I’m In The Arena Exploiting Stuff: AVAX & Stars Arena

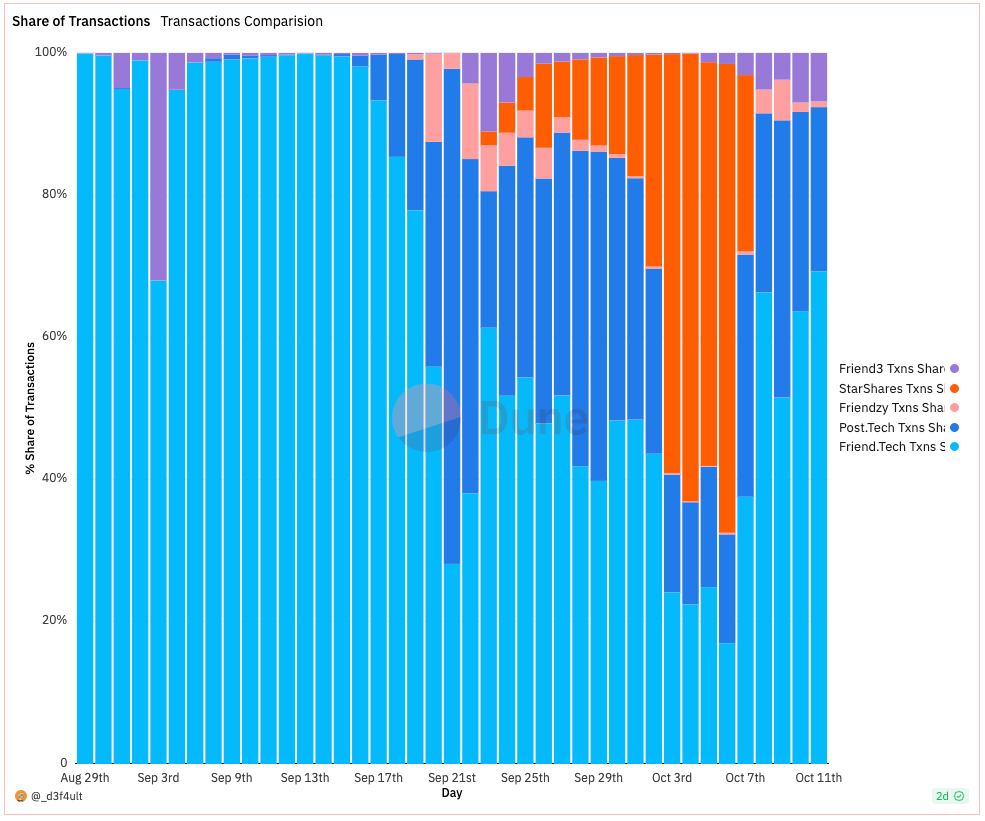

The success of friend.tech captured crypto twitters’ attention as speculations rushed towards SocialFI. Naturally, other players showed up to compete and try to take a piece of the pie.

Their competitors’ fee models and social stickiness were no match for @0xRacerAlt’s product and many of them disappeared quickly. However, a challenger finally emerged that managed to steal the spotlight, for a short while at least.

