The Weekly

Get your popcorn ready

SPELL- Round 2, Fight

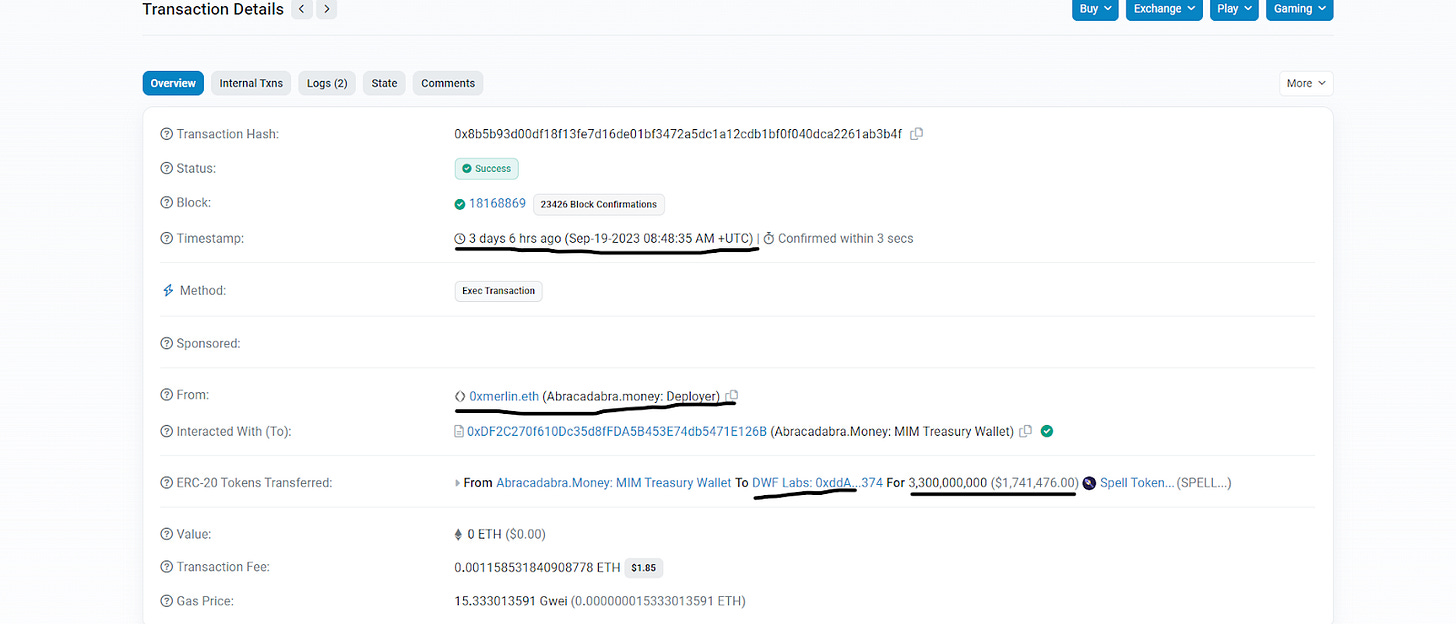

Recently, SPELL has shown a lot of trading activity and momentum following their recent proposal to partner with DWF as their primary market makers. Tuesday morning, a transaction worth $1.75 million, roughly 3.3 billion Spell tokens was noticed through on chain alerts. This transfer was from Abracadabra.Money's MIM Treasury Wallet to DWF Labs.

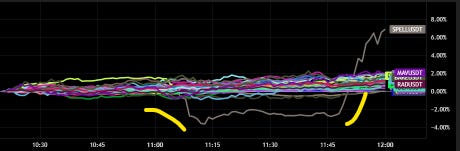

The market responded positively to this news, lifting the token's price by 25% in the subsequent three hours, reaching $0.0006. Following this event, the market has been trading in a 10% range, fluctuating between $0.00053 and $0.0006.

Another point of interest was the sudden increase in sell order deltas right before the news emerged. Spell's value dropped about 3.6%, shaking out some leveraged long positions before the uptick. It's worth mentioning that this small dip was specific to Spell, showing some type of manipulation attempt before the announcement.

Galxe 2.0

Tuesday, following last week's Bithumb listing, Galxe's Twitter account tweeted an image showing a 10-minute countdown, teasing Galxe 2.0. The new version was unveiled 14 minutes later and includes several new features, including a mobile app, smart balance, and Web3 score. The initial ‘announcement of announcement’ allowed traders to build up long positions, albeit for a short period of time.

The main announcement saw the price consolidate for some time before surging with a strong bullish momentum. An interesting point to note is that the announcement was partial, as they only released part 1, with part 2 expected to be released later, possibly providing traders with a ‘sell the news' opportunity in the future.

Alchemy Pay

In an announcement by Cointelegraph on Thursday, Alchemy Pay revealed they had obtained a Money Transmitter License in the state of Arkansas. This is a significant development for ACH, as the license also places them in a select group of crypto firms, including giants like Coinbase and Jack Dorsey's Block, who are allowed to legally transmit money in the United States. The price of ACH went up roughly 11.5% following this announcement and continues to maintain its bullish momentum.

Token2049 Singapore

Over 10,000+ attendees descended to Singapore’s Marina Bay Sands for two days of scheduled events with speakers including Balaji Srinivasan, Author of The Network State; Changpeng Zhao, CEO of Binance; Ben Zhou, CEO of Bybit; Daniel Ricciardo, Scuderia AlphaTauri Formula 1 Driver; Jeremy Allaire, Co-Founder and CEO of Circle; Sam Altman, Co-Founder of Worldcoin and CEO of OpenAI; Jenny Johnson, CEO of Franklin Templeton; Sandeep Nailwal, Co-Founder of Polygon; and Cameron and Tyler Winklevoss, Co-Founders of Gemini.

For readers that didn’t make the trip, here's a TLDR:

Huobi Rebrands to HTX

In celebration of the crypto exchange’s 10th anniversary, the Justin Sun ‘advised’ exchange unveiled its global brand “HTX” in an effort to acquire a greater global user base.

In a press release to explain this branding turn the exchange explained:

“H” stands for Huobi, "T" represents TRON with a commitment to being all in TRON, and "X" stands for the exchange.

As many users commented the approach left much to be desired, with the rebrand appearing alarmingly close to the late FTX crypto exchange for which Sam Bankman-Fried faces seven different charges relating to its collapse.

Telegram & The Open Network Foundation announce Crypto Wallet

Popular messaging app Telegram will launch their new product, the self custodial wallet “TON Space” to the messaging app’s 800 million global users, excluding some jurisdictions such as the U.S.

