The Weekly

Guilty On All Charges

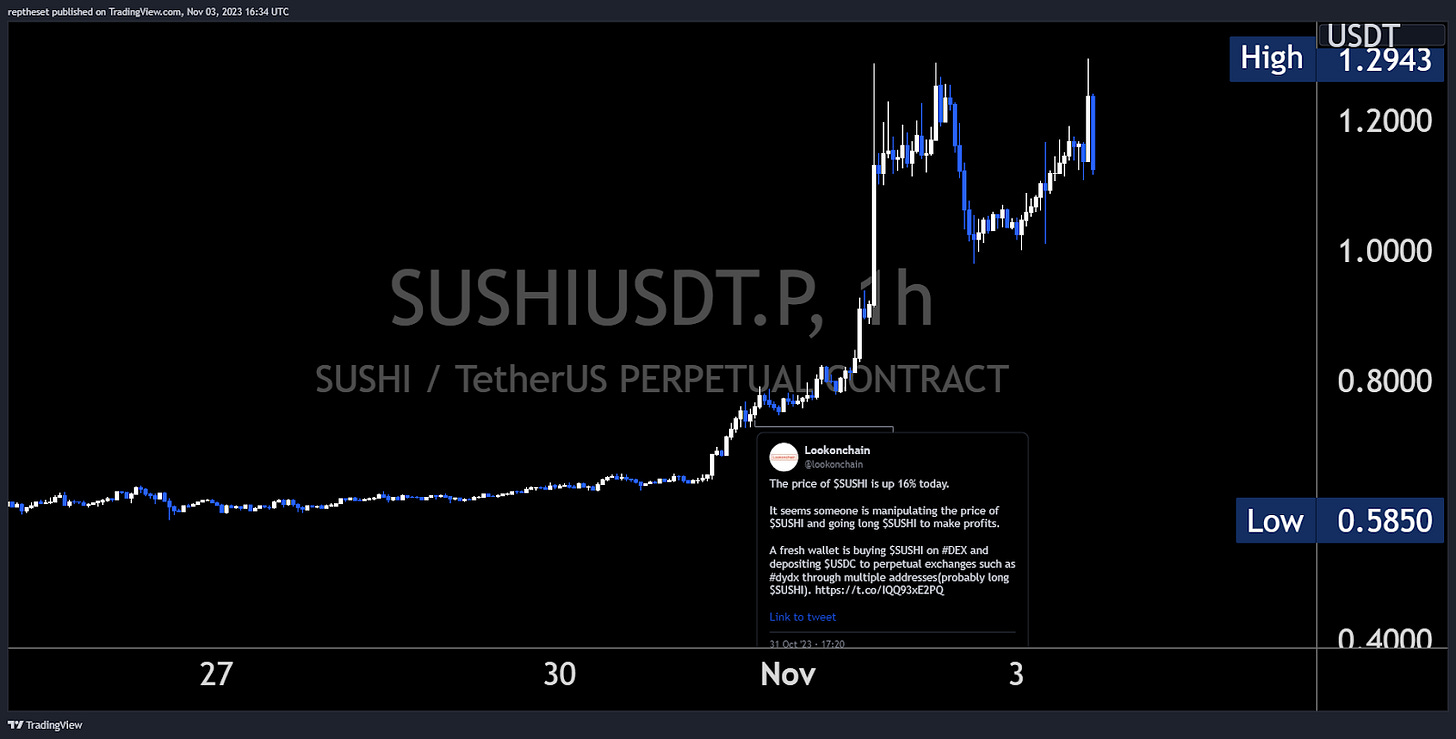

Sushi Whale Eating Good

On Tuesday October 31st, Sushi broke out of its 75-day range and experienced an impressive 20% surge in price. Later during that day, Lookonchain reported an apparent manipulation of Sushi's price, reporting that some whale was building a long position on DEXs, through multiple addresses.

Wednesday was when the fireworks really went off. Price pumped another 50% after consolidating at the highs for a few hours and then continued its upward momentum. It made a triple distribution trend day, with value consistently moving higher.

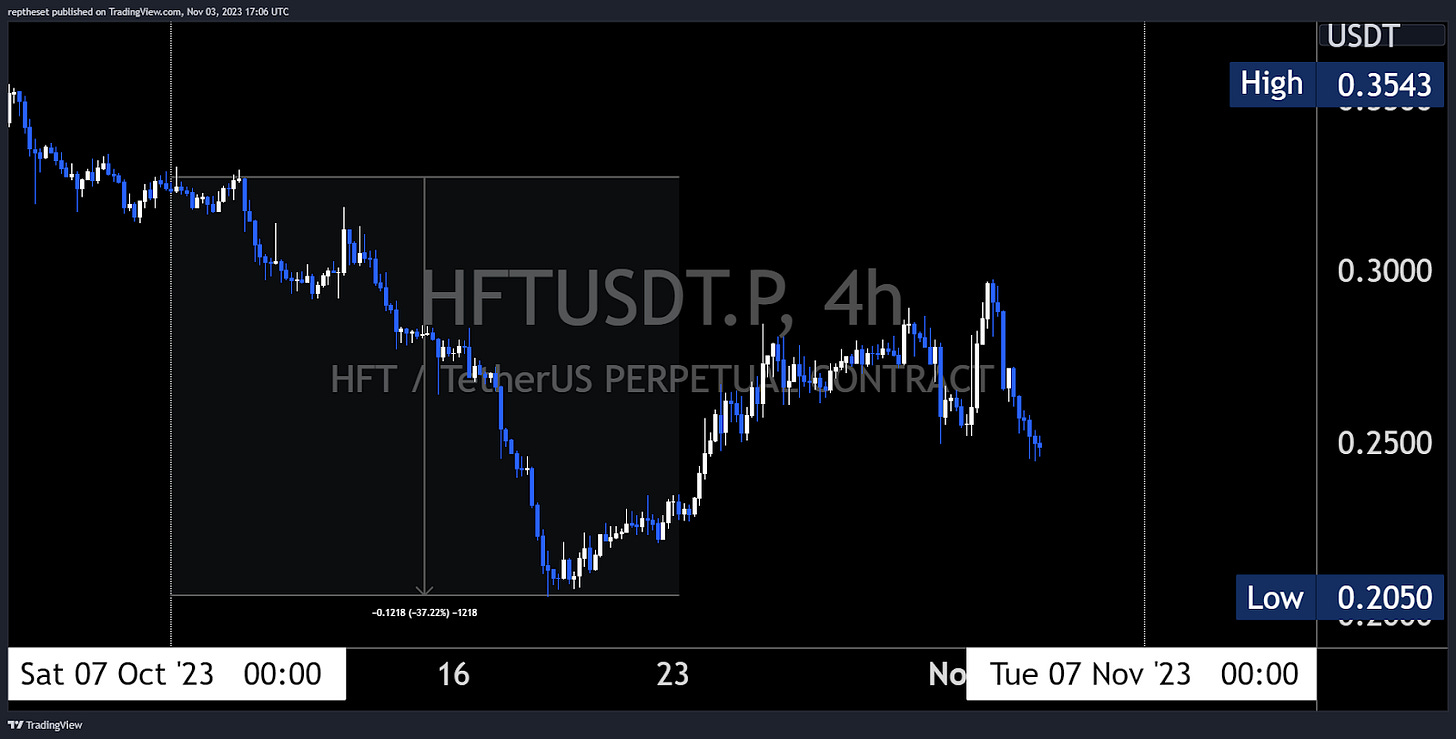

Tokenomics Upgrade Good?- HFT

On November 1st, Hashflow implemented a new fee system, which received approval from its DAO. This system involves a minor fee applied to each trade on Hashflow, with the exact amount varying depending on the asset pair being traded. Importantly, the blog post emphasized that this fee structure would not affect trading volume. The resulting revenue will be distributed monthly among stakeholders, benefiting both Hashflow and HFT stakers.

