The Weekly

We are early, we just don't know it yet.

iShares Ethereum Trust Filing

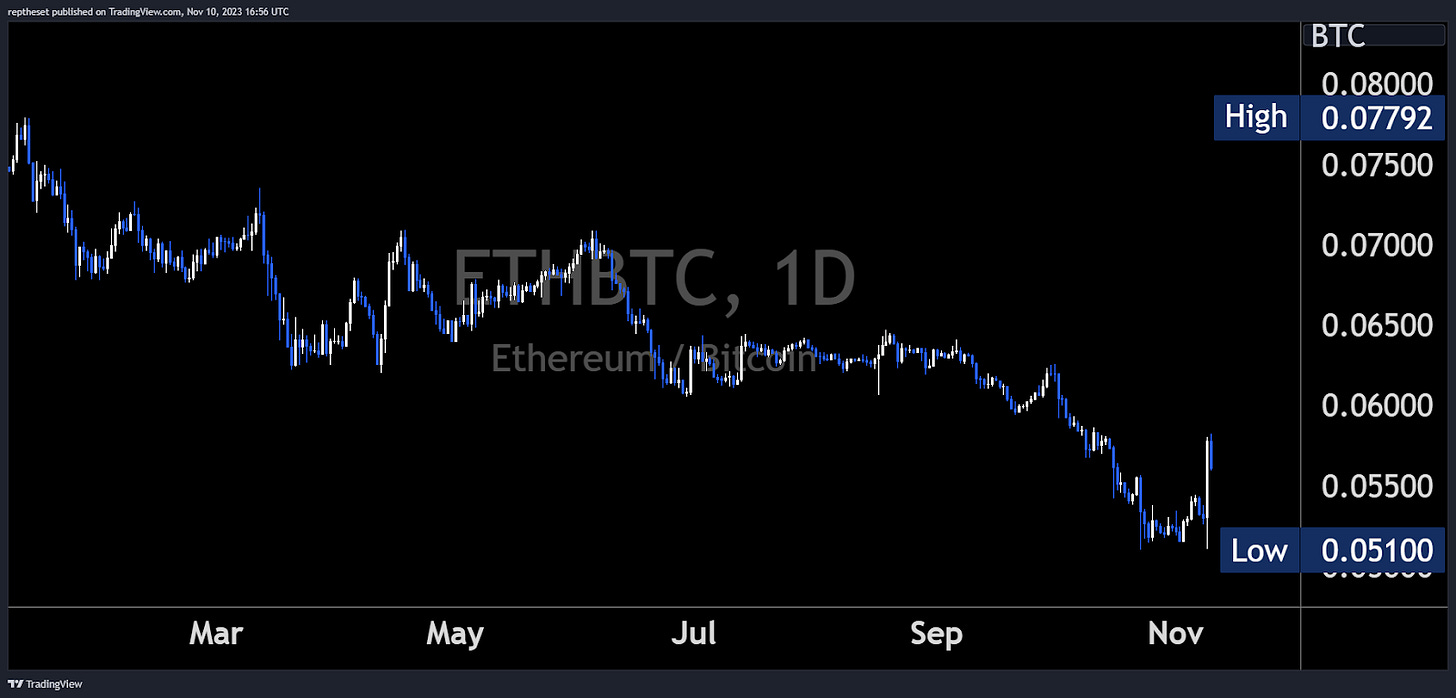

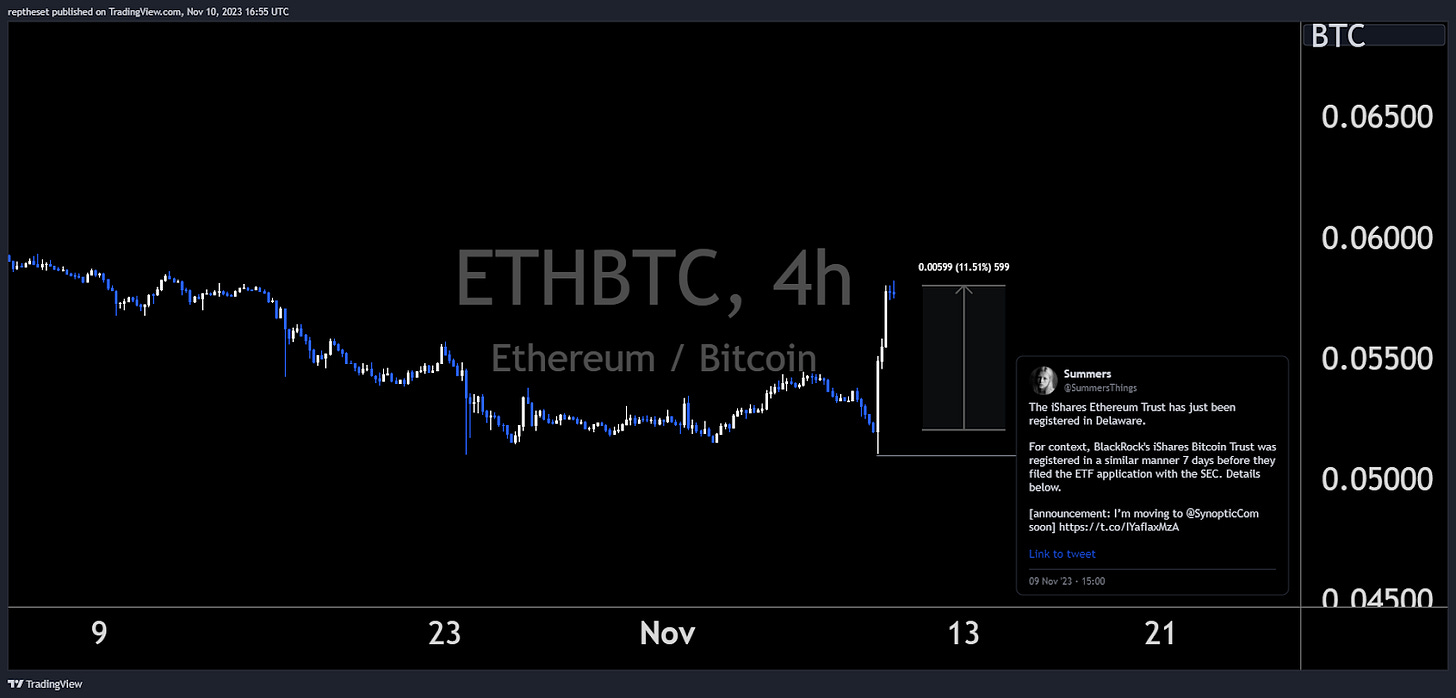

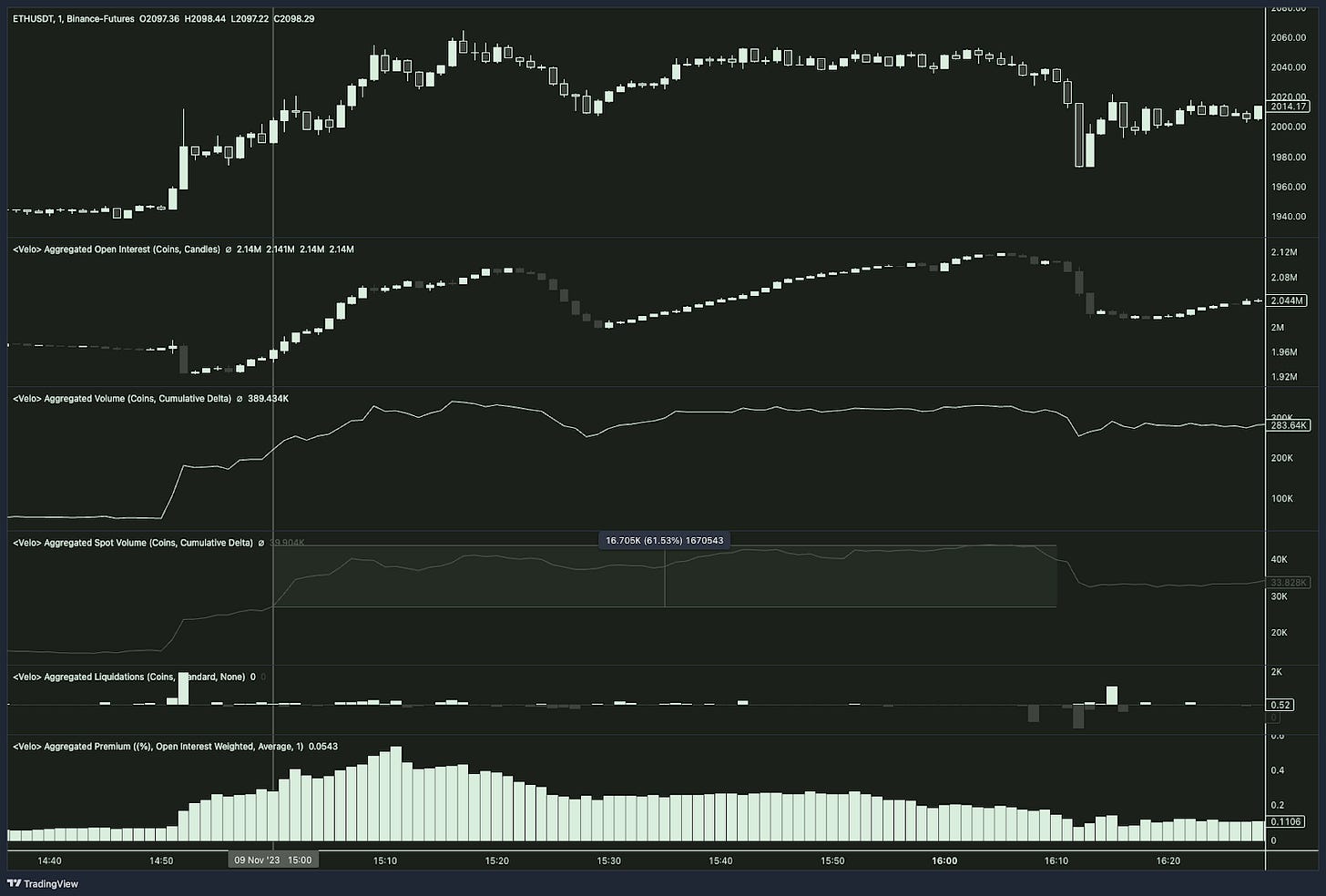

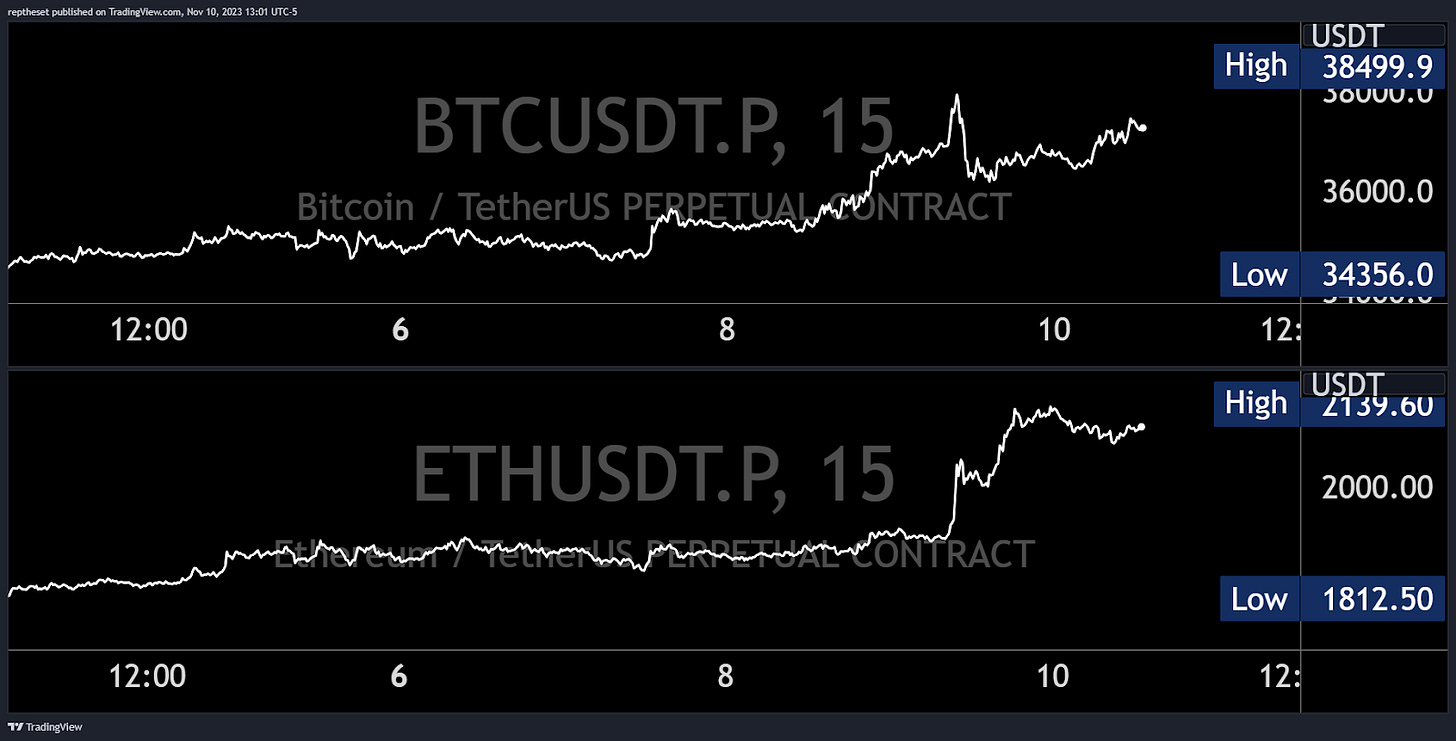