After some regulatory complication via an SEC complaint in 2019, Telegram’s development of the Telegram Open Network (TON) blockchain was taken over by The Open Network Foundation (TON Foundation). supporting a number of blockchain applications on Telegram. This includes The Open Platform (TOP), responsible for the development of TON Space wallet.

The news added further fuel to the rally that started in August, as the price of Toncoin rose by an additional 35%, launching its market cap in the top 10 for a brief moment.

Zilliqa announces strategic alliance with GoogleCloud

The GoogleCloud partnership, a timeless classic for news traders, provided a sharp 8% move on the announcement of the multi-year alliance.

Darewise Entertainment announced plans to launch to BTC-Based Metaverse Token

The Animoca Brands subsidiary aims to expand Bitcoin’s capabilities by expanding into the metaverse with in-game assets furthering the Ordinals ecosystem on Bitcoin.

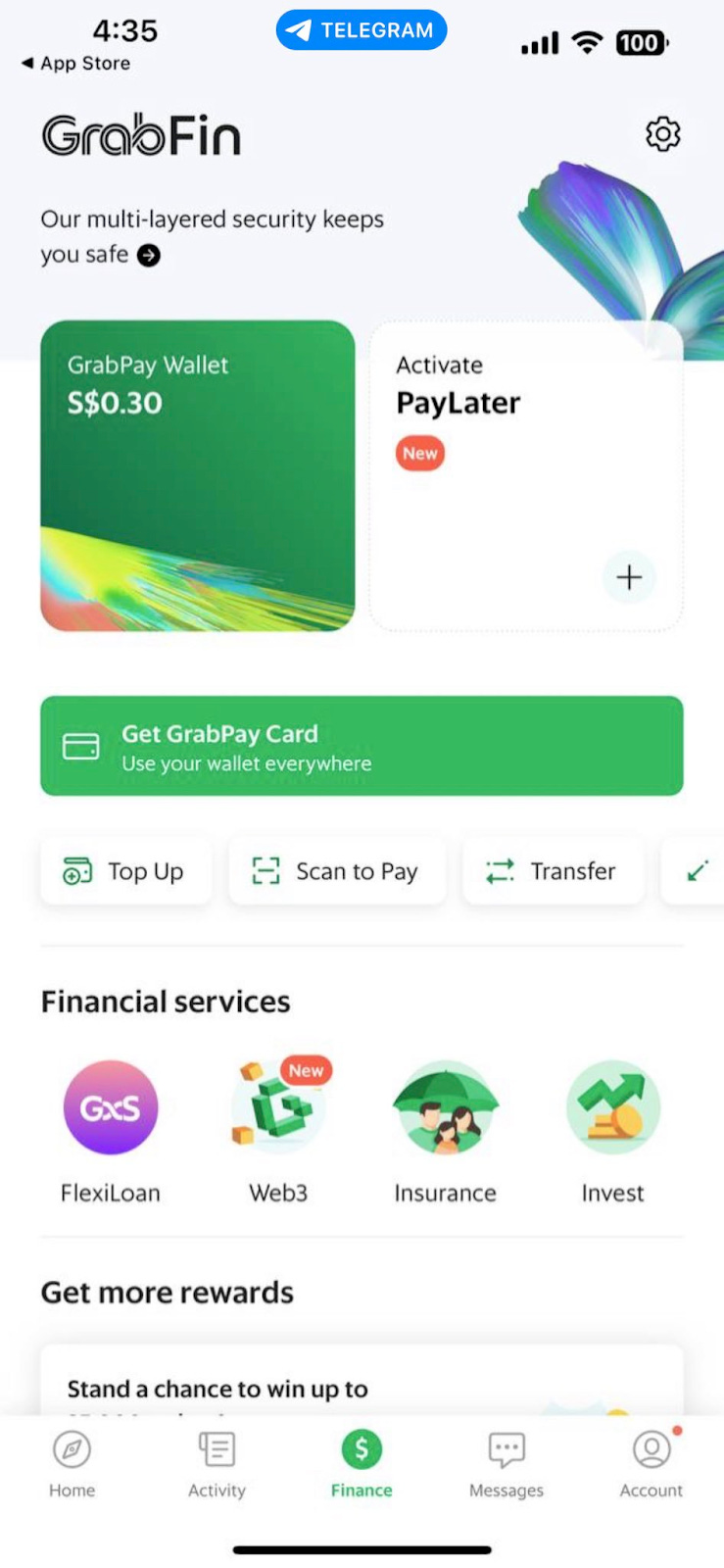

Circle announce partnership with Grab for Web3 Wallets

Following reports earlier in the month, the partnership enables users of the ride-hailing app to access blockchain wallets and earn rewards and collectibles in the Grab app supported by the Polygon blockchain.

(image via @0xjaypeg)

Astar Network to launch Layer-2 zkEVM with support of Polygon Labs

The partnership aims to boost adoption of blockchain in Japan within gaming and entertainment with its layer 2 solution, Astar zkEVM, utilizing the Polygon CDK. This partnership did not move markets.

KXVC launches $100 million fund with sights on Web3, AI and deep tech

Kasikorn Business-Technology Group (KBTG), a subsidiary of Kasikornbank (KBank), Thailand's second largest bank announced its KXVC fund, with a focus on the APAC region.

“For Web3, KXVC targets Web3 infrastructures, nodes validators, RPC providers, middlewares, modularity technologies, privacy, ZKP, wallets, alternative L1/L2s, shared securities, LsdFi and consumerization of NFTs.”

Upcoming Events

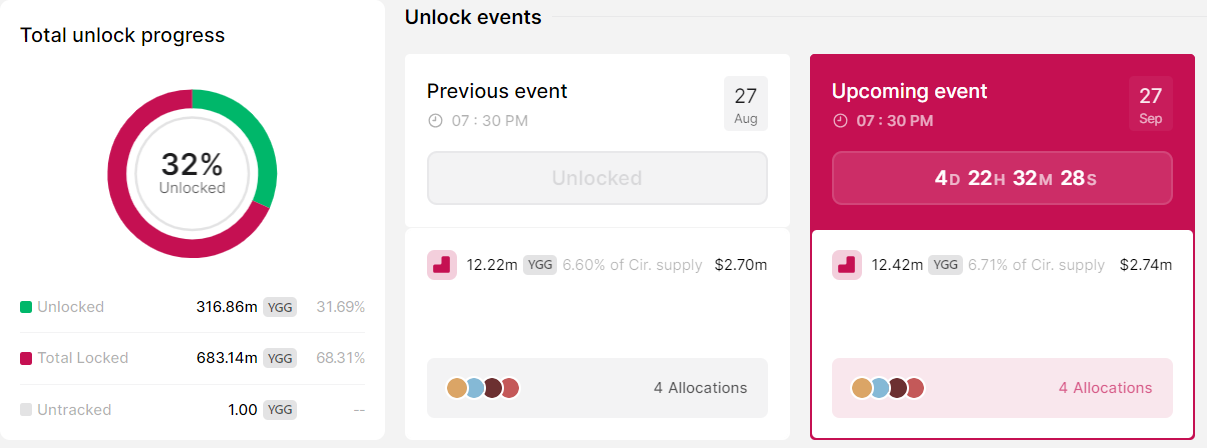

YGG Unlock

YGG has a 6.71% supply unlock on 27th September. The previous unlock was of similar quantity and had no significant market impact. It is worth noting that the market reaction to unlocks always depends on how traders are positioned going into the event. Large short open interest frontrunning unlocks tend to get squeezed, even though supply increases are considered “bearish” when it comes to tokenomics.

