

Bitbit’s Note

In the realm of trading we thrive on risk. Some traders take greater risk, while others opt for a more tempered approach. Yet, amidst this dance with uncertainty, one thing unites us all; risk management. As traders we must know when to cut our losses.

A true trader is armed with a plan where the cornerstone lies in a strong invalidation strategy. This can be expressed with a fundamental/technical event, or, a designated price point, i.e. a stop loss. By incorporating this strategy, we elevate ourselves as traders navigating the markets with finesse and poise.

In my opinion, Friday was a day where risk management should have outperformed. These days don’t happen often. Some traders did amazing on the short side, but it’s never that simple or easy, it’s all about sticking to your plan and trading your strategy.

These markets provide amazing opportunities at select times. When there is uncertainty and illiquid markets, survival should be your number one priority. When the market will change, you will be there to take advantage.

Good luck.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @FoftyOerney @cryptoalle @Wassie2835 @SmartGamblinggg @ahoras_ @MeDeity

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

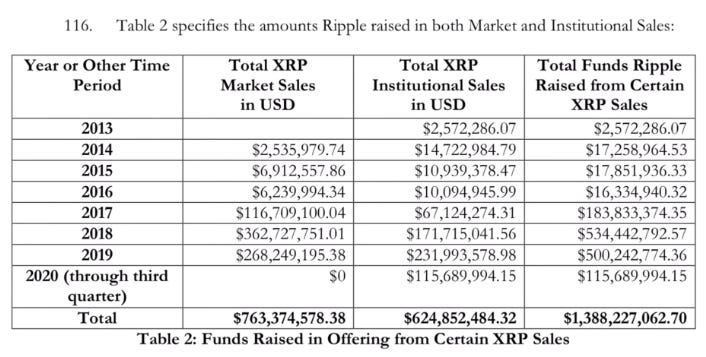

Under Section 5 of the Securities Act, all issuers must register non-exempt securities with the Securities and Exchange Commission (SEC). Section 5 regulates the timeline and distribution process for issuers who offer securities for sale. The actual registration process is laid out in Section 6, under which registration entails two parts: First, the issuer must submit information that will form the basis of the prospectus, to be provided to prospective investors. Second, the issuer must submit additional information that does not go into the prospectus but is accessible to the public.