The Weekly

BTC ETF APPROVED - REPORTEDLY

BTC ETF APPROVED (NOT) - REPORTEDLY

In an unfortunate(fortunate) incident, Cointelegraph's social media team, without prior editorial approval, posted unverified news on X. The inaccurate information claimed that the SEC had approved BlackRock's iShares spot Bitcoin ETF. This misinformation originated from an unconfirmed screenshot posted by a now deleted account on telegram, who alleged it came from Bloomberg Terminal. The fake news spread like wildfire and within 7 minutes, BTC was trading above 30k.

Happiness was short-lived as the community soon realized that there was no credible source to support the claim. Positions began to unwind even faster than they had been established. Within the next 15 minutes, BTC retraced all the way back to 27.7k, erasing approximately 11% of the open interest on Binance. The fact that Coinbase was trading at a premium added to the initial excitement over the news. Coinbase had maintained a premium throughout the weekend, trading at a healthy $30 above the Binance spot price. This premium had contributed to the belief that insiders were buying into the news.

Eventually cointelegraph extended its sincere apologies to its readers and acknowledged its recent lapse in journalistic standards (btw those $100m in liquidations refused to accept the apology).

However, not only did many professional traders successfully capitalize on this brief market event, both on the way up and on the way down, but it also provided valuable insights on several key points:

1. Money is on the sidelines, indicating that many traders are not positioned for this ETF news.

2. The ETF news is not exactly priced into the market, as evidenced by the rapid price surge.

3. This incident served as a practice session for traders, offering a glimpse of how explosive the move could potentially be and allowing them to reflect on their execution strategies.

4. Options quickly adjusted to price in increased volatility. The Bitcoin volatility index (BVIV) surged by 20% in a matter of minutes, if not seconds, to account for the heightened uncertainty. As a result, option flows underwent significant changes after the event, with retail call buyers exhibiting FOMO tendencies.

Let's hope that the next time we receive such news, it originates from the SEC website rather than a random dog picture on Telegram.

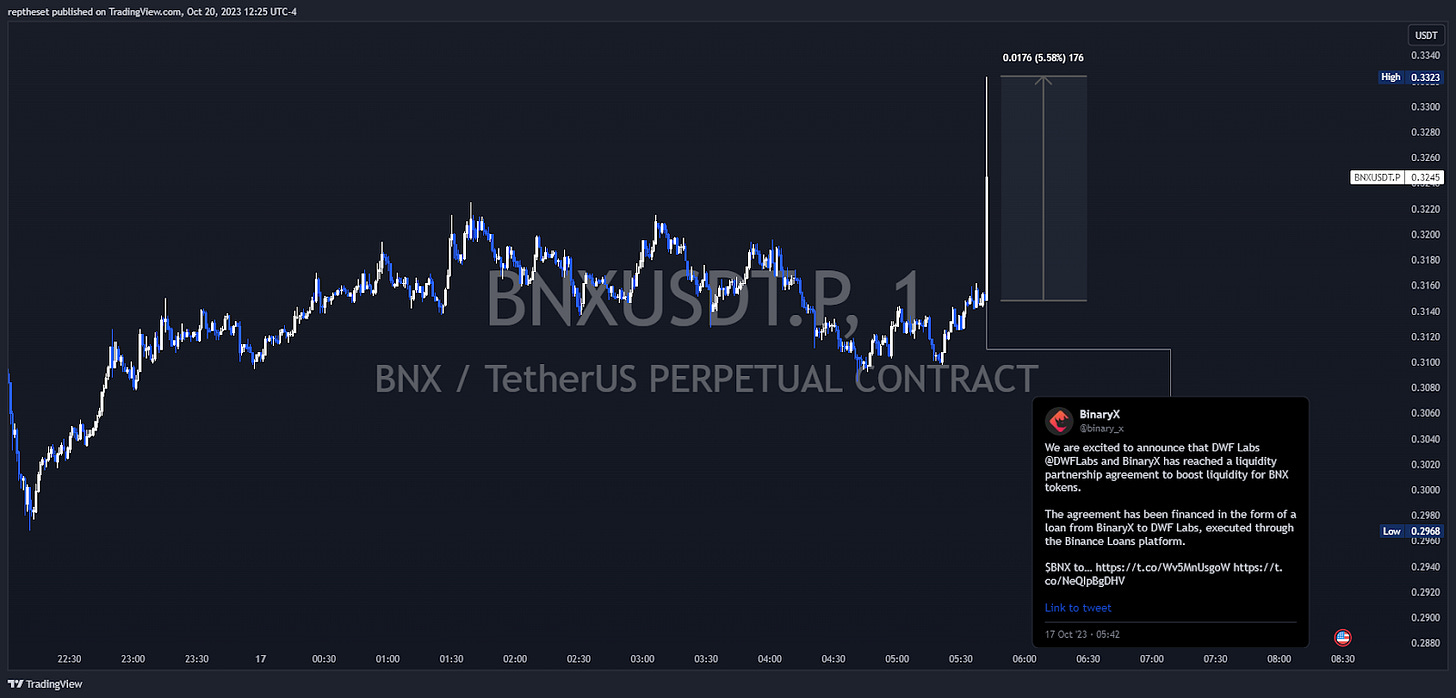

BNX & DWF Labs: NFA DYOR 🎢

BinaryX and DWF Labs announced a liquidity partnership agreement on 17th October.