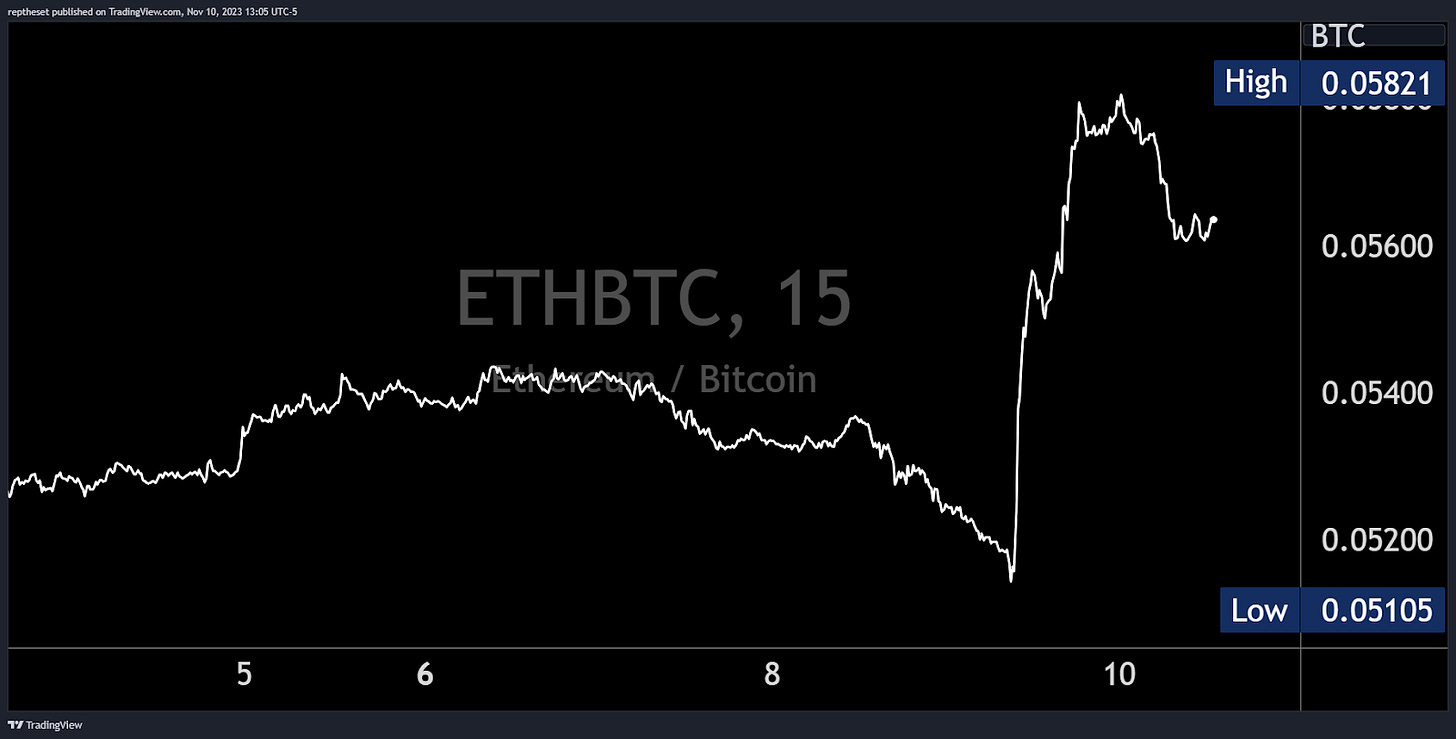

As we inch closer to deadline dates for a spot BTC ETF, some had asked what might come next. The assumption, a spot ETH ETF. Regardless of this assumption markets had been complacent, with ETH/BTC ratios falling significantly throughout the year, falling from highs in January of 0.077 to lows of 0.051 in October.

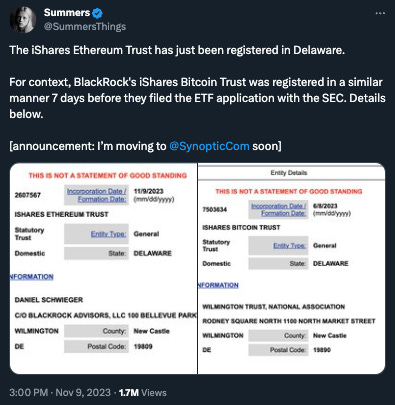

When news broke that the iShares Ethereum Trust has just been registered in Delaware, the market was quick to react and begin to reprice this ratio.