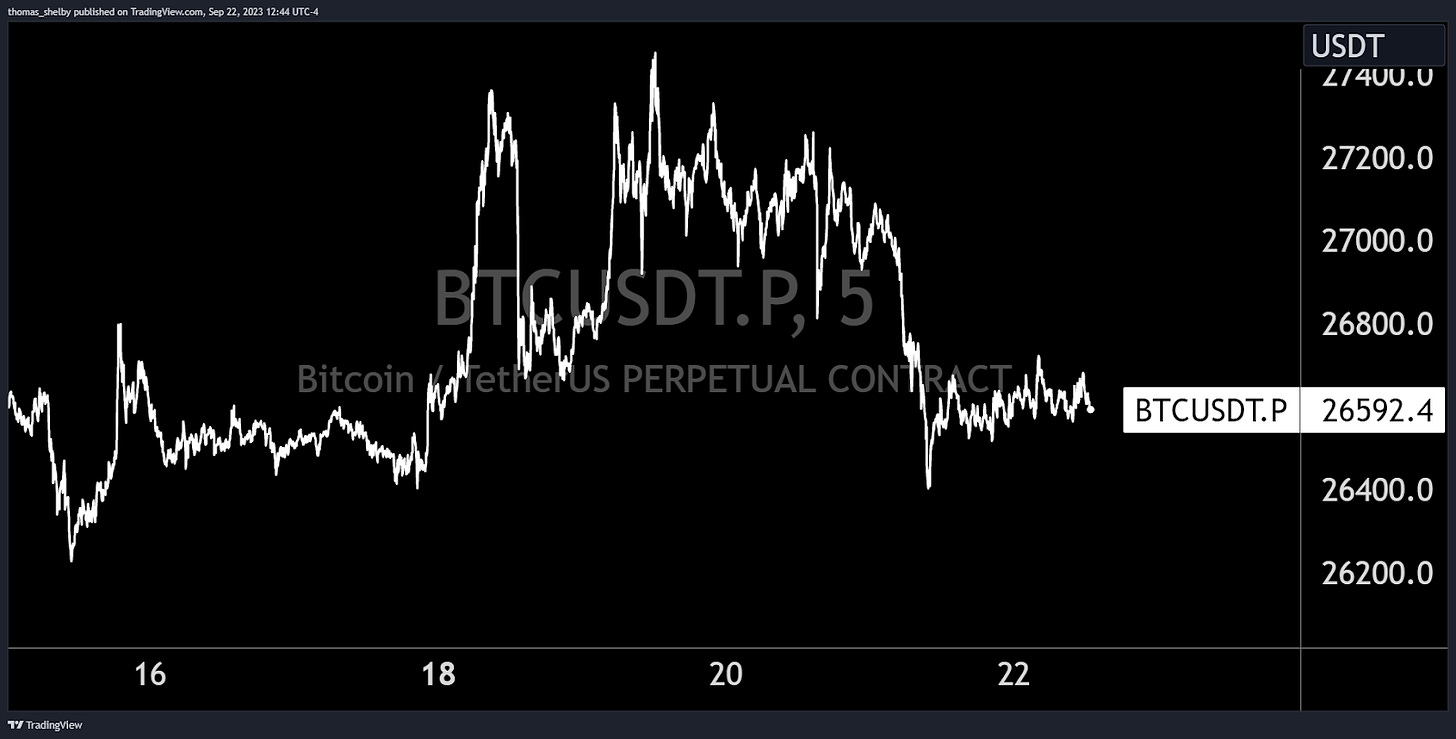

BTC and ETH

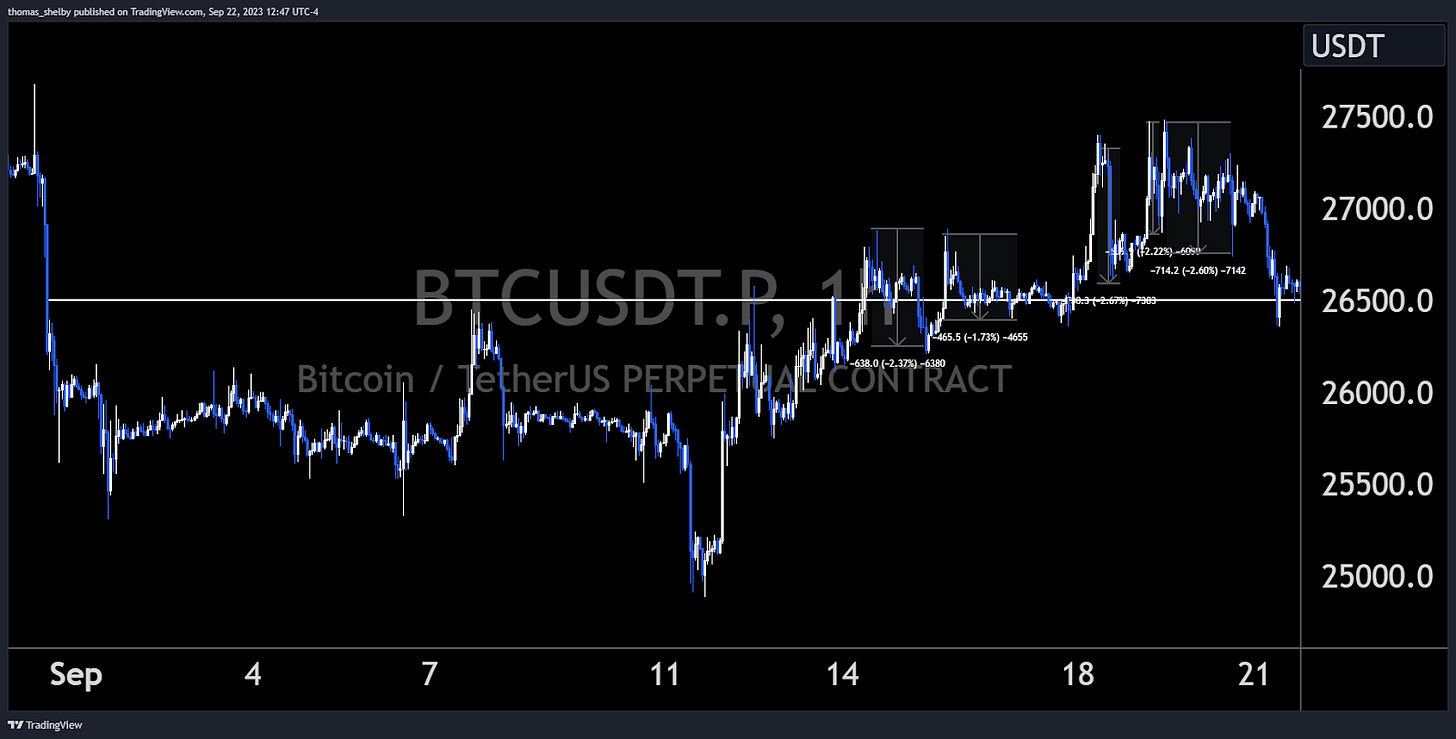

Following last week’s green close, Bitcoin started this week on a bullish note. Monday to Wednesday saw prices rise, expanding the range to 27,500. However, come Thursday, sellers showed up during the Asia session. This was a delayed reaction influenced by the traditional and bond markets' sell off following the prior day FOMC comments/digestion. We are now back to trading at beginning of the week prices.

