Sam Bankman-Fried on Trial: The Battle of Two Narratives

courtroom sketch via Reuters/Jane Rosenberg

The Sam Bankman-Fried trial is currently underway in New York City. Bankman-Fried is charged with seven counts of fraud and conspiracy in connection with the collapse of FTX, the cryptocurrency exchange he co-founded. He has pleaded “not guilty” to all charges.

Since opening statements were laid out, the trial became a battle of two narratives: the prosecution's narrative of “fraud and deceit” versus the defense’s narrative of “mistakes but no crimes”.

The prosecution's narrative

- The prosecution alleges that SBF used FTX customer funds to provide capital to his own investments and lavish lifestyle, and that he misled investors about FTX's financial health. The prosecution has presented evidence that SBF knew that FTX was insolvent yet continued to solicit customer deposits, and that he directed his employees to manipulate the price of FTT, FTX's native token.

- The prosecution also alleges that SBF used FTX customer funds to fund risky bets through Alameda Research, another company that he controlled. These positions got rekt leading to the eventual collapse of FTX and the loss of billions of dollars for FTX customers.

The defense’s narrative

- The defense argues that SBF made mistakes but did not commit any crimes. The defense acknowledges that FTX's collapse was a disaster but they argue that it was the result of a number of factors beyond SBF's control, including the broader cryptocurrency market downturn and the failure of other crypto exchanges.

- The defense also argues that SBF was always transparent with employees and investors about the company's financial situation. They also presented evidence that SBF was unaware that FTX was insolvent until the very end.

- During the defense’s arguments, Mark Cohen was careful to use language to further humanize Bankman-Fried, referring to him often as “Sam” and painting the picture of a young math nerd that abstained from alcohol and partying, doing his best to run a rapidly growing company.

A notable update from the trial was the testimony of Caroline Ellison, a former FTX employee and ‘polycule member’ who pleaded guilty to seven offenses. Ellison testified that Bankman-Fried knew that FTX was insolvent but continued to solicit customer deposits. She also testified that Bankman-Fried directed her to manipulate the price of FTT, FTX’s native token.

Gary Wang, the co-founder of FTX, testified that both he and SBF were aware of the commingling of funds between FTX and Alameda Research. However, Wang mentioned that he did not believe that this was illegal.

Wang also testified that he was directed by Bankman-Fried to make changes to FTX's software code to give Alameda special privileges on the trading platform. Wang was aware that others were telling investors and customers that Alameda had no such privileges, but he did not raise any concerns with Bankman-Fried.

The trial is still in its early stages, however the updates so far suggest that the prosecution has a strong case against Bankman-Fried. The testimony of Ellison and Wang is particularly damaging to Bankman-Fried's defense.

The trial is expected to last several weeks. If Bankman-Fried is convicted, he could face up to 115 years in prison.

