Stop the chain

Going BONKers

On December 13th, the already impressive year-to-date rally of about 7000% for the Solana Ecosystem memecoin BONK took another leap when Coinbase announced its plan to list the token on its assets roadmap with an “experimental” label. Since then, the memecoin has been on fire, fueled by expectations of dramatic improvements in the tech 😉. As of December 15th, it has rallied an additional 200%, post announcement. The 14th of December alone witnessed a massive 130% pump in a single day, a level of volatility unprecedented outside of euphoria-led bull markets. BONK has also entered the top 50 coins by market cap on CoinGecko, attracting increasing attention.

Moreover, due to the substantial appreciation in BONK's price, the airdropped BONK tokens that come with the Solana phone are now worth more than the phone itself. Buyers of the phone are promised an airdrop of 30 million BONK tokens, which currently value at about $800-900, while the phone is priced at $599. These phenomena are exclusive to the world of magic internet coins. The phones are sold out in the US for right now.

It goes without saying that TikTokers have begun adding fuel to the fire with their content.

End SNX Inflation

On December 5th SNX Founder Kain Warwick tweeted about reducing SNX inflation which was positively welcomed by the community and followed by a swift increase in $SNX price.

According to the original post by Kain, inflation was originally introduced in 2019 to boost staking, but since then its effectiveness has waned. This proposal also aligns with new strategies, like using Andromeda deployment fees for SNX buybacks and burns, aiming to make the token deflationary. The community agrees that the change is expected to benefit the network without affecting other developments like app chain deployment or changes in the use of SNX as collateral, ultimately fostering Synthetix’s growth.

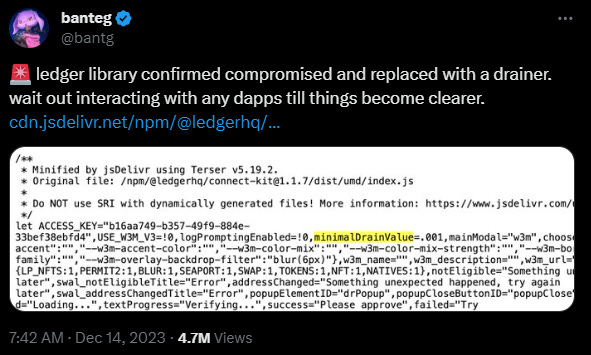

LEDGER Connect Kit Exploit

On December 14th some X users started ringing the alarm about an exploit regarding Ledger.

This news was slowly followed by a sell-off on the overall crypto markets a few minutes later which was quickly bought back as soon as Ledger’s official account confirmed the exploit by posting on their X account.

Fortunately, this exploit was quickly recognized and stopped which resulted in only a small amount of money lost. Most importantly, this exploit did not affect the Ledger hardware wallet itself.

As professional traders in the industry, we highly recommend using wallet software that provides you with transaction simulation before initiating a transaction. This can save you from being phished and hacked by making sure you know what will happen before signing a transaction on chain. Such software can be easily found online and should become standardized in our opinion.

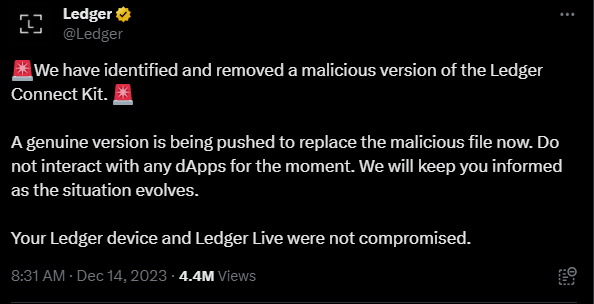

Fusionist Hits Binance

On December 11th, Binance announced its latest Launchpool listing, a game token named Fusionist ACE, marking it as the 40th project on the Binance Launchpool. ACE is designated as the native token for Endurance, a decentralized gaming and social blockchain platform that hosts Fusionist, a web3 AAA game. It's somewhat unusual for users to have the opportunity to farm ACE tokens over a brief 5-day period by staking BNB and FDUSD, which contrasts with the more typical 30-day schedule. The market is currently focused on GameFi, particularly following the successful price performance of the collaboration between IMX and EPIC Games. The Launchpool event is set to offer a substantial portion of ACE's total supply—about 7%, nearly half of its expected circulating supply upon listing. Additionally, it's noteworthy that the ACE platform already boasts a functioning marketplace and native economy, and Fusionist is available on Steam.

The announcement sparked notable activity in the BNB market, which had been fluctuating between $220 and $260 over the past two months. The BNB/BTC pair experienced a roughly 10% increase in the two days following the announcement, but it has almost reverted to its price at the time of the announcement. This created a short-term trading opportunity in response to the news on the pair.

🌎Worldcoin Updates

Three major updates on WLD since last week’s note:

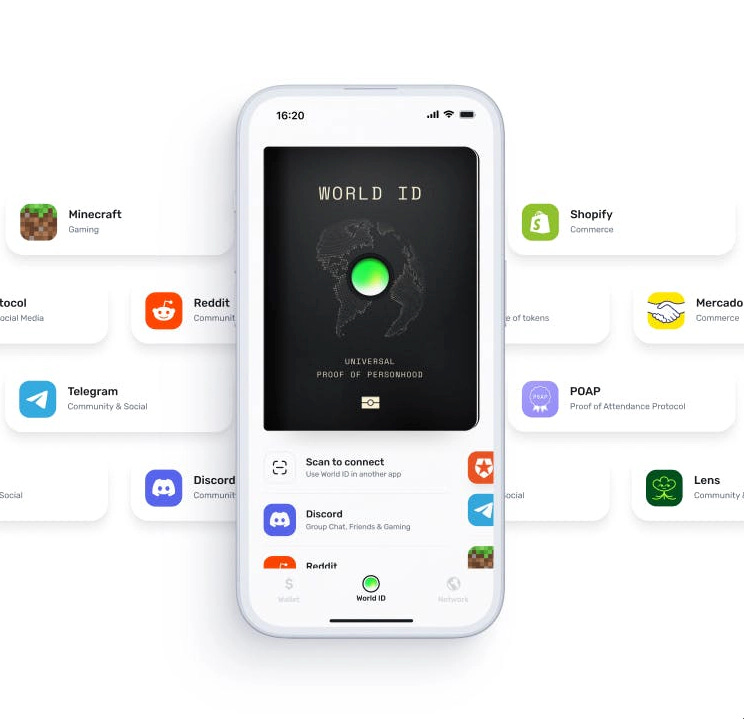

1️⃣Worldcoin announced significant updates to the protocol this week with World ID 2.0, “a privacy first human passport for the internet”.

