ETH Spot ETF? - CATHIE WOULD Think So

On a slow, bearish Wednesday, the markets felt notably heavy and sluggish. ARK Investment Management, in partnership with crypto exchange-traded products issuer 21Shares, filed for the ETH SPOT ETF. Their intent is to introduce the first ETF that is physically backed by ETH and will trade under the ticker ARKE.

The news is simultaneously noteworthy and pedestrian. It stands out because they are the first to pursue an ETH SPOT ETF. However, its impact is somewhat muted. While anyone can introduce an ETF, its true relevance won't be realized until a Bitcoin spot ETF secures approval.

Cathie Wood remarked:

There is so much friction in the process that this will save people.

One might jest, "Perhaps it's Cathie to the rescue instead of Hsaka!"

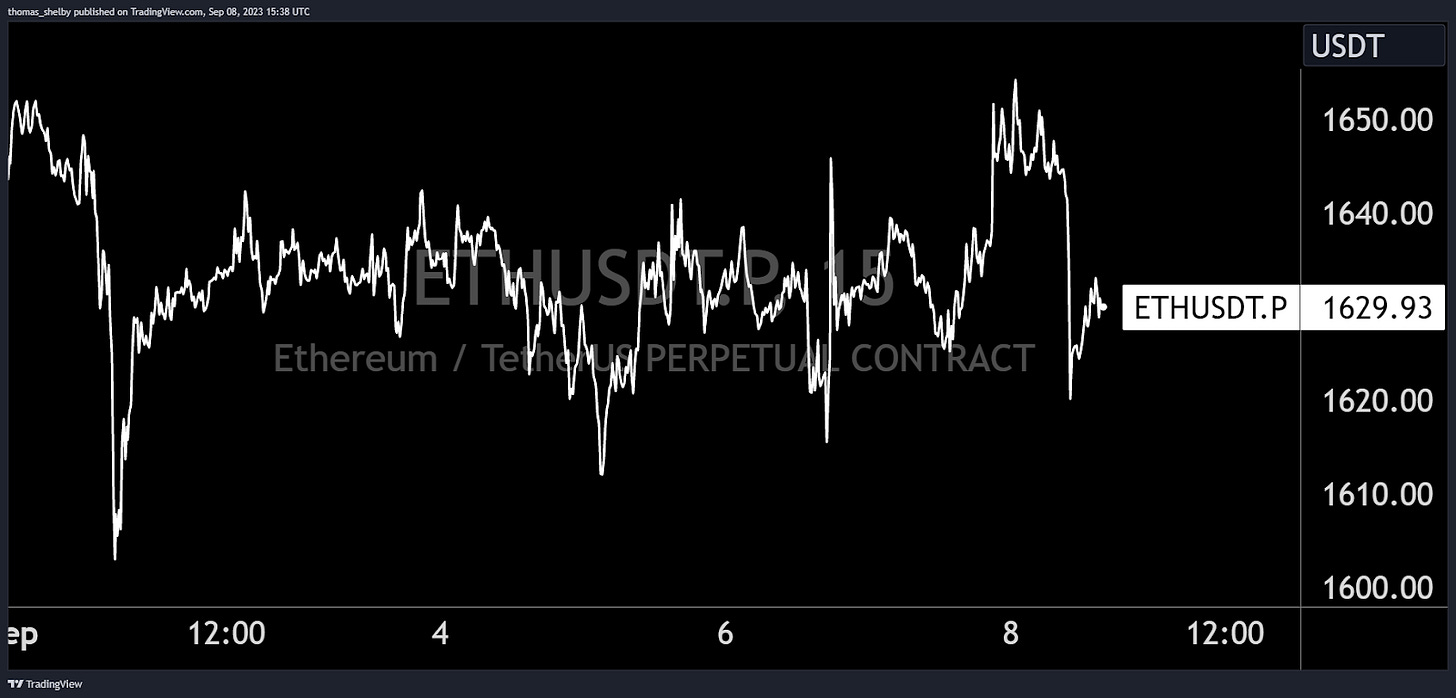

On a regular day, such news wouldn't drastically sway the market. However, in just four minutes, ETH surged from $1620 to the $1680s on Binance's perpetual markets — a rise of approximately 3.5%. This kind of reaction is almost predictable when most of the market is bearishly aligned on an otherwise calm day.

This chain of events triggered a brisk 3.5-4% open interest purge on ETH perpetuals, with virtually no follow-up movement. It appears to have been a hurried short-covering spree in the PVP markets.