XRP - Lower Your Expectations

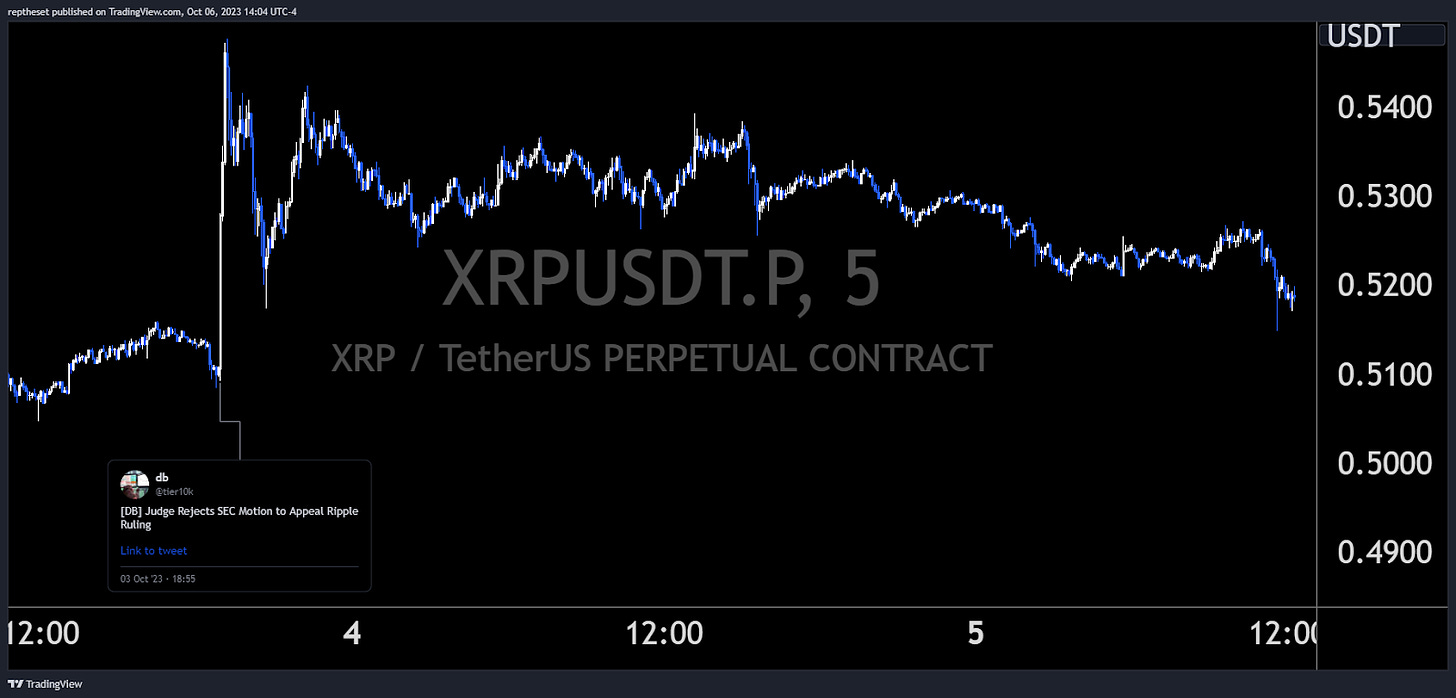

On Tuesday, news came out that a federal judge had rejected the U.S. Securities and Exchange Commission’s motion to appeal its loss against Ripple. XRP pumped by approximately 7.5% following this news, but unlike the July event, it failed to maintain bullish momentum.

Traders should be aware that similar news for XRP will likely have diminishing returns in the future, and only significant and/or unexpected events could move XRP in the same way it did back in July.

“Markets move on expectations”

Polygon's Co-founder is taking a Step Back

Jaynti Kanani, co-founder of Polygon, has announced he's stepping away from daily operations after serving the project for six years. He made the statement on Oct. 4 via a post on X indicating his decision was made six months prior. Kanani also said that he is going to seek new adventures while continuing to support Polygon from a distance.

When the news broke, MATIC was hovering around the $0.58 resistance area. After consolidating for a few minutes, the coin quickly dropped by 3.5%. It sold off another 3% in the 24 hours following the initial reaction and has been slowly recovering since.

SUI - No Pump Without Bots

On Thursday, the block tweeted that SUI foundation has reallocated 117 million SUI from external market makers, to support growth initiatives.

This initial tweet saw the price of SUI move by only 0.5% before consolidating. 12 minutes later, Decrypt tweeted the same news but including the words "ecosystem fund" mentioned in the tweet.

This was picked up by various Telegram bots and, as a result, Sui pumped by ~2% over the next 18 minutes before retracing the whole move.

This is a great example of how certain Telegram bots pick up specific keywords which pump the price, even though the exact same news came out much earlier. It’ll be interesting to see if other accounts recognize these incidents, and change their twitter strategy to take advantage of this phenomenon.

McCarthy who? Make way for McHenry

In a somewhat shocking turn of events on Capitol Hill, the House of Representatives voted to remove Speaker Kevin McCarthy from his position on October 3rd. This event is significant as this is the first time in U.S history that a Speaker of the House has been voted out of office. Additionally, Patrick McHenry is currently serving as Speaker pro tempore until an election for a new speaker is completed. It's worth noting that Patrick McHenry is as crypto-friendly as a Congressman can be.