The update introduces Apps and new verification levels including integrations with Reddit, Discord, Shopify, Minecraft and Telegram, via the Worldcoin App Store.

2️⃣Reports surfaced from The Block that the project’s main developer ‘Tools For Humanity’ was seeking a raise through the sale of WLD according to investors familiar with the matter. Seeking to raise $50mm with WLD priced at $1 the raise offers a significant discount to current market price.

3️⃣Following last week’s note on WLD market maker agreements, we saw a statement on a new loan agreement that was being finalized, to begin on December 16th. The new terms state much smaller loans for the 5 market making entities.

10mm WLD total loan.

6 month Loan period.

10mm increase in WLD circulating supply.

No call options.

There are two events here, the ending of the prior market maker loan agreement & the new agreement starting. Both of which have an impact on the circulating supply of WLD, depending on how many WLD tokens market making firms elect to purchase.

The component that's interesting here is the free ev that the sweetheart market maker deals came with, when those avorable options expire, so the dynamic of price action might evolve.

WOO X Wintermute

Following recent events that saw liquidity on WOO X significantly impacted by the reported hack of DMM Kronos for an estimated $25mm, WOO X announced a much needed partnership with market making firm

Markets responded positively to the news, bolstering confidence in the trading platform with WOO trading up as much as 68% within days at the time of writing to highs of 43c from 27c per token.

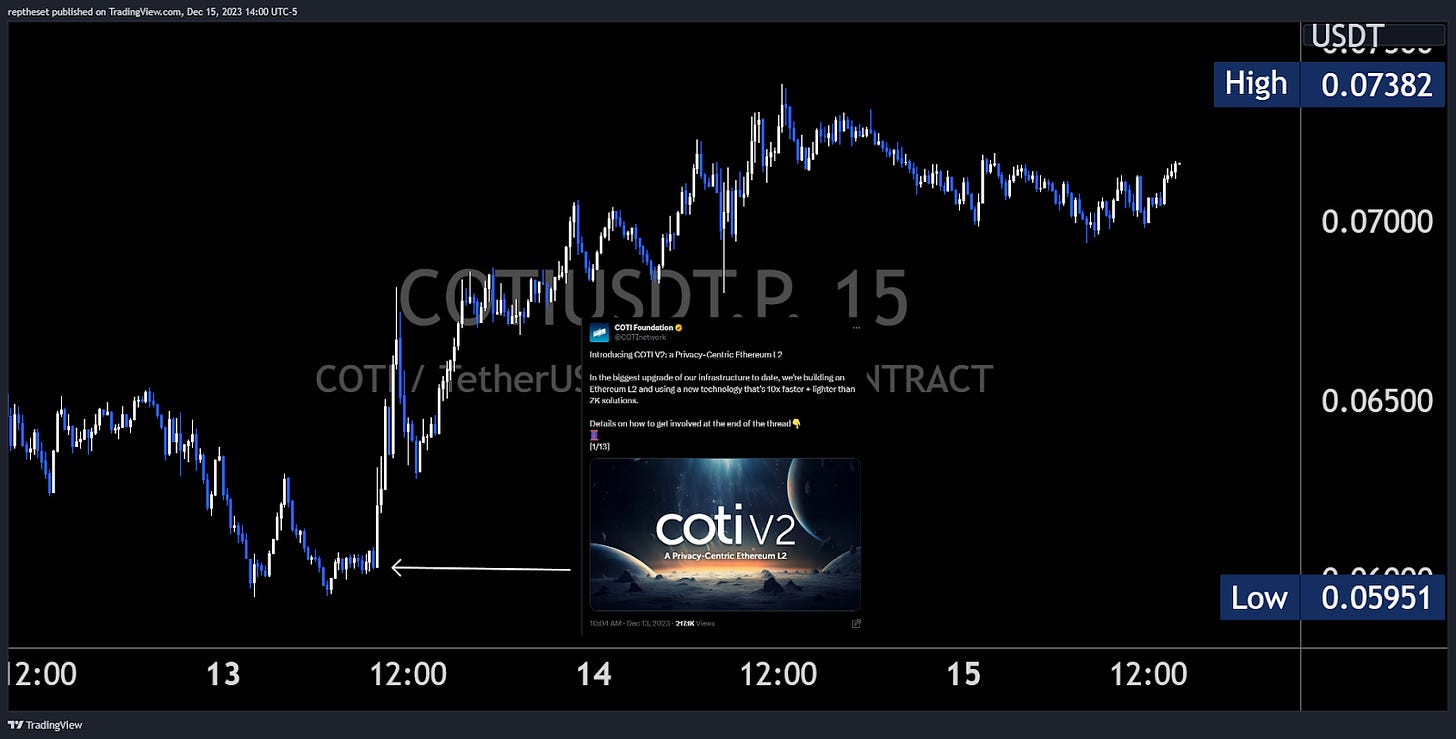

COTI set to become Ethereum privacy-centric layer 2

Coti is set to launch an Ethereum Layer 2 as part of an upgrade scheduled for next year. The upgrade essentially means that its blockchain will support native Ethereum dApps. Additionally, the upgrade is focused on addressing privacy concerns, as the new Layer 2 will use cryptographic technology known as Garbled Circuits. COTI claims this will make it 10 times faster and 10 times lighter than existing ZK solutions.