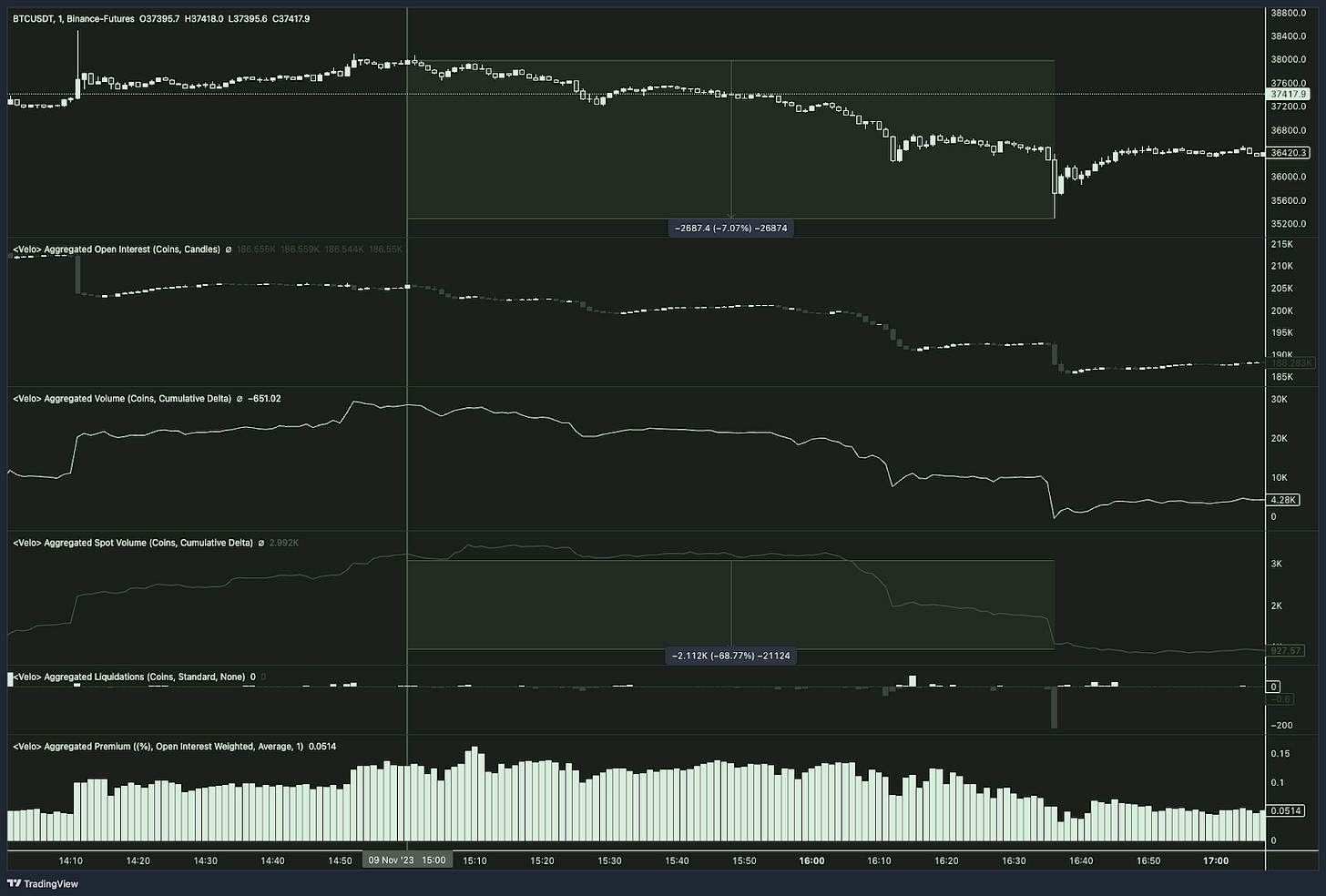

Long positions in spot and perpetual BTC markets were closed rapidly in exchange for positions in ETH, leading to a 7% drop in the price of BTC. The rotation pushed the basis on ETH perpetual futures to as much as +75 bps on Binance Futures and saw price continuation as subsequent reiterations of the headline broke.

As positions in BTC derivatives closed out and chased ETH, liquidity in the altcoin market dropped rapidly leading to a liquidation event.

data via coinglass

Binance Blockchain Week

Binance Blockchain Week 2023 was held in Istanbul, Turkey from November 8-9th, 2023. The event brought together over 10,000 attendees from around the world, including thought leaders, policymakers, investors, and innovators in the blockchain and Web3 space.

No stranger to the mental workings of crypto market participants, Binance took the opportunity to coordinate a social media campaign in the days prior to the conference. Some might say, “an announcement of an announcement”.

BNB rallied 2.8% as traders speculated on the outcome of the announcement.

Binance Wallet and TWT

On November 6th, CZ tweeted, "3 Coming Soon," hinting at a new product for Binance. Speculators immediately went long on the recently listed TWT Binance perpetual contracts. Over the next few days, speculation grew that Binance would integrate Trust Wallet into their platform. With well timed news, just after the TWT breakout of contract highs, the price continued to grind up, reaching a 22% increase from the announcement.

A few minutes before Binance Blockchain Week in Istanbul started, in our public Discord, a new member named Hasmo posted a link to the conference and monitored the event closely. When Richard Tange took the stage and presented a new wallet product, some speculators went long, anticipating it to be Trust Wallet. However, it turned out not to be the Trust Wallet but Binance Official Wallet, with no mentions of TWT or Trust Wallet. This information was out 6 minutes before Binance's official blog announcement.

In the next hour, TWT dropped by 18%, stabilizing when Trust Wallet announced that Binance's new wallet is powered by the Trust Wallet service. However, the price barely reacted, as the trade had already been done, wiping out all speculators from the previous days and the price retraced to the announcement level.

This news trade is an excellent example of a pure news trading edge. It's very rare to get hands-on valuable information 6-8 minutes before major news sources and official announcements.

Announcement Square - Polygon

On November 7th, Sandeep Nailwal, co-founder of Matic (now Polygon), disclosed an upcoming announcement. We have reviewed this playbook hundreds of times now, where these 'announcements' often serve as bullish catalysts, especially during overall strong market conditions while money is flowing into the system. The price reacted immediately, as we were struggling to break the overhead resistance at 0.75 and almost never looked back. It was a good buying opportunity for news traders because once the resistance was breached, the following day (November 8th) saw a double distribution trend day to the upside that resulted in nearly a 10% increase within 24 hours with minimal drawdown.

For traders who prefer not to take unhedged risks, the Matic/Eth pair also performed similarly percentage-wise. Therefore, going long Matic and short Eth would have been a good plan following this headline.

Hi Poloniex, you may want to take a look

Not words any exchange wishes to hear from the blockchain security and data analytics company Peckshield.

