The Weekly

But where did the sellers go?

XLM Follow Up

As noted in the past week's newsletter, the XLM sell the news event was a clear example of knowing the context when it comes to reacting to anticipated news. The greater the pre-event anticipation, the fewer prospective buyers remain once the news becomes public. XLM sold off seconds after the announcement and is trading 8% below news price with no signs of relief. Pay attention to our “upcoming crypto events section” to be ready for any market moving upcoming event.

FTX Holdings, Liquidation Approval

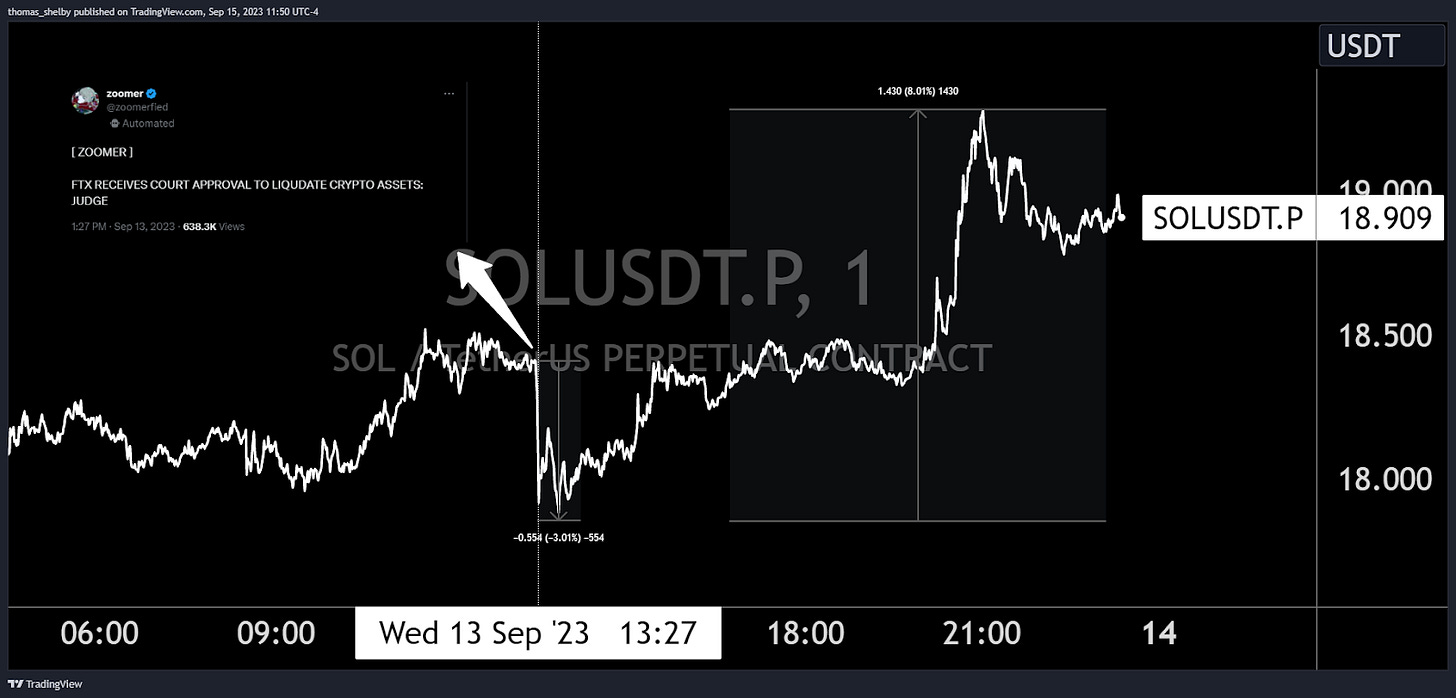

Another context news trade this past week was on the announcement of the court approval for FTX to liquidate their crypto assets. @zoomerfied tweeted this news and SOL (FTX holds approximately $1.16b worth of Solana) immediately sold off a couple %. After stalling at the lows for a couple hours, the market started pumping and squeezing short positions up to 8% from the lows, forcing short positions to pay up. Participants were clearly expecting a further down move and were caught off guard.

The reason behind this market reaction is clear. “FTX likely to get approval to liquidate assets on September 13th” was already leaked and flooding twitter a couple days prior. The market sold off Solana and other assets as well prior to the official announcement, front running the event. And as you can guess, once the news is out there is no one left to sell. This explains the tiny down move ( triggered by algos scraping news sources), and eventually short squeeze retracing the whole dump. The lesson is to always stay aware of the context to avoid being caught off side and at the mercy of these vicious markets.