The price of COTI pumped by ~22% over the next day before consolidating.

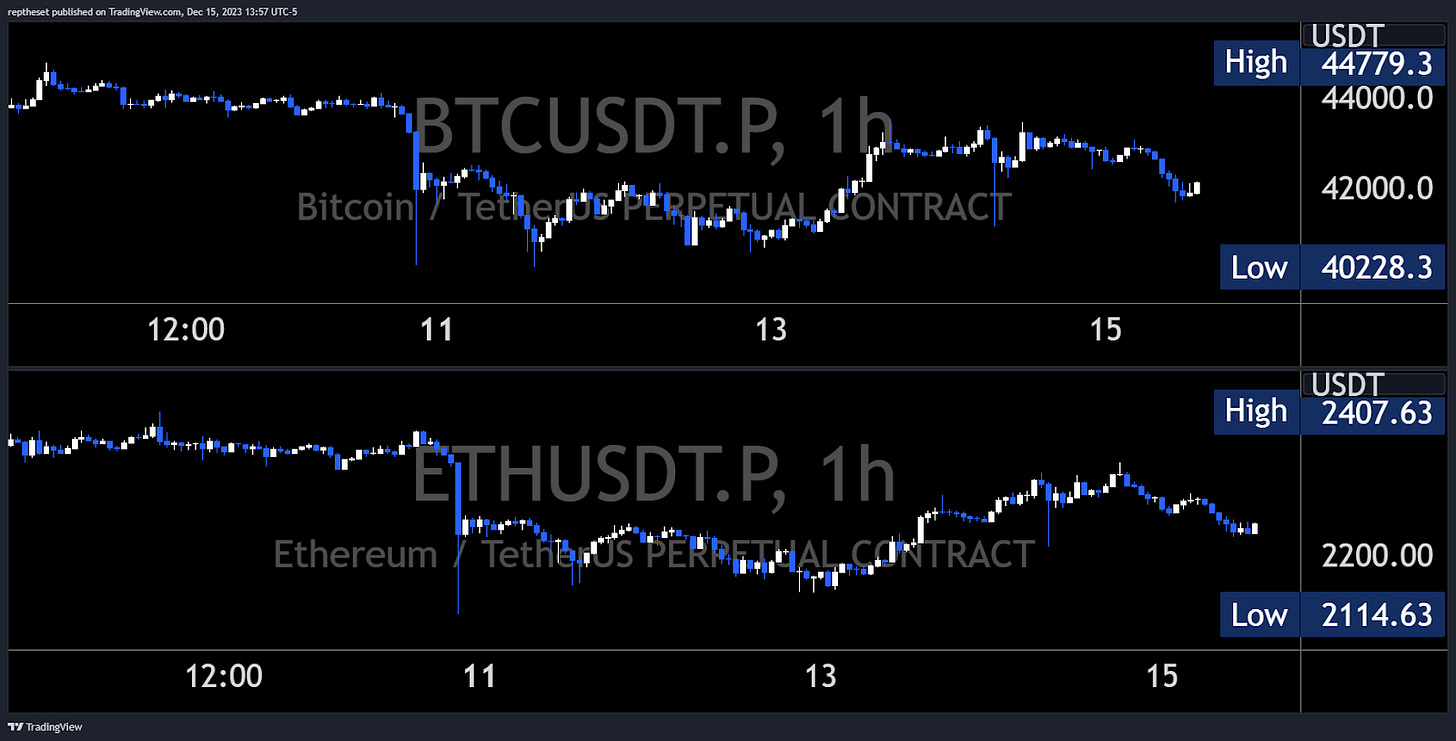

Bitcoin and Ethereum

The week began with a market-wide nuke, with BTC and ETH dipping ~8% and ~10%, respectively. They found support at previous resistance levels of $40.2k for BTC and $2100 for ETH. A big nuke is typically followed by the formation of a range as market participants begin repositioning. The remainder of the week saw both coins establishing a trading range, fluctuating between the lows reached during the nuke and the point of origin of the nuke.

FASB Confirms 'Fair Value' Approach for Corporate Crypto Holdings

The Financial Accounting Standards Board (FASB), a U.S. organization responsible for prescribing guidelines on how companies should disclose assets on their balance sheets, released a standards update on Wednesday. This update allows corporations to acknowledge changes in the "fair value" of their cryptocurrency holdings.

This is a positive development for the crypto sector. The upgrade to accounting standards will facilitate the adoption of BTC/ETH and other altcoins as treasury reserve assets by corporations worldwide, as pointed out by Saylor.

