The Weekly

Markets move on expectations

Saylor Wants More

After seeing large BTC TWAPs throughout the past 2 weeks, people were speculating on a possible new big player joining the space. Unfortunately its the same old.

On September 25th, Saylor took a break from posting his usual cringe bitcoin memes, to announce that MicroStrategy has loaded up on another ~5500 BTC, a value of approximately $147 million, at an average price of ~$27,000. According to the filing, this added purchase was transacted between August 1 and September 24.

Bitcoin and Ethereum

It’s been an interesting week for the majors, with ETH leading the way for a change. Early in the week, BTC traded below the previous week low following the stock market selloff. On Wednesday we saw a strong bounce, and an eventual complete retrace within the same day. Much of the negative price action was dominated by the sell-off in legacy markets, and momentary strength by DXY and long-term yields. Thursday saw a relief rally on SPX, which helped with the sentiment on risk assets, and we saw BTC close the day with a 2.5% green candle.

ETH behaved much better than BTC this week, being up a modest ~3% on the ETH/BTC pair. Since the Wednesday vicious retracement move, ETH is up close to 6% showing strong relative strength, possibly due to a combination of two factors: the ETH futures ETF narrative and the absence of Saylor's buying pressure on BTC.

It is worth noticing that Bitcoin hasn't been particularly affected by the SPOT ETF delay news this past week. While we don't claim expertise in this area, the prevailing opinion suggests that these decisions might have been made well before their official deadlines, likely due to the anticipated government shutdown.

Upcoming Events

Chainlink’s SmartCon 2023: Web3 fiesta or siesta?

Over 100+ expert speakers are set to appear in the Spanish city of Barcelona across a program of keynotes, workshops, panels, networking meetups, hacker events, and side quests. The event officially kicks off from the 2nd to 3rd of October, with a pre-conference lineup starting from the 30th September.

Heavily publicized as a ‘Web3’ event, with a staggering 35 mentions of the polarizing phrase in a recent Chainlink press release, the conference plays host to notable speakers from the Chainlink ecosystem such as Sergey Nazarov, Google & Google Alumni, Swift, State Street, Foresight Institute and many more.

The participation of renowned speakers representing Swift is not entirely unexpected, especially considering that the conference follows the recent launch of CCIP (Chainlink Cross-Chain Interoperability Protocol) in July. CCIP is specifically designed to facilitate the secure & seamless movement of data and value between public or private blockchain environments. The technology leverages Swift’s messaging infrastructure, which settled some $1.8 quadrillion in transactions in 2021 (that’s $1,800,000,000,000,000).

The conference coincides with LINK approaching the upper bound of its trading range, a level it has tested for the 8th time in nearly 17 months. Meanwhile, “Link Marines” continue their relentless battle against the continuous inflow of tokens from Chainlink’s 7% annual supply via the 'Chainlink Non Circulating Supply' wallet into the Binance Exchange wallet.

For those that recall, the 2022 SmartCon event saw LINK prices fall over ~20% in the subsequent 15 days. Will this time be different?

Those unable or unwilling to attend in the meatspace can register for the virtual livestream here.

FET

Tuesday afternoon, FET’s official twitter account, Fetch.ai tweeted the classic “announcement of an announcement”. The market did not react as we saw very little appetite for altcoin speculation earlier in the week, due to the stock market and crypto market overall heaviness. This pair is still worth keeping an eye on because if the market flips bullish, we can possibly see an inflow of buyers show up to front run the eventual official news. In this specific scenario, this can bring an opportunity for traders to sell the news once fetch.ai releases this

“game changing announcement”.