Following the announcement, the price experienced an initial 8% increase, followed by a retracement, and then a 15% swing opportunity. Currently, the price has returned to levels below those at the time of the announcement.

TIA - The New Shiny Thing?

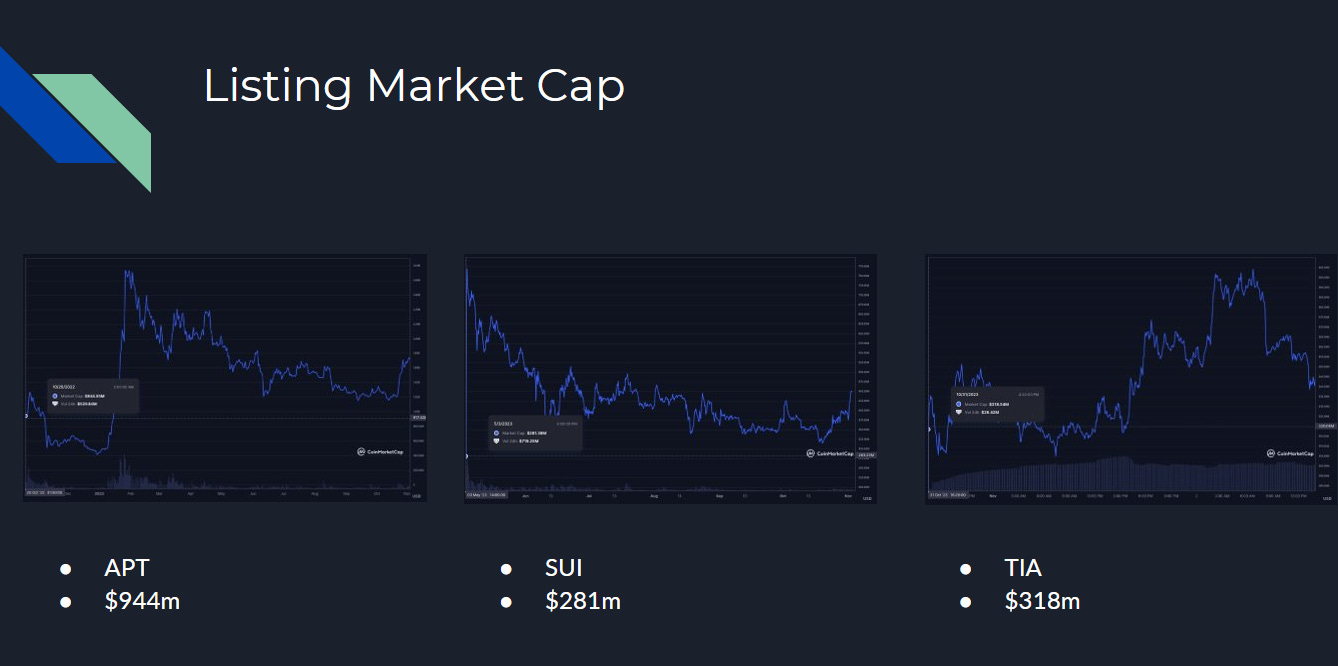

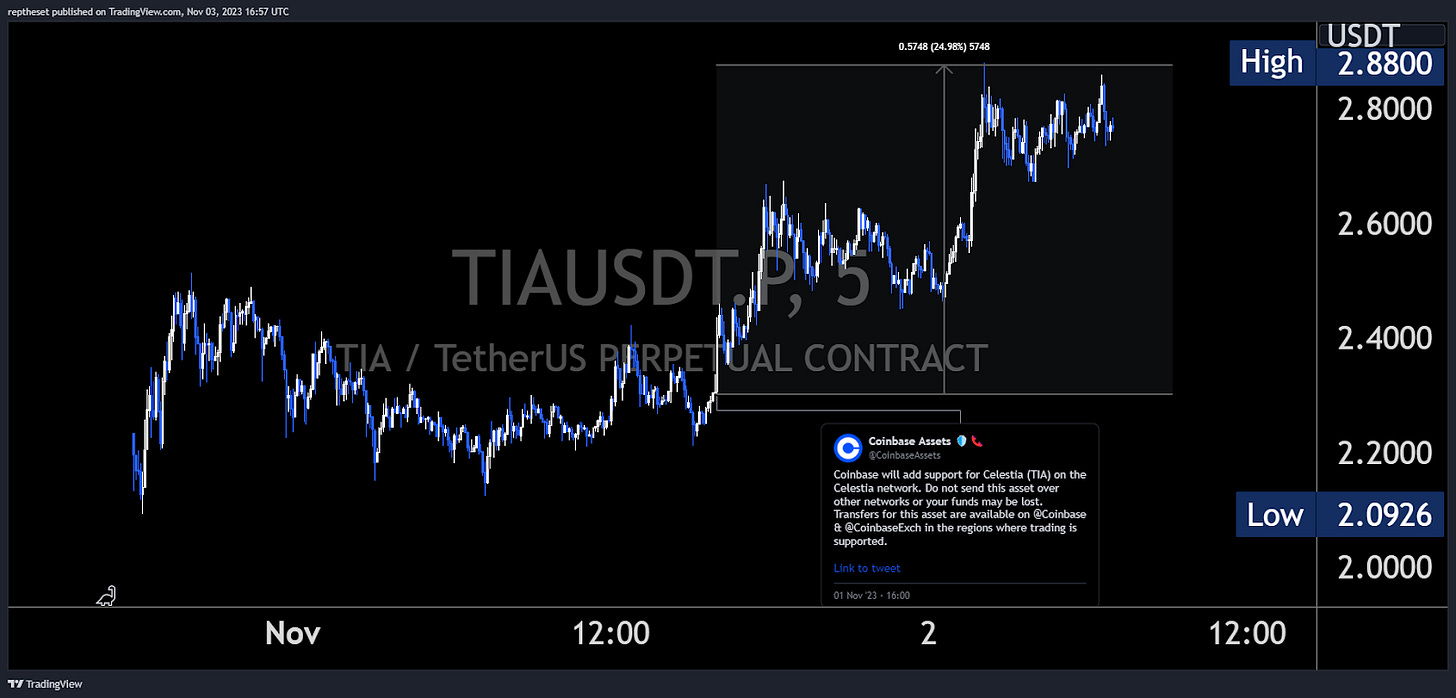

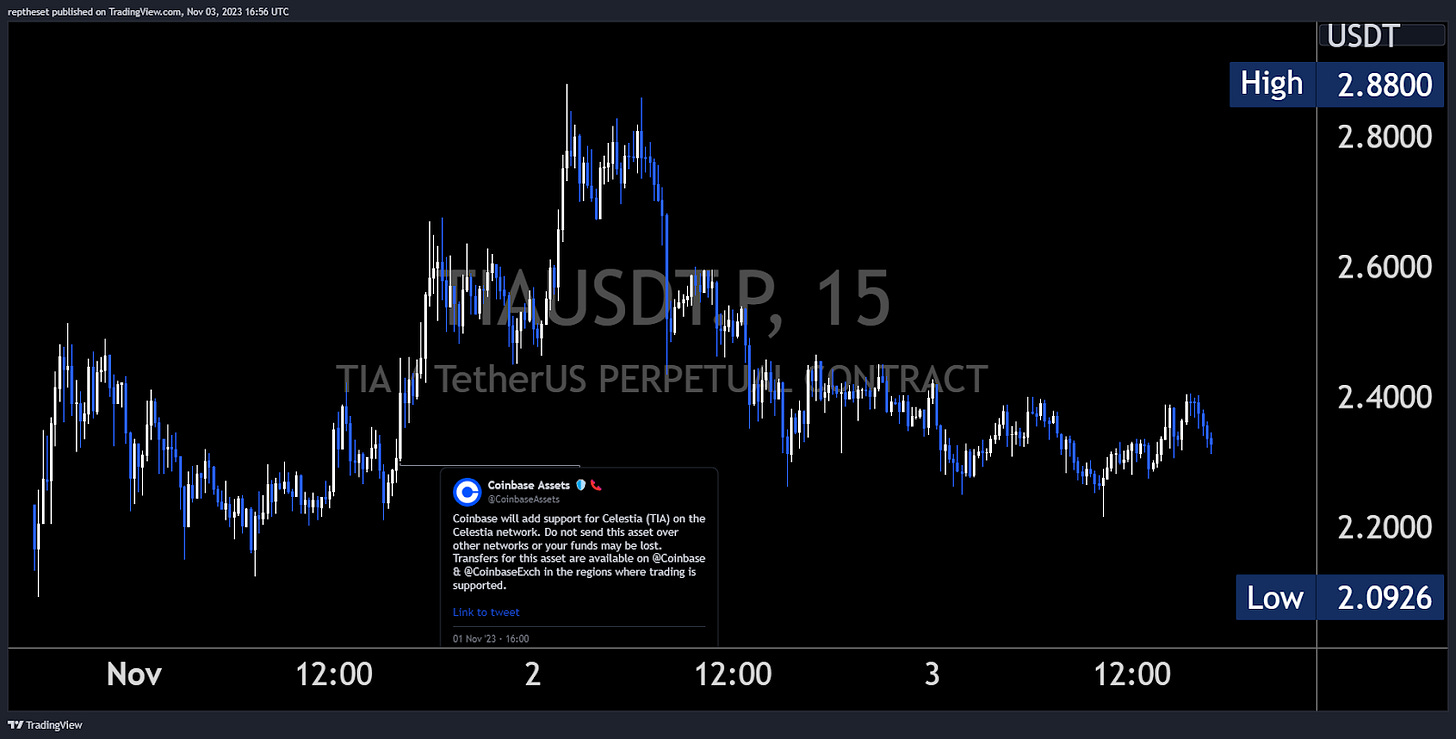

Celestia's mainnet (TIA) launched on Tuesday (October 31st) and saw the release of over $300 million worth of TIA tokens. Celestia is a flexible (modular) blockchain network designed to provide developers with the tools they need to create and manage blockchains. It serves as a foundational platform that allows other blockchain projects to leverage it for data availability and consensus purposes. It also allows developers to choose their own programming language and execution environment, and blockchains built on TIA are sovereign, meaning they are not controlled by any entity.