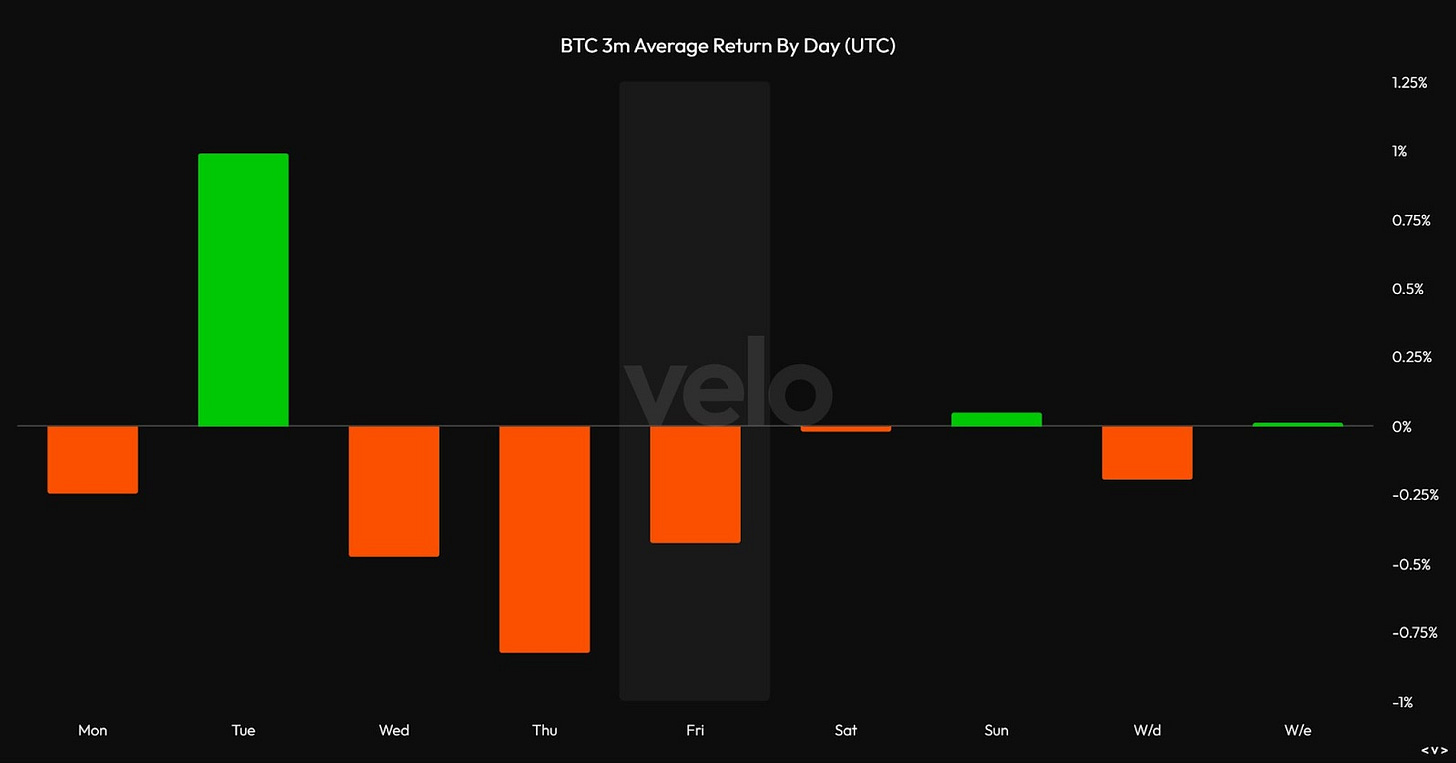

Thursday Seasonality still in full force

Observation for BTC this week; every time we've achieved a new high during the rally, aggressive sellers suddenly show up, protecting the range and preventing further price increase. The past five new highs witnessed an average drawdown of about 2.7%. Our sympathies if you've been attempting to buy these breakouts.

“ The range holds longer than everyone expects it to.”