Although Eric elaborated on the "BOOM" part, even we couldn't make sense out of it.

VISA X SOL

On September 5th, Visa announced that it is expanding its stablecoin settlement capabilities with Circle’s USDC, adding pilot programs with merchant acquirers Worldpay and Nuvei, and utilizing the Solana blockchain.

It took 5 minutes for the market to react to this news, providing ample time for traders to build a position. The price of Solana increased by 5.69% over the next few hours. While this partnership signifies a significant achievement for Solana, the initial enthusiasm and momentum it generated couldn't sustain itself for more than a few hours and the price eventually retraced.

BTC and ETH

This week brought more of what we’ve gotten used to: choppy price action, deviations outside the range, followed by another round of chop.

The week started with a dip on both BTC and ETH, followed by a weak bounce on Tuesday. Wednesday saw quite a lot more action in the form of a long squeeze right before the Ark ETH ETF headline. The headline triggered a significant amount of short covering, leading to a massive short squeeze. After squeezing both sides, by the end of Wednesday, we were back at square one, as both moves fully retraced, and the choppy trading resumed into Thursday.

Thursday brought some optimism, as both BTC and ETH held the pre-headline levels ($25,600 and $1,625) and began climbing, returning 2.3% and 3.3%, respectively, by the end of the day. However, the optimism was lost by Friday morning after Thursday’s move got fully retraced, as price was unable to hold the freshly made highs for more than 12 hours.

Upcoming Crypto Events

Anyone that is involved in crypto trading should be aware of the famous “announcement of an announcement” shilling technique. If you are not familiar, here is a brief explanation of this method. Crypto projects have an announcement/news to deliver to the public, that is sometimes very important and market moving, and other times “non-event”, when it comes to trading their token.

With the weaker announcements, they tend to announce in advance that “an announcement is coming“, to create hype and let the market participants speculate and try to front-run this piece of news by buying before the actual information comes out. This creates a snowball effect and everyone starts paying attention to this token that is soaring in price and therefore brings more and more buyers. These events usually end in disappointment because when the news actually comes out, there is no one left to buy. This is called a “sell the news event”. This happens almost every time a piece of news from a certain project is anticipated.

This brings 2 trade opportunities for active market participants; buy into the event and cover your position within 24h before the news is expected to come out, and second, short the token a couple seconds after the announcement is published for a more often than not full retrace of the speculation pump. Evaluating the actual importance and effect of the news is one part of a traders job, but do not underestimate the importance of following the price action going into the event.

XLM Pump Attempt

On September 2, the official XLM twitter handle @StellarOrg posted a tweet about an upcoming announcement in 10 days, September 12, and the market immediately started buying XLM ahead of the news. Price pumped ~15% through the day. Another tweet came out 5 days later showing a 5 day countdown gif, revealing the motivation from the project’s marketing team to try and push the price even further. Mark this date on your calendar, and have XLM on your watchlist because there is no doubt this pair will bring interesting volatility.

Worldcoin “People will be very happy”

Another eventual “sell the news” opportunity will be on November 6th, trading WLD.

2 days ago, Sam Altman, the founder of ChatGPT and WorldCoin, tweeted of a future announcement targeting developers saying : “on november 6, we’ll have some great stuff to show developers! (no gpt-5 or 4.5 or anything like that, calm down, but still i think people will be very happy…)”. It is worth keeping an eye on WLD trading activity going into this event.

Tradfi

Economic Data

This week's data releases have once again shown the resilience of the US economy. The ISM services PMIs exceeded expectations, with the employment index reaching its highest level since November 2021 and stoked Fed-Hike wagers for November.

Some relief was served a day later with the release of FED’s beige book, stating that economic activity was “modest during July/August“. Price growth slowed down overall, and there were indications that consumers may have exhausted their savings and are relying more on borrowing to sustain their spending.

On the other hand, there was a downward revision in GDP for the Eurozone and disappointing industrial data from Germany, where factory orders plunged by 11.7% vs -4.3% expected, the highest drop since Covid.

China also didn't deliver the results markets have been hoping for, as services activities eased, with the sector expanding more slowly than expected, falling to 51.8 vs 54.1 in July.

As a result, the Dollar Index edged up on Thursday, sending the currency towards its longest rally in years and for the eighth week of gains, indicating that this divergence is drawing investors into the US with higher yields.

A little under the radar but notable is a headline that America's biggest employer Walmart is starting to cut pay for new hires and will change its wage structure, implying a start of loosening in the labor market.