Another noteworthy aspect is that 53.4% of the supply is held by insiders, and the network is funded by several prominent venture capital firms, including Polychain Capital, Bain Capital and Binance Labs, among others.

Price consolidated between 2.22 and 2.44 at the launch. Following an announcement that Coinbase would be launching the token on their platform on November 1st, the price broke out of the range and pumped 25% in the next few hours. It offered a very good trade opportunity for focused traders to buy the dip around $2.35 and ride the wave. At time of writing, TIA is back to trading within the range, as the momentum following the listing has slowed down.

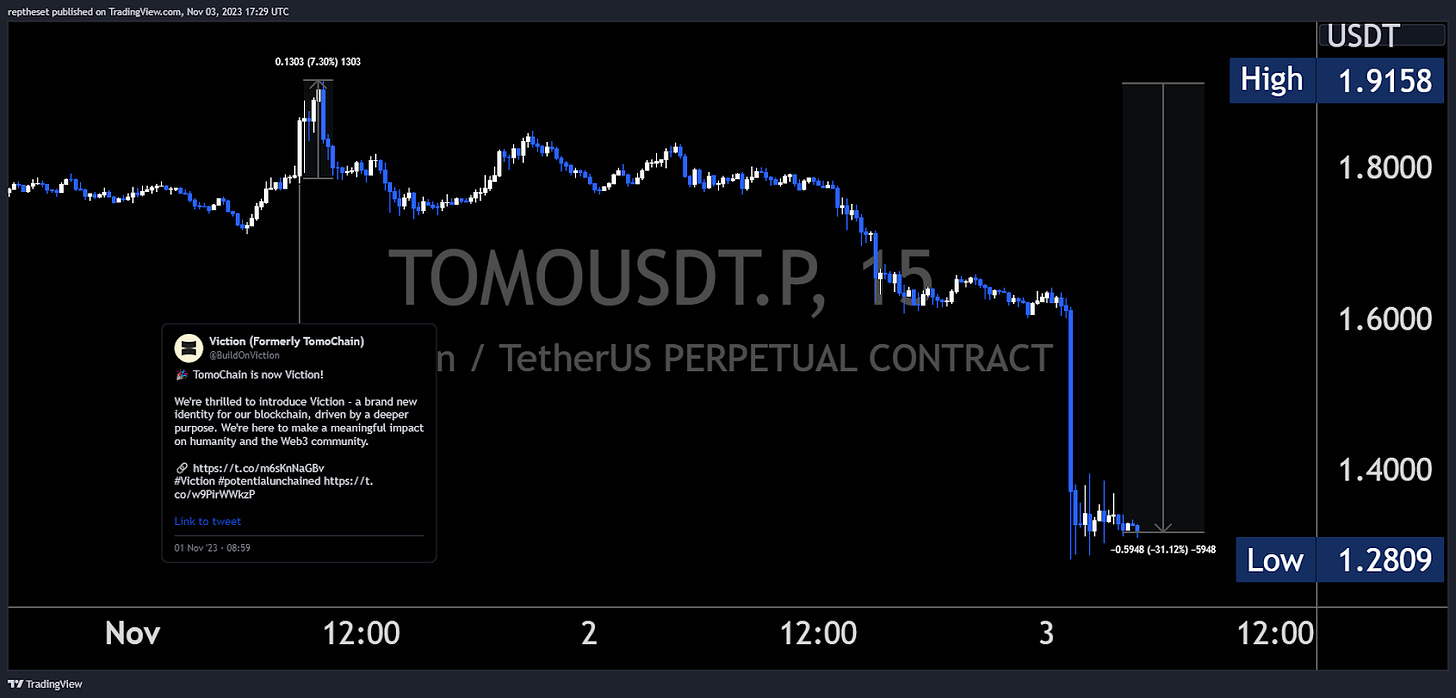

Rebrand Failures: TOMO and C98

In the past, we have seen multiple instances where various projects try to use the “rebranding” marketing strategy to bring interest and manipulate their tokens. However, this week we saw 2 rebrand attempts, which both failed to produce any meaningful pumps.