Upcoming Event

SEC vs Grayscale: Deadline Approaches

The deadline for the SEC to file an appeal in the Grayscale v. SEC case is October 13, 2023. Should the SEC miss this deadline, the court's ruling will become final, forcing the SEC to either approve Grayscale's spot Bitcoin ETF application or to reevaluate and provide a more detailed explanation for any denial.

In June 2022, Grayscale submitted an appeal to the D.C. Circuit Court of Appeals after the SEC rejected its request to convert Grayscale Bitcoin Trust (GBTC) into a spot ETF. The SEC contended that Grayscale's application didn't meet its anti-fraud and investor protection standards. However, in August 2023 the D.C. Circuit sided with Grayscale, deeming the SEC's decision "arbitrary and capricious."

The SEC has not yet disclosed its intentions regarding an appeal of the D.C. Circuit's decision. If an appeal occurs, it would escalate the case to the US Supreme Court. Nevertheless, the Supreme Court isn't obliged to review every case that’s appealed, which can lead to a situation where they may decline and disregard the Grayscale case entirely.

Should the SEC decide against filing an appeal, it is anticipated that the court will release an order outlining the subsequent actions to be taken. Actions could include the instruction of the SEC to approve the Grayscale application, or to revisit the Grayscale application. It is worth noting that this still allows the SEC to reject the application on other grounds.

If Grayscale is successful in its appeal, it will be the first spot Bitcoin ETF to be approved in the United States, marking a substantial milestone and potentially opening the Bitcoin market to larger inflows from mainstream market participants.

Even if Grayscale's appeal falls short, the case may still have some positive influence. The D.C. Circuit's ruling in favor of Grayscale effectively rebuked the SEC's cryptocurrency regulation approach, as some crypto enthusiasts commented, forcing Chair Gensler to ‘hold this L’. Leading to expectations that the SEC will need to soften its stance and become more receptive toward cryptocurrency ETFs in the future.

Market participants' expectations continue to shift positive as the year goes on. GBTC discount to the implied underlying value of the trust has shown tremendous strength, cutting its discount from -45% at the beginning of the year to a current discount of -19%.