Dune

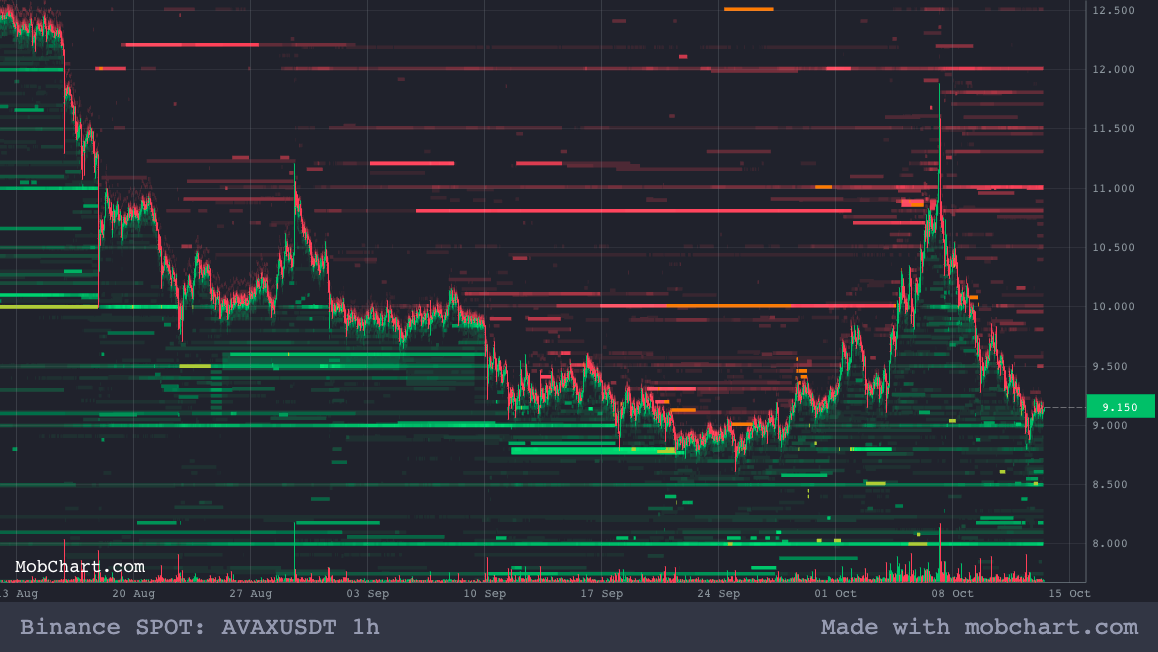

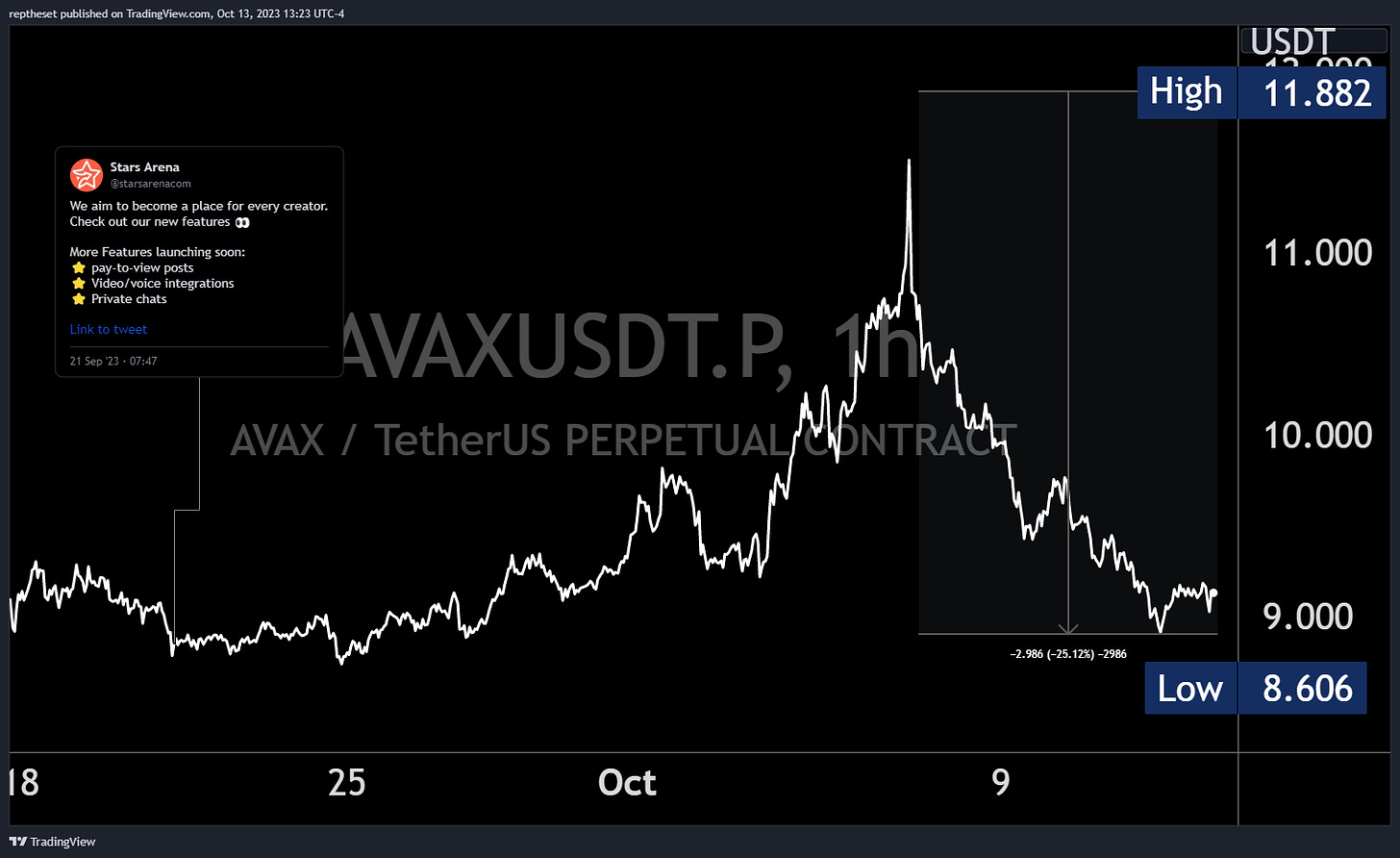

On Thursday September 21st, friend.tech TVL hit new highs and was soaring over $30mm. Yet for the previous ten days, a large buyer had been patiently waiting in the $AVAX order book. As their bids for ~80,000 tokens started to fill, Stars Arena (then named Star Shares) published a tweet.

Stars Arena is a decentralized social media crypto platform, a type of project often referred to as SocialFi. The project, built on Avalanche C-Chain, allowed users to buy and sell shares of their favorite content creators using a bonding curve as a pricing mechanism, a practice used by first mover friend.tech on the Base network.

As word spread, speculators and content creators were given a second chance to get in on the ground floor of a rapidly growing SocialFi platform, supported by the now heavily discounted $AVAX token, with a fee structure that encouraged a frenzy:

⭐️ 7% Creator

⭐️ 2% Platform

⭐️ 1% Referral

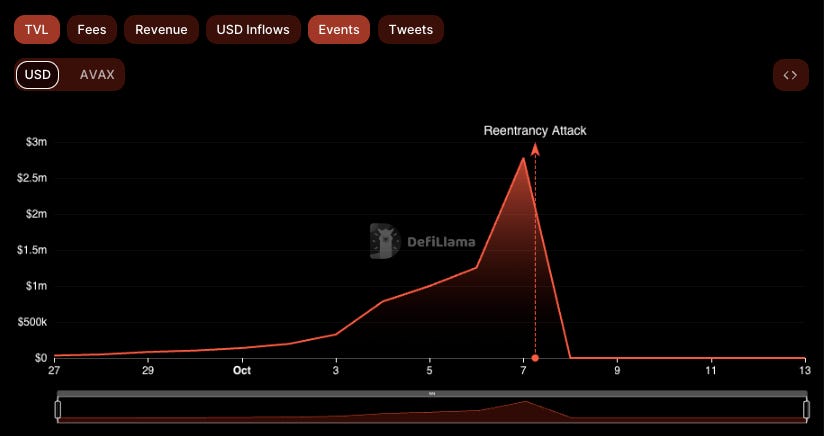

Not long after the initial influx of activity, the calm seas turned choppy as the waves began to swell. Unbeknownst to the majority of speculators, the contract forked from Base had added attack vectors.

Within hours Stars Arena reported, with lengthy prose, to have fixed the contract issue which had caused a small drop in TVL and in the price of $AVAX. The show went on.

Yet seas can remain unpredictable for longer than some can stay afloat. Just as TVL and $AVAX price resembled a parabola, Stars Arena ran into a major issue resulting in a $2.9mm loss, zeroing TVL. The exploit abused the shares contract using a reentrancy vulnerability to sell shares above their intended price.