GAL Bithumb Listing

On Tuesday, 30 minutes after the daily open, Bithumb, the largest Korean exchange, announced the listing of the GAL/KRW pair. The price of GAL increased by approximately 21% over the next hour. For traders, the listing of tokens on exchanges like Bithumb and Paribu often presents an excellent opportunity, as these listings tend to result in significant volatility and price pumps.

SPELL Gets Grachev-ed

Abracadabra Announces Token Loan and Purchase Plans: SPELL Surges

Earlier this Tuesday, Abracadabra unveiled its plans for the DWF Labs Token Loan and purchase. In the discussions on the Abracadabra forum, it was observed that the platform's current emission model predominantly targets decentralized exchange (DEX) liquidity. However, a significant portion of volume and influence still remains with centralized exchanges.

The proposal is a strategic move to bolster liquidity for the SPELL token across both the decentralized finance (DEFI) and centralized finance (CEFI) ecosystems. The specifics of the proposal involve:

A token loan of 4.62 billion SPELL along with 1.8 million $.

A token purchase worth 1 million $, offered at a 15% discount. These tokens will be locked for 24 months.

A 5% annualized interest rate, payable monthly with stablecoins.

By adopting this approach, the liquidity depths on several prominent exchanges are projected to rise:

Binance by 100,000$

Bitfinex, OKX, Huobi, and Bybit each by 40,000$

BTC Turk by 50,000$

When the proposal vote kicked in on Monday, the market went into hold-my-beer mode, and SPELL shot up faster than a meme coin riding a tweet (or is it riding an X nowadays?). Within 24 hours, it mooned by 25%, wrapping up Tuesday with some serious gains. Let's not forget the supportive flows from BTC that same day, completely reversing the previous day's downward expansion. Right now, SPELL's chilling in its comfy summer spot, where it hung out during the days of June through August, priced around a modest 0.0005$ per coin.

