ETF Update

During the early trading hours on Friday, the Wall Street Journal reported that the SEC had rejected the filings for Bitcoin spot ETFs due to insufficient and inadequate information regarding the "surveillance sharing agreement" provided by the filing parties. Initially, the markets appeared demoralised, as reflected in the price action. However, they eventually absorbed the news.

Encouraging signs emerged in the footnotes, where the SEC advised asset managers to resubmit their filings after revising the language and providing more details, particularly regarding the surveillance sharing agreements and custodian parties.

Although this setback may be considered a temporary obstacle, it is worth noting that BlackRock has not yet resubmitted their filing as of Friday. This hesitation on their part could lead to a pause or consolidation in the current momentum. As a result, additional refiling attempts may not generate the same level of impact as before. Nevertheless, it is important to recognize that this situation is still evolving.

Fidelity ETF

Tuesday saw another major Bitcoin ETF announcement, this time coming from Fidelity Investments, an asset manager with over $4.5 trillion in assets. However, the impact of the news was minimal compared to previous filings, which suggests that any future Bitcoin ETF filings will have less and less market impact.

There Is No Second Best

Earlier this week, Michael Saylor announced that MicroStrategy bought another 12,333 BTC for approximately $347.0 million. This brings Microstrategy’s Bitcoin position to a total of 152,000 BTC, with an average purchase price of $29,668.

CME Group Ratio Futures

CME Group has revealed its upcoming launch of Ether/Bitcoin Ratio futures, subject to regulatory approval, scheduled for July 31. These futures contracts will be settled in cash and will derive their value from the final settlement price of CME Group Ether futures divided by the corresponding final settlement price of CME Group Bitcoin futures. The introduction of this new contract will mirror the listing cycle observed for CME Group's Bitcoin and Ether futures contracts.

This announcement shows another significant progress in the realm of crypto derivatives regulated by the CFTC. With such advancements, an Ethereum ETF could be the next natural progression in this journey.

Bitcoin and Ethereum

During the past week, BTC and ETH successfully consolidated at the high end of the range from the previous week.

BTC started the week around $30,500 and reached a peak of approximately $31,300 before declining due to the SEC's 'inadequate filing' news. The majority of trading activity took place between $30,150 and $30,700 throughout the week.

ETH, on the other hand, began the week by consolidating between $1,830 and $1,890 for the first half. However, it significantly outperformed BTC following the SEC ETF news. This signaled that there is still some risk appetite in the markets. Fair value was established between the $1,840s and $1,900s for the week.

Tuesday Buybacks

Tuesdays are good days for long exposure, and the reason is clear. Take a glance at the chart below, and you'll notice a recurrent trend. Monday, the market corrects due to traders/funds taking profit on their positions following weekend rallies aka “Sunday SCAM pump”. The market then corrects the previous day selloffs on Tuesday, as we can notice in its consistent positive returns throughout this past year.

Stats don’t lie, and as a trader timing is one of the most if not the most important factor when taking a trade. Whether the market is in a bullish or bearish environment, Tuesdays is a good day to lean towards buying dips.

Past 2 week average return on Tuesday : 3.42% vs 1.57% Average Weekday

Past 1 month average return on Tuesday : 3.20% vs 0.81% Average Weekday

Past 3 month average return on Tuesday : 1.91% vs 0.15% Average Weekday

Past 6 month average return on Tuesday : 1.16% vs 0.36% Average Weekday

Altcoins

Solana Summer

The month of June was rough for SOL holders as they saw consistent pressure from the SEC deeming them a security. On top of that, Robinhood announced that they would delist it, and that any SOL position left open by users on the platform would be manually liquidated by June 27th. Solana was put in a basket by traders together with ADA and MATIC, as these three were declared securities by the SEC.

However, of these three coins, Solana had the strongest rebound and buying pressure since the FUD settled.

There are several reasons that can be attributed to this:

Solana was not owned by Celsius, whereas Matic and Cardano were. With Celsius bankruptcy proceedings, there was added selling pressure on MATIC and ADA.

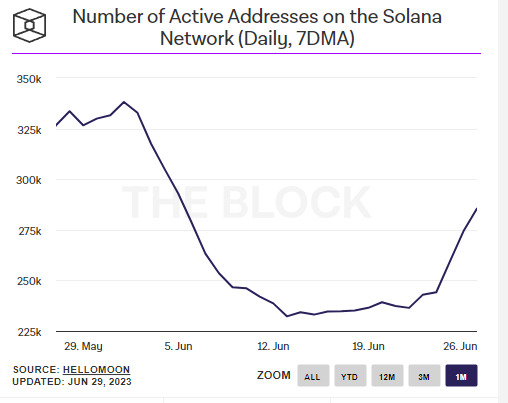

Solana active addresses are increasing even after the FUD. This means that the chain remains popular. (It is the 3rd most popular chain after Bitcoin and Ethereum.)