Upcoming Events

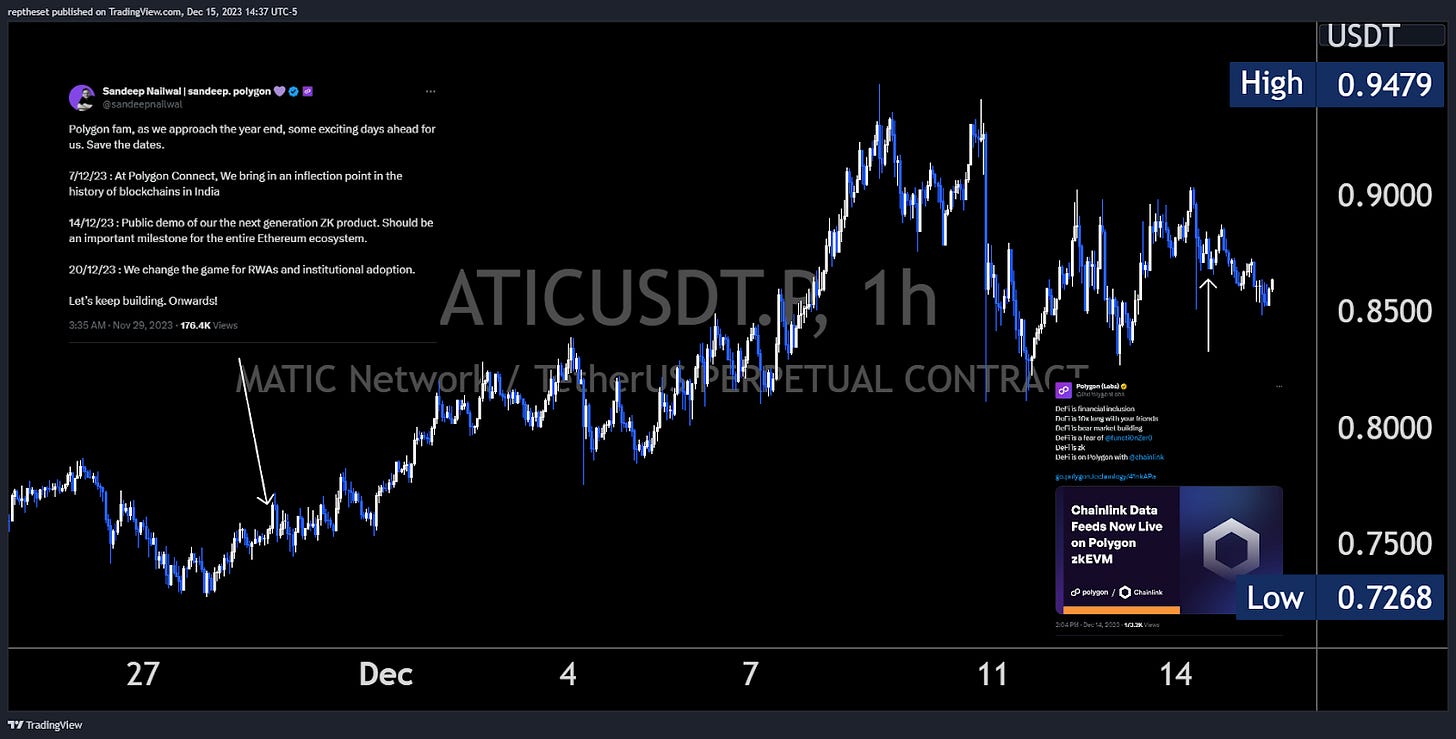

🟣Polygon

Following a prior notice from Polygon founder Sandeep Nailwal at the tail end of November, Polygon announced Chainlink Data Feeds on Polygon zkEVM.

The announcement leant into Chainlink’s CCIP update from earlier this year to suggest Polygon would benefit from its two subsequent narratives, RWAs and institutional adoption.

Although both announcement moves were absorbed on low time frames, MATIC has seen price appreciation of nearly 12% between Sandeep’s announcement teaser and the official news from Polygon Labs.

Expect an official announcement on December 20th as a follow up to Sandeep’s teaser on RWA and institutional adoption.

ASTAR: “high Japanese quality 🤝”

Astar Network founder Sota Watanabe shared a slightly ambiguous image announcing “something will be born in a month”.

The blockchain network has been endeavoring to become a hub for Japan’s gaming ecosystem, with Watanabe speaking at Nintendo’s office earlier this year.

Some noted the similarity of the image to Pokémon characters, hypothesizing a move from the Japanese media franchise into NFTs. The implication could serve ASTAR well with the recent hype cycle especially in 1st edition Pokémon base sets.

If the official announcement underwhelms it might serve an opportunity to close for those that bought the rumor, currently +10%.

Current Crypto Narratives

• $ZRO - LayerZero V2 Introduced

• $IOTA 2.0 "All You Need To Know" Announced

• $IOTX Foundation Launched A $5M Accelerator Program

• Gensler Says SEC Still Weighing Between 8-12 Spot Bitcoin ETFs

• Ledger Exploit Resolved With Malicious Code Being Deactivated

• $ARB - Arbitrum Proposed Orbit Tech For Celo's Layer-2 Blockchain

• $STRAX - Token Swap Announcement Scheduled For The 20th December

• $WLD - New 6-Month MM Agreements for 10M $WLD Collective Loans Start December 16. Adds Integrations With Minecraft, Reddit, Telegram, Shopify And Mercado Libre. Price Of ChatGPT 4.5 Revealed, Rumors Suggests Announcement Date Is Soon To Be Unveiled

• $SSV - Ethereum Staking Network SSV Launched Mainnet

• $LUNA - Court Extends Do Kwons Detention Until 15th February

• $DYDX - 3AC Labeled Address Transferred 4.45M Tokens (Worth ~12.7M)

• $DOGE - X Payments Phone Line Ready According To Leak Posted By @EkataCT

• $COIN - Coinbase Announces Project Diamond A Smart Contract Powered Platform

• $ASTR CEO Hints At Announcement In A Month (Looks Like Something Related To Pokemon)

• $WOO Announced Partnership With Market Maker Wintermute To Enhance Exchange Liquidity