BTC and ETH

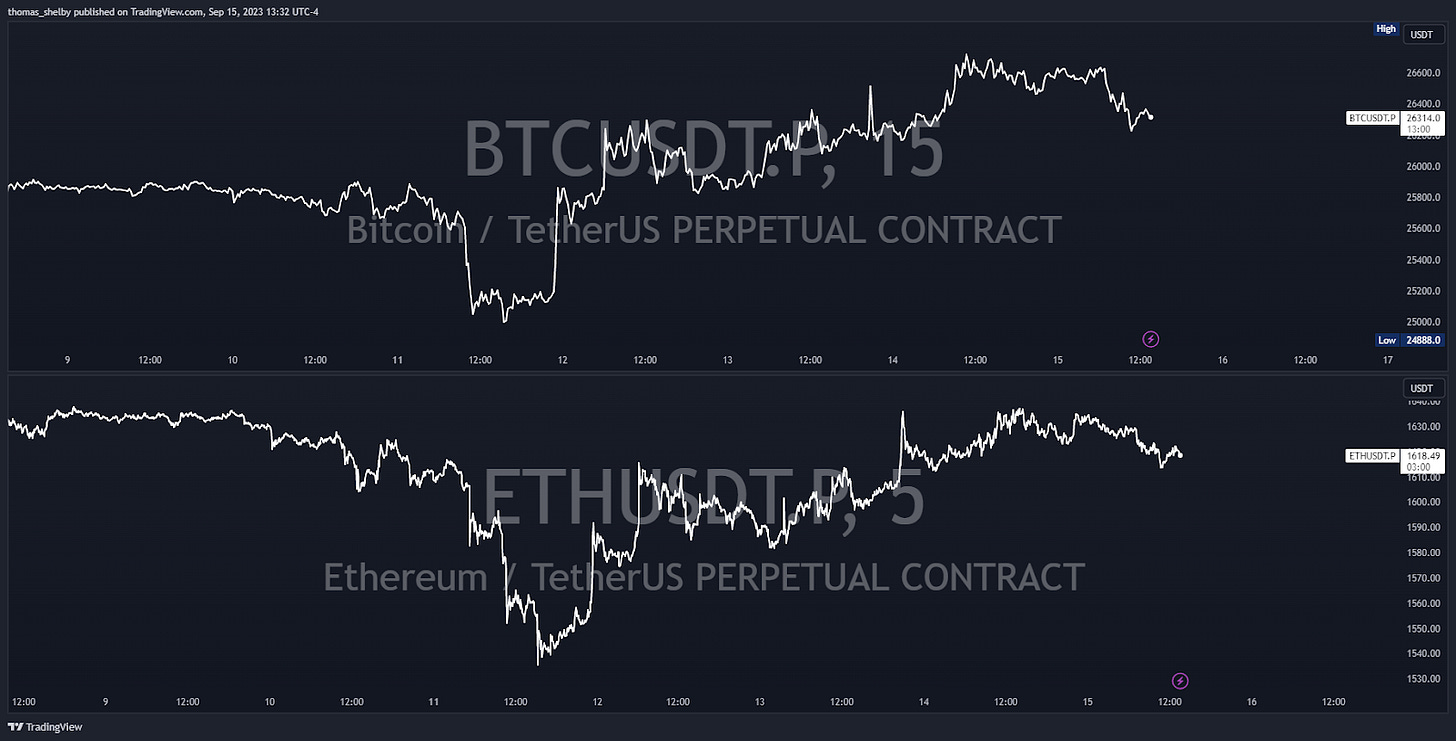

This week started with a dip on Bitcoin and Ethereum on Monday morning, momentarily trading below their range low, $24 900 and $1 530 respectively.

Following this dip, the market rallied hard throughout the week trading back within range a day later and showing that the range plays longer than people expect it to.

Thursday marked the weekly highs for both major assets, with Bitcoin trading $26 800 and Ethereum trading at $1 645. It is worth noting that BTC has been showing more resilience compared to Ethereum in this past week's range.

Upcoming Crypto Event

APE Unlock

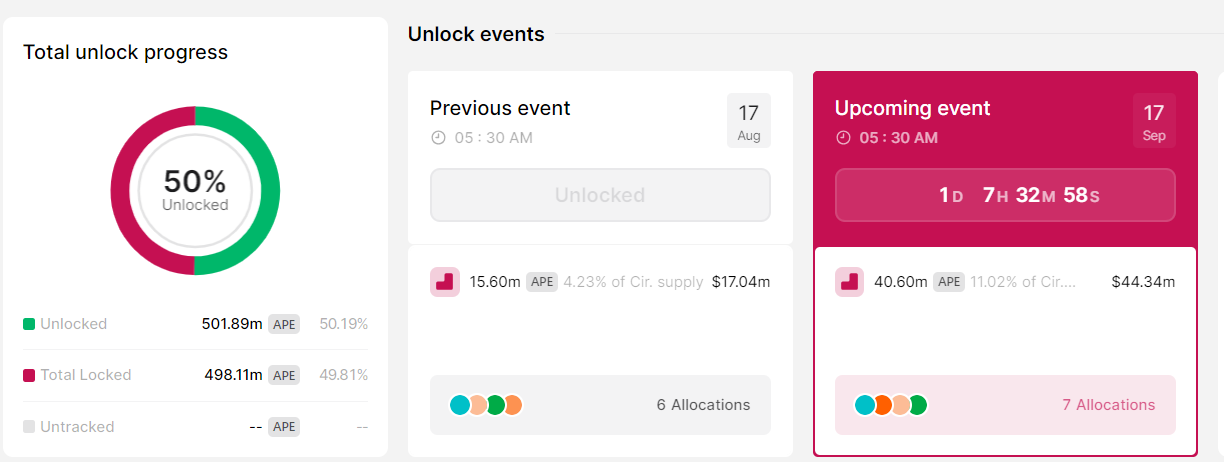

Although token unlocks have become a crowded trade, the APE chart tells an interesting story. The chart below shows how APE has been performing after each unlock.

As we can see on the chart, the price of APE gets suppressed with each unlock with no sign of relief.

Before the last unlock on August 17th, APE was trading at $1.73. 4.23% of the supply was unlocked, and the price is down approximately 38% since then.

On Sunday, APE has another unlocking event with 11% of the supply unlocking, almost three times the previous amount.

Generally, we have observed that a significant amount of short interest builds up going into unlock events, leading to some short squeezes occurring post-unlock. However, in the case of APE, historical data shows that the price consistently continues to decline. Therefore, caution should be exercised when considering long positions.