TOMO rebranded to Viction, and following the announcement, the token pumped ~7% before reaching a local top and then proceeded to sell off ~33% over the next few hours.

Similarly, C98 rebranded to Ninety Eight and pumped ~10.5% before selling off ~17.5%.

These events bring to our attention that participants are becoming more and more sophisticated in recognizing real market moving events, and are not falling for all the marketing traps these crypto protocols try to use to try and lure them in.

It's over for Soyboy

After 15 days of testimony and just about four and a half hours of deliberations, the verdict is out: GUILTY on all seven counts of fraud and conspiracy. While celebrations are ongoing, please remember to mark your calendars for the sentencing hearing, scheduled for March 28, 2024. He faces a potential sentence of up to 110 years in prison.

7 ) What

image credits intern

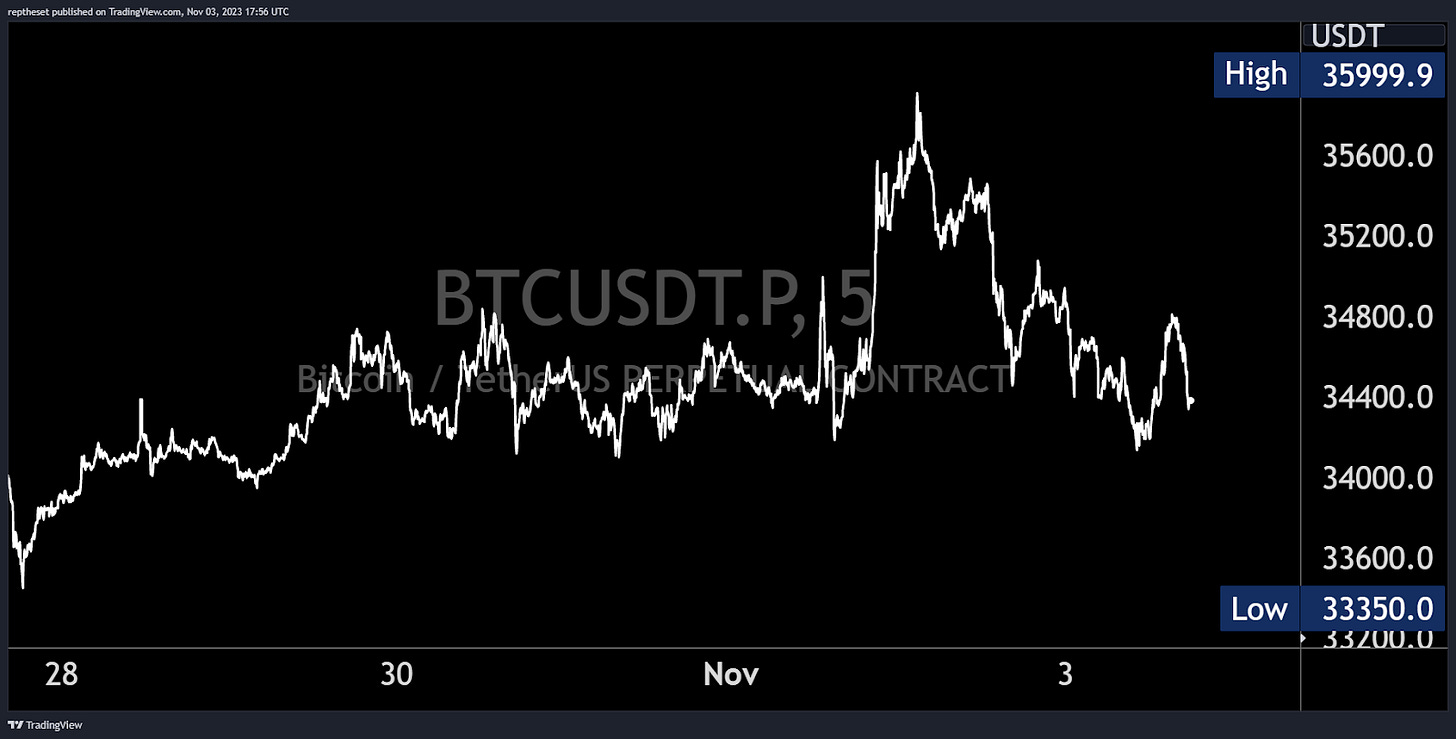

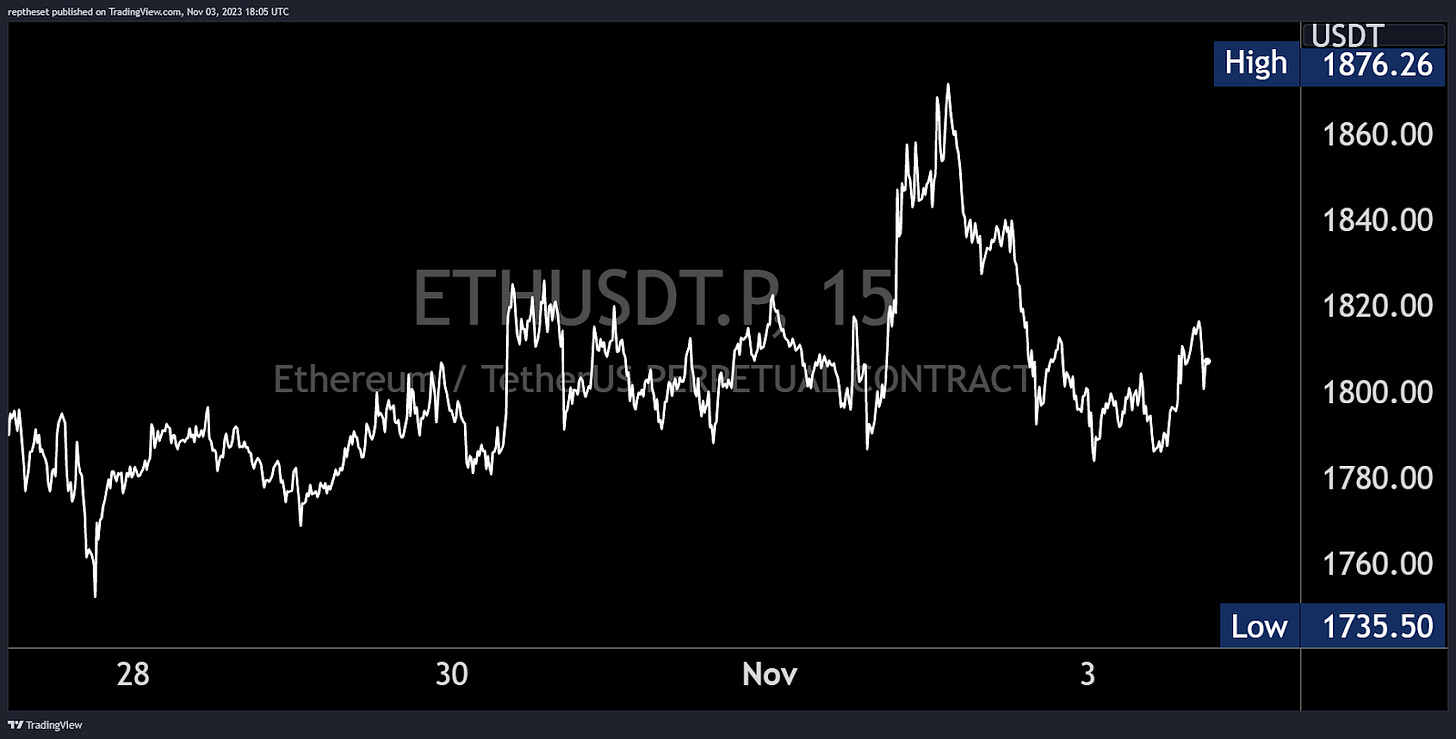

Bitcoin and Ethereum

The past week’s trading activity showed BTC consolidating at the recent highs, with a notably strong bullish close on the monthly chart. Price is finding support near of 34k, while teasing both bullish and bearish sentiments, with a high of 36k. The upper limit of the current trading range stands at around 35k.