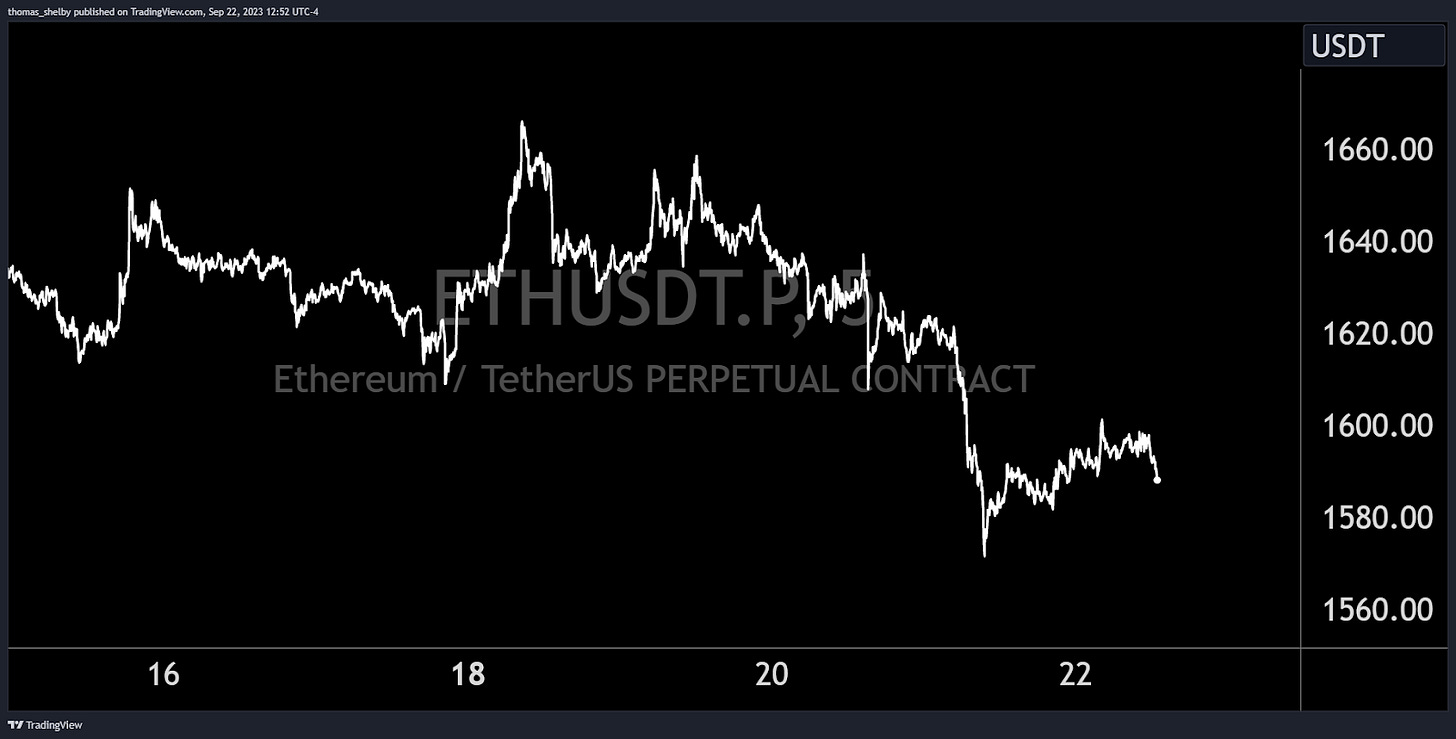

As noted in the previous newsletter, Ethereum continues to lag behind BTC. The ETHBTC pair has decreased by 3% this week. ETH never traded above the Monday highs of 1670s, and is now trading all the way back to 1560s.

TradFi/Macro

Economic Data

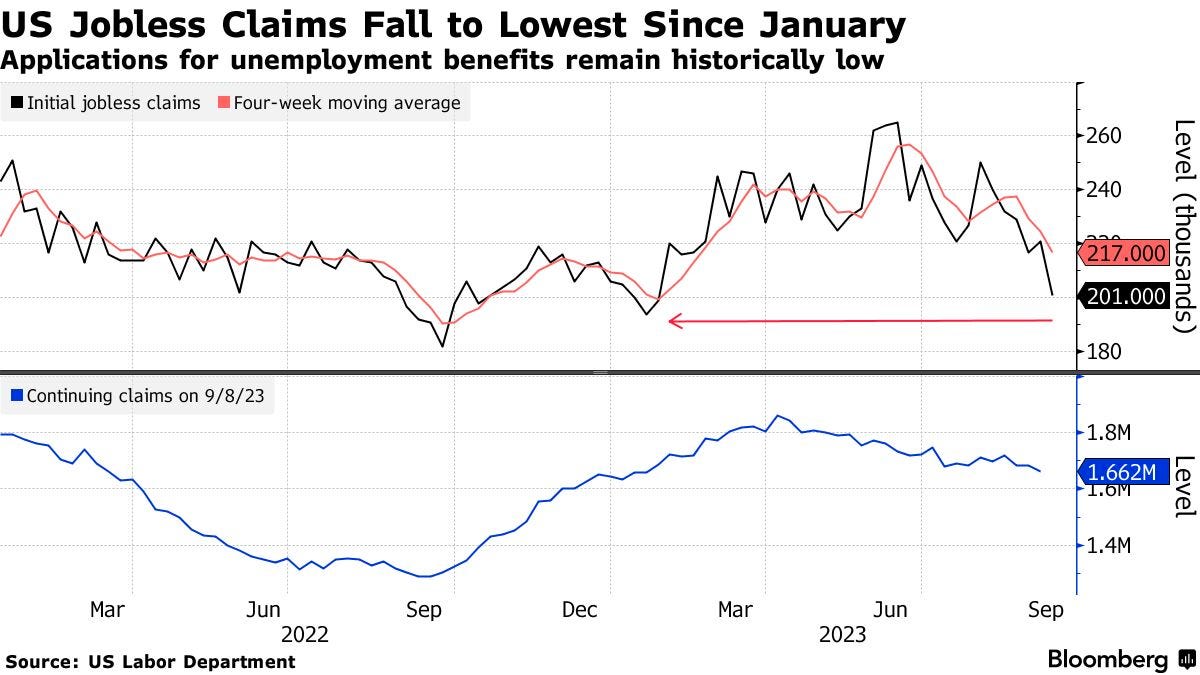

Mixed data from the US this week: applications for unemployment benefits and continuing claims declined to the lowest level since January, indicating a healthy labor market.

US composite and services PMIs remained little changed, while the Philadelphia Fed factory index surprised to the downside. New orders contracted to -10.2 vs 16 expected, while the prices paid component increased to 25.7 vs 20.8 expected, confirming the recent stagflationary picture.

FedEx, another gauge for economic activity, reported solid earnings on Wednesday after the bell, with an EPS of $4.55 per share, beating expectations of $3.73, albeit slightly missing revenue of $21.7 billion vs expected $21.84 billion.