It's been a long time we haven't seen a McDonalds partnership…

Token Unlocks

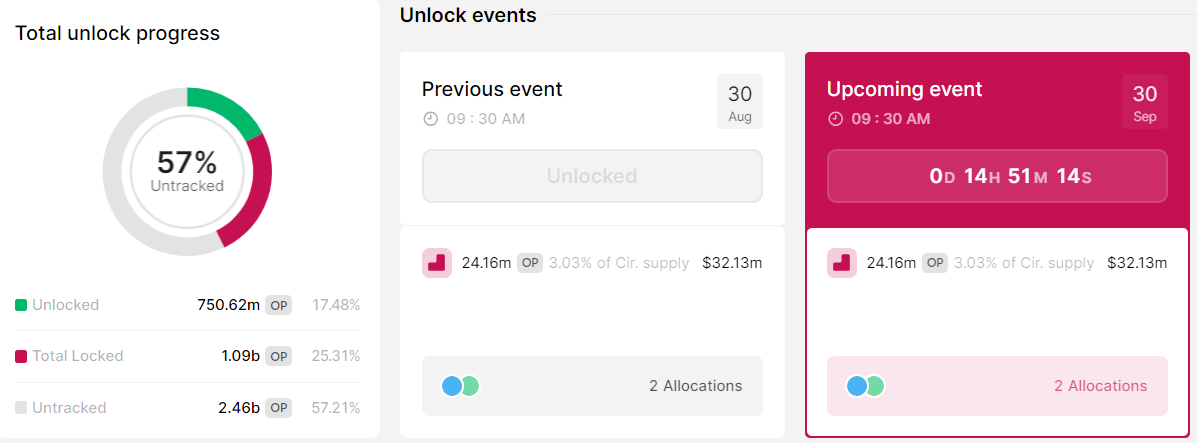

Optimism

OP has a 3.03% ($32.13M) supply unlock scheduled for Saturday, making ARB/OP an interesting pair to keep an eye on. With ARB trending up again due to a proposal for ecosystem project grants, the pair could experience further upside potential.

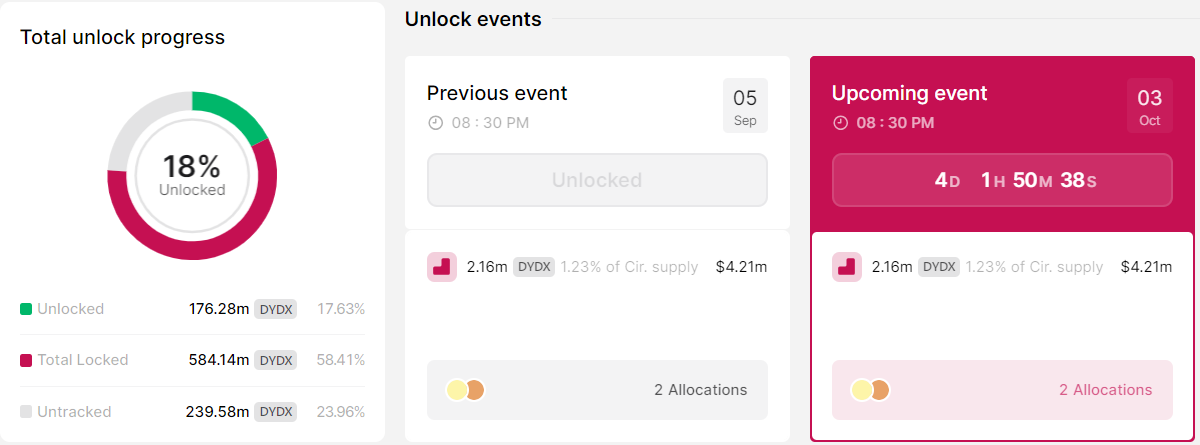

DYDX

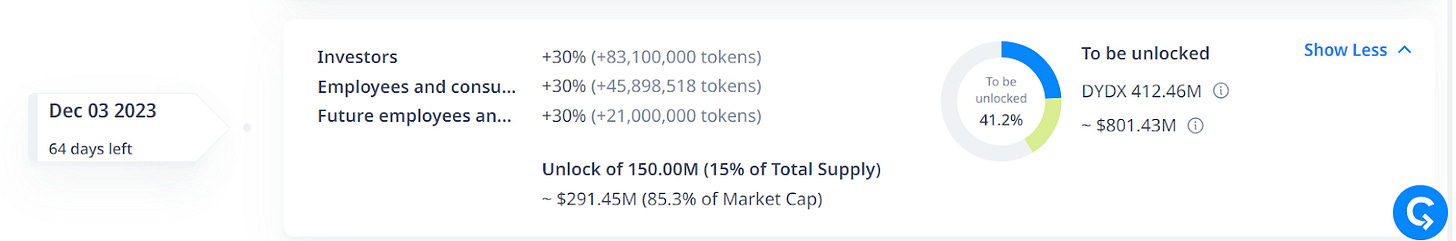

DYDX unlocks 1.23% of the circulating supply (~$4.21M) on Tuesday. While this supply unlock may not be significant, DYDX faces a much larger unlock of 15% of the total supply in December, which was previously delayed from February. It will be interesting to observe how DYDX performs in the lead-up to this December unlock, as it could present shorting opportunities if the market flips bullish.