As for ETH, it recorded a decent monthly close, albeit staying within the previous 200+ day range, in contrast to BTC. ETH began the week around $1800, reached a peak of approximately $1875, and is presently trading around the midprice at $1800. ETH maxis, now is your time to shine?

Upcoming Events

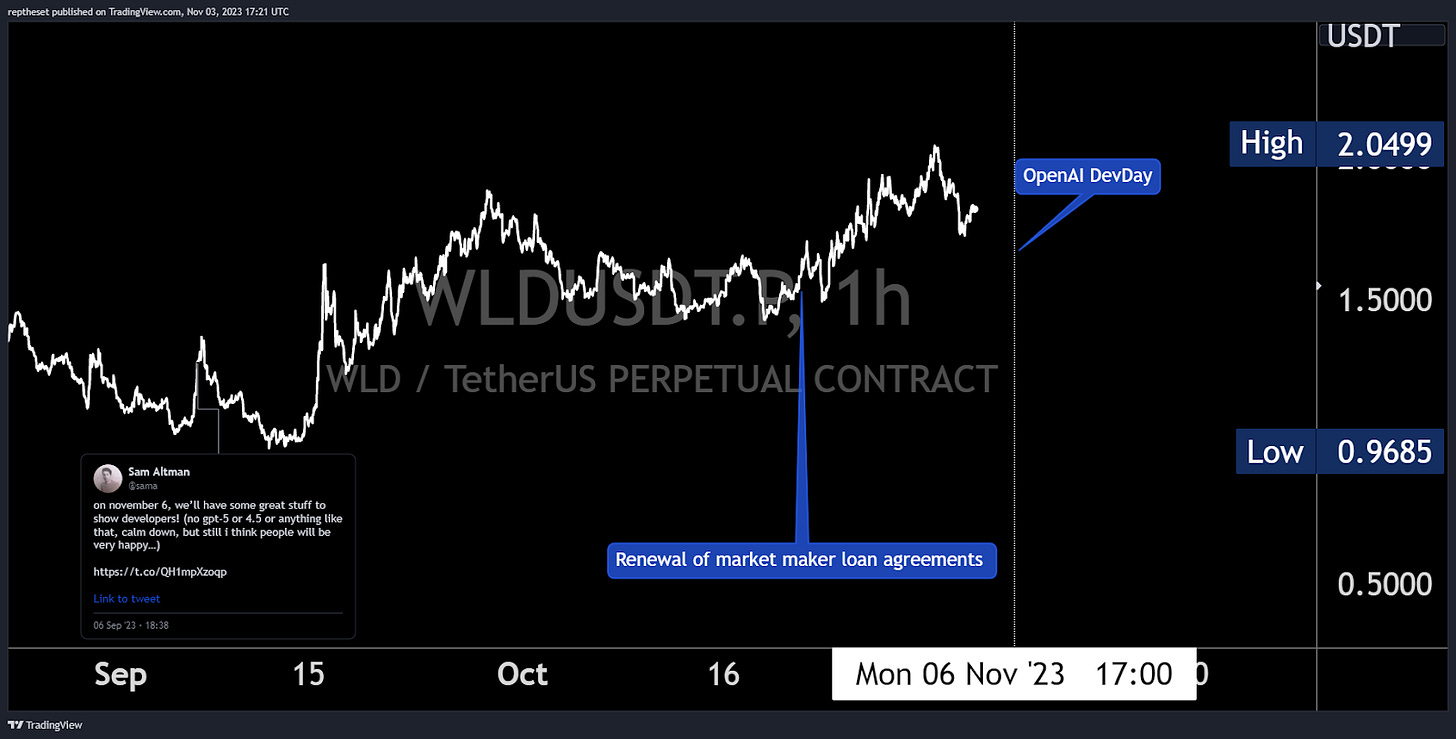

OpenAI DevDay

In a previous edition of The Weekly, we explored the possibility of OpenAI DevDay conference to spark speculative positioning on one of Sam Altman's other (crypto) endeavors, Worldcoin.

Shortly after Altman's announcement of the developer conference, the Worldcoin token (WLD) experienced a 30% decline in value, followed by a large rally of 111%. While it's important to avoid mistaking correlation for causation, it's worth being aware of the potential influence of the "conference effect" as we approach November 6, 2023.

Those interested in the conference's content can join via livestream.

NEARCON 2023

This year's NEARCON will be held from November 7-10. The event will see Near announce [Redacted] and [Redacted].