DWF Labs’ strategic ‘market activation’ strategy has become well-known by most market participants, causing any DWF Labs token announcements to spark an increase in trading volume. Although the exact terms of the loan were not made public, speculators rushed into the market on the initial announcement, causing prices to spike 5.5%.

This was short lived as the token instantly reversed into a -29.5% drawdown from the high, as spot markets saw significant token distribution both during and after the announcement.

Perhaps the BinaryX social copywriter should have taken a page out of Andrei Grachev’s book and prefaced their announcement with NFA DYOR when they stated “$BNX to the moon”.

(It should be noted that the initial tweet was deleted and mention of the Binance Loans Platform removed from the reposted tweet announcement.)

Blur Airdrop Season & New Tokenomics Discussion

On October 8th, Alex-Arca started a thread on the Blur forum regarding the introduction of a trading fee for the Blur protocol. Currently, BLUR doesn't have trading fees, which means it does not generate any revenue. The 20th of November is a critical date for BLUR as the second season of airdrops is scheduled to begin, with plans to distribute 300 million BLUR coins, representing 30% of the circulating supply.

There is an urgent need to improve the token's economics in order to prevent further depreciation of BLUR and retain the few remaining users. The community and developers are frustrated with the down-only price action.

The fee discussion revolves around a 1% or 0.5% trading fee, which would result in a monthly burn of 0.3%/0.15% of the supply. While this may not be significant with the current Total Value Locked (TVL) and volume, it has the potential to generate millions in a bull market.

On Wednesday, BLUR became the daily leader, marking the top with a parabolic move and quick dump, resulting in a 42% increase since the first announcement. Given the new tokenomics model, imminent airdrops, ongoing discussions, and potential new proposals and announcements regarding Season 2, BLUR is expected to provide trading opportunities on both sides in the coming weeks. As we continue to dive deeper into the distribution of the airdrop, we will provide updates on the changes in tokenomics and upcoming events for BLUR.

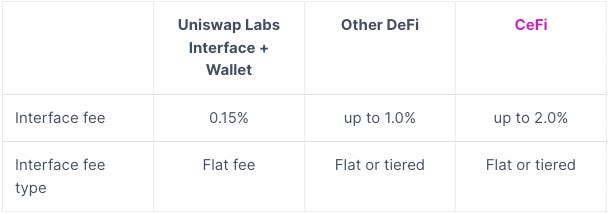

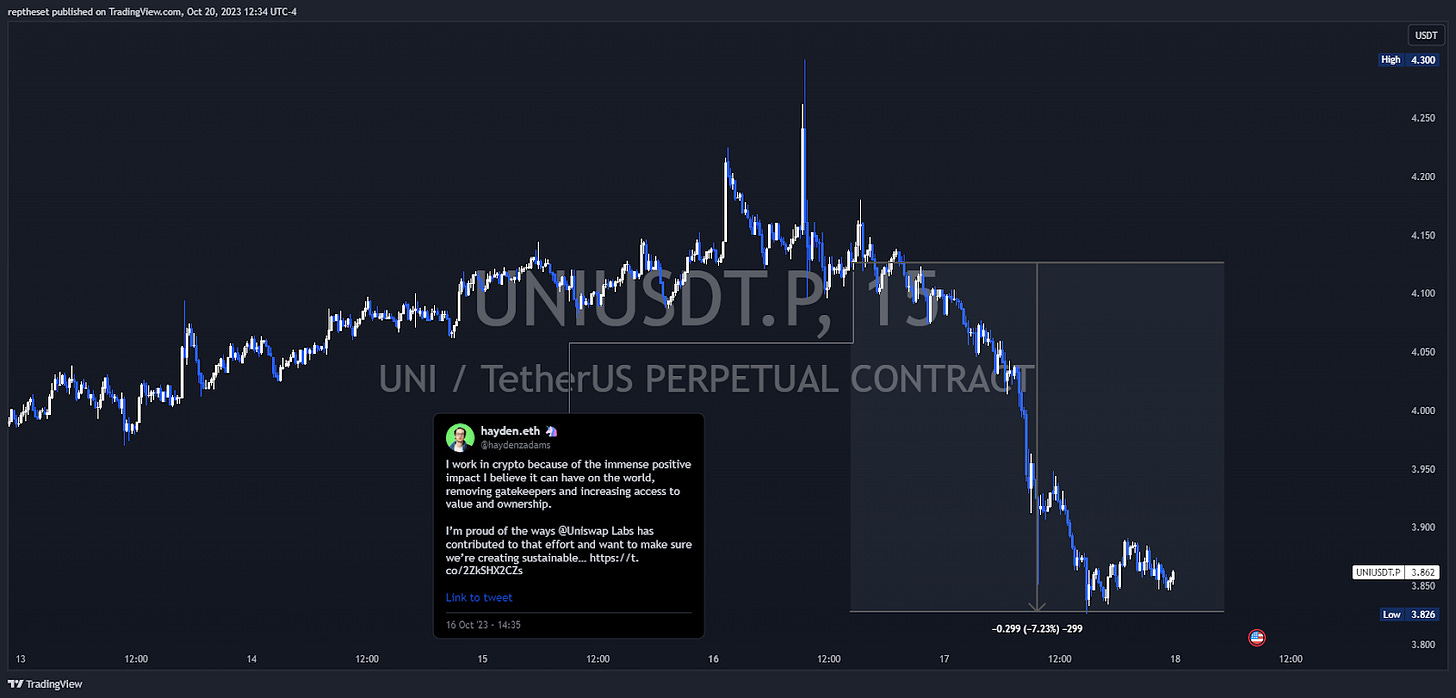

Retail Tax: Uniswap Fee Change

On the 16th October, it was announced that as of the following day Uniswap would implement an additional charge of 0.15% swap fee on certain tokens in the Uniswap web app and wallet.