Macro/TradFi

Economic Data

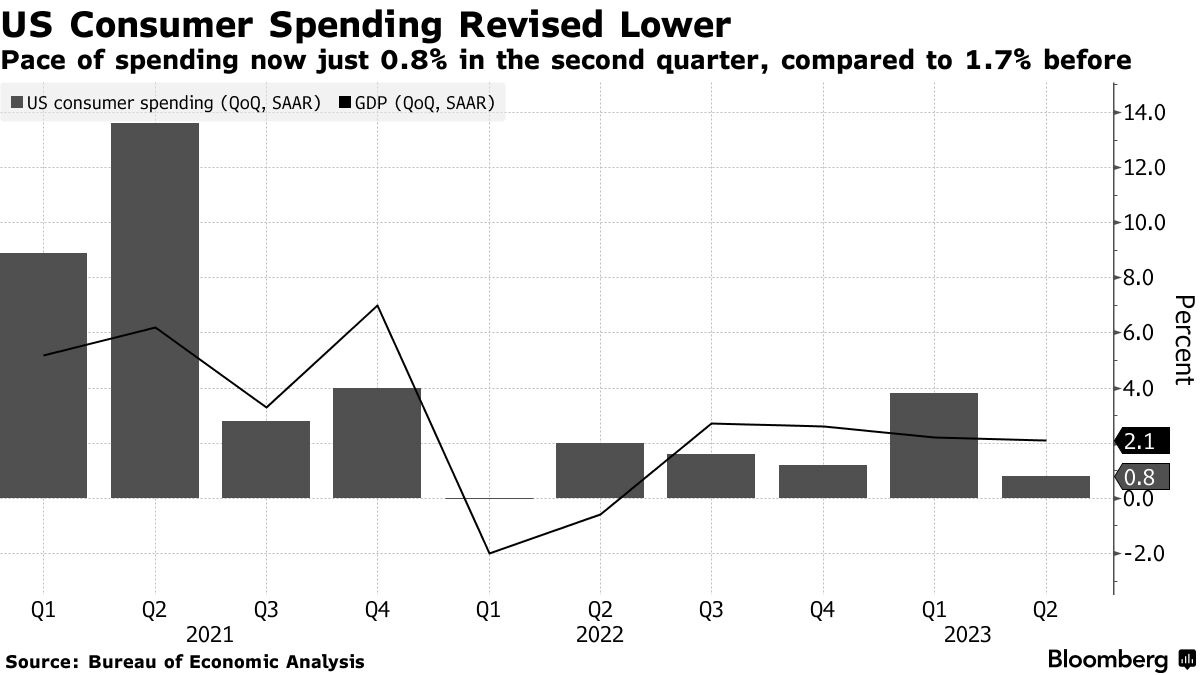

This week's data was favorable for the Fed but less favorable for the economy. Confidence among consumers fell to a four-month low on Tuesday, followed by a significant downward revision in consumer spending on Thursday, with consumer spending rising at the weakest pace in a year last quarter.

Overall, GDP rose by 2.1% in Q2, with strong business fixed investments helping to offset the slowdown in consumer spending.