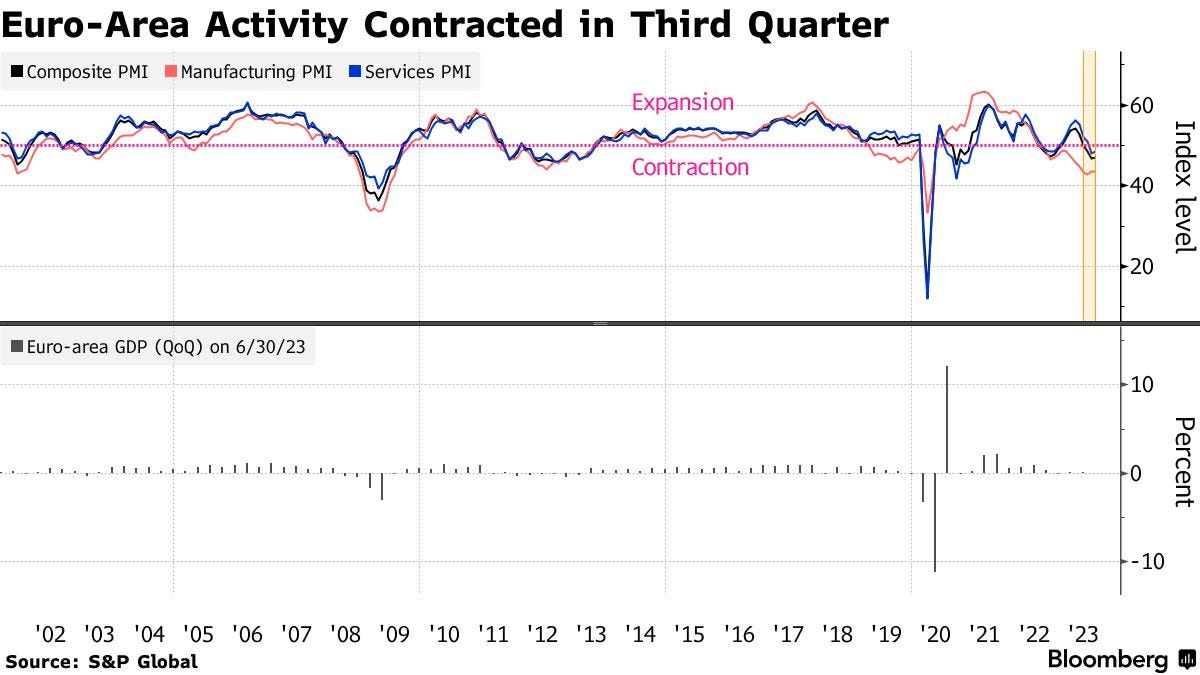

On the other hand, Europe continues to disappoint. According to S&P Global, key economies like Germany and France showed negative readings for both manufacturing and the service sector for the fourth consecutive month. This indicates that the euro zone will enter into contraction in the third quarter. Consequently, the euro fell to its lowest level since March, heading for a 10th week of losses against the dollar.

Stock & Bond Market

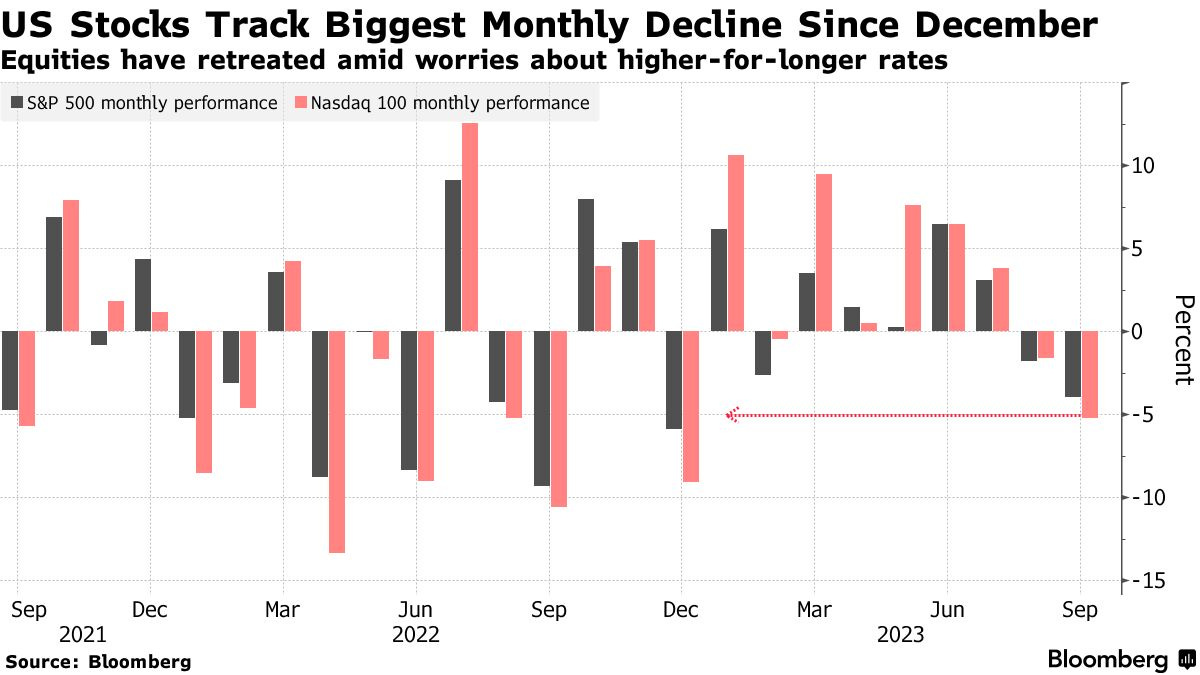

As described in our previous edition of the newsletter, bears took another shot at the markets post OpEx, and stocks began to re-price to the current macro environment. Equity funds experienced outflows of $16.9 billion in the week through September 20. On Thursday, The S&P 500 declined by 1.64%, breaking a streak of 103 days without a decline of more than 1.5%. Along with the tech-heavy Nasdaq 100, both indexes are on track for their largest monthly decline of the year.