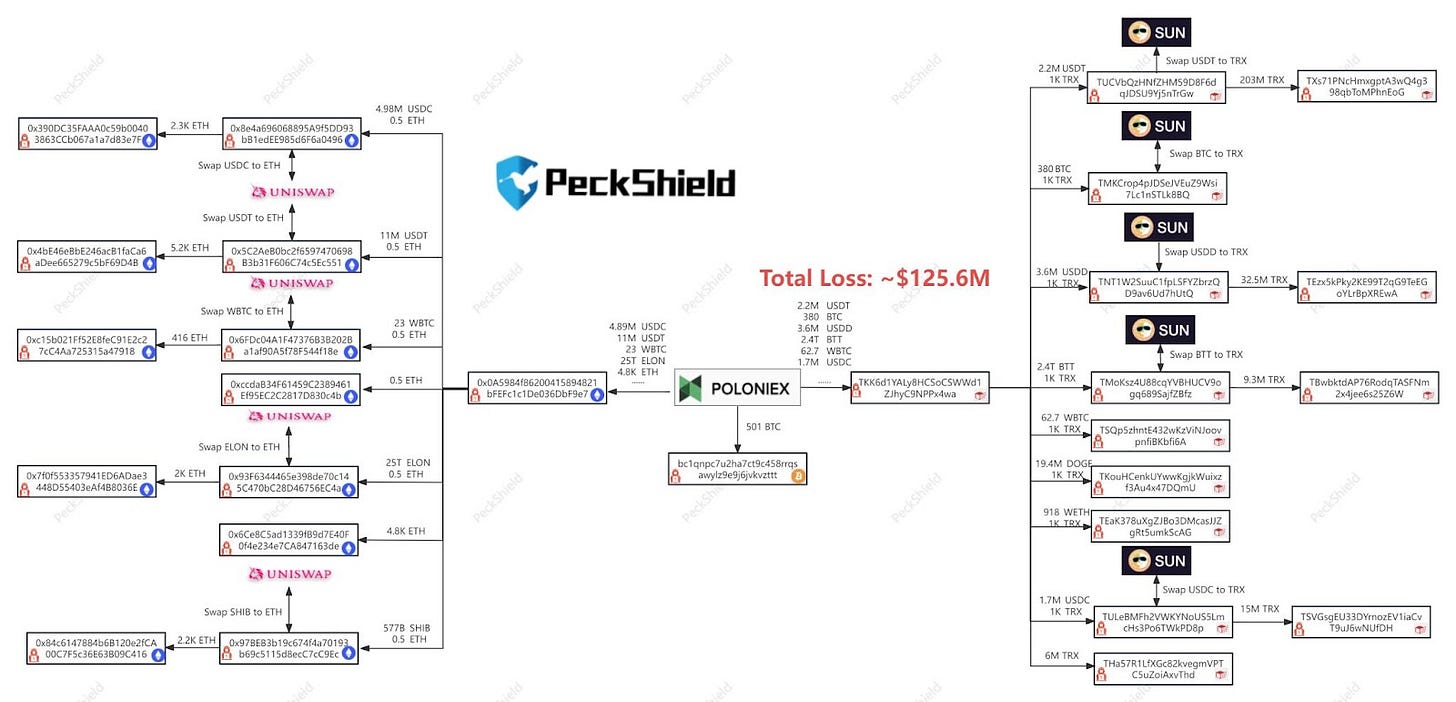

analysis via PeckShield

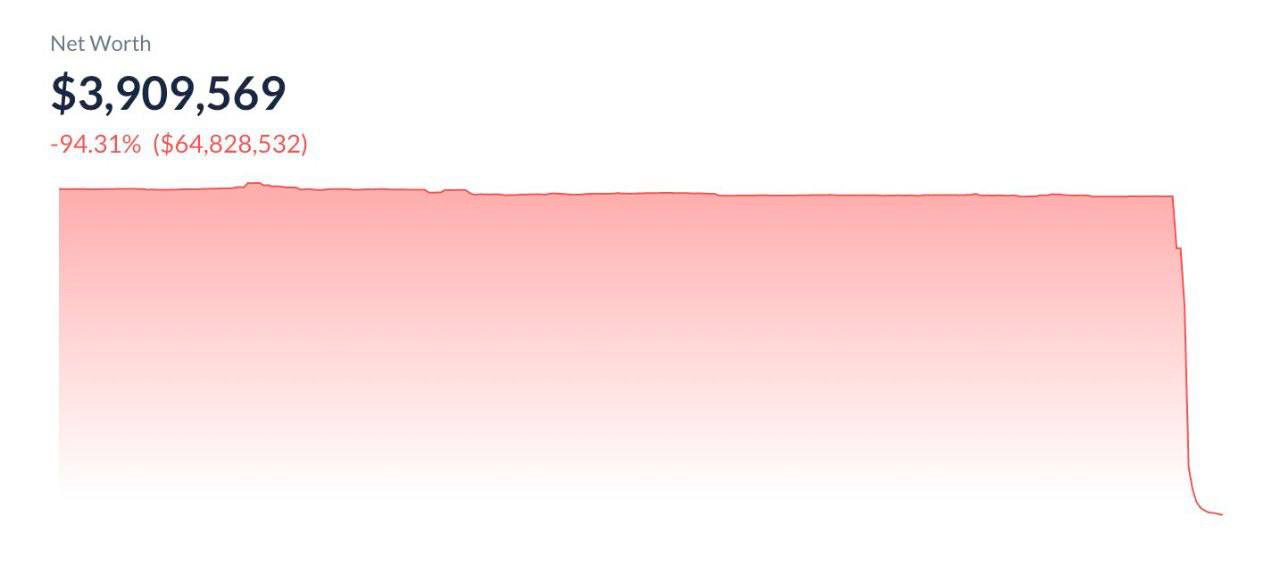

Justin Sun's Poloniex was hacked today for over $125m in various coins.