However, these changes in swap fees do not affect users that call the uniswap swap contracts directly, through aggregators or any other UI’s.

(table via Uniswap)

Token pairs with interface fees:

ETH, USDC, WETH, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, XSGD

These tokens are subject to fees only when traded through Uniswap Labs interfaces on mainnet and supported L2s.

Fees are only collected on swaps where both input and output tokens are subject to fees.

Swaps from one stablecoin to another stablecoin are excluded from this fee.

Wraps between ETH and WETH are excluded from this fee.

In an announcement, UniSwap founder Hayden Adams was clear to make a distinction between this update and the eternally awaited Uniswap Protocol fee switch, which can only be ‘voted’ via the theatrical UNI token governance process.

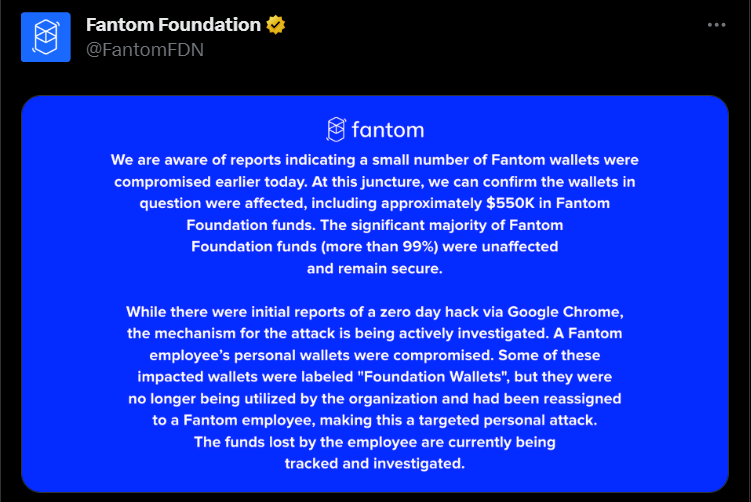

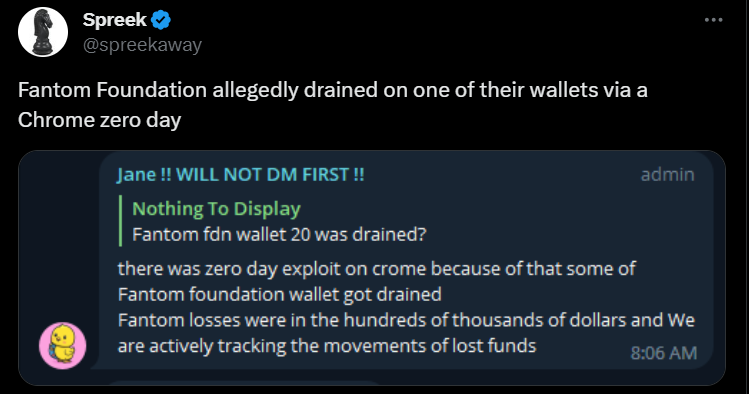

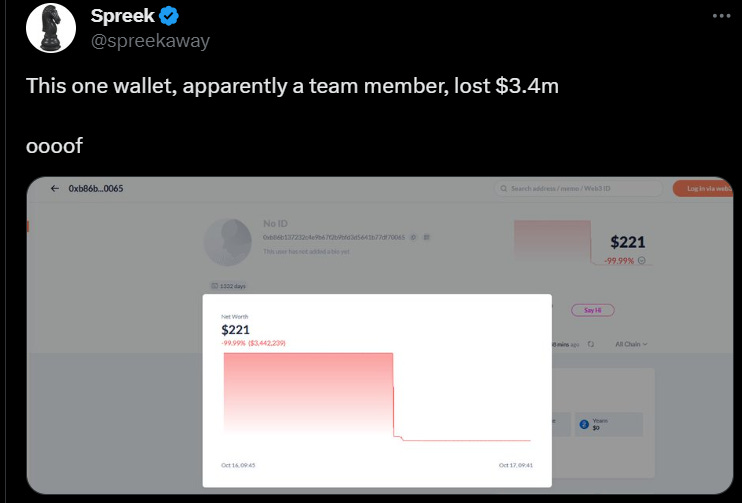

Fantom Attack

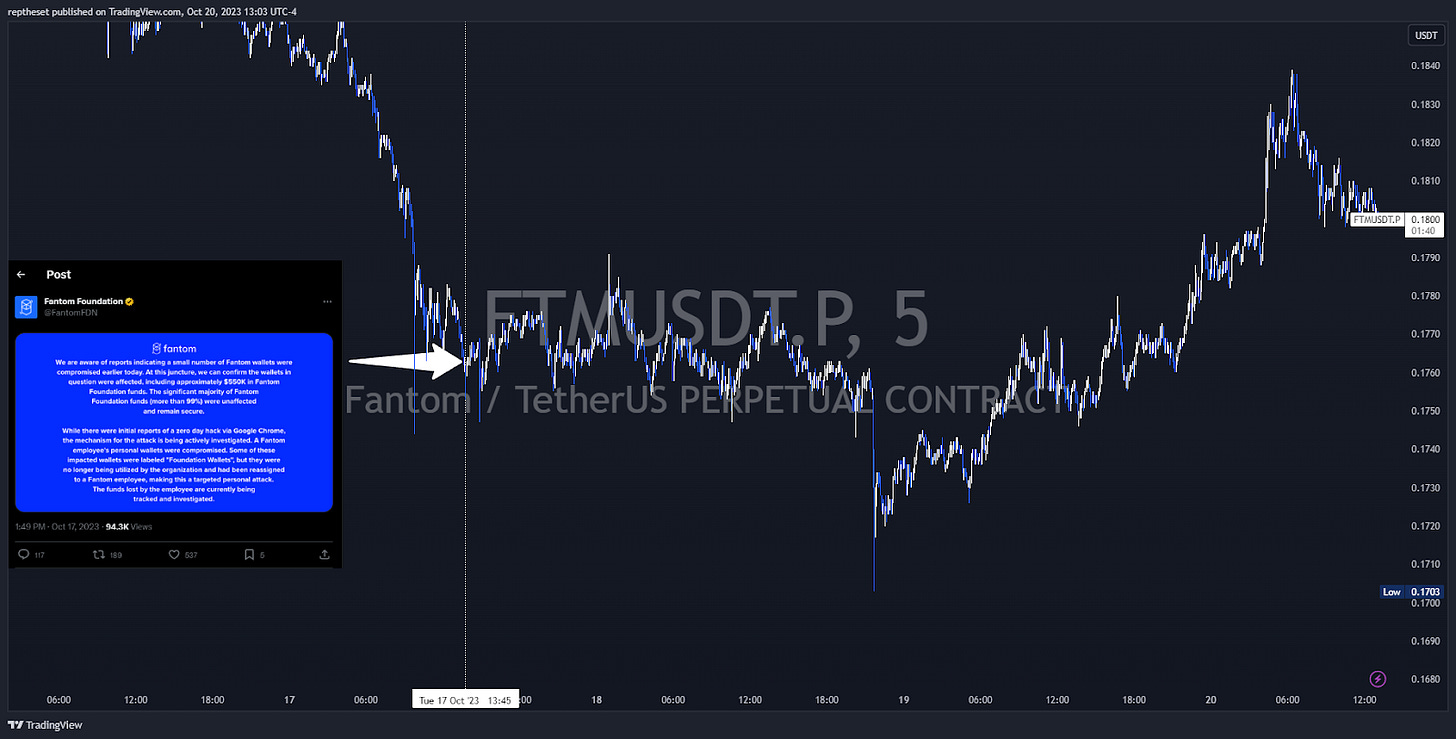

In a recent incident, the Fantom network experienced a security breach resulting in a loss of approximately $550,000 worth of FTM. Initially, it was reported that the breach might have involved as much as $7 million, but it was later clarified that this was not the case. The attacker allegedly targeted individual wallets, including that of the Fantom Foundation, rather than compromising the overall security of the network.

By the time FTM made the formal announcement, traders had already caught wind of it from unofficial accounts and blockchain explorers, causing the token to drop approximately 5% from that day's opening price. Open interest had increased by about 15%, indicating that decent short positions had accumulated. However, after the official confirmation that the total loss was of $550,000 vs the $7 million rumor, the market attempted to establish a short-term balance between 17 and 18 cents. In the aftermath, price reversed its course on Friday, in tandem with Bitcoin and the overall market's strength.