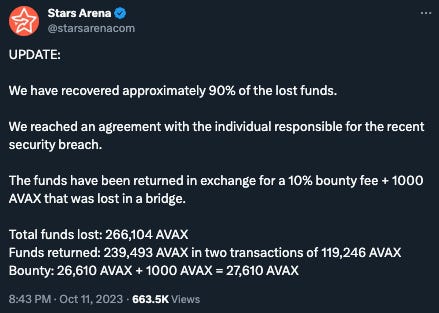

Since the reported ‘security breach’ many have speculated to the origin of the exploit and the trustworthiness of the Stars Arena team. Yet despite these concerns, a brief scan of X ‘previously Twitter’ shows there's still strong desire from many to get “back in the arena” to “try stuff”. Especially since communications from the Stars Arena team indicate progress in increasing their platform security & securing approximately 90% of the stolen funds.

As it stands, the price chart of $AVAX resembles that of a structure often described as a “tall, majestic, cosmopolitan, mixture of glass and steel, representing state of the art engineering by the world's finest overseeing the middle east”, having suffered a -25% drop post exploit.

For those bold enough to get back into the arena and look past the behavior of the team, you can keep an eye on the team’s multi-sig wallet as the arena opens once again this Sunday, albeit with trading functionality temporarily paused.

WOO

On Wednesday, The Block reported that Woo Exchange will buy back shares from 3AC to "clear uncertainty." Following this news, the price of WOO pumped by approximately 3.75%.

Roughly five hours later, a blog post from Woo announced that the exchange had integrated with Bithumb, South Korea's second-largest crypto exchange. The price of WOO spiked up by approximately 2.5% in one minute before forming a local top and eventually retracing to the initial news price, where it found support and has been ranging since then.

IMX partners with Amazon to advance Web3 Gaming

On October 10th, IMX announced a partnership with Amazon Web Services (AWS). Yes, I know what you are thinking: we have seen this before. This partnership will allow Immutable to utilize AWS's technology and support, to enhance gaming services and also assist companies in better understanding their respective products. However, Amazon will not be involved with Immutable's currency, i.e., IMX. This partnership is more about sharing expertise and resources to boost Web3 gaming development than merely a financial exchange (namesake?).

The reaction to the news was quite extreme - which tells us that books on these coins are very illiquid right now, so be gentle on the leverage. Open Interest surged by a total of 40%, but it is important to note that the OI ramp up started exactly 30 mins before the announcement - (Henlo insiders please don't do crime). The price surged by ~7.5%, but couldn't sustain momentum (news buyers were indeed exit liquidity). This resulted in a huge wick on the 5-minute timeframe and immediately retraced the entire move. Since then, the price has reacted negatively, with the token price hovering around 51 cents at the time of writing - confirming that only insiders made money on the long side and it was a sell the news event after.