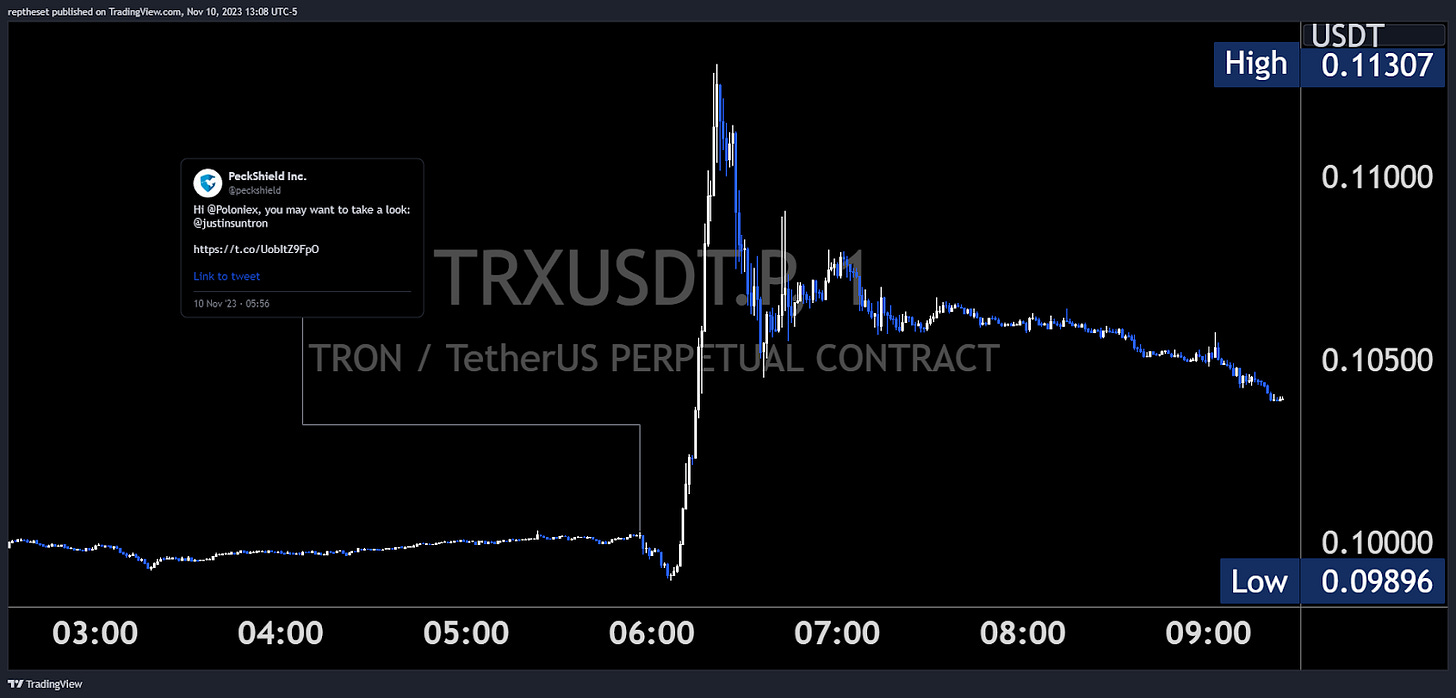

PeckShield reported this on Twitter, and as soon as the report came out news traders keen to take advantage positioned themselves short in Justin Sun’s TRX adding 20m TRX in short interest causing a move of -1%.

In a surprising turn of events, the hacker proceeded to make various swaps, including the purchase of TRX with the stolen stablecoins, possibly with the idea of preventing the stables from being frozen. Another speculation is that they made a strategic trade with the idea of squeezing TRX short speculators and making extra gains in the process. Later on, they proceeded to sell the TRX on-chain.

Within the hour Justin Sun took to twitter to offer a 5% white hat bounty to the Polinex hacker, allowing the hacker a 7 day window for the return of funds before the engagement of law enforcement.

Sun, keen to assure Polinex users, stated that a portion of funds had been frozen and that the losses were “within manageable limits, and Poloniex's operating revenue can cover these losses.”

The Poloniex hack is a reminder of the ever-present risks of parking collateral on centralized exchanges. While exchanges like Poloniex have security measures in place, hackers are constantly developing new ways to exploit vulnerabilities.

BTC and ETH

BTC started the week consolidating and grinding higher, something we like to see in a bullish environment that indicates buyers are in control. On Tuesday, we reached the week's low around the 34500 level. Since then, value has been gradually moving higher. There has been consistent buying pressure from the spot market on major exchanges and the current week's value area ranges from 34600 to 36600. Another positive aspect is that volume has been increasing despite higher prices, indicating trade facilitation and price acceptance.

ETH experienced a significant rally on Thursday following the announcement of BlackRock's proposed iShares Ethereum Trust ETF. Prior to this announcement, ETH had struggled to outperform the BTC pair and breach the psychological level of 2000 on the USD pair. However, this news instantly changed the situation. After briefly hitting Sifu's liquidation level and a quick dip, ETH continued to climb during the New York session and surged above 2100 upon confirmation of the news at the close of the New York session. The ETH/BTC pair also rose to 0.058, marking a rapid 13% increase from the lows. The current value area for ETH during the week is between 1840 and 2030. As mentioned in a previous newsletter, ETH buyers had an opportunity to step in, but we did not anticipate Mr. Fink himself to be among them.

Upcoming Events

CKB Halving - Like BTC or LTC?

The first halving of Nervos' CKB is estimated to be reached on November 19.

The rewards that miners receive for validating and adding new blocks to the blockchain will be reduced by half. Historically, halving events have been bullish narratives as new supply is reduced. Intro to economics classes have taught us that if demand is constant and supply decreases, price goes up.

We have two popular examples of halving in BTC and LTC. BTC typically rallies after halving as there is demand for it. Earlier this year, LTC didn't rally after halving since the demand wasn’t there.

In any case, speculation and market conditions have aligned in CKB's favor and we should expect the price to rally going into the event. However, post-halving is anyone's guess if there will be demand for CKB, which would decide its future price action.

👾YGG Web3 Games Summit

The YGG Conference 2023 is a eight-day event that will take place from November 18-25th in BGC, Taguig, Philippines. The conference is focused on the intersection of gaming, blockchain, and Web3.

The conference will feature a variety of talks, panels, and workshops on a wide range of topics, including:

Web3 gaming development

Driving gaming adoption

esports

Venture funding in gaming

Some of the speakers and panelists that have been confirmed for the conference include:

Sebastien Borget, Co-Founder and COO of The Sandbox

Yat Siu, Co-Founder and Chairman of Animoca Brands

Gabby Dizon, CEO of Yield Guild Games

Jeffrey “Jihoz” Zirlin, Co-Founder Axie Infinity & Sky Mavis

YGG currently sits 125% above its September low ahead of the conference.

📈‘USDC to $2’

Circle, the issuer of the USDC stablecoin, is reportedly considering going public in early 2024, according to a November 7th report by Bloomberg.

The company has reportedly initiated discussions with advisors about a potential initial public offering (IPO) next year. These discussions are ongoing and it remains unclear whether Circle will ultimately decide to proceed with a public listing.

Circle has been exploring the possibility of going public for some time now. In July 2021, the company agreed to a merger with Concord Acquisition Corp., a special purpose acquisition company (SPAC), in a deal valued at $4.5 billion. This deal was terminated in December 2022, leaving Circle to explore other options.

Circle's potential IPO could have implications for Coinbase, given that Coinbase is an investor in Circle through an investment that was announced in 2022.