Bitcoin and Ethereum

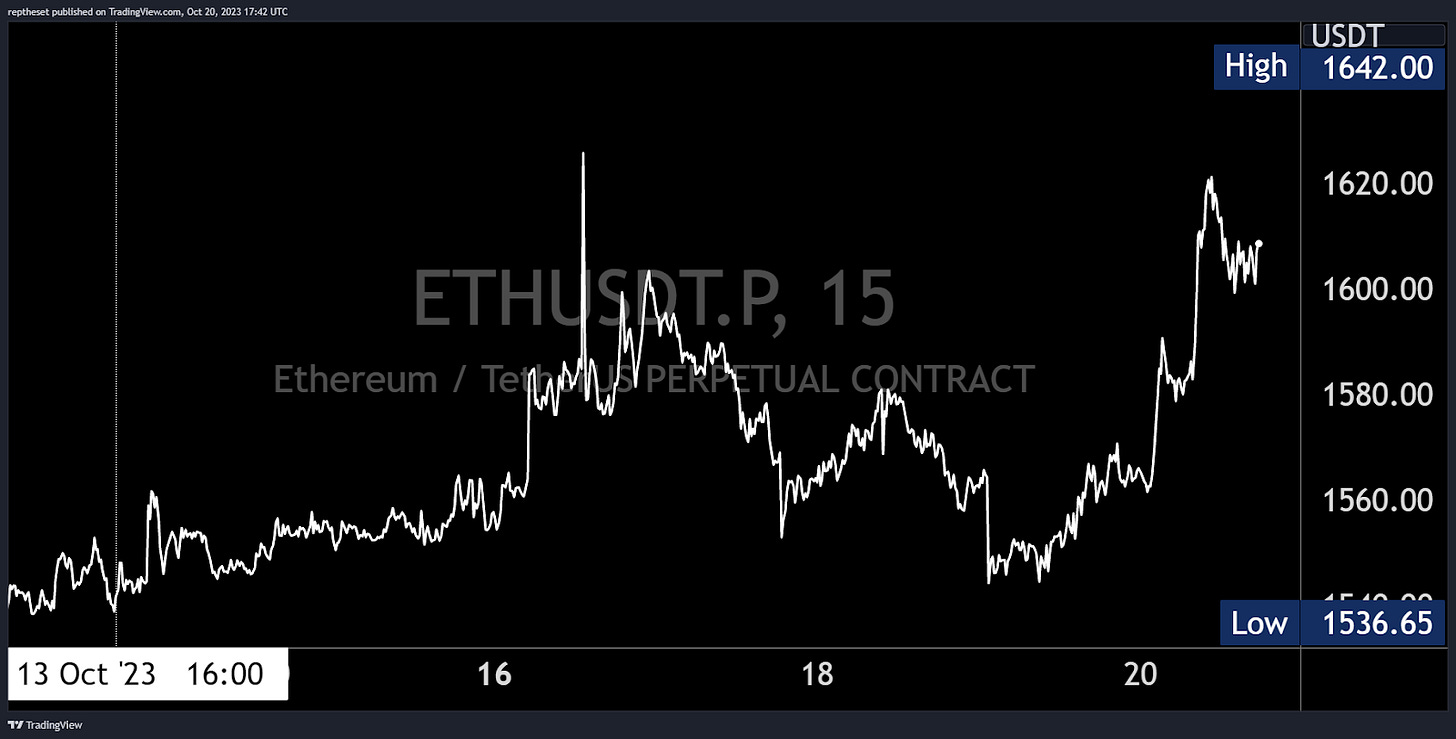

Following last week's Grayscale news, the bullish momentum on Bitcoin continued this week. Along with the spot ETF news we discussed earlier, BTC had an uptrend week, beginning the week at $27k and testing $30k twice, gaining more than 10%.

Ethereum followed Bitcoin on the ETF false approval, but had a much more muted rally. It eventually retraced before finding support near the weekly open around $1540 and bouncing back above $1600.

The ETH/BTC pair continues to show weakness as the BTC ETF narrative captures the market's attention and activity.

Upcoming Event

Polkadot Unlocks

On October 24, 2023, 113,373,579 DOT tokens will be unlocked, currently valued at ~$420 million USD, representing 8% of the total Polkadot MarketCap. These DOT tokens were initially locked in the first round of parachain slot auctions in 2021, with Moonbeam (GLMR) being the largest participant, contributing 35,759,931 DOT tokens. At the time of the parachain auctions, DOT was trading at $25. Participants are currently down 85% of their original investment. The chart clearly shows us that speculators are selling into this event and it would be no surprise that this “bearish” headline marks a temporary bottom.

TradFi/Macro

Economic Data

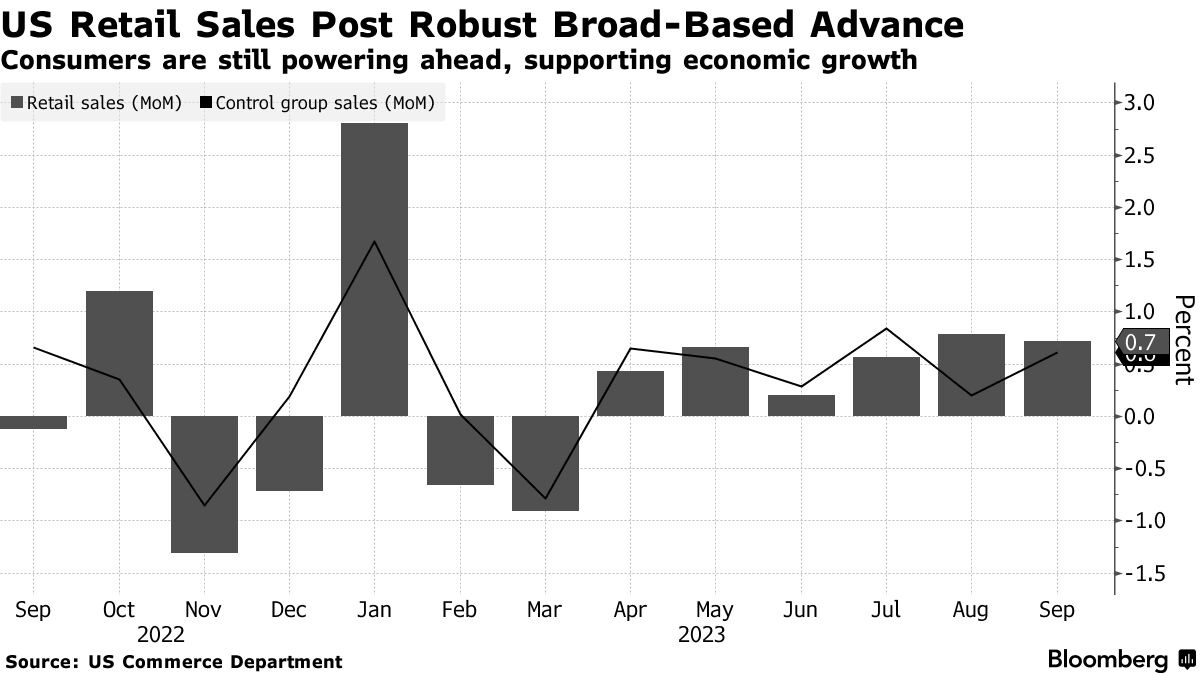

This week's economic data from the US was light, but the recent picture remains unchanged. On Wednesday, fresh evidence of a resilient consumer emerged, as retail sales exceeded all estimates and industrial production strengthened again. Although sales were heavily seasonally adjusted, they increased by 0.7%, and the so-called control group, which is counted in the GDP report, rose by 0.6%.