Macro/TradFi

Economic Data

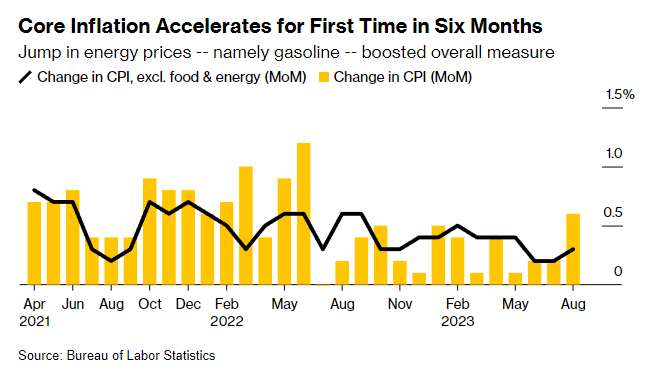

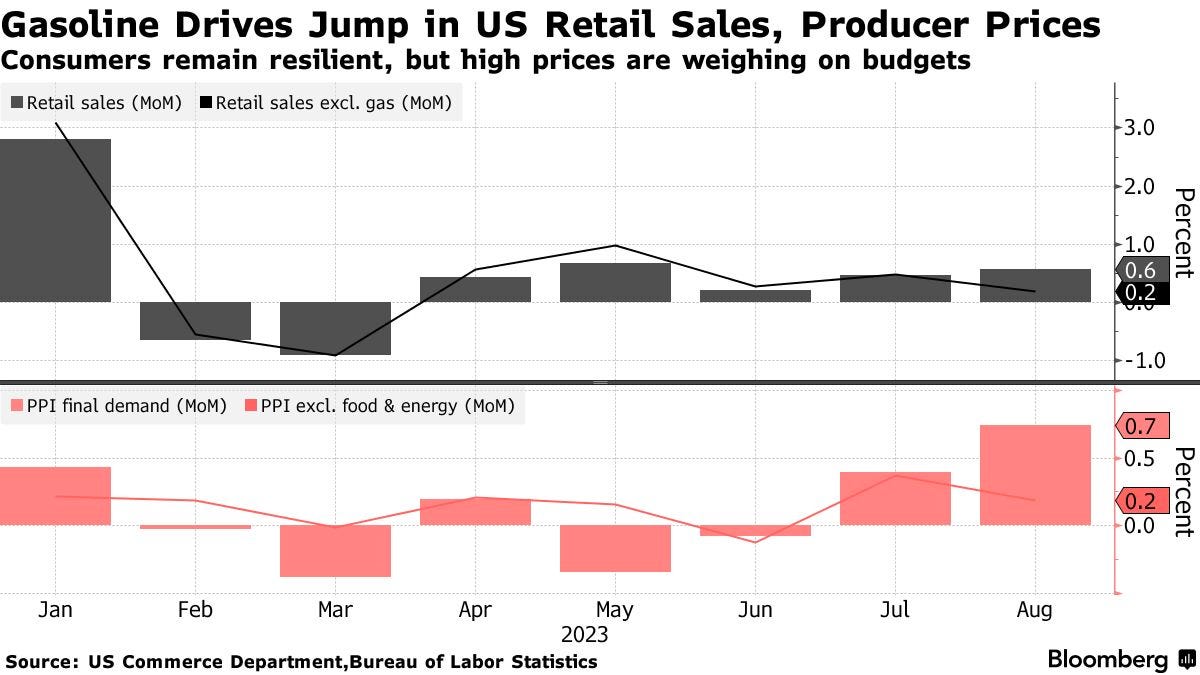

Economic data have, once again, largely surprised to the upside this week. Consumer prices rose 0.6% from the previous month, the most significant increase in over a year. Gasoline was the biggest contributor, accounting for more than 50% of the rise.

The more closely watched core prices, which exclude energy and food, climbed 0.3% and were up 4.3% year on year, beating estimates for the first time in six months, reminding markets that inflation is far from being tamed.

US producer prices and retail sales both rose in August, also driven mostly by fuel costs. Excluding energy, retail sales only climbed by 0.2%, in line with estimates. Sales in the controls group rose only 0.1%, the smallest advance in five months, which is more favorable for the Fed’s upcoming meeting.

Jobless claims remained low at 220k, in line with expectations, a sign that companies are still not reluctant to let workers go.

Stock and Bond Market

The S&P 500 rose 0.8% on Thursday and extended its streak without a 1% move all month. Up and down sessions were equal, and the market has yet to decide a meaningful direction. The 50-day moving average has been respected for the last 27 days in a row, marking its longest run in six years.

Equity funds saw the biggest weekly inflow in 18 months as confidence continues to grow that the US economy is heading for a soft landing. Global stocks attracted $25.3 billion in the week ending September 13.