TradFi/Macro

Economic Data

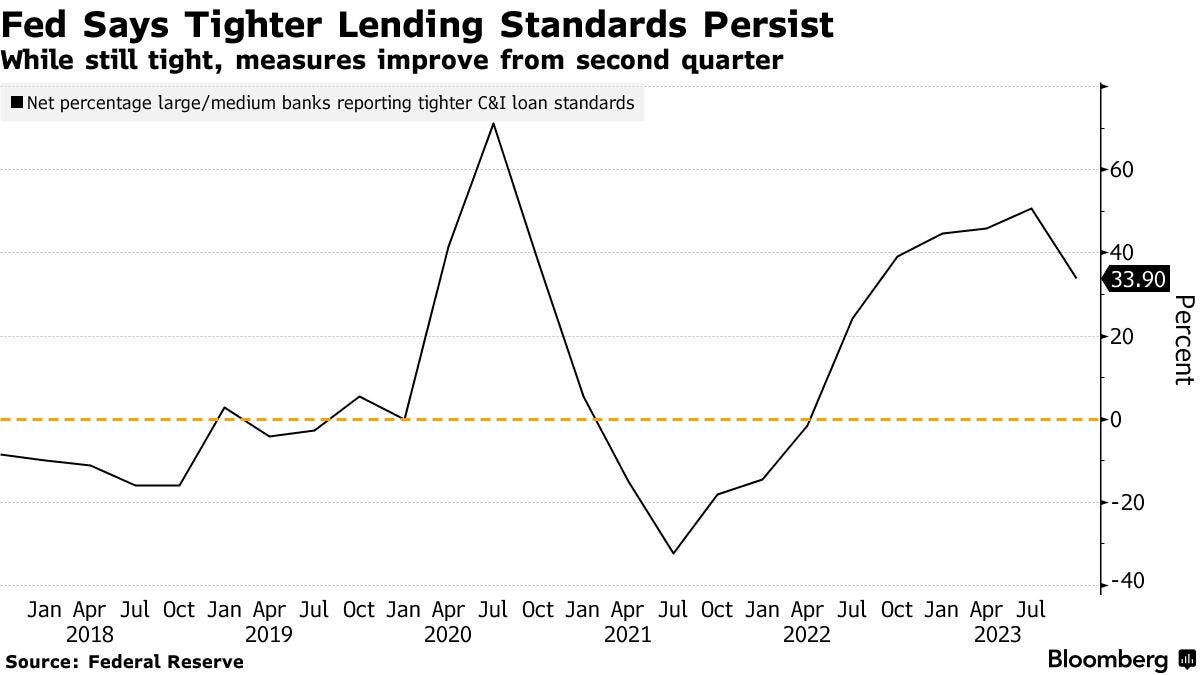

It was a soft week on the data side. The senior loan officer survey showed little change, with lending standards remaining tight, demand for loans weak, and banks maintaining lending conditions pretty much unchanged.

Consumer long-term inflation today hit a 12-year high, rising to the highest level since 2011. Meanwhile, consumer sentiment slipped to a six-month low of 60.4, weaker than all forecasts.

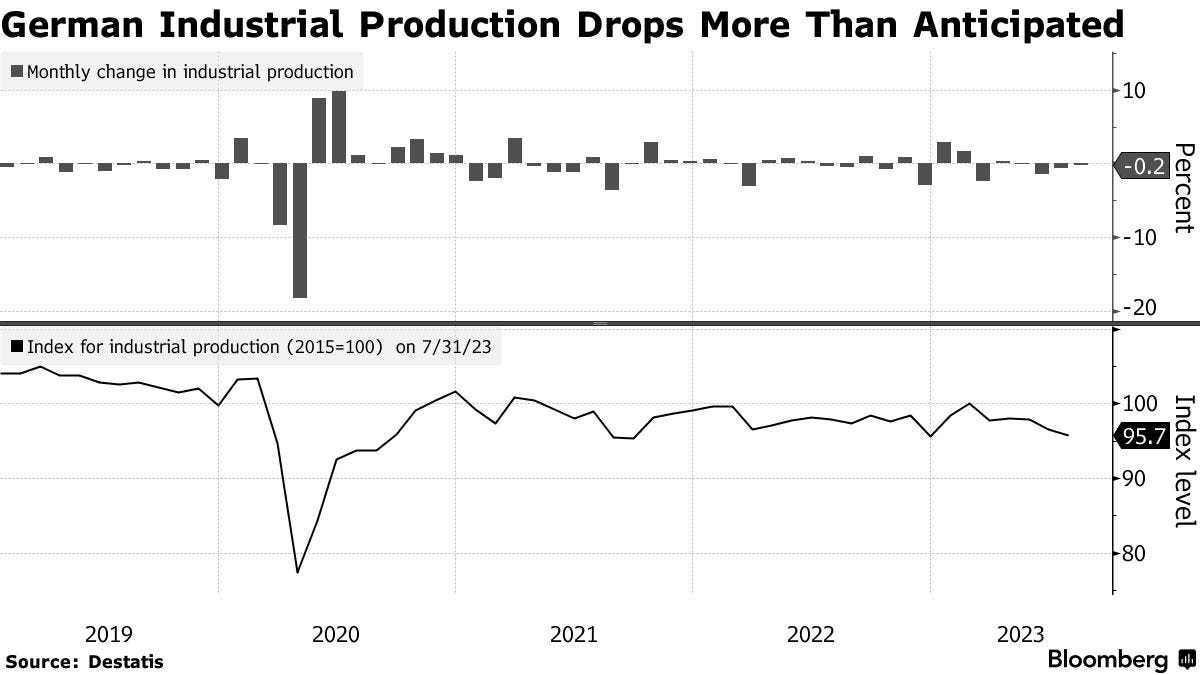

Europe continues to disappoint, and the outlook has worsened, with Germany reporting the fourth consecutive month of falling industrial output, reaching its lowest level this year. This trend is putting a lid on EURUSD.

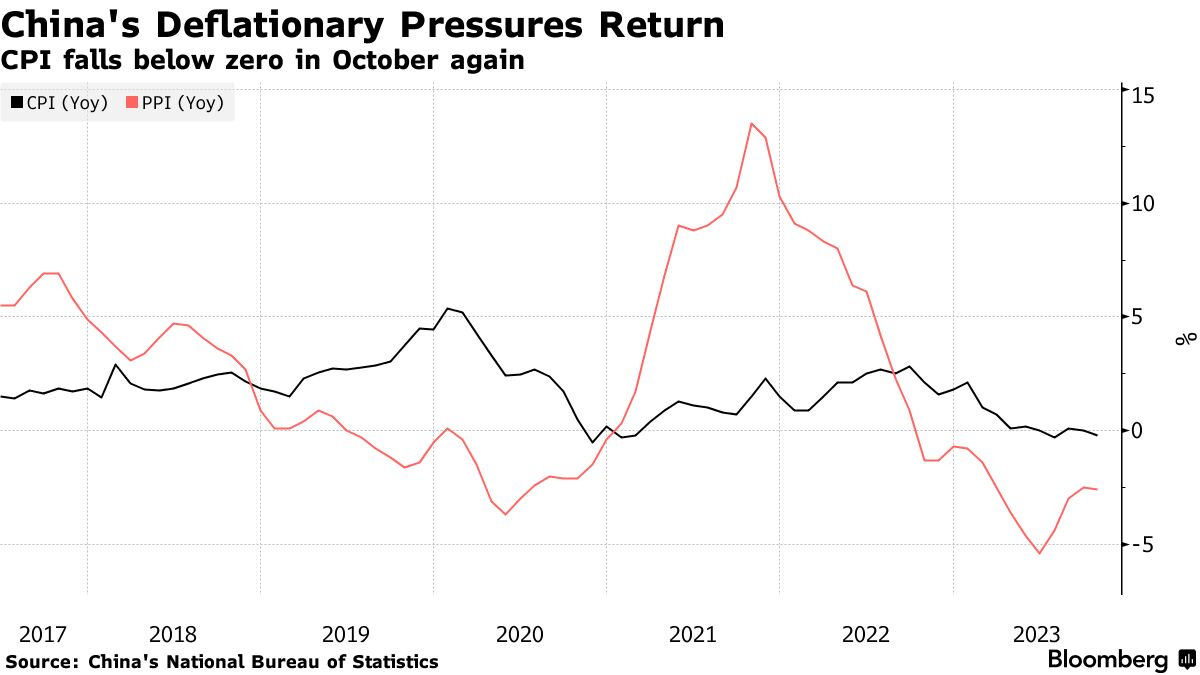

China doesn't look any better; consumer deflation is still the theme, and the recovery remains fragile. Consumer prices fell 0.2% year-on-year, slipping below zero, while producer prices declined for the 13th straight month by 2.6%.