Bitcoin and Ethereum

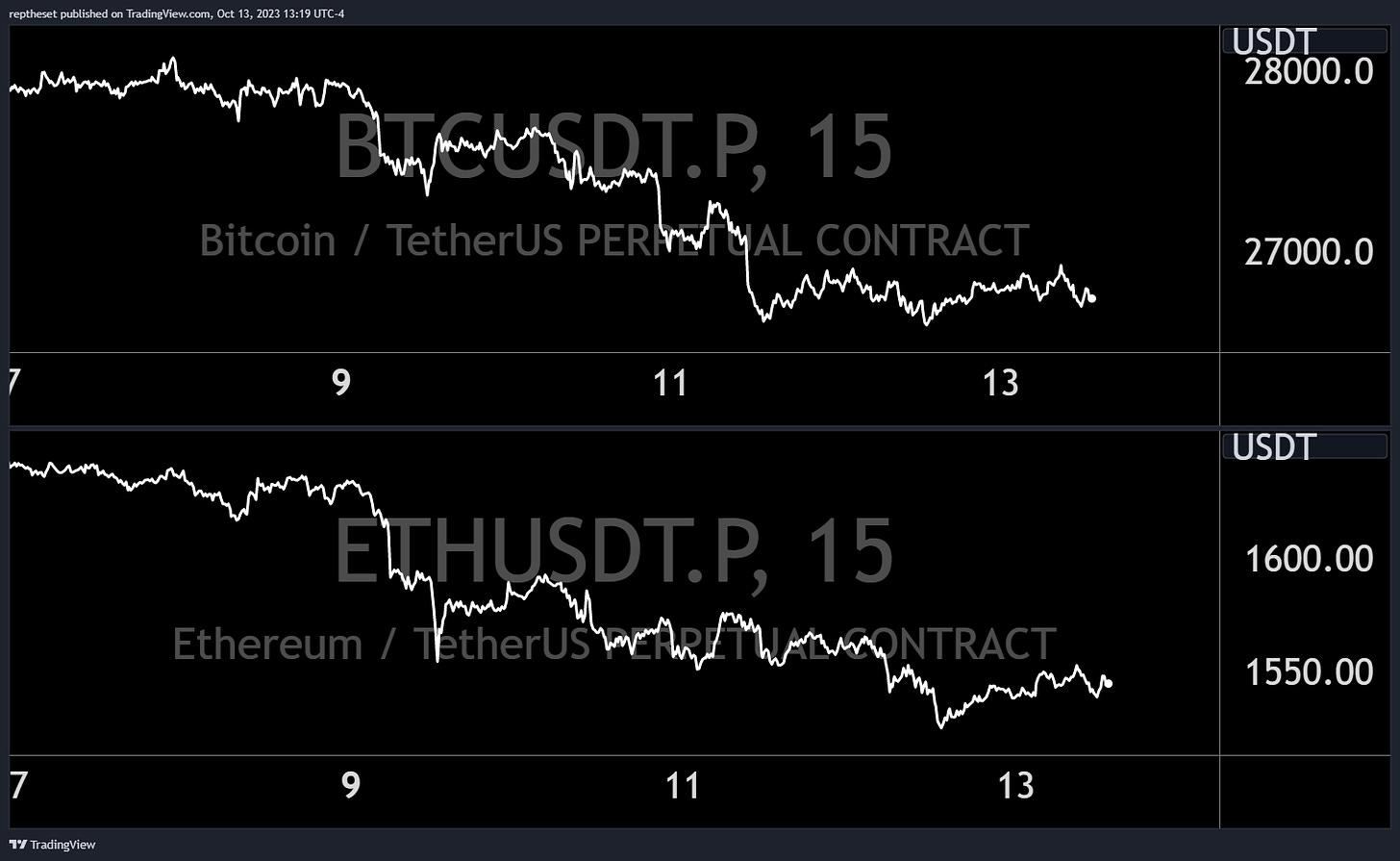

Traditional markets started the week off strong, recovering from last week’s sell off, while crypto markets continued their downward momentum. Uncertainty surrounding global economies can be attributed to why investors are lowering their exposure to riskier assets such as crypto. Another speculative narrative is that terror groups are selling crypto in order to fund their ongoing activities.

By the end of the week, BTC and ETH lost approximately 5% and 7%, respectively.

TradFi/Macro

Economic Data

This week has been light in terms of economic data. We had Columbus Day on Monday, as well as public holidays in Japan, South Korea, Taiwan, and Canada. Tuesday was muted, with the only notable event being the IMF's publication of its economic outlooks for the world, which contained no surprises.