Funding was negative at the lows for days. Traders were either hedging or shorting after the flush out wick. Usually a recipe for a squeeze.

FTX 2.0 revival. With rumors of FTX 2.0 coming back, and FTT not existing on futures, the only ‘proxy’; to this is SOL as it was known as the ‘SBF coin’.

Even through one of the largest financial frauds in modern history (FTX), SOL, backed by SBF, didn’t break $10. This was a positive sign as the “sell me all you want at $3” self fulfilling prophecy was never realized.

With the FTX collapse, the biggest institutional supporters/shillers of SOL had already been wiped out and either sold their holdings or lost them on FTX (ex: Multicoin Capital, Sino Global, etc…). These guys managed to squeeze every retail dollar out of the solana ecosystem that they could, and when SBF went down, these bad actors followed.

With all the reasons mentioned above, we think that SOL could be a prime candidate for a short squeeze rally in the next couple of months. Furthermore, we see SOL outperforming other big cap competitors during the next crypto bull cycle.

BLURJ Khalifa

Tuesday the 27th, South Korea's largest and pump hungry exchange, UPbit, announced the launch of the BLUR/KRW (Korean fiat currency) pair. During the past year, Upbit listings has brought positive attention to tokens, and we've seen strong rallies on coins like MAGIC, HOOK, MASK, SHIB, AAVE, ASTR, etc following their listing announcement. Recently though, we suspect projects and protocols use these listings as a strategy to reduce their exposure, knowing that speculators/traders will FOMO buy their tokens on events like this, and therefore use this liquidity to sell tokens. The latest example of this is the GRT UPbit listing, pumping 12% on announcement and retracing the whole move and more that same day. BLUR followed a similar path, lifting ~30% from low to high, and retracing the whole move up a day later.

A trader should be careful buying on these events, and trying to find short opportunities is probably the safest approach.

Near & Alibaba Cloud

NEAR protocol announced a partnership with Alibaba Cloud, which led to a 21% pump. However, the partnership's impact was not significant, as it primarily focused on infrastructure plugins for validators and other minor services. The initial enthusiasm quickly faded and NEAR retraced the entire move over the next 48 hours.

Affiliations with big names is an old trick from projects to try and pump their coin, especially in bullish environments. As traders we must know to differentiate between real partnerships and plain pump and dump attempts.

AI Narrative Continues

The World Artificial Intelligence Conference (WAIC) will be held in Shanghai from July 6-8, 2023. The conference is one of the most influential AI events in the world, and it brings together leading companies, researchers, and policymakers from around the world. Many companies including Alibaba, Tencent, Qualcomm, Baidu and Huawei will be attending the conference. We may see new Crypto - AI narratives, and probably a couple market moving partnership announcements.

Tradfi

Economic Data

Good week with solid data from the US. Jobless claims came down again to 239k vs 265k expected, after three consecutive weeks of beating expectations. GDP came in hotter with 2% vs 1.4% expected, confirming that the world's biggest economy may have found a bottom and is in better shape than many have forecasted at the start of this year.

The economic surprise index has risen to its highest since early 2021 for the US while the rest of the world is lagging.

Fed´s favorite inflation gauge showed some sign of moderation, with Core PCE at 4.6% and slightly cooler than 4.7% forecasted. Headline fell back below 4% for the first time since April 2021. Similar to the current situation in Europe, goods inflation is coming down rapidly but service inflation ex housing stuck at high levels.

Key and noticeable for Fed´s July rate decision are wages, which started to re-accelerate to levels not seen since May 2022 for private workers.

Central Banking:

All eyes were on Portugal and all Central Banks at the ECB forum in Sintra.

The whole podium affirmed the current hiking cycle with the exception of BOJ´s Ueda which still seeks for more evidence for persistent inflation before considering a policy change.

The most interesting of a rather nothing burger event for us was Powell's statement, after he got asked about loosening financial conditions, and if he was or wasn't concerned about the fact that markets kept fighting the Fed which he recently has seen as counterproductive in the fight against inflation.

His answer was not only surprisingly dovish, but he has given the markets an ‘all clear’ to fight the Fed.

Stock and Bond Market

US yield curve inversion continues, short-dated yields rising more than longer maturities, implying that the bond market expects more rate increases from the Fed to curb future growth. Swap markets now indicating a 50% chance of a second rate hike by year-end.