• $BIGTIME Officially Reduced The Token Generation Rate From 3M To 1.4M Per Day

• $BNB - Binance Introduced $ACE on Binance Launchpool By Staking BNB And FDUSD

• $SNX - Synthetix Has Voted To Cease $SNX Token Inflation

• $FXS Halving Event Is Set For The 20th

TradFi/Macro

Economic Data

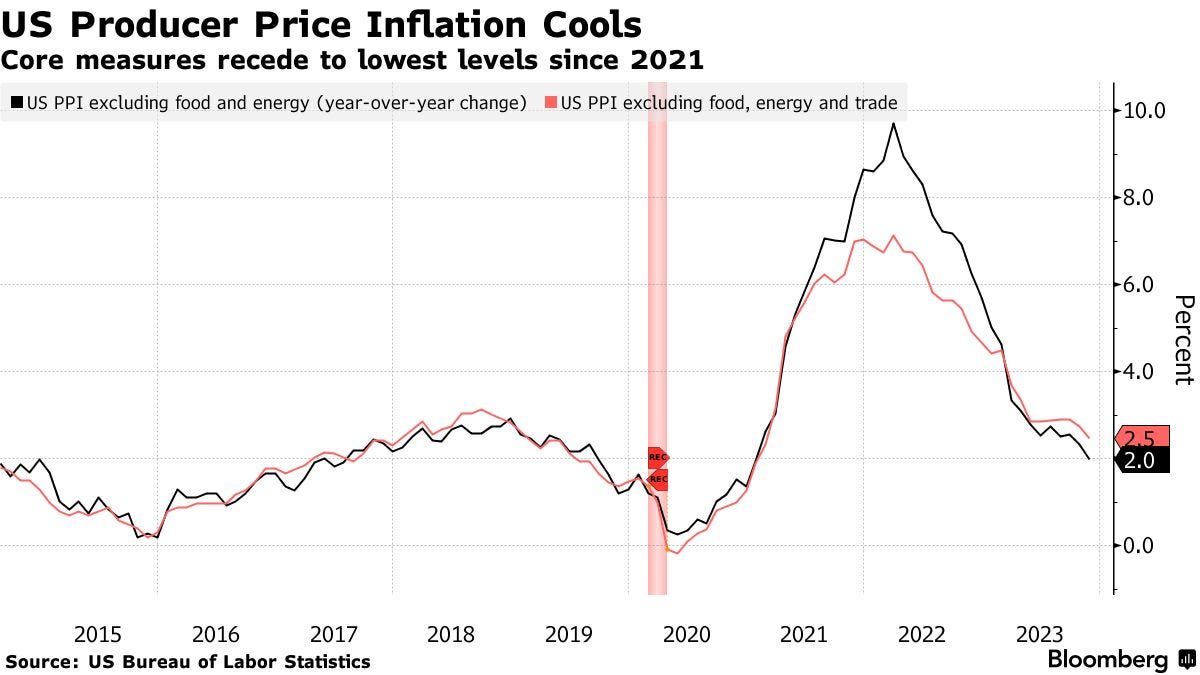

Thin week for economic data releases this week, producer prices front-ran FOMC on Wednesday with the slowest gain since January 2021, adding signs of abating inflation pressure. Year on year, the overall measure was up 0.9%; stripping out food, energy, and trade services, prices rose 0.1% from the prior month.

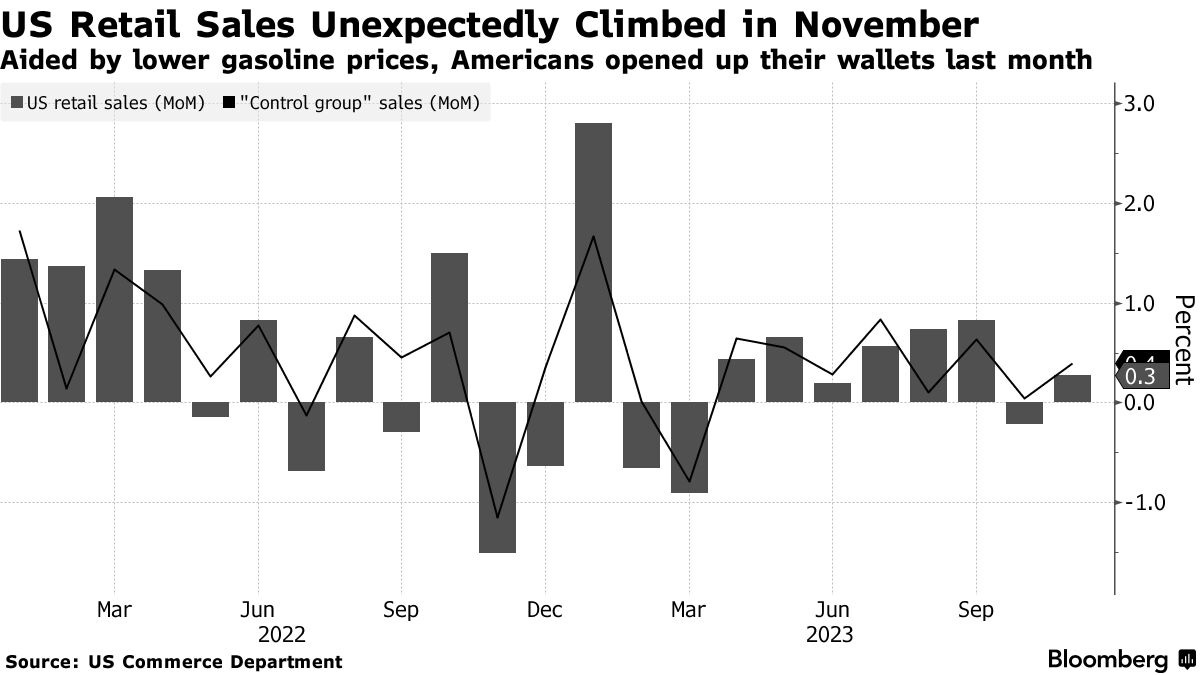

US retail sales surprised to the upside, increasing by 0.3% on Thursday. Stripping out gasoline, sales rose 0.6% from prior month, which is explained by lower gasoline prices, which, in reverse, allows consumers to spend more elsewhere.

Applications for unemployment benefits dropped by 19,000 last week to the lowest level since October as auto workers returned to work.

