Markets At The Open

Summer Low VOL Chop Continues

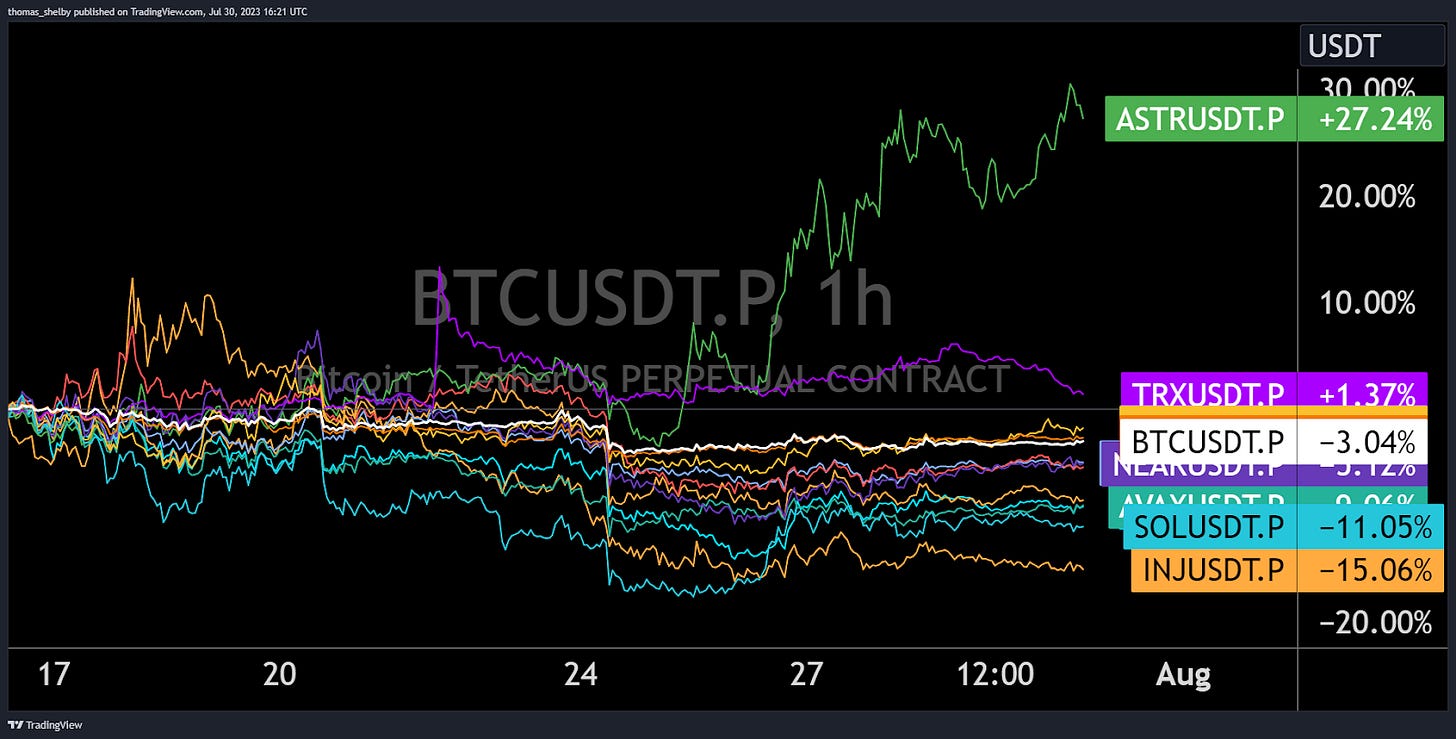

A Star Is Born?

Astar Network (ASTR) has been quietly making strides in Japan; however, it is lacking the attention of crypto traders and investors. Last week, they expanded their partnerships to include major names like Japan Railway, Seven Bank (commonly known as 7/11), and Tokyo International Airport. Moreover, Astar Network is actively participating in the CBDC Forum led by the Bank of Japan.