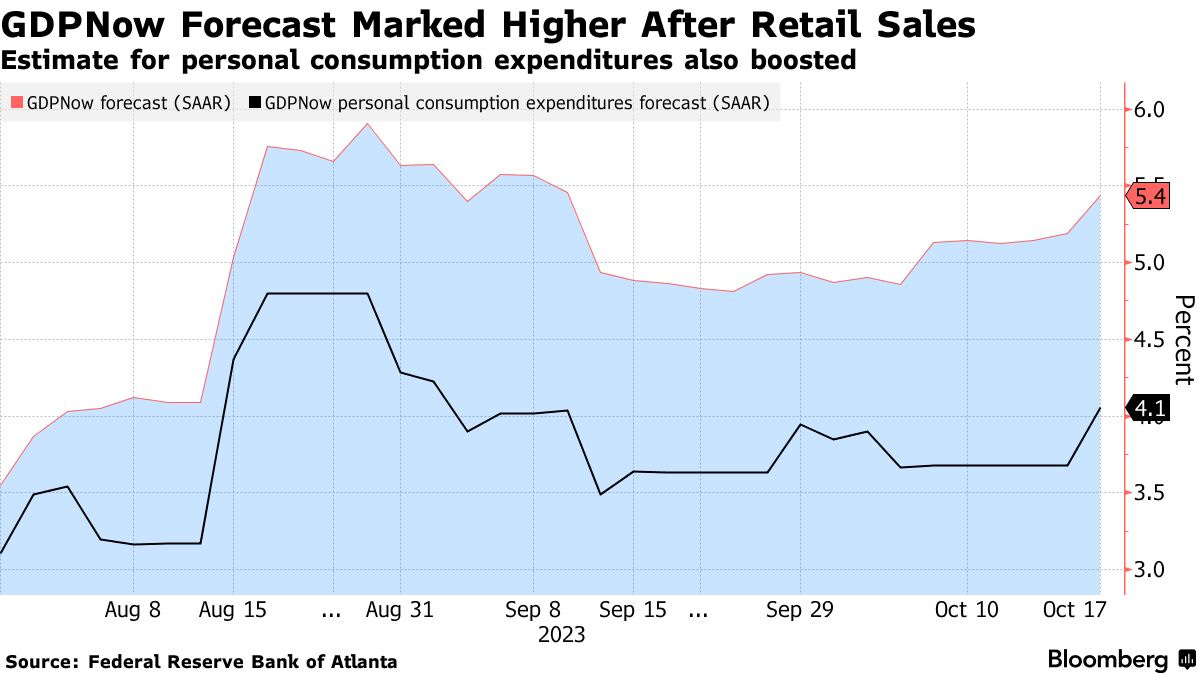

As a result, the Atlanta Fed's GDPNow forecast was boosted to an annualized 5.4% for Q3, the strongest since the end of 2021. However, the Fed's Beige Book survey on Thursday presented a different outlook, forecasting stable or slightly weaker growth, with continued easing of labor market tightness. Firms expect prices to increase, but at a slower pace than in previous quarters.

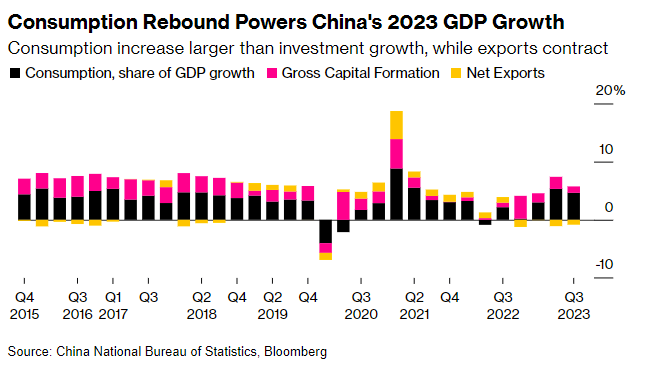

The more interesting news this week came from China. Retail sales beat expectations, the jobless rate fell, and the growth goal of 5% remained well within reach. This perhaps represents the strongest confirmation of a cyclical bottom, according to Citi economists.

Stock & Bond Market

After the feared escalation over last weekend turned out to be a nothing burger, and with diplomatic efforts to prevent an expansion into regional conflicts, we have seen stocks grinding higher and the bond market continue to sell off as a mechanical reaction to the unwinding of hedges.

Traders have shifted their focus to corporate earnings, as we observed increased put buying and call selling on Wednesday after the expiration of the last VIX contract.

Tesla's results on Wednesday were worse than the previous set, and despite price cuts earlier this year, the US automaker wasn't able to clear its massive inventory. Operating margins dropped further; gross margins are at the lowest levels since 2018 and operating profit fell by $1.9 billion, raising concerns about the demand for high-end products.