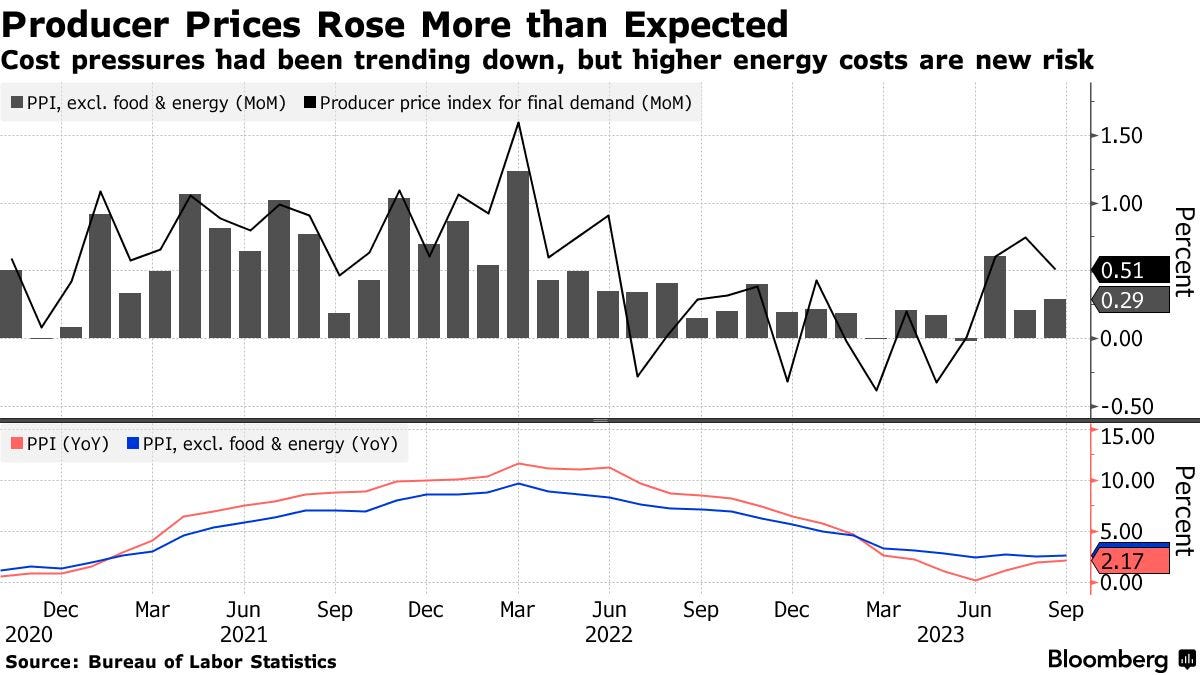

The producer price index (PPI) on Wednesday came in hotter than forecasted, primarily due to increases in gasoline and food prices, marking its third straight increase. While gasoline costs increased by 5.4%, and food costs saw their strongest increase in nearly a year, categories preferred by the Fed have shown a more mixed picture. When stripping out those volatile components, prices only edged up 0.2%.

The headline Consumer Price Index (CPI) on Thursday rose by 0.4% month-over-month, which was slightly higher than the 0.3% increase forecasted by economists. Meanwhile, the core measure, which excludes food and energy prices, came in at 0.3%, which was in line with expectations.

Gasoline prices, housing costs, and car insurance accounted for most of the gains in the CPI. The so-called "supercore" gauge, which is the Federal Reserve's preferred measurement, ticked up by 0.61%. Overall, there were no real surprises, as shelter costs are seen as lagging indicators, while the rest of the basket came in as expected.