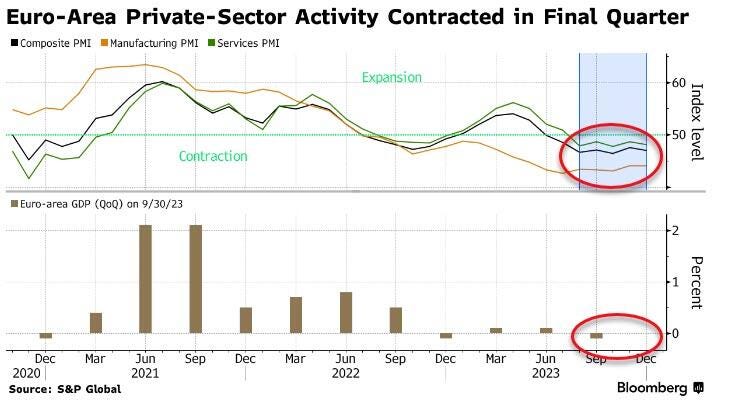

Looking over the Atlantic, we see the Eurozone further deteriorating, and again, it's happening faster than expected. The Euro area flash PMI fell by 0.6%, below expectations, and the employment index came in below 50 for a third consecutive month.

Stock & Bond Market

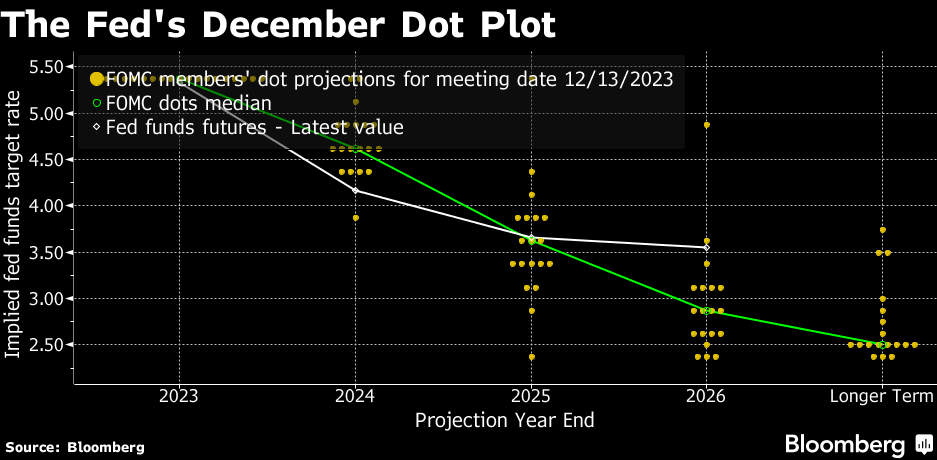

Traders across all assets cheered the tweak the Fed made in its dot plots, with officials now forecasting 75 basis points of rate cuts for 2024 at a sharper pace than indicated in September. The S&P 500 topped 4.700, the Dow Jones Industrial hit an all time high and the Nasdaq 100 extended its surge to over 50% this year, closing the seventh week of consecutive gains.