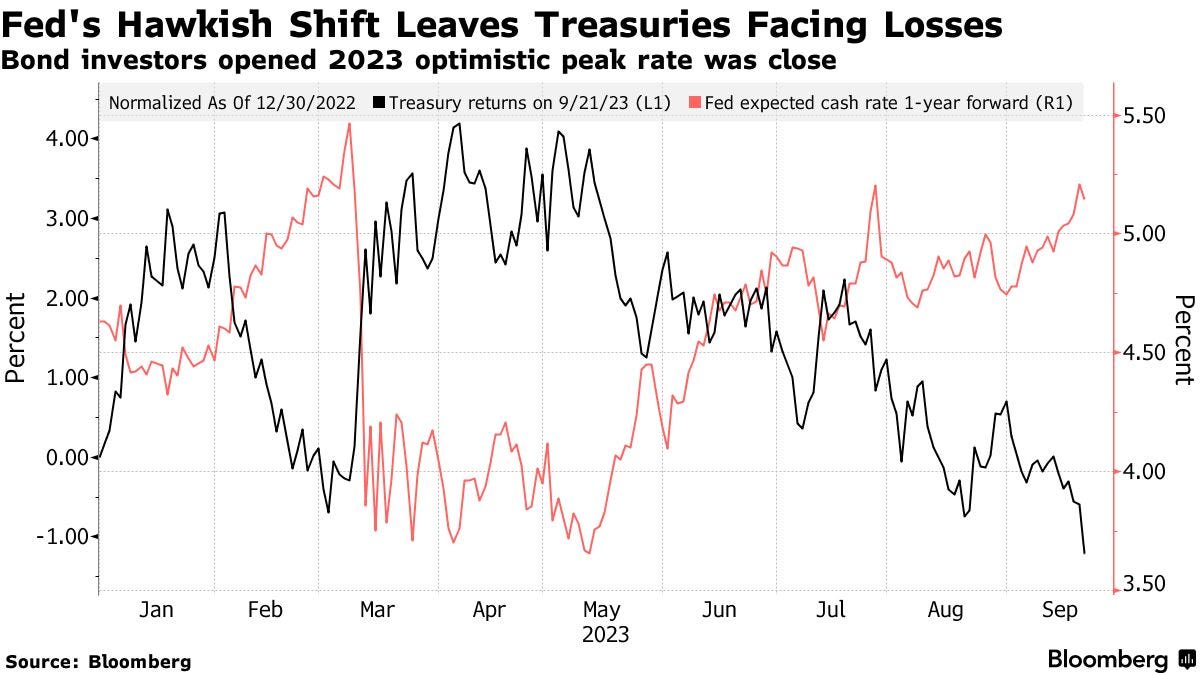

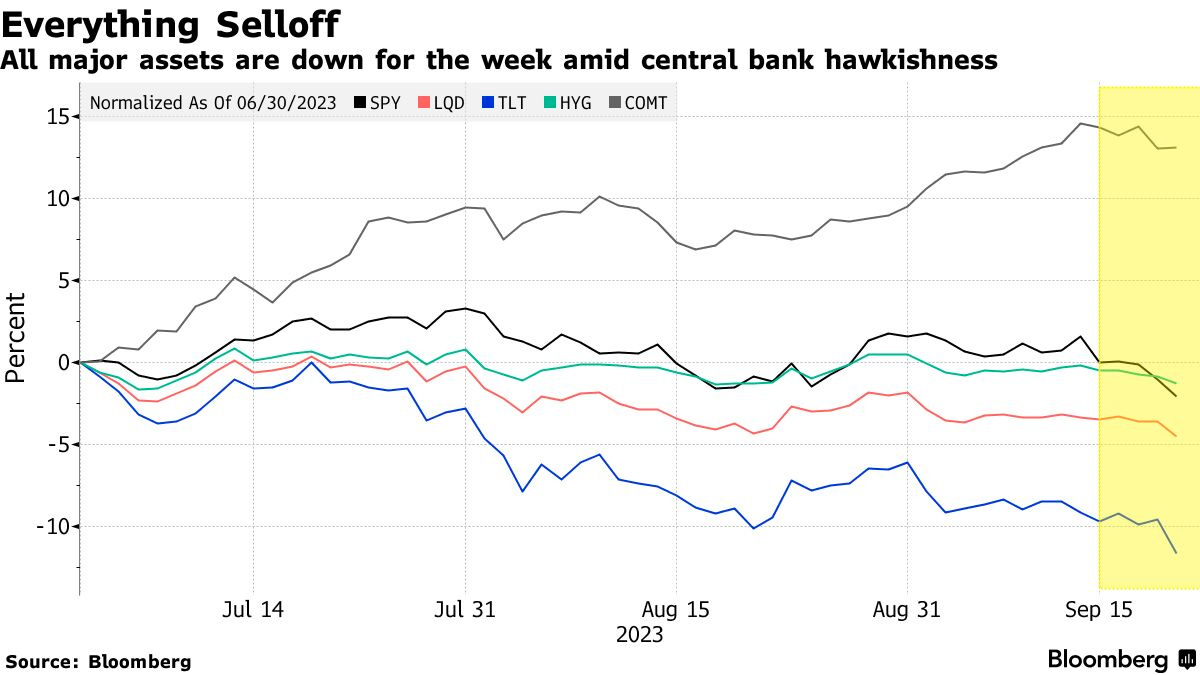

Many investors were caught off guard, expecting the Fed to align with market expectations. The declines accelerated when projections came out and revealed that 12 out of 19 officials penciled out one more rate hike this year and fewer cuts than previously anticipated, resulting in an “everything selloff“ of bonds, stocks and commodities.

In the wake of strong labor data and the prospect of higher interest rates for longer, treasury yields and the dollar index remained stable. The 10-year note reached 4.5%, its highest level since 2007.

Surging oil prices, coupled with a fresh ban from Russia on diesel exports, pushed yields higher on every benchmark.

Central Banking

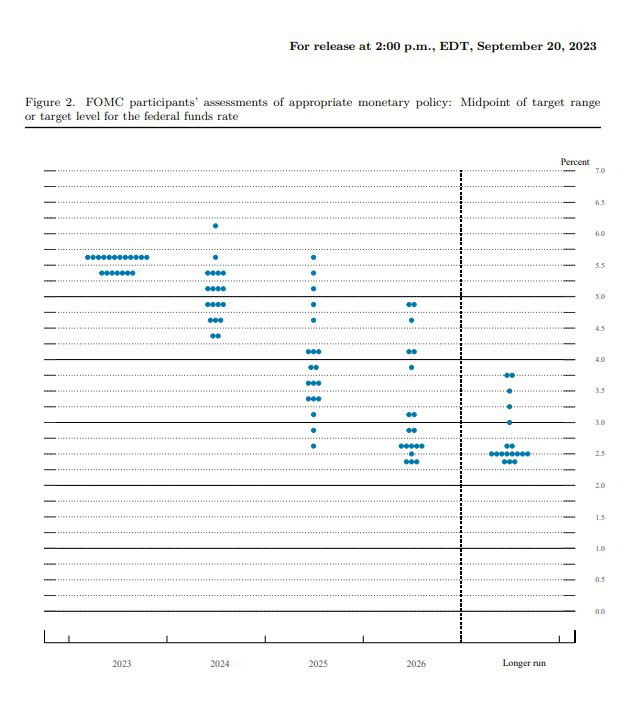

The Federal Reserve maintained interest rates at the September meeting but indicated to keep rates higher for longer. The dot plots revealed a more hawkish stance than expected, with projections showing that policy makers plan to raise their target rate once more by the end of the year, reaching a range of 5.5% - 5.75%. However, they anticipate only two rate cuts in 2024, which is two less than what was forecasted in June. This would put rates around 5.1% by the end of 2024.