Stock & Bond Market

After the biggest gamma squeeze in years, markets showed little change this week, trading in a tight range of 50 points as Fed speakers and Jerome Powell on Thursday kept a lid on further upside.

The bond market experienced little relief on Tuesday and Wednesday after a stellar 3-Year and mediocre 10-Year were auctioned, causing yields to drop by as much as 5 bps. However, stocks and bonds began to tumble after a catastrophic 30-Year auction stopped with the biggest tail on record. The cause of this was later attributed to a hack of the Chinese Industrial & Commercial Bank.

Central Banking

The Royal Bank of Australia ended a four-meeting pause on Tuesday and raised the rate to 4.35%.

All in all, central bankers around the world have a clear and consistent message this week: officials won't hesitate to tighten if needed while assessing incoming data.

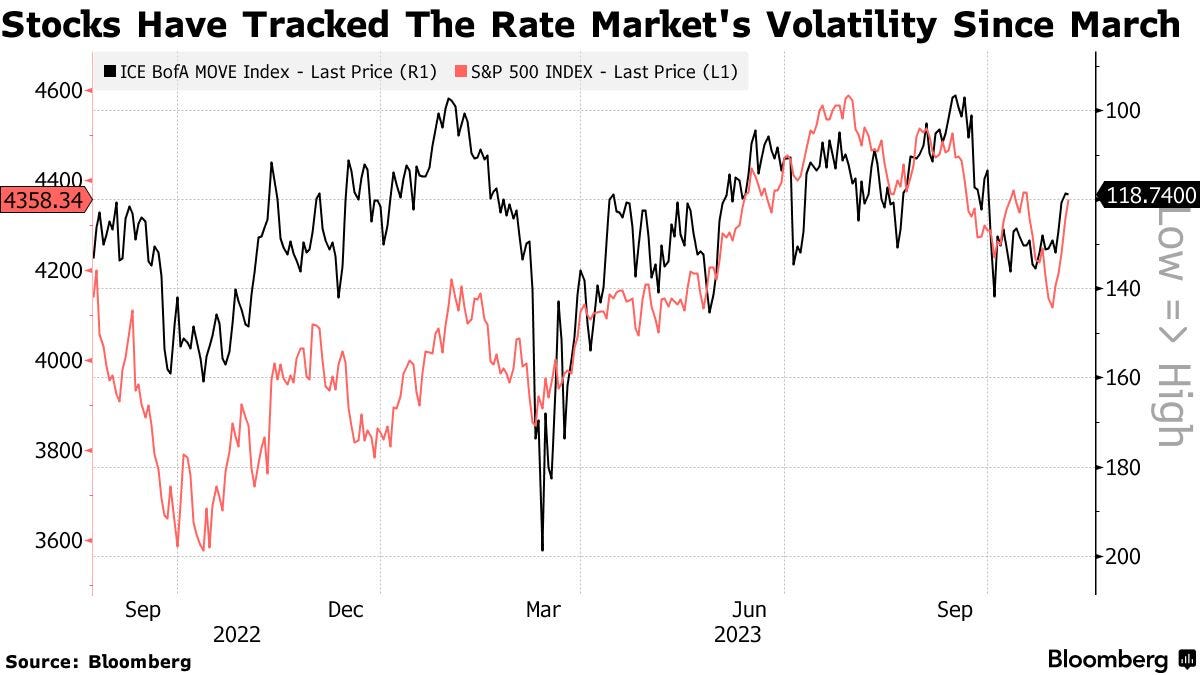

Outlook For Next Week

Our market outlook hasn't changed from last week. The year-end greed is in full force, and optimism has been reflected in fund flows, recording $8.8 billion in the week through November 8. For the market to keep a sustainable rally from here, it needs something it hasn't received yet, which is a calm down in the treasury market. We advise keeping an eye on factors that influence that bond volatility, such as bond auctions, labor market or comments from Fed officials.

Key Events For Next Week

Monday:

EU Commission Economic Growth Forecast

Tuesday:

UK Employment Change

EU Q3 GDP

EU Employment Change

US Fed´s William

US Fed´s Jefferson

US Fed´s Goolsbee

US CPI

Japan Q3 GDP

US Consumer Confidence

Wednesday:

China Retail Sales/Industrial Production

UK CPI

UK BoE Monetary Policy Report

US Retail Sales

US PPI

Thursday:

US Industrial Production

Friday:

UK Retail Sales

EU CPI

US Housing Starts & Permits

Trader Takes @cryptoalle

1: How would you describe your trading style ?

Intuition driven discretionary trading.

2: What do you think is a personality trait that a professional trader must have?

Staying open minded when it comes to reflecting on your trade selection, and ‘listening’ to the market when it presents you hints of a flip in sentiment. Another one is to be flexible with your size and this is one of the hardest skills to perfect.

3: What is something that you implemented that improved your trading the most in the past year?

Consistently withdrawing money from the prop futures account, to a place I don't have access, after a good streak of wins.

4: What advice would you give to a beginner trader?

Have confidence in your intuition, and learn from repetition. Make your decision based on your observations, and believe in them. Through time you will build experience in this approach.

5: What is your market outlook for next week?

I think Ethereum will break the YTD highs and the market will be all over the place until the end of the year. It's hard to stay active as a trader during an uptrend, so stay focused on the rotations/narratives these markets will bring.

Bitbit’s Note

The biggest sign that a trader is in pain is when he is silent. In a bullish cycle, noticing the overall trading sentiment pays the most.

Yesterday, during the BTC flush from 38k to 35.5k, there was a massive amount of liquidations on a large list of Binance futures altcoins, across the board. The feed was silent. That was it. The opportunity. This is what real opportunities look like.

Our eyes are on Friday the 17th, we believe the bullish sentiment will remain strong till then. At least.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall @SmartGamblinggg

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.