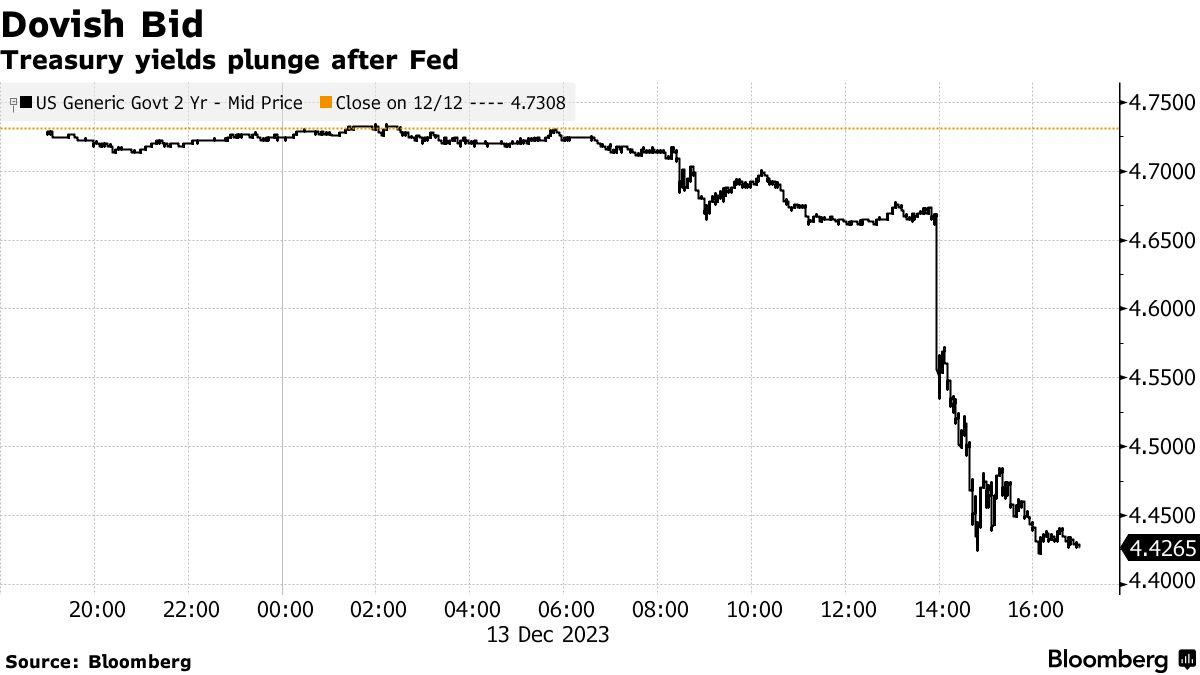

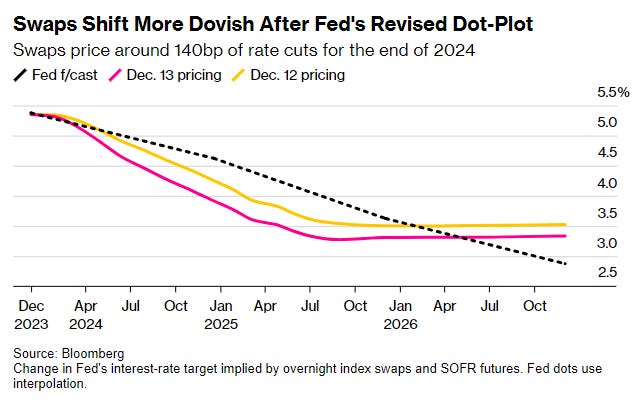

Two-year yields sank 30 bps to around 4.4%, the dollar to a four month low and swaps showed increased bets of 140 bps of rate cuts in the next 12 months.

According to BofA, equities saw the largest 8-week inflow since March 2022 and the ninth week of inflows to US equities, the longest streak since December 2021. In the first redemptions in eight weeks, money market funds had outflows of about $31 billion. From distressed leveraged assets to the biggest underperformer and laggards of the year, everything is being scooped up as investors are now going all in on expectations of central bank cuts next year.

Traders anticipate a “this time is different“ and that rates will get cut in a soft landing instead of too rapidly slowing the economy.

Central Banking

The Fed decided to leave interest rates unchanged but the highlight of this week’s FOMC were the fresh quarterly projections that showed a significant upward revision to economic growth and forecasts in rate cuts.

Jerome Powell confirmed for the first time this hiking cycle that policy makers discussed the timing of rate cuts which was taken as a clear pivot by markets, as he was seen stating the opposite only two weeks ago at a podium discussion on December 1st.

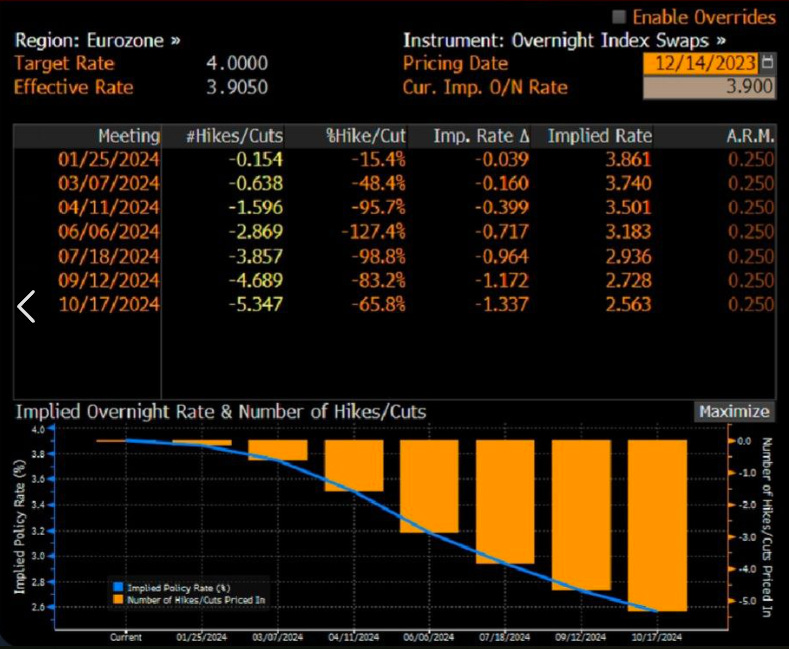

The counterpart from the Euro Zone followed suit with keeping interest rates on hold but with a moderately hawkish press conference, in which Christine Lagarde affirmed that rate cuts haven't been discussed and lowering guard was absolutely not on the table.

Noticeable between the ECB's and Fed's meetings this week was the clear contrast between the resilient US economy, the highly dovish press conference by Powell, and the faltering European economy with a hawkish stance by Christine Lagarde. An article in the Financial Times noted that ECB officials were caught off guard by the dovishness of Jerome Powell on Wednesday, creating the impression that something might be amiss.

Odds for Fed rate cuts are now priced at 66% by March. Goldman Sachs is forecasting three consecutive rate cuts, starting in March, followed by quarterly cuts to a terminal rate of 3.24%-3.5% by 2025.

Markets don't believe in the hawkishness of the ECB and are pricing in the first rate cuts by April and a terminal rate of 2.5% by end of 2024.

Outlook For Next Week

After a busy and volatile week in markets, the Fed has sent John Williams today to calm things down a little. Williams said in a CNBC interview it was too early to begin thinking about rate cuts and that the committee wasn't really talking about rate cuts, which is a sign that the Fed will keep pushing rate cuts further out of the year if the desired progress fails to materialize.