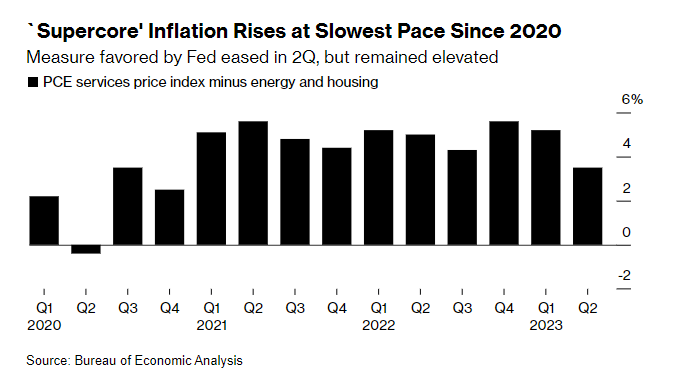

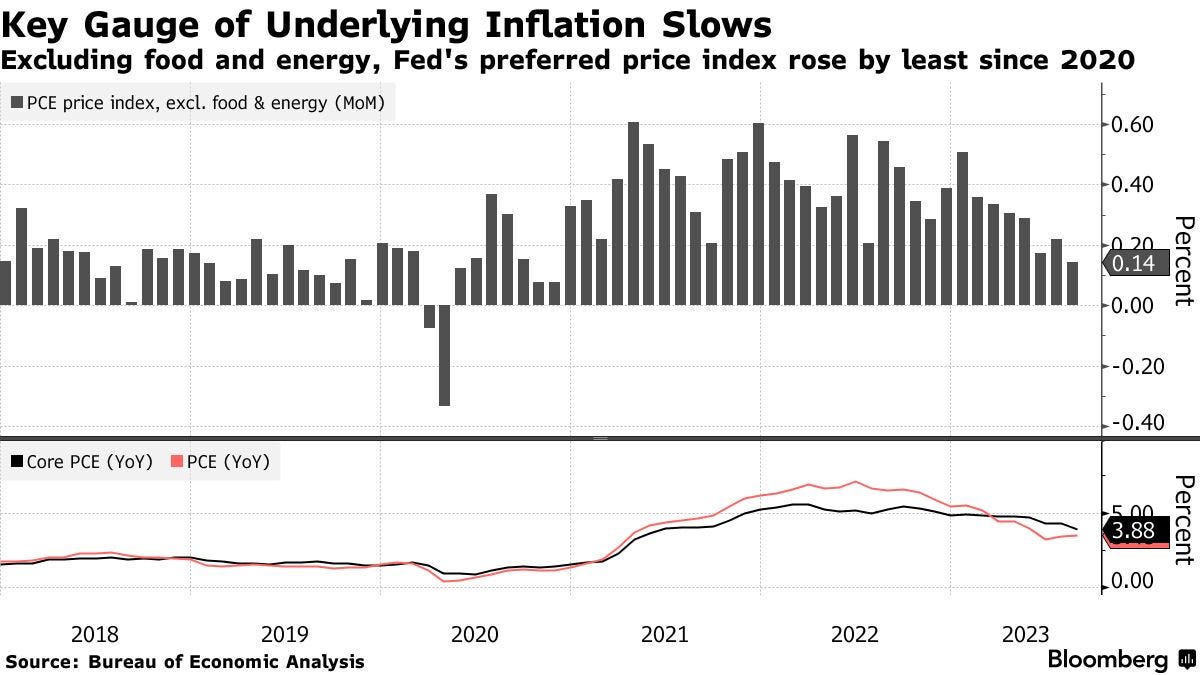

The core PCE component, a gauge closely watched by Fed officials, rose by 3.7%, marking the lowest pace of increase since early 2021.

Friday's core PCE and consumption expenditure price index completed the picture and posted the smallest monthly advance since 2020. Year-ahead inflation expectations fell to the lowest levels since 2021.

Applications for unemployment benefits dropped to a 12-month low of 204,000.