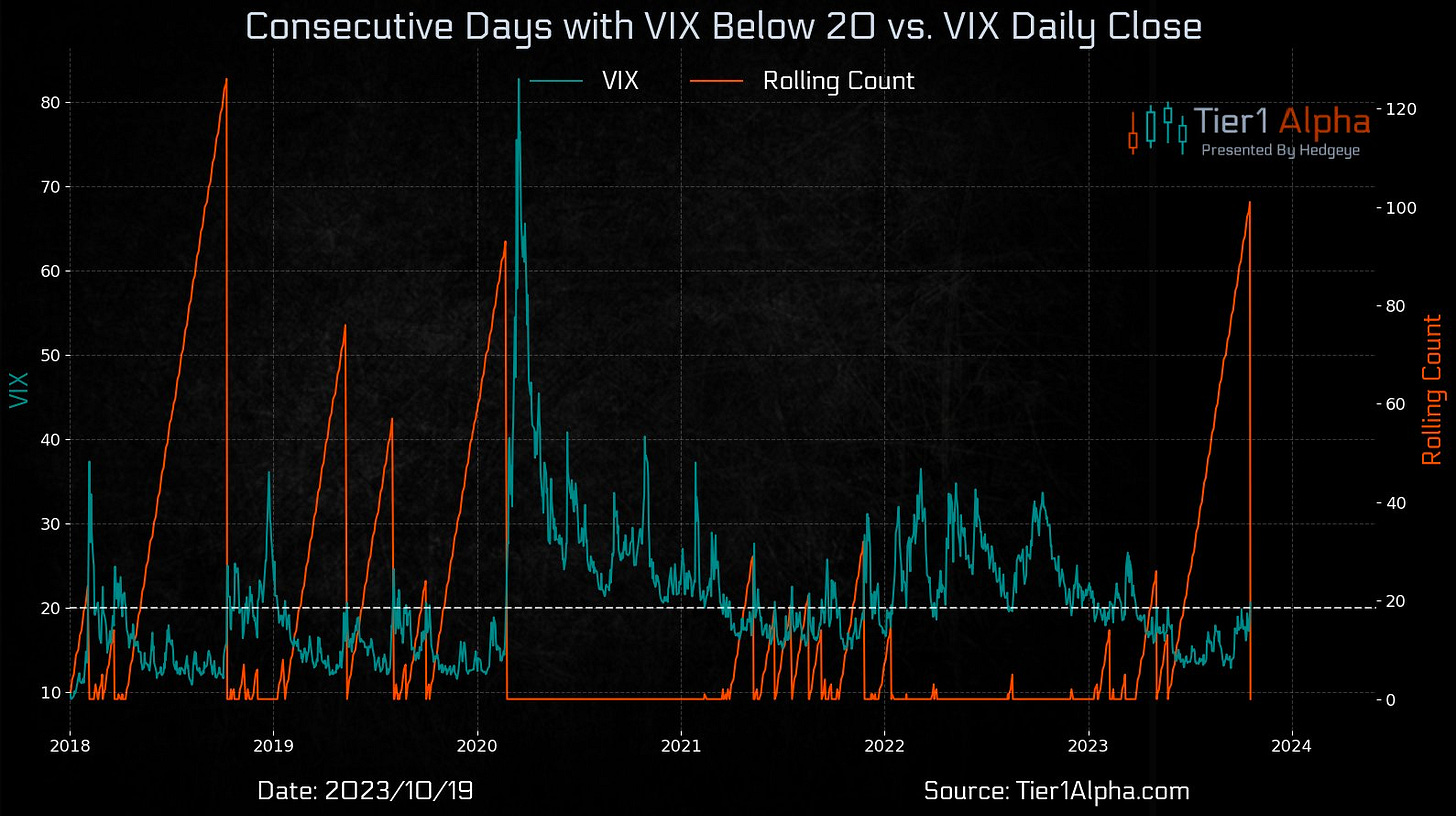

As we forecasted in our last newsletter, the S&P 500 gathered around the 4300 mark for OpEx. Markets remain in negative gamma, and traders are looking at positions to get rolled over lower in case the market remains bearish. The VIX closed above 20 for the first time on Thursday, ending a streak of 106 days below this mark.

Central Banking

This week, Fed officials have left their stance on monetary policy unchanged. Yesterday, Powell´s comments affirmed market expectations for the Fed to skip a rate increase in November's meeting, and suggested that the recent run-up in long-term yields could lessen the need for further hikes. However, he also reiterated his view saying that the central bank should hold interest rates steady and restated his intentions to get inflation back to 2% target, while keeping the door open for a future hike if policymakers see further signs of a resilient economy.