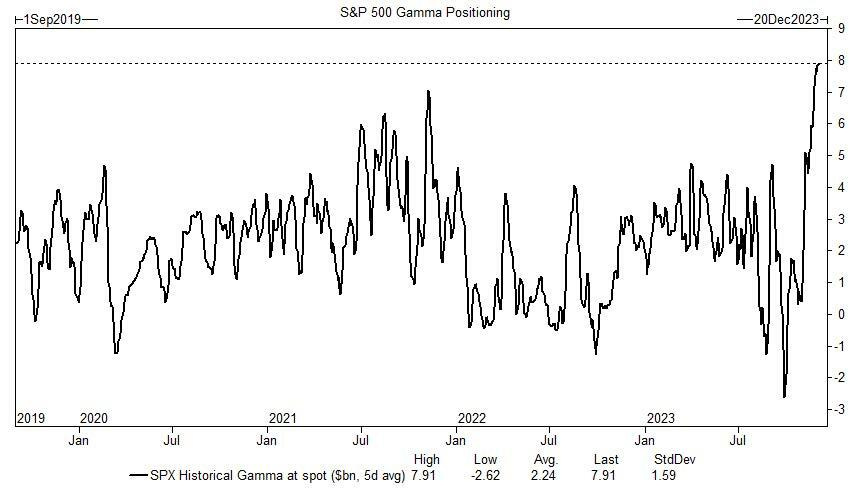

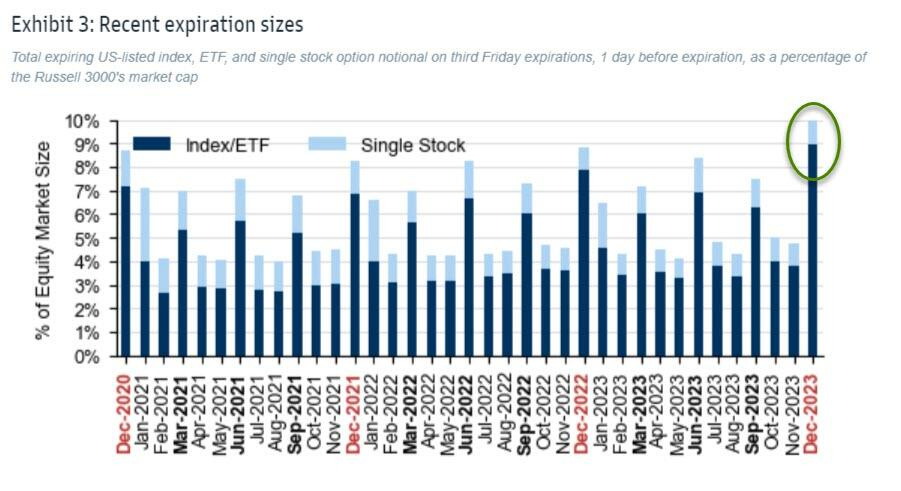

Today marks also the biggest quad-witching ever with $4.9 trillions of option notional to expire and $8 billion long gamma to be unbound, which typically serves as magnet for spot and results in increased volatility when taken out of the market.

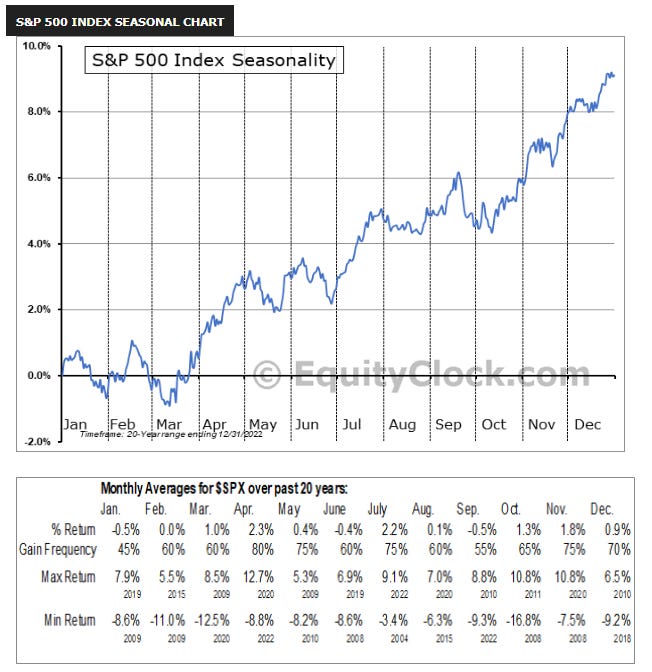

We expect markets to range and digest recent events for the next two weeks, low liquidity and low volume as most traders leave today for holidays. The so-called “Santa Rally“ officially starts then after the Christmas holidays and will show if markets and positioning get even more extreme for another push into year end, before we enter 2024 which is seasonally slightly worse for risk assets. As mentioned in previous episodes of this newsletter, attention will now completely switch from fear of rising yields to economic conditions. As markets fully price a soft landing, economic deterioration will also have a cooling effect on risk assets.

A blow off top seems to be consensus now but for this we will need to see more extreme call bidding and constant stock up, vol up scenario running into January’s Vixperation. With that being said, we expect more chop over the upcoming weeks, with a little further push into year-end with a potential blow off top occurring after January OpEx.

Key events for next week

Monday:

Germany IFO Business Climate & Expectations

EU ECB Schnabel Speech

Tuesday:

Japan Bank of Japan Meeting

EU CPI

US Housing Starts & Permits

Wednesday:

UK Retail Sales

UK CPI & PPI

Germany PPI & Consumer Confidence

EU Consumer Confidence

US Consumer Confidence

US 20-Year Bond Auction

Thursday:

US Q3 GDP

US 5-Year TIPS Auction

US Philadelphia Fed Manufacturing

Friday:

UK Q3 GDP

UK Retail Sales

US PCE

US Personal Income & Spending

US Durable Goods

US New Home Sales

TRADER TAKE @PokerKingSully

What made you decide you wanted to be a trader for a living?

Being a gamer at heart, I always had an interest in things that would challenge my mind and require the use of analysis and strategic reasoning. I ultimately decided to embark on this career path because trading for a living is both exciting and extremely rewarding. It is exciting because of the necessity to continuously learn and evolve, and it is rewarding because mastering it can bring personal and financial freedom.

How would you describe your trading style?

I would consider myself a swing trader. I mostly rely on technical analysis to establish my positions. However, I also think it is important to take into consideration the social, economic, and political narratives that are at play. Being a swing trader gives me an edge by allowing me more time to build a solid position, and allows me to block out all of the noise in order to avoid being shaken out.

What advice would you give to a beginner trader?

Establish rules, have the discipline to respect them and develop the ability to adapt when market conditions change.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall @EdwinTheDealer

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.