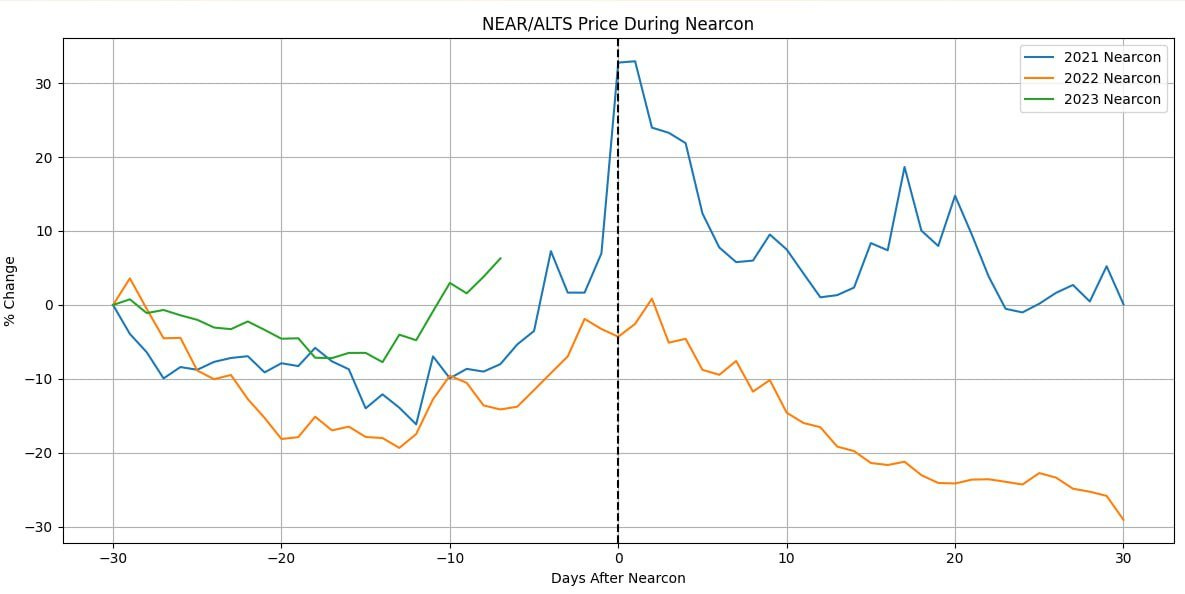

NEARCONs have usually been a good buy for NEAR going into the event. The image below shows the performance of Near against alts going into NEARCON.

Image via Ouroboros Capital

This year, NEAR has pumped ~61% from the lows as both the market conditions and the narrative have aligned to provide optimal conditions for the pump.

If history repeats itself, we may see a sell-off as NEARCON begins and [Redacted] gets unveiled, providing a good opportunity to book profits. It is advisable to remain cautious with shorting, as we may see some unexpected news that could pump it even further, especially in the current bullish environment.

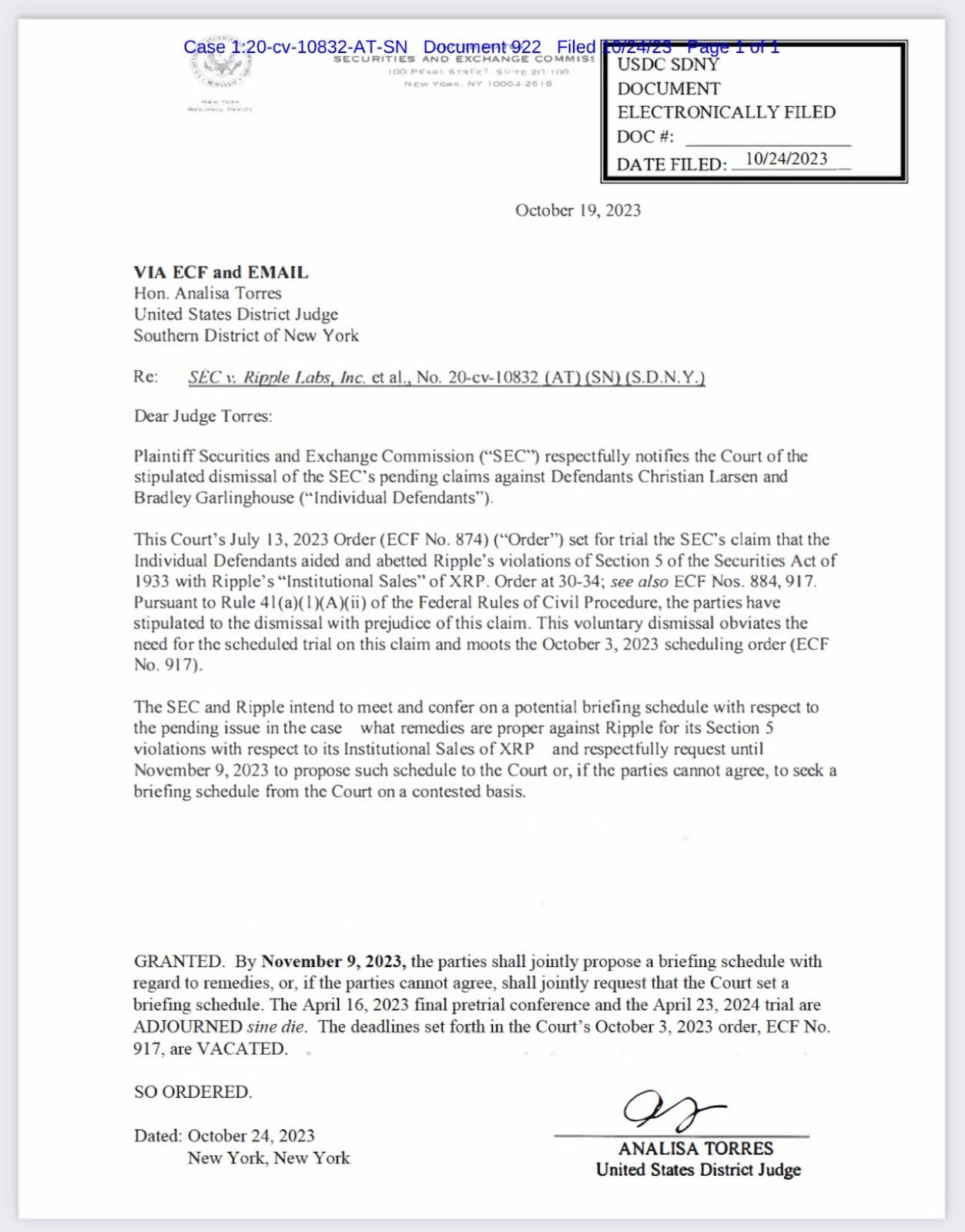

Ripple Swell and Court Deadline

The 2023 Ripple Swell conference will be held in Dubai on November 8-9, taking place in person for the first time since 2019 and follows the Dubai Financial Services Authority’s approval of XRP under its virtual assets regime.

Historically the weeks leading into the event have led to increases in price followed by a sell off, as is tradition for conference price action. However, November 9 is a crucial date for another reason.

Judge Torres has set a deadline of November 9th for Ripple and the SEC to come to an agreement on a briefing schedule regarding remedies. If they fail to do so, the court will set the schedule itself. This has led to speculation that the lawsuit may be coming to an end, as Ripple has already won a partial victory and the SEC's request for an appeal was denied.