Before these recent partnerships, Astar had already established significant collaborations, including Sony, where they provide support for early-stage blockchain projects. Notably, a project nurtured by Astar Network secured a $3.5M seed round investment from Sony on June 28. Additionally, they partnered with NTT Digital by NTT DoCoMo, one of Japan’s largest telecommunication companies, on July 11. Not to mention, earlier this year, Astar has also partnered with Toyota, another one of Japan’s most influential companies.

Despite frequent updates from their CEO on Twitter, the price action for ASTR has not been very friendly for news traders. However, the token's price has been showing slow but steady upward trending movement, outperforming other competitors in the L1 blockchain space. The anticipation of Astar 2.0's mission to onboard billions of users into Web3, along with speculation of revamped tokenomics, has been signalling a potential price increase.

Interestingly, Japan’s Prime Minister has also recognized the transformative potential of Web3, actively supporting Web3 promotion policies. He recently spoke positively about it at WebX Asia, the largest crypto conference in Asia. With Binance Japan set to launch in August, it will be intriguing to observe how this dynamic unfolds and whether the narrative continues to gain traction.

DOGEing Low Volatility

In the midst of the quiet market last week, traders began seeking out potential narratives following Elon Musk's rebranding of Twitter to X. Predictably, their attention was drawn to none other than Dogecoin. Not long after the rebranding, Elon started engaging more with Twitter pages connected to Dogecoin, even retweeting content from Doge Designer, which had a notable impact on Dogecoin's price. However, the most significant move came when Elon tweeted a video of the new X logo created by Doge Designer, resulting in the price of Doge to surge by nearly 9% on Tuesday.

In addition, Elon made a subtle change to his Twitter bio by adding the letter "X" and the symbol of Doge.

What In The Worldcoin

Lots of buzz and hype, as well as a fair share of criticism, surround the launch of Worldcoin, co-founded by ChatGPT Founder Sam Altman.

From the viewpoint of a potential "Investor" in WLD, the main things to consider are privacy issues regarding the Iris scan data and potential regulatory scrutiny (especially in the US where you cannot partake in WorldID at this moment).

The current Airdrop allows everyone to receive 25 WLD + 1 WLD per Week (approx $50) upon signing up for WorldID, which explains WLD's popularity in economically disadvantaged regions like Latin America, where this amount means a significant "free" money opportunity. The question everybody has to answer for oneself is, "Do you want to hand over your biometrics to some techbros for $50 and trust them to handle that data in a responsible manner?"

Altman dodging questions about Distribution and Token supply in interviews doesn't really inspire great confidence in the future valuation of a token with such a huge FDV.

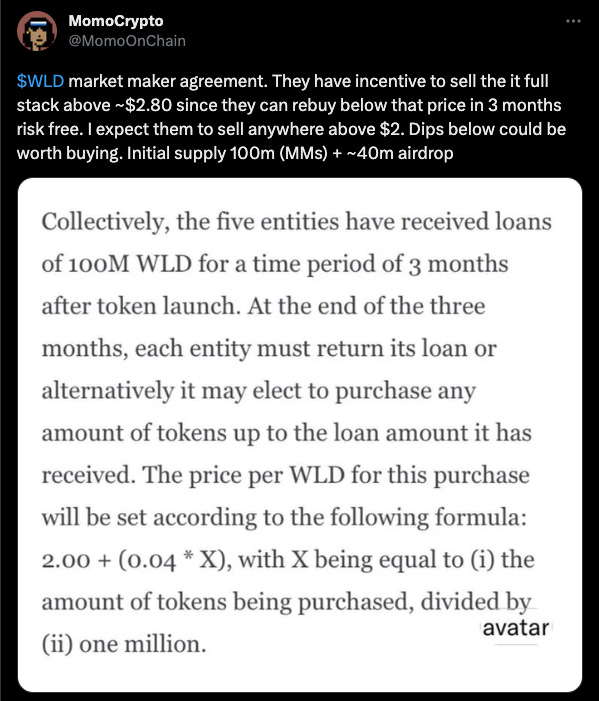

On the trading side of things, the price action has been ranging between $2 and $2.5, with most of the available supply (100 Million of 143 Million) being in the hands of a few market makers, with a clear incentive to distribute.

Considering that most of the supply is held by market makers and, therefore, easy to manipulate, our approach would be to trade the wide range and not get caught offside by playing too close to the market, employing a "sell the rips and buy liquidation dips" mindset until more supply gets introduced via Airdrops and the 3 months long MM-Deal runs out.