Bitcoin and Ethereum

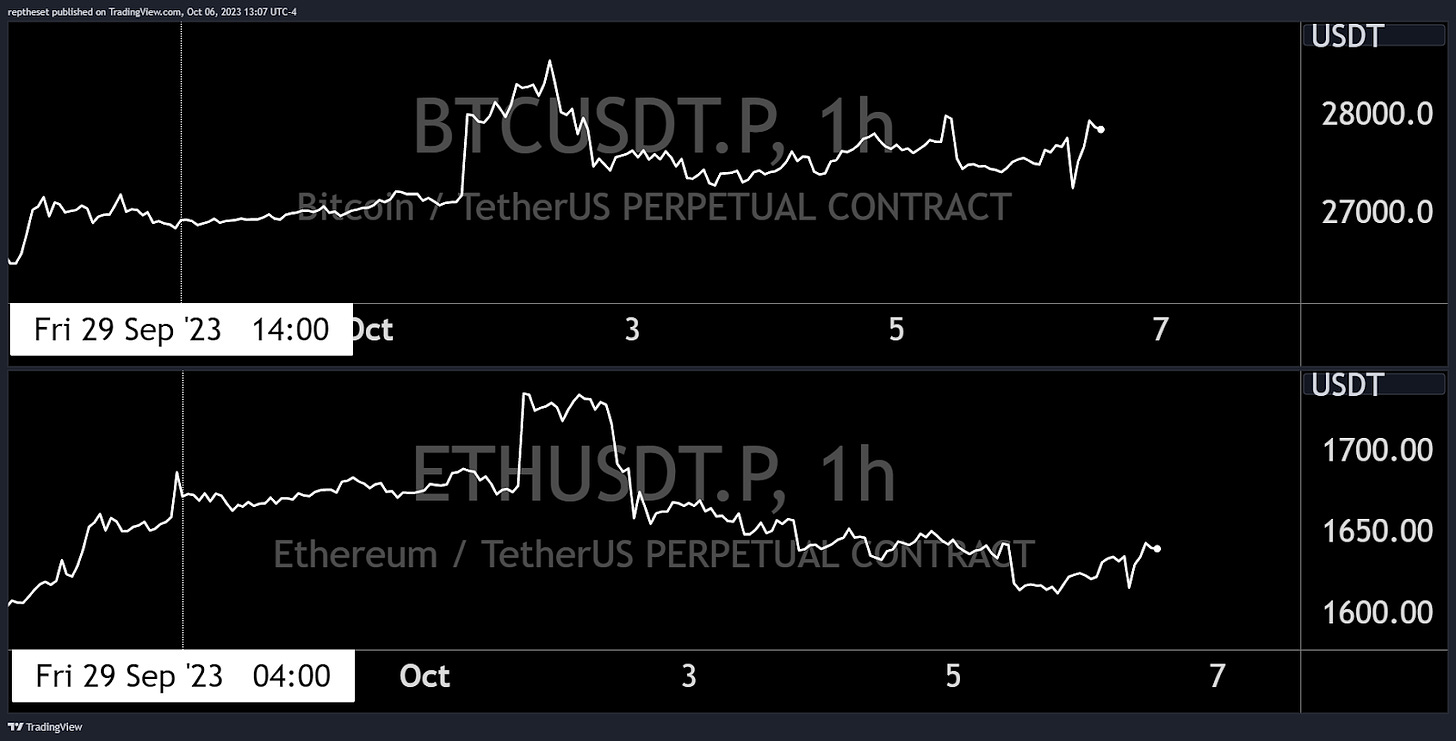

Bitcoin spent most of the week trading in the range of $27,000 to $28,500. After a very slow weekend, BTC pulled a vicious “Sunday scam pump“, moving from $27,100 to $28,400 in a matter of minutes. Crypto markets spent the first half of the week following traditional markets and slowly retracing the weekend pump. 27k continued to show support as this level was tested multiple times towards the end of the week.

The BTC/ETH pair continued to trend up all week long. Recently, Bitcoin showed relative strength compared to Ethereum and speculators are hoping this might be hinting at interest in upcoming BTC ETF decision deadlines.

This week was just another week where range traders prevail, and trend/breakout traders suffer.

Macro/TradFi

Economic Data

Mixed data this week and probably confusing for a lot of people, as the Bureau of Labor Statistics keeps printing the opposite picture of what private data providers report. But let's start from the beginning.

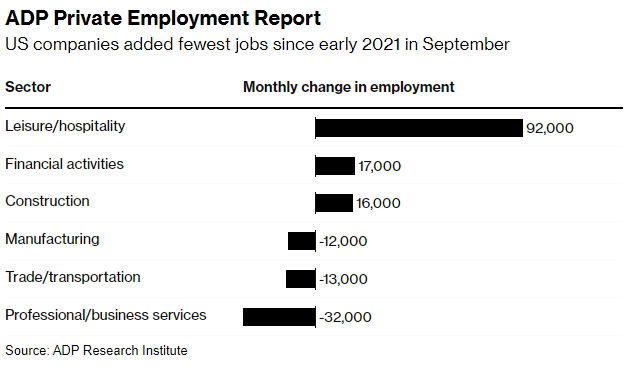

According to the ADP Research Institute, private payrolls rose by 89,000 last month and were weaker than all estimates, with a median of 150,000. According to ADP's chief economist, we are seeing a steepening decline in jobs and wages, and the median rise in annual pay is the weakest since June 2021.