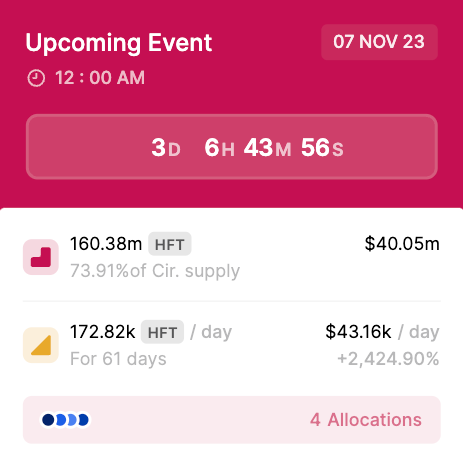

Hashflow Unlocks $39m

Hashflow is set to unlock 160.38m tokens, equivalent to 73.91% of its circulating supply or $39.65m, on November 7. This is the largest token unlock among crypto projects in November.

The tokens will be distributed to early investors, the core team, ecosystem development and community rewards.

Hashflow's token price fell as much as 36% following last month's token unlock of 3.23m tokens. With Novembers token unlocking almost 50 times the size, all eyes are on HFT.

TradFi/Macro

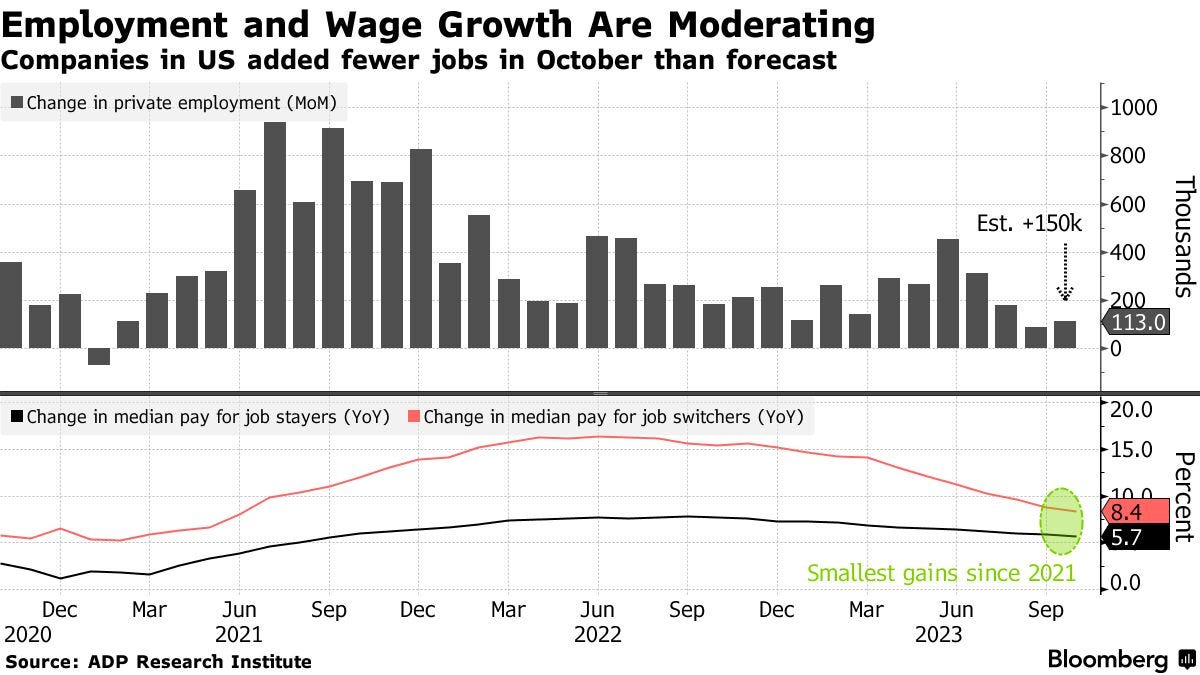

Economic Data

It's been a week with a focus on the US labor market, and it’s one that has potentially changed the tone for the current cycle.The ADP Research Institute released their private payrolls on Wednesday, showing that companies added fewer jobs than markets forecasted, suggesting that the demand for workers is starting to wane.

After posting the weakest advance in two years in September, private payrolls only increased by 113,000 vs 150,000 expected in October. Notably, leisure and hospitality, which held up the post-pandemic recovery for the whole year, added the fewest positions since early 2022.

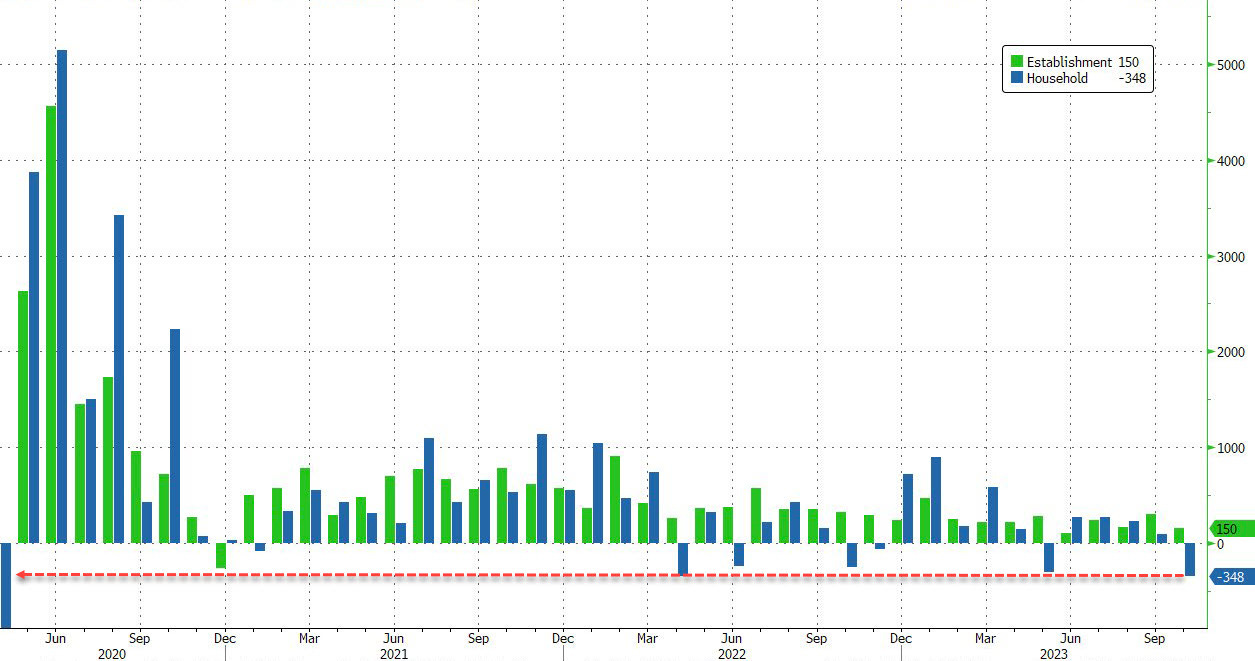

After months of divergence between private and government data providers, the job report today by the Bureau of Labor surprisingly aligned with the private sector, posting 150,000 payrolls vs 180,000 expected, while the unemployment rate climbed to a two-year high of 3.9%.