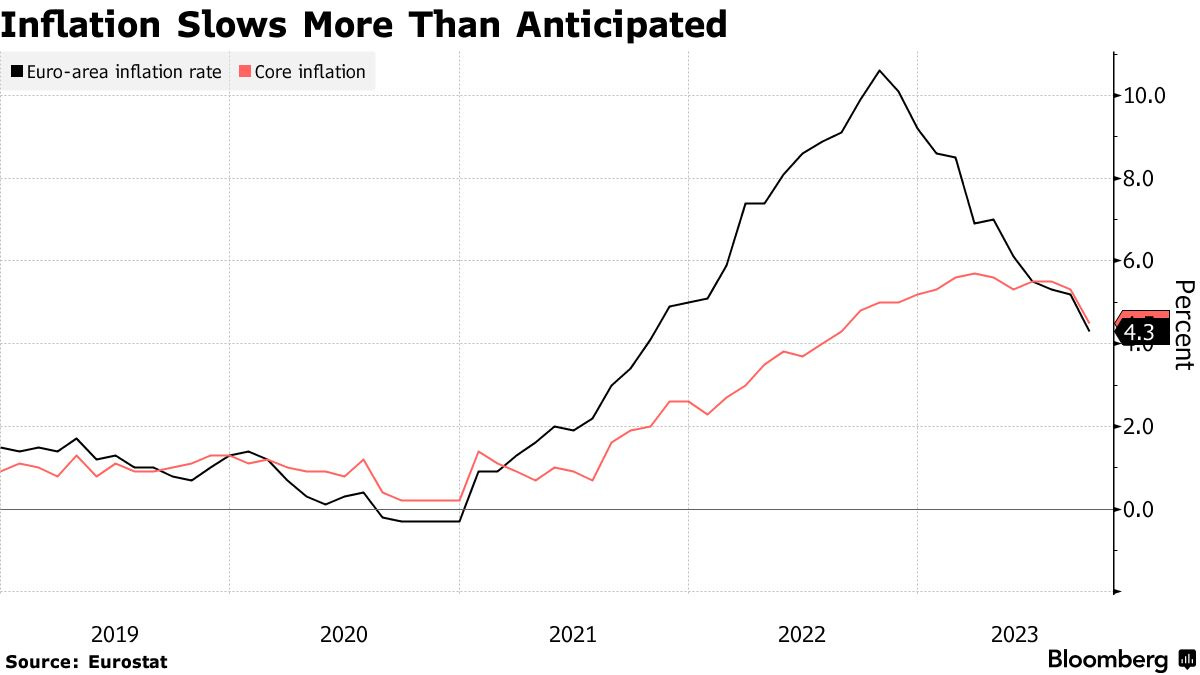

Euro-Zone core inflation eased to its slowest pace in a year, supporting expectations that central banks will keep rates on hold.

Stock & Bond Market

With ongoing hawkish statements from Fed speakers at the beginning of the week, the fear of central banks failing to curb inflation, which could break the economy, led to a long unwind across the board. On Tuesday, the S&P 500 fell by 1.8%, widening its drop from July's peak to 11%.

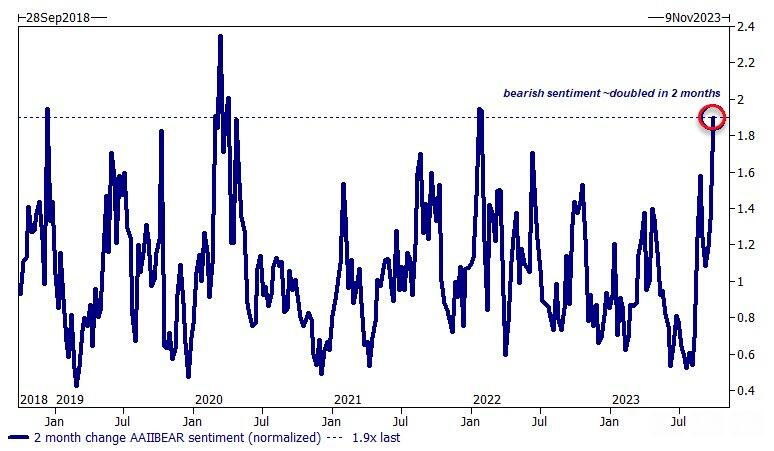

Following the drop in treasuries on Thursday, the S&P 500 rebounded by 0.7% from its lows, opening higher on Friday after the release of the PCE data, while the odds of a November rate hike eased. Bearish sentiment remains at levels last seen in March 2020 when stocks experienced a 30% crash, according to Goldman.

Yields hit cycle highs at the beginning of the week in anticipation of higher rates for a longer duration, fueled by comments from the Fed's Kashkari and JPM CEO Jamie Dimon, who mentioned the possibility of the Fed Fund Rates going up to 7%.

Thursday’s GDP data, along with lower revised consumer spending and today’s PCE data brought some relief, markets started to price in the fact that peak hawkishness is behind us. While bonds remain oversold, a further stabilization should encourage holding on to long positions.

Central Banking

While Neel Kashkari started the week with hawkish comments, expecting a soft landing and giving a 40% probability for one more rate hike, he made more dovish comments towards the end of the week. He stated that a government shutdown and the ongoing UAW strike weren't taken into account in the Fed’s forecasts.

Fed´s Barkin and Goolsbee are also leaning toward the dovish side, stating that last month's inflation data was encouraging and both expect the economy to slow down.

Jerome Powell held a town hall on Thursday where he did not address his outlook on rates or the economy.

Outlook For Next Week

As we enter Q4, the US economy will face headwinds for the first time of the year. This includes not only the possibility of a government shutdown that would cost $1.9 billion per day, but also the resumption of student debt payments and the ongoing UAW auto worker strike.