Stock and Bond Market

The springily robust ISM data and higher yields kept a lid on further upside this week. Low volume and pre OpEx trading, where dealers buy back their short put hedges, were responsible for the sideways action this week, a classic example of macro vs positioning.

Apple’s stock fell due to a report that China barred government officials from using iPhones at work, leading to a 6.5% sell off over the last 2-day and a 9% drop from recent August highs. As the most heavily weighted stock in the S&P 500 and Nasdaq 100, this caused both indices to drop by almost 1% intraday.

After a 2.7% decline in August, European stocks have had a bad start in September. The Stoxx Europe 600 index posted its longest losing streak since February 2018 after european chipmakers saw a decline in the wake of Apple headlines and luxury brands such as LVMH retreaded after a warning from Richemont that inflation is starting to hit demand.

Central Banking

Mixed messages this week from central bankers. While Fed members are not decisive, ECB officials rang dovish bells, hinting at a pause for the upcoming ECB meeting next week. Here’s a little summary of Fed and ECB speakers:

Fed´s Waller: Want to be careful on saying inflation job is done

Fed´s Waller: Data last week allows Fed to proceed carefully

Fed´s Collins: Fed needs patient, careful, deliberate policy approach

Fed´s Bostic: Economy still has strong momentum, demand remains high

Fed's Williams: Underlying inflation measures have come down quite a bit

Fed's Williams: Need more data before deciding on the September move

ECB's Visco: We are near the level where we can stop raising rates

ECB's Visco: The ECB must avoid both overdoing and not acting enough

ECB's Visco: We must be very careful on the future policy path

ECB´s Kazimir: One more, likely last rate hike is still needed

ECB´s Knot: A further hike is a possibility but not a certainty

The Bank of Canada and the Royal Bank of Australia kept their rates 5% and 4.1% respectively.

Interesting outlier this week was Poland where its central bank surprisingly cut rates by 75 bps vs 25 bps expected to 6%, with inflation still running well above 10%.

Interest rate probabilities are little changed. Swaps price 34% for a rate hike from the ECB next week and 10% for the US a week later, with probabilities of 24% and 41% for their respective November meetings.

Outlook For Next Week

As described in the last episode of this newsletter, markets have been chopping around, volatility is contained and the put support at 4450 is respected. Higher yields, higher Dollar Index and Apple´s turmoil in China couldn't break the range to the downside. Implied volatility is still low, which tells us that the range will stay intact and traders are focused on next week's CPI report and ECB meeting.

Assuming no major shocks, we expect the beginning of next week to play out the same way going into quarterly OpEx next Friday where all structural products expire and 4450 put support will act as a pin.

Some attention is directed towards the oil market as OPEC+ decided to extend their voluntary cuts till the end of the year, causing inflation expectations to tick up and yields consequently to rally. A persistent rally in energy and higher gas prices will lead to a decline in consumer confidence and therefore consumption, putting the economy in danger of falling into a recession.

Key events for next week

Wednesday:

US August CPI

Thursday:

ECB meeting

US retail sales

US Producer Price Index

Friday:

China retail sales

China industrial production

US Michigan consumer sentiment

Bitbit’s Note

My note begins with the tweet of the week:

During bearish/dry markets, the best approach is capital preservation. It is vital to stay focused and disciplined and always remember that your only goal in these moments is survival. Bear market comes with casualties, and unfortunately, those boys are not coming back.

The past week we had all kinds of random pumps and everyone knows these are impermanent. They were tempting to hop on and trade, and came with many traps in an illiquid environment. Starting with CYBER, then NMR, PERP, UNFI, XVS, OGN, and others that I traded and already forgot their names. Some were more liquid than others, but in general, if you played big and had to close a position, you’d move the market by a few % (slippage). Understanding your trading environment and knowing when to walk away, even if it’s unpleasant or hurtful is a must. You must stick to a specific plan. This is your only ticket to the next cycle. You will be among the bear market casualties if you approach these pumps without a particular strategy.

There are all kinds of speculations running on Twitter trying to guess who’s behind these PNDs.

I don’t know if they are true, this is not my business, all I know is that it’s getting to be a small trend.

I usually follow the funding when I trade these, but I don’t trade them big, there is no reason to do so. This is not the market to get rich, you must put this in your head. If you’ve been here during bull market cycles, you know what an excellent juicy market looks like; we’re not there. Stay safe, lads.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @FoftyOerney @ahoras_ @Wassie2835 @betsizing

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.