Most notably, there was a pickup in layoffs and a downward revision of 103,000 payrolls for the months of September and August.

What also stands out is that the less manipulated household survey, which avoids counting multiple job holders, dropped by 348,000.

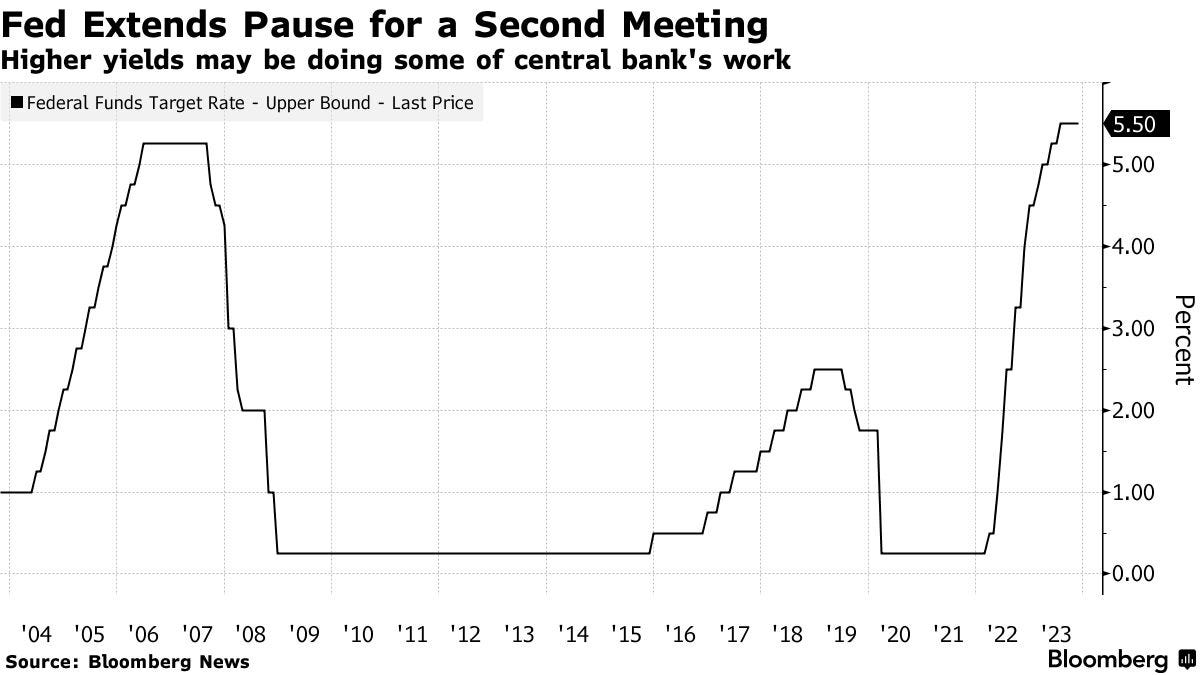

The significance of this week's job report is especially evident in Fed Swaps, which are now pricing in only 25% odds for another hike by January, 73% odds of cuts in May, 81% odds of cuts in June and 93% odds of cuts for July.

Stock & Bond Market

A wild squeeze in all markets this week, caused by the QRA announcement, Powell’s dovish presser, and the job report on Friday. The S&P 500 is up 5% over the last four days, posting its best four-day stretch for the index since November 2022. The Nasdaq and Small Caps are both up 6%.

The same squeeze is happening in the bond market, for both the long and short-end. 2-year yields are down 25 bps from Wednesday’s highs, 30-year yields are heading for their biggest three-day decline since the onset of the pandemic. The dollar is down almost by 1%.

Central Banking

The FOMC left its benchmark rate unchanged on Wednesday in a range of 5.25% - 5.5%. The highlight of the meeting was the dovish stance, where officials signaled that the recent rise in treasury yields reduces the need for further tightening. Essentially, the Fed was indicating that they won't do much more, inclining towards an extended rate pause.

Powell distanced himself from last meeting’s quarterly projections of another rate hike for the year-end, stating that it only represented officials’ individual views. He also repeatedly pointed out that the committee was moving “carefully”, a wording that implied a low likelihood of further tightening.

Outlook For Next Week

While bad news still triggers algos to bid everything higher and will continue to do so for a while, we would like to point out the potential shift in market sentiment. Fears of higher yields are behind us, and the job report has cemented expectations that the Fed has reached peak rates. Markets have returned to celebrating the Goldilocks scenario. Although today's job report is perfect for a risk-on rally and we think markets will do so for a while, recession chatter will have a dampening effect. A good way to monitor when to jump ship is the weekly jobless claims, and we would suggest keeping an eye on the 250,000 mark. As long as claims stay below that level, traders will stay confident in a soft landing scenario and therefore risk-on.

Key Events For Next Week

Monday:

EU HCOB Composite & Services PMIs

Tuesday:

China Trade Data

Australia RBA Meeting

EU PPI

Wednesday:

Germany CPI

EU Retail Sales

US 10-Year Note Auction

Thursday:

China CPI & PPI

EU EcoFin Meeting

US 30-Year Bond Auction

Friday:

UK Q3 GDP

EU Economic Growth Forecast

University of Michigan Consumer Sentiment & Inflation Expectations

Trader Takes @tradeboicarti16

How would you describe your trading style ?

I'm a day trader, meaning I usually close all my positions by the end of the day. I try to focus on finding trading opportunities through news and narratives in the crypto markets.

What is your most memorable trade experience in the last month?

When the Blackrock etf was listed on the DTCC website and then removed. Both of these headlines provided opportunities to put on size and get paid quickly.

What is the best trading advice you’ve been given?

“ Tomorrow can be your best day ever trading, keep clicking and always look for the next opportunity”

What do you think is a personality trait that a professional trader must have?

Confidence and patience are the 2 most important attributes a trader should work towards, in my opinion.

Bitbit’s Note

Following the recent FOMC meeting on Wednesday and Jobs report today, we’re getting a hint that the Fed's tightening is coming to an end. Supporting this narrative is the fact that the stock market is up only since. As mentioned in this newsletter at the beginning of the quarter, this is one of the main catalysts for an end-of-year rally, as everyone will start projecting QE in the following year. The market moves on expectations, remember?

There is something about bull cycles that drives participants to FOMO and stick their neck out, to the extent of getting liquidated, and end up on the sidelines when the market recovers. The market can be tricky, especially when it goes higher and tests new levels. Move slow. There is no reason to jump on every single uptick.

This week, we are trying something new. We want to grow our network. I think the timing is right, and I hope we will achieve our goals. If there is something I learned about this market over the years, it is that you can’t make it alone, it's almost impossible to get all the insight and stay on top of everything. You need to make friends, and build relationships with trustworthy people. Everyone benefits from these kinds of initiatives. And that's the best advice I can give you here - make good friends, you’ll need them.

One last thing,

Almost a year after the FTX collapse, SBF is finally getting his trial. People probably underestimate this event, but the more bad actors get exposed and prosecuted the better it is for the crypto space, community, and of course better for the markets. Stay Bullish.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.