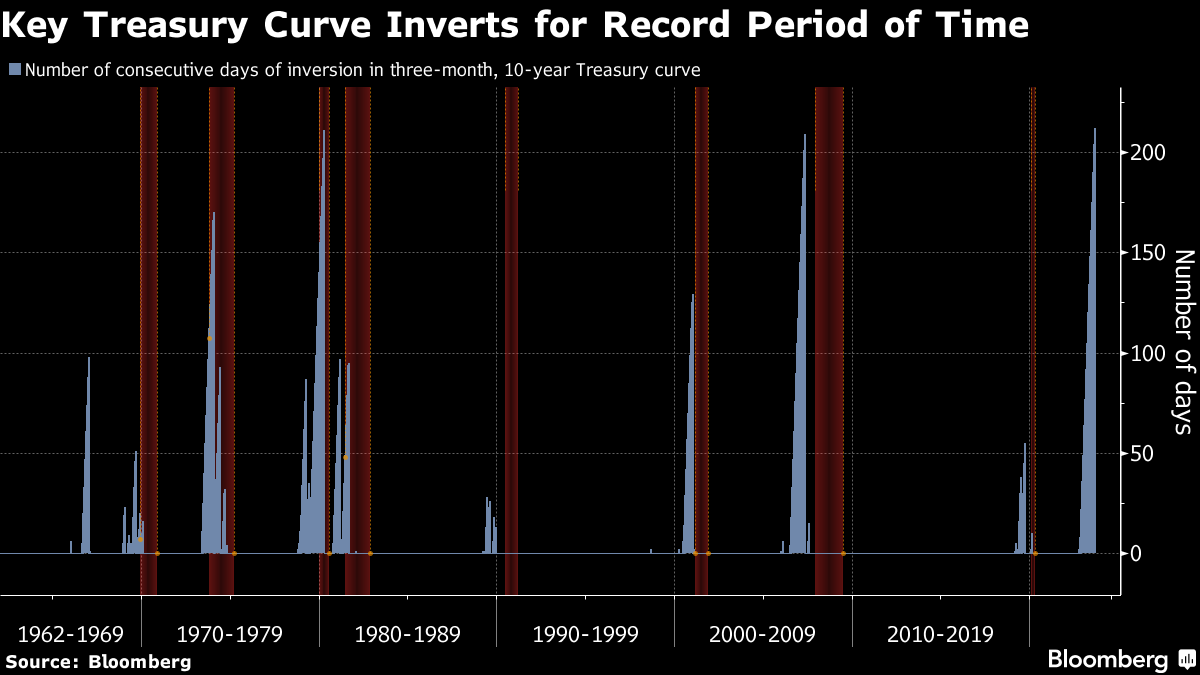

While Wall Street is celebrating optimism that the Fed will be able to engineer a soft landing next year, bonds keep delivering a different message. On Thursday, the 3-month and 10-year yield curve marked its 212th day of inversion, surpassing the record set in 1980. Such inversion is usually the leading indicator of a slowdown and has predicted all eight of the last recessions.

Central Banking

This week's data certainly complicates the picture for Fed policymakers. However, looking under the hood, we see that most of the increases came from gasoline, airline fares, and new cars. This leaves the Fed a window to look through a temporary bump in energy prices and keep rates unchanged at next week's FOMC meeting.

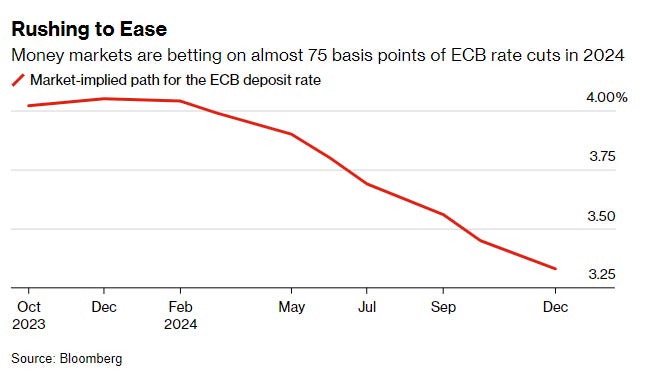

In contrast to the Fed, the ECB increased rates by a quarter percentage point, considering interest rates have reached levels that, if maintained for a sufficiently long duration, will significantly contribute to the timely return of inflation to the target. After yet another dovish presser, the euro dropped to a six-month low against the dollar, and money markets started to price in the first rate cuts by June 2024, three quarter-points in total.