IMX On Upbit

On Friday, July 28th, IMX was listed on the Korean exchange Upbit. The price quickly surged 10% in a few seconds as all the listing bots bought in. After the initial surge, the price continued to climb another 8%, breaking through a resistance level that had held for three months, at around $0.8. However, in the next 18 hours, IMX almost entirely retraced the entire move, giving back most of the gains made earlier. As we have mentioned in past newsletter, Upbit listings can be tricky to trade and often experience retracements.

Bitcoin & Ethereum

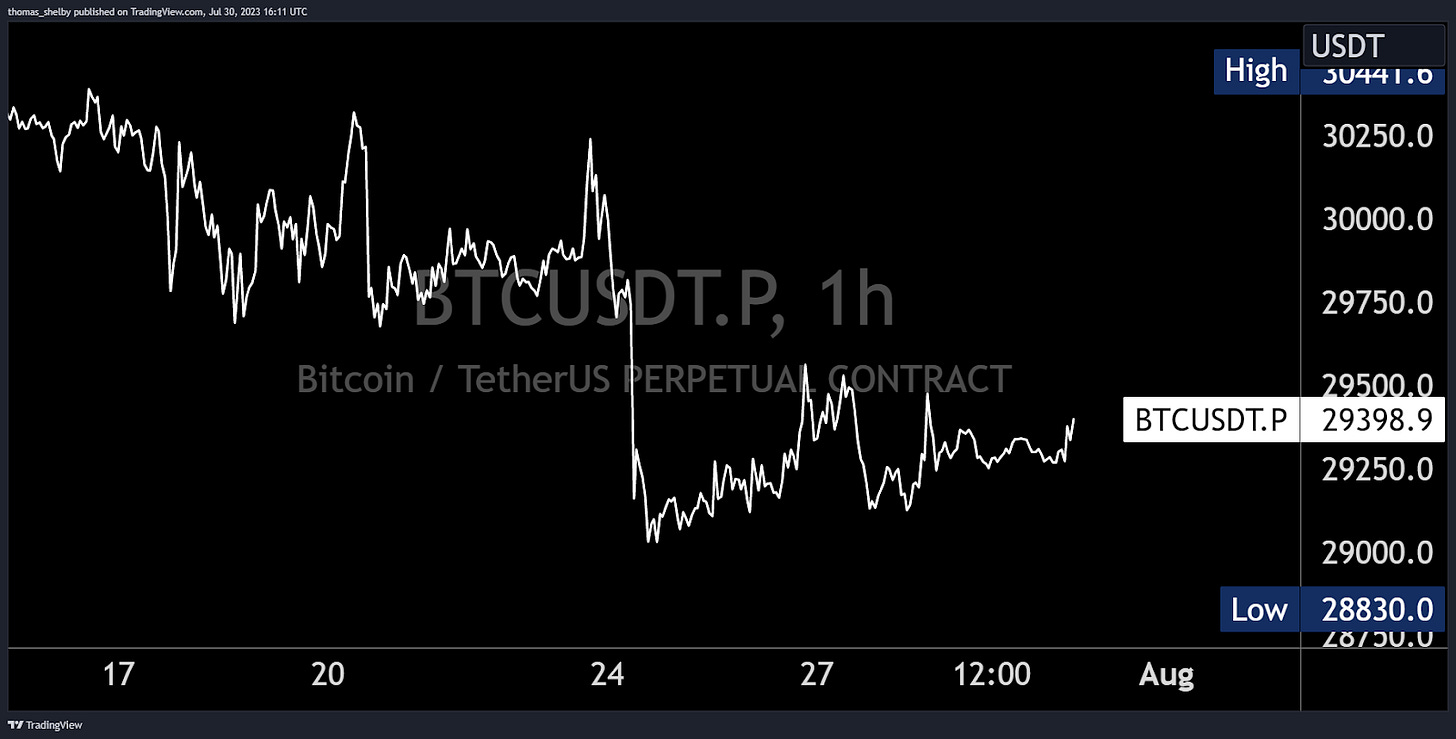