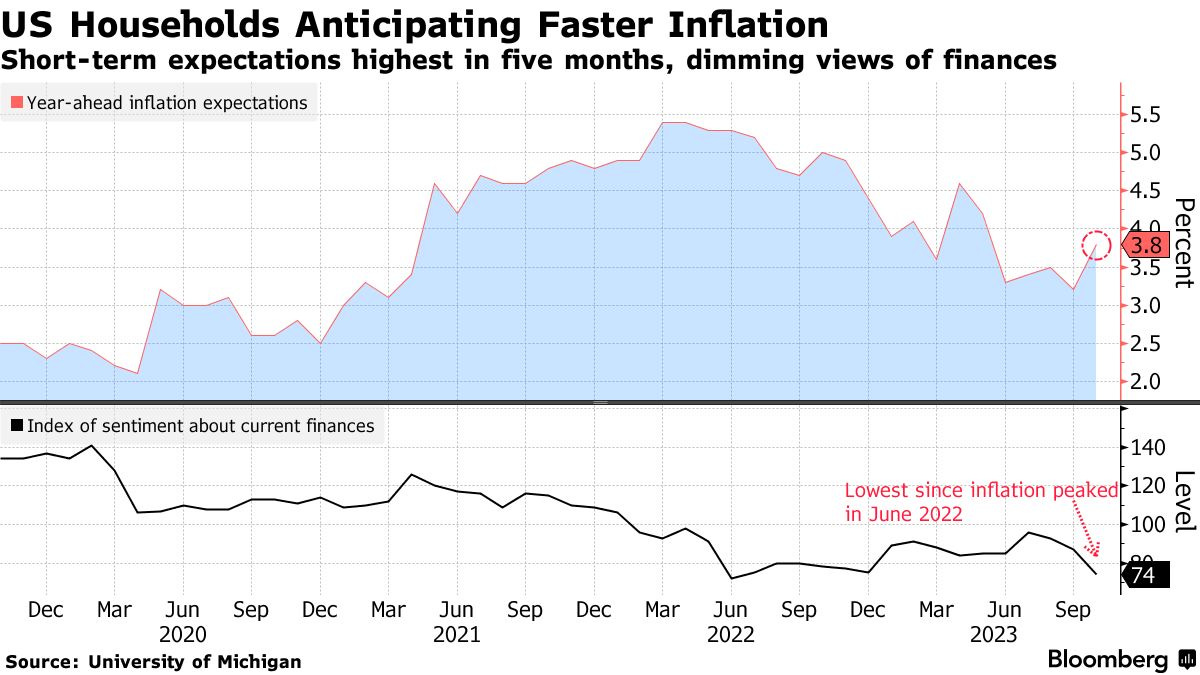

US consumers finally got the memo of recent increases in energy prices, the current sentiment conditions gauge fell to a five-month low of 66.7, down from 71.4 in September. Americans now expect prices to climb at a rate of 3.8% over the next year, the highest in five months and up from 3.2% in September.

Stock & Bond Market

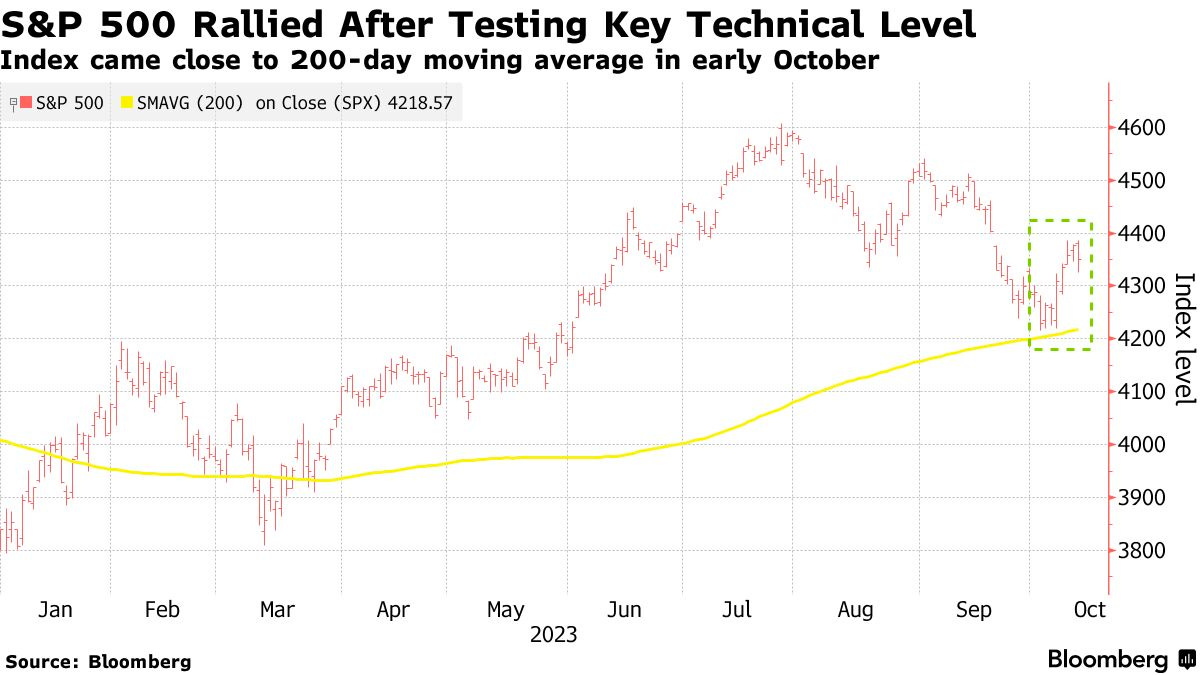

As described in our newsletter from last week, stocks have seen the expected mechanical reversal from the 4200 support level. Record short positioning and out-of-the-money puts puked at the beginning of the week, while market makers started to close their short hedges, which provided the necessary fuel for this week's rally.

It seems to be the case now that stocks can hold onto the 200-day moving average, as long as yields stay below 5%. A drop below could also be driven by rising oil prices and a stronger dollar.

Other highlights this week:

There were $8.2 billion in outflows from global stock markets, while cash funds attracted $16.9 billion.

BofA Bull & Bear indicator dropped to 2.2 - the lowest level since April.