Outlook For Next Week

Today’s triple witching OpEx, the largest September one in history, has the potential to trigger some volatility as $3.4 trillion in notional value, including $555B in single stock options expire, and traders look to close or roll over their positions into the next contract. After that, markets will enter a “window of weakness“ beginning next week, where supportive Vanna and Charm flows caused by market makers unwinding their short put and short stock positions will be taken out of the market, and equities could re-price to current macro landscape.

Since 1990, the S&P 500 has fallen in the week following triple witching 79% of the time, with an average loss of 1%.

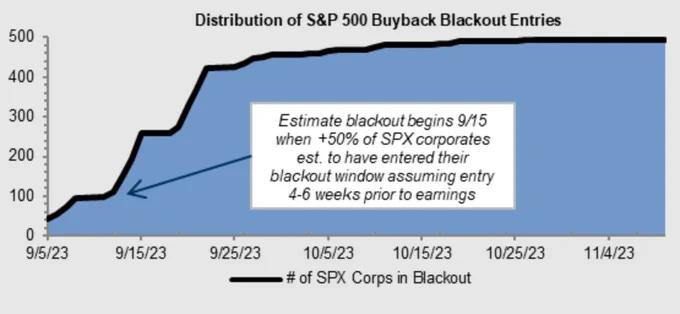

Another important point to note is that we are entering the customary buyback blackout period ahead of Q3 earnings season, which begins today and poses a potential danger to the stock market. According to Goldman, 50% of SPX corporates enter the blackout window next week. During this period, companies are restricted from buying their own shares until 48 hours after announcing their quarterly earnings results.

FOMC Preview

All Fed officials, along with Nick Timiraos, have telegraphed the FOMC to hold rates at 5.5% at next week's meeting.

Markets will mostly watch out for the Fed's quarterly projections and dot plots in which each FOMC member displays an outlook and assessment of their path for monetary policy including GDP growth, inflation forecast and outlook for the federal fund rate.

Recent economic surprises could lead officials to revise up their growth forecasts and, therefore, tighten assessment.

Economists expect the guidance to remain unchanged, with a year-end inflation rate of 3.2%, and the committee leaving the door open for further tightening.

Key Events For Next Week

Tuesday:

EU HICP

Wednesday:

PBOC meeting

German PPI

UK CPI/PPI

US FOMC

Thursday:

Bank of England meeting

EU consumer confidence

Friday:

Bank of Japan meeting

S&P Global Services & Manufacturing PMIs

We decided to add a section in our newsletter called “Trader Takes”. Each week, we will choose a different trader from our prop desk to answer some questions about their trading career and experience.

Trader Takes @SalsaTekila

What do you think is a personality trait that a professional trader must have?

The ability to self-reflect honestly. Being able to look at yourself in the mirror and call out your flaws, your weaknesses, and recognize your strengths. Being able to not let the ego and greed take over, but to admit being wrong, and you will be wrong a lot.

What is the best trading advice you’ve been given?

Edge is the only thing that makes money, the most important thing.

Must add: <lucky entries, likely exits>.

What advice would you give to a beginner trader?

Don't: most people will fail in this game and quit at a loss before success is found.

It might take more than a year of losing before being profitable: have minimum 2 years of expenses and time that you can afford to lose as a tuition.

Delete your preconceived biases and look at the market through original lenses. Technical analysis is not the holy grail, it is over hyped by marketers selling products and services.

What is your market outlook for next week?

Bullish: I think 25k was possibly the bottom. Buy all dips and favor the bid.

Bitbit Note

Average traders get average results - Average traders lose money.

In a bullish and juicy cycle, most traders make money, but don't end up keeping it. As soon as the market changes, the most aggressive end up giving it all back and are probably gone forever. Once the market shifts completely to bear, the ones who understand that it was only a temporary condition and derisk on time will stay with some profit. These participants are very rare to find. The average joe tends to stay until he is forced out. Even worse is the player who borrows money and digs an even bigger and more complicated hole.

My advice to you is to stay professional. Professionals always seek to improve, hone their skills, and understand that it is a dynamic and competitive field. If you get lazy and fall asleep, the average will catch up with you.

As the Jewish New Year comes along I wish you all the best of success and happiness, and may you never let yourself fall in the “average trader” category, this year and the years to come.

Oh, and btw, watch the funding, DYOR | NFA 😉

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @FoftyOerney @ahoras_ @Wassie2835 @betsizing

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.