A government shutdown also impacts the release of economic data. While private data and unemployment claims will still be released, important data for the next FOMC meeting, such as JOLTS job openings and the employment report, which includes non-farm payrolls and the unemployment number, may get delayed.

Key Events For Next Week

Monday:

US ISM manufacturing PMI

S&P global manufacturing PMI

EU unemployment rate

Fed chair Powell speech

Fed's Harker speech

Tuesday:

US JOLTS job openings

Australia RBA meeting

Wednesday:

EU HCOB services

EU PPI

EU retail sales

US ADP employment report

US ISM services PMI

Fed´s Bowman speech

Thursday:

Challenger job cuts

Friday:

US employment report

US unemployment rate

Trader Takes @mrcvl_1401

How would you describe your trading style?

A big part of my edge revolves around execution precision and speed, with the majority of my positions lasting only a few seconds. Practically, there are certain windows of market distress throughout the day that present several inefficiencies or patterns, that I aim to capitalize on with complex automated orders. I prioritize quick decision-making and timely placement of orders, a practice that necessitates specialized trading tools and platforms. In fact, my trading approach is not compatible with the standard exchange user interface.

Tell us something that you implemented that improved your trading the most in the past year.

One of the key enhancements I've made involves maintaining a diligent and regular review of my trading statistics. For example, it became evident that a substantial portion of my PNL stemmed from trades with a duration of less than a minute. I figured that trades lasting longer than that were indicative of me fighting the market, and therefore, I implemented a time-based stop as well.

What advice would you give to a beginner trader?

My advice would be to approach everything with a healthy dose of skepticism. In the era of readily available online information, it is crucial to not take everything at face value. Scrutinize any trading strategies or insights you come across.

Furthermore, I encourage beginners to develop their own observational skills. Don't solely rely on external sources; good alpha is never shared. Instead, actively engage with the markets, gain firsthand experience, and form your own judgements. Edge is there but you have to spend more time than your competition to find it. Nothing beats screen time.

Bitbit’s Note

Markets move on expectations.

Markets tend to front-run the next narrative or event that’s coming up. It’s simple, participants take positions before the event and that’s enough to move the market.

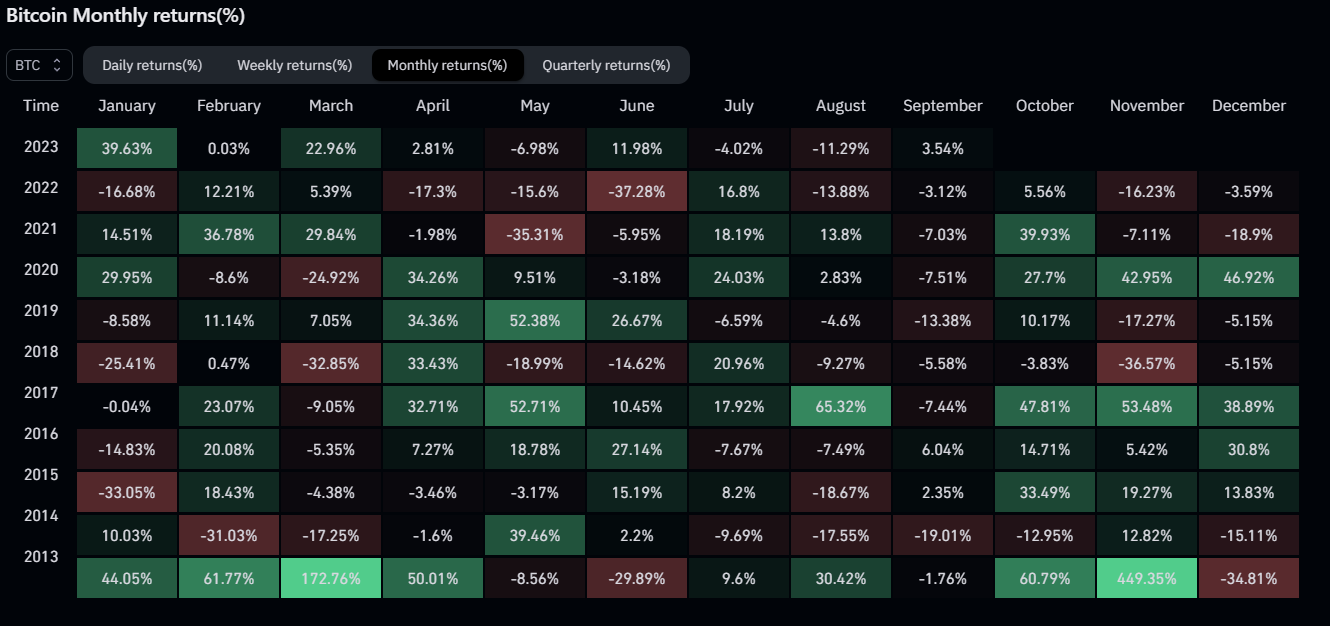

Uptober is just a meme but the stats aren’t, October normally is a strong month for Bitcoin.