Bonds experienced some of the ugliest auctions ever this week, resulting in higher yields and sell-offs across all risk assets. For example, the 30-Year not only had its highest yield since 2007 but also tailed 3.7 basis points in yesterday's auction, which is the third-largest tail on record. Today's drop across all durations was mostly caused by traders hedging geopolitical risks over the weekend, which provides short-term relief for risk, but will probably fade after a quiet weekend.

Central Banking

Although the FOMC minutes came out more hawkish than expected on Wednesday, the language used by all the Fed speakers this week pointed in a more dovish direction. This implies that the hiking cycle is over, and the question now is for how long, rather than how high, interest rates will remain elevated.

Today, Fed's Harker stated that the Fed is likely done hiking rates, following statements from other officials earlier this week.

Outlook For Next Week

We started into Q3 earnings season, all major banks reported decent numbers today beating estimates resulting in the financial sector in the S&P 500 to rally by 2.5% at open.

As banks are typically a decent performer in current conditions, their earnings beats came with little surprise. Our focus will be more on the consumer side for Q4, particularly the "magnificent 7" names, which rely on a strong consumer.

An interesting remark regarding consumers came from JPM's CFO during the earnings call today: "Consumer spending growth has now reverted to pre-pandemic trends, with nominal spend per customer stable and relatively flat YoY. Cash buffers continued to normalize to pre-pandemic levels, with lower income groups normalizing faster," confirming our view of a bumpy Q4.

Here is an earnings calendar and implied moves for next week; the highlights are Netflix and Tesla on Thursday as a gauge for big tech:

Market-wise, OpEx flows are the strongest until Tuesday, and earnings front-running should continue next week, protecting the markets from significant drawdowns. From our point of view, volatility will remain muted, and markets will likely stay pinned around the biggest strikes 4300 (max pain) until OpEx on Friday. We also get a little relief from Yellen´s rage at selling bonds next week, as the offered amount is roughly around $35 billion, which should calm yields further down.

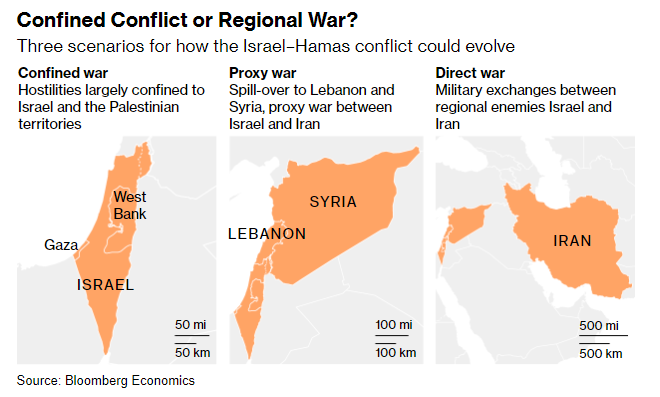

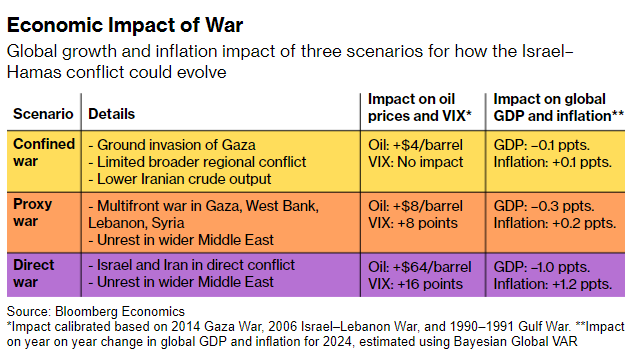

As interest in geopolitics is increasing recently, here a playbook with possible outcomes and impacts on markets:

Key events for next week

Monday:

US New York empire state manufacturing

Fed's Harker speech

Tuesday:

UK employment change

US retail sales

Fed's Williams

Fed's Bowman

Wednesday:

China retail sales

China GDP

EU HICP

UK retail sales

US 20-Year Bond auction

US Fed's Beige Book

Fed´s Waller

Thursday:

US Philadelphia Fed manufacturing

US 5-Year tips auction

Friday:

UK retail sales

Germany PPI

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.