The Fed justified their projection by forecasting GDP to increase to 2.1% this year, with growth to slow to 1.5% in 2024 - more than double what they had estimated in June. In their statement, the committee described current economic activity as “expanding at a solid pace”.

During the post meeting press conference, Powell appeared somewhat uncertain for the first time, backpedaling on the released dot plots and economic projections by saying that the Fed is “in a position to proceed carefully on firming rate“ and that he “wouldn't call a soft landing a baseline expectation“ anymore.

On Friday, The Bank of Japan stuck to its ultra-easy monetary policy and maintained its commitment to add stimulus as needed, without indicating an end to negative rates. Japan’s currency weakened to a 10-month low against the dollar, surpassing levels that prompted Japan to intervene last September.

The Bank of England and the Swiss National Bank surprised by keeping key rates unchanged while revising down their economic outlooks and suggesting further rate hikes if inflation persists.

Outlook For Next Week

Post FOMC is pre FOMC, with November's meeting just around the corner and one more rate hike penciled out for year end, next week is primed to either re-price the current Fed's position or confirm it. Powell clearly left himself a lot of wiggle room in his press conference and the Fed hasn't been the best forecaster of the future; inflation is transitory or the 2006 “no housing bubble“ are the most prominent examples.

As the current pain is driven by plunging treasuries, real yields and oil prices, we would like to point out two things to observe next week: the release of the second quarter GDP and Powell's favorite inflation gauge, PCE on Friday. Another downward revision in GDP and employment would result in lower yields and energy prices while favoring equities, which seems like a good bet looking at previous months this year, where every month of 2023 has been lowered.

Returning from the blackout period, we will also see Fed speakers at the podium again and commenting on their recent decisions and projections.

Key Events For Next Week

Monday:

Germany IFO business climate

US Chicago and Dallas Fed Business index

Tuesday:

US Consumer confidence

Fed´s Bowman speech

Wednesday:

Germany GFK consumer confidence

US durable goods

Thursday:

Germany CPI

US GDP

Fed´s Goolsbee

Japan Tokyo CPI

Japan unemployment rate

Friday:

UK GDP

Germany retail sales

Germany unemployment rate

EU HICP

US PCE

US personal spending and income

US University of Michigan consumer sentiment and inflation expectation

Trader Takes @audy_xbt

What is the best trading advice you’ve been given?

To think of entries as 'gifts'. Some call it lucky entries, others call it forced hands or price dislocations. Principle stays the same; when others are forced to transact with you, it's more often than not a good trade.

You can infer involuntary execution from OI flushes, aggr sound, price velocity, liquidations, actual reaction etc.

What is something that you implemented that improved your trading the most in the past year?

Adjusting my edge to fit the current market 'meta'. The market changes periodically, your strategy and heuristics have to change with it. Compare last week's price action to the one we had in mid-late August. Your entry and exit parameters should be drastically different. Thus, my bias is primarily attentive to what conditions I'm trading rather than direction. Bruteforcing the same strategy year-round with only directional concerns isn't profitable.

Secondly, disabling all PnL from my trading interface. Trading should be process based, not PnL based. I try to not care about how much money I make or lose but rather, if I make regrettable decisions or not, irrespective of the outcome. Jumpy numbers and colors also make you more likely to act impulsively. Why do you think online casinos are full of them?...

What advice would you give to a beginner trader?

Making money from EV- practices is the crux of a beginner's downfall. Your thinking should be probabilistic. Review your decisions in EV terms. Some examples include: 'Would I take this exact trade another 10 times if offered?' or 'Will I regret this trade if I get stopped out'?.

Market is agnostic. It doesn't care about your entry, feelings or needs. Try to operate in this frame of mind. For example, if you catch yourself closing your long breakeven to 'not lose money', ask yourself: 'If I was flat, would I want to be a seller here?'. In other words, aim to trade your edge objectively, don't get tunnel vision from your PnL.

Bitbit’s Note

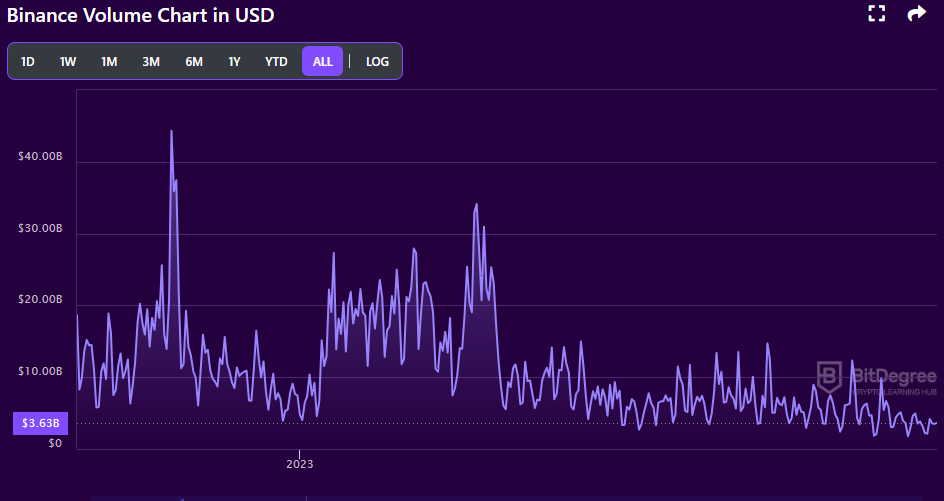

Binance exchange soft exodus.

Binance is starving. We are recently seeing a huge drop in volume, below last December's levels. In January, Binance generated an average of $17 billion/day, this month it is roughly $3 billion per day.

Do you remember the December days? The markets were utterly dead, and Bitcoin was trading around 16k. Binance’s volume is currently lower than at that price level.

Other exchanges do get volume, but it’s not looking great over there either. I say this because Binance lost ~$18 billion average daily volume, while others didn’t increase by that amount.

We can speculate and say that the exchange’s counter strategy to this issue is to list all kinds of shitcoins with intent to milk any kind of revenue, but one thing is for sure, this isn’t looking good.

In this environment, you can’t expect to perform as well as you did through the bull cycles, simply because there is no liquidity. If you try, your capital will eventually end in someone else's account, someone more patient and sophisticated. The MMs are part of this bloodbath and have recently been showing (on CT) how stressed they are. The patient ones will survive, but the ones who stick their neck out will get killed.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.