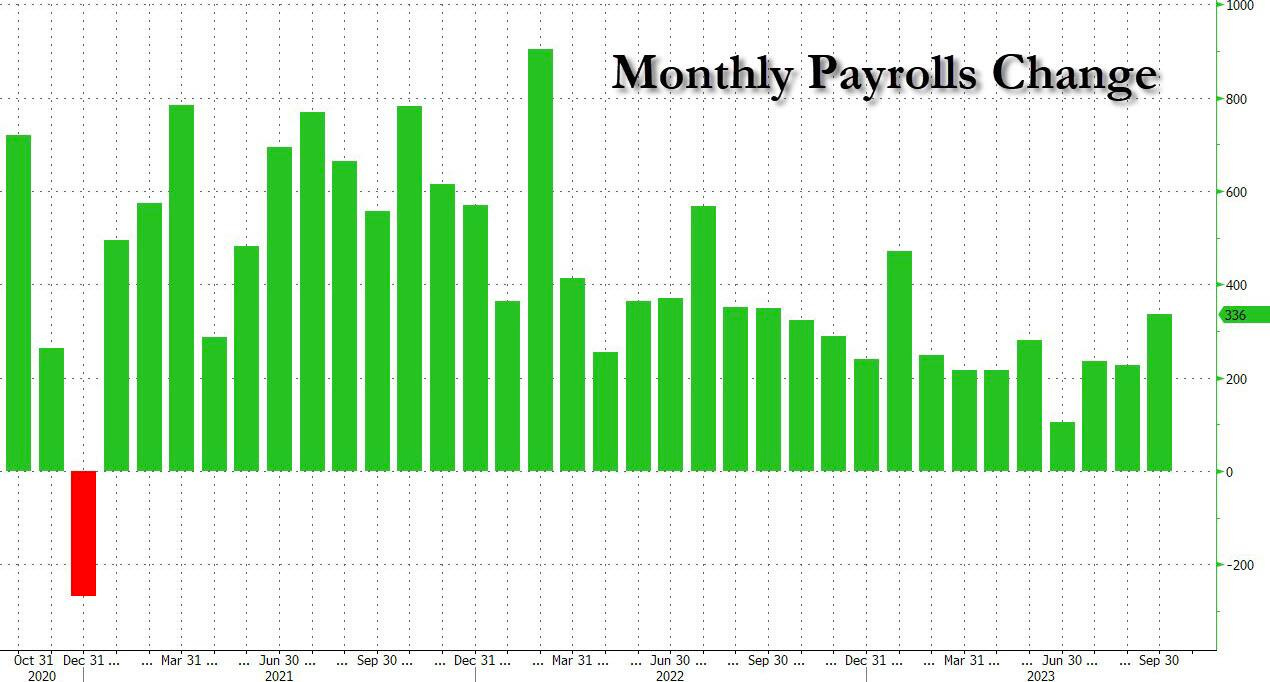

On the opposite side, government figures blew all estimates once again, with employers reporting 336,000 more jobs added—the most since January this year and almost double what economists forecasted. Meanwhile, the unemployment rate climbed 0.1% to 3.8%.

At first glance, this seems like a very decent print. However, when we dig deeper, we see the usual picture. Payrolls were led by the hospitality-leisure sector and the education healthcare sector. Additionally, multiple jobholders increased by 123,000, part-time workers by 151,000, while full-time jobs decreased by 22,000—the lowest since February.

The household survey, which only asks whether people are employed or not, only printed 86,000 new jobs. Average hours were flat and below last year's surge, indicating that employers aren't pulling more workers from the sidelines.

Meanwhile, the economy has lost 692,000 full-time jobs in the past three months, and the divergence between the household and payroll surveys has expanded to new highs. The last occasions we saw this were in 2001, 2008, and 2020.

Stock & Bond Market

As markets currently trade in a "good news = bad news" environment, yields and further tightening remain the focus. Most of the releases by the BLS this week have caused further uncertainty and sell-offs in equities. Investors have started to boost bets on another Federal Reserve rate hike, and the S&P 500 has struggled all week to hold its 200 day-moving average.

Yields started to punch higher after job openings on Tuesday unexpectedly climbed by 690,000, marking their largest monthly gain since July 2021. Yields on 10-year Treasuries neared 4.9%, while the 30-year bond rose above 5%, both touching the highest levels since 2007. The 30-year fixed mortgage rate surpassed 7.5%, the first time in 20 years.

Given the abrupt surge in yields compared to recent quarters, strategists have started to signal alarms and increased risks of an accident in the financial system. After today's payroll release, the 10-year Treasury yield surged more than 15 basis points to 4.89%, while the rate in Germany jumped 8 basis points to the highest since 2011.

Central Banking

Although we had a bunch of Fed speakers this week, most abstained from commenting on interest rates or monetary policy, and those that did haven't said anything new.

One comment worth noting came from Fed's Daly, who stated that the recent bond market tightening is equivalent to about one rate hike, indicating that the Fed is at or near a peak for their interest rate target.