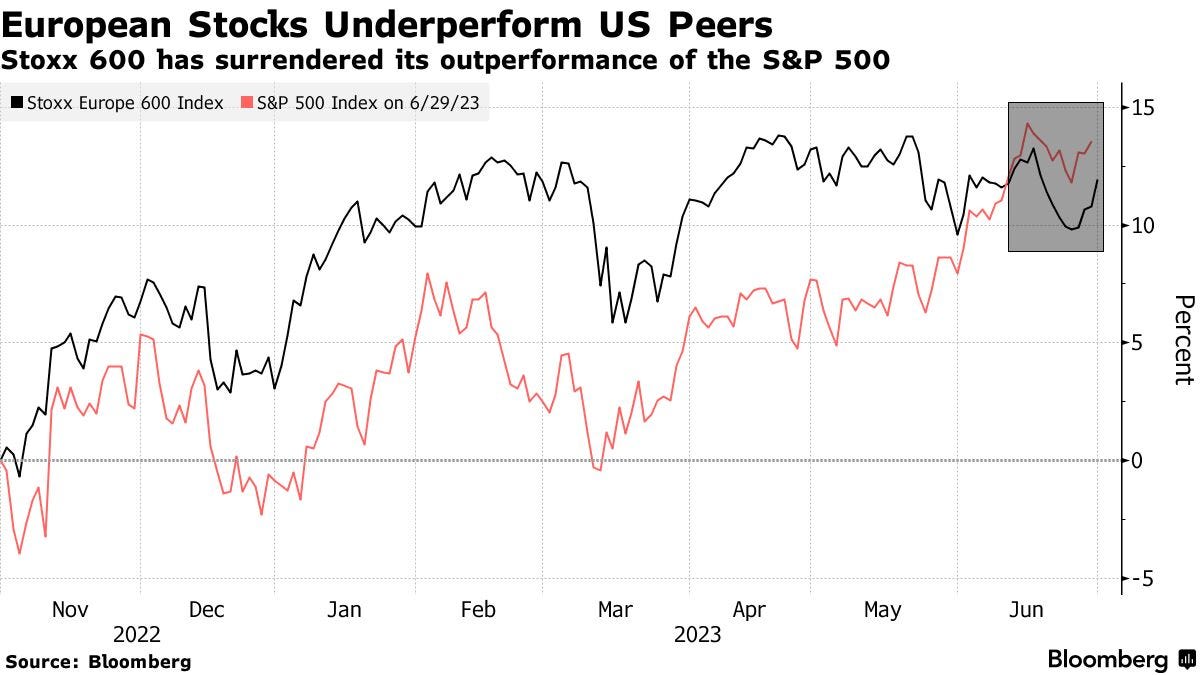

European markets on the other hand, relatively weak to the US, European names suffered a 16th straight week of outflows, topping at $27B year to date, while Nasdaq is about to record its best ever first-half of the year.

Outlook for next week

Slow week ahead with independence day on Tuesday, focus on labor data from the US, RBA meeting as a proxy for Fed´s upcoming meeting and manufacturing/service data from China.

Monday: Caixin Manufacturing PMI

Tuesday: RBA meeting

Wednesday: Caixin Service PMI; FOMC Minutes

Thursday: ADP Employment Report; JOLTs Job Openings

Friday: Nonfarm Payrolls; Hourly Earnings

Bitbit’s Note

Trading is often seen as an easy job, but that's far from the truth. As someone with experience in this market, I've come to realize that trading involves a lot of pain and challenges that aren't apparent at first glance. However, in my humble opinion, it is the best job in the world. Despite the difficulties, the satisfaction and reward that comes from profitable trades is the best feedback you can get, and this will grow your confidence and make your hard work pay off.

The Blackrock ETF sparked a bullish shift and opened the road to bitcoin ATH. As we’ve seen in any past up trend, there are obstacles and corrections along the road, you see them on the chart. The ETF application refilings are already happening, and the market is pricing it in as we speak.

The past quarter was most focused on the SEC against crypto giants, and the coming one will be the SEC with regards to the ETFs. This narrative will dictate the direction for the next quarter, and any SEC update about the applications will affect the market, immediately. In our language high leverage won't be your friend, especially if BTC start trading above 32k. There will be many opportunities in the near future so make sure to survive the bumps on the road. Expect the extreme volatility and prepare yourself for it.

Good luck and stay safe.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @cryptoalle @EdwinTheDealer @FoftyOerney @ahoras_ @Wassie2835 @SmartGamblinggg @MeDeity @betsizing

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

Head up for turnaround Tuesday. Interesting stats. Good article.