Source: Coinglass

But, what I’m looking at isn’t October stats, I’m looking at the next year's events:

Fed funds rate - from tightening to easing

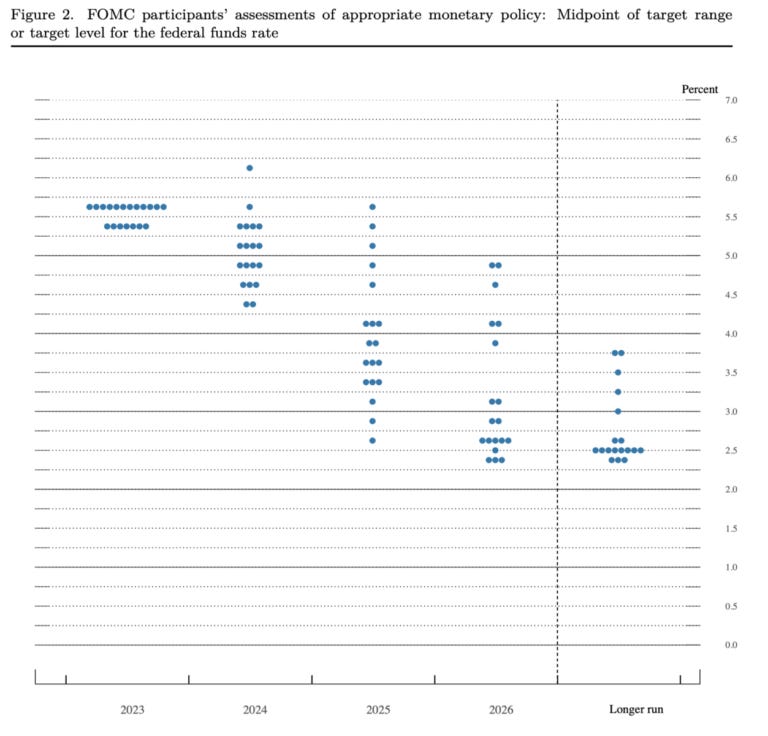

Followed by the last FOMC the dot plot suggests one more hike this year and then what? Easing?

Election year

The second thing is that election year is coming up. The stats suggest that a bullish year is coming, filled with high hopes and big returns; the average return is ~12% per year including 2020.

ETF applications SEC decision

Source: Bloomberg

A wave of 16 ETF applications are waiting for the SEC decision. Blackrock’s application, together with all the others, have high odds for an approval. The consensus is that the SEC is going to delay their decisions until the last possible moment, especially if the decision is positive, as there is no reason to rush this process.

Halving

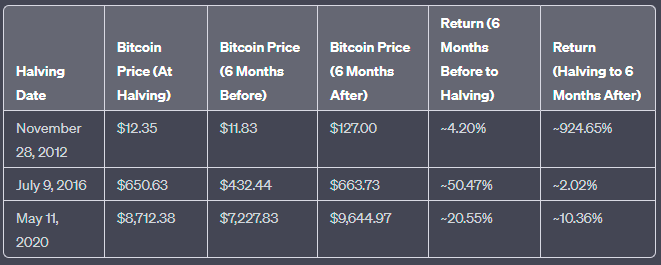

Following Halving historical data, Bitcoin tends to start a bullish trend 6 months before the event, and continues the momentum for the following 6 months. Markets move on supply and demand. And after halving, the mining supply is reduced by 50%.

To sum things up,

As the last quarter of the year approaches, I believe that there will be more and more bullish predictions for 2024, and the speculations will create a massive buying pressure heading to the end of the year. The more speculations the more expectations - markets move on expectations. This is all the market needs to create another bullish cycle. That is why I believe we will witness this phenomenon this upcoming quarter.

With that being said, we still have lots of ongoing FUD.

So as Grachev always says - NFA | DYOR.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.