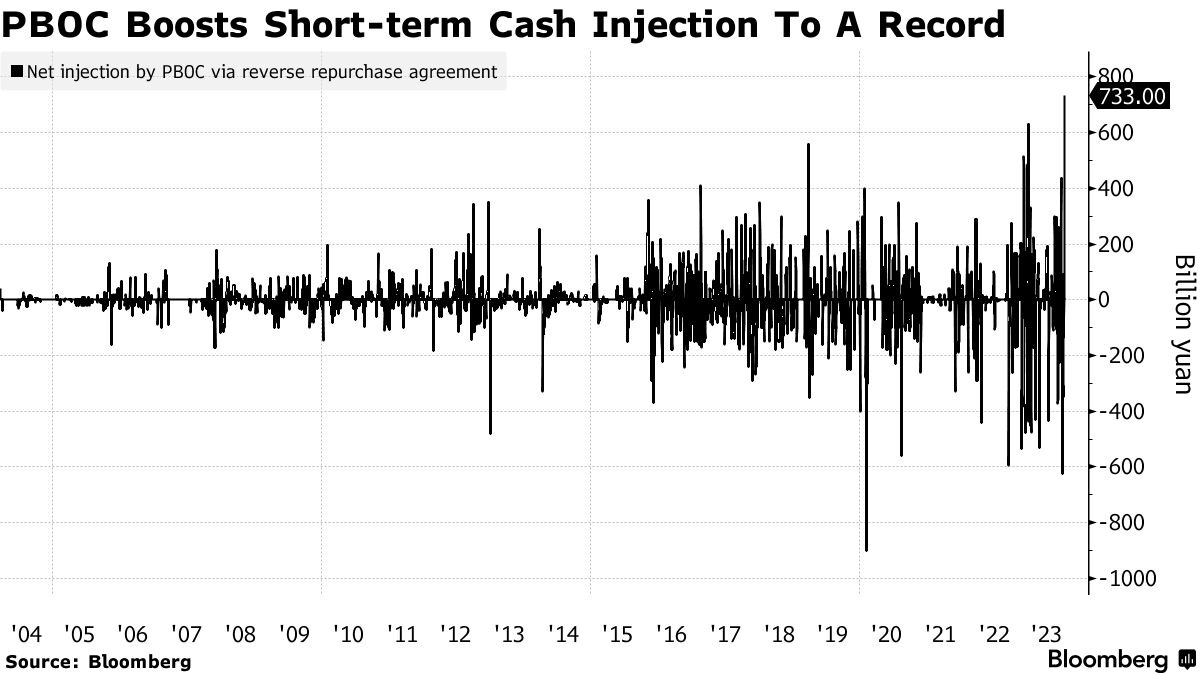

The biggest surprise came during today’s meeting of the Peoples Bank of China, which injected a record sum of cash via its repo contracts. This is a sign that Beijing is ready to bolster growth and take more measures to roll out further fiscal stimulus.

Outlook For Next Week

While the record injection by China and the return of corporate buybacks next week may offer some support, we anticipate that the market will remain turbulent until at least the start of November. Traders will keep their books hedged, and positions are expected to be rolled over lower next week.

Considering the ongoing volatility in commodities and bonds, along with Fed Chair Powell giving the green light for further sell-offs in bonds and keeping the door open for one more rate hike, we believe investors will be pushed further out of riskier assets, but should be on the lookout for more growth and inflation data down the road.

After observing a decent amount of foreign buyers of 20-Year bonds, a total of $141 billion in bonds will be open for auction next week. We suggest staying alert on these auctions, as they provide a gauge for risk appetite.

All central banks enter their blackout period after today's close. The Bank of Canada will kick off the new round of policy decisions, followed by the European Central Bank (ECB) on Thursday.

Key Events For Next Week

Monday:

EU consumer confidence

Tuesday:

UK employment change

EU HOCOB manufacturing and service

US S&P manufacturing and services PMIs

2-Year note auction

Wednesday:

Germany IFO business climate

Canada BoC meeting

US 5-Year note auction

Thursday:

EU ECB meeting

US Q3 GDP prelims

US durable goods

US 7-Year note auction

Japan Tokyo CPI

Friday:

US PCE

US personal income & spending

US Michigan consumer sentiment

Trader Takes @Dominik96491301

1: What is your most memorable trading experience in the last month?

It was this week, the fake Bitcoin ETF approval trade. My alerts went off when Bitcoin crossed $30,000. It became clear that the headline wasn't legitimate, and I decided to fade it. I had strong conviction that the price should retrace back to the origin of the move. I went short with a larger position compared to my regular size, and the trade played out in less than 15 minutes. I like this trade because throughout the entire execution, my target and invalidation was clear. I consider this type of setup a 9/10, in terms of conviction and expected strike rate.

2: What do you think is a personality trait that a professional trader must possess?

One of the most important traits is to have confidence in following your intuition. If you spend a lot of time in front of screens, you eventually develop a feel for the market, which you should use as a guiding principle. Trust your gut in every area of life, and you will see significant progress in many aspects within it.

3: What made you decide you wanted to be a professional trader?

I used to play poker for a living. I eventually decided to transition to trading, together with many of my friends. I love freedom, and consider myself a competitive person. Like everyone else, I am looking to make a living. Trading offers a solution to all of these, making it an easy decision for me.

4: What advice would you give to a beginner trader?

Start small. Even if you excel in other similar fields of work, this talent doesn't necessarily directly translate into trading success. In the beginning, trade as much as you can, analyze your trades and prioritize on gaining experience. With time, you will gain confidence and find yourself increasing your position size naturally. Most traders incur many losses due to simple mistakes, try to refine your system as much as you can and focus on the things you can control.

Bitbit’s Note

Stocks - heavy. Bitcoin - strong. Alts - weak.

The more SEC-related headlines we get, the more the consensus leans toward a spot Bitcoin ETF approval. The market is starting to digest these announcements and realize how thin the BTC sell side is, and how an approval will affect Bitcoin’s price right away, on the upside of course.

But if we look at Ethereum and the rest of the altcoin market, we can clearly see that the sentiment is still bearish, and the current state of the market remains dry. The so-called covid era retail is long gone. The remaining speculators are getting chopped left and right. If you’re a trader, your biggest challenge right now is to stay patient. You can still speculate and be active in the market, but you can’t play big in this environment. Especially following recent geopolitical events, the market is and will be as illiquid as it's ever been.

Therefore, before any size-up for all the traders operating in the prop and myself as well, I would need to see Bitcoin trading above 32k. There is no need to stick your neck out. We’ve seen what a juicy market looks like, and we’ve witnessed talented traders perform. Trying to force things in this environment is abusing your talent. Doing this will have a negative impact once the market brings forth better opportunities.

P.S. Bitcoin trading above 30k twice this week is a signal that there is light at the end of the tunnel.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall @SmartGamblinggg @MeDeity

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.