Despite today's "hot" jobs report, overnight index swaps haven't budged much, and remain at 5.41% for November and 5.45% for December.

Outlook For Next Week

You can't fight the algos that drive yields and equities based on headline numbers. But as the days go by, many investors will question the credibility of the reports published by the BLS. We might enter a new era of more "Dalai Lamas" in the market, as seen today, where yields and metals reversed course, and equities closed the week green. The most-watched 200 day-moving average around 4,200 points in the S&P 500 continues to provide nice support. As the window of strength approaches from next week, market makers will start buying back their short put and short stock hedges, providing further protection from more downside while having a dampening effect on volatility.

In our opinion, markets will start to sniff out Biden's goal-seeking high numbers. With returning Vanna & Charm flows and traders front-running Q3 earnings, there will be a decent risk-reward ratio playing for more upside.

Furthermore the 1 day skew for SPX indicates that traders will hold onto their positions over the weekend and see the period till Wednesday as a risk free trade.

Due to Monday's banking holiday, we will have a shortened 3-day window of bond auctions: 3s/10s/30s with a total issuance of $61 billion. These will be watched closely as an indicator of what big money thinks of recent and upcoming events. Currently, the greater the demand for bonds, the better it is for risk assets.

Key Events For Next Week

Monday:

US Columbus Day

US IMF meeting

Germany industrial production

Tuesday:

US 3-Year note auction

Wednesday:

Germany HICP

US PPI

US FOMC minutes

US 10-Year note auction

Thursday:

UK GDP

EU ECB monetary policy meeting accounts

US CPI

US 30-Year bond auction

Friday:

China CPI/PPI

China trade data

France CPI

US Michigan consumer sentiment

Trader Takes @Its_50_send

How would you describe your trading style ?

My trading style has evolved so much since I started trading ~ 6 years ago. I began as a chart/TA guy, and have evolved into a data driven and semi-automated trader. I put heavy focus on using different tools that I’ve programmed to help me find an edge in the market. As the market is constantly changing, I have learned to not only rely on a discretionary approach, and put my attention towards finding useful data to help me make informed decisions.

What do you think is a personality trait that a professional trader must have?

I believe the obvious answer is discipline, but I will say creativity. The current market environment is an advanced PVP market where participants are getting more and more sophisticated, using tools and softwares to push them ahead of other traders. As a creative trader, it's your job to find and use these tools to look for imbalances in the market, and be able to make profitable trades. You must be able to think creatively and constantly search for value outside of the conventional methods. Everyone is a TA guy, what are you doing differently to get an edge over them?

What is something that you implemented that improved your trading the most in the past year?

As a human, your ability to make quality decisions deteriorates significantly as your day progresses from morning to night. This worsening in your decision making process will cost you a lot of money over your trading career. Learning to be conservative in the number of important decisions you make in your daily routine will help you make the right decisions at the right time. I’ve been working to achieve this by shifting to semi automatic trading. This helps me to make simple decisions based on a few key alerts, structures and algorithms. Since I’ve reduced so much noise from my trading (for example, having less charts), it has allowed me to focus strictly on the setups I want which makes it easier for me to stick to my plans.

Bitbit’s Note

This week I will keep it short for a reason.This is the time to stay focused. There has never been a smooth rally in crypto, there are always casualties all the way to ATH. The past week was heavy and choppy mainly because of the traditional markets. Now that stocks have recovered almost 2% after the September Nonfarm number, it shows. ETH is heavy and can stay heavy until the next ETH narrative kicks in, and no, it’s not the ETH futures ETF. It’s time to focus on Bitcoin, 27k is a crucial area IMO, as there will be many stops below. I think the way is up and I will keep the BTFD strategy until it gets invalidated.

Now here is the thing, the bull market actually exists, but it’s not in the perpetual futures. I’ve been trying these new SoFi apps lately, and something is happening over there. I don’t think anyone should throw their hard-earned money on these, there is absolutely no reason to do so. Nevertheless, it is worth taking a look.. to learn how the participant's focus shifts to completely different things. The idea is definitely grabbing attention and AVAX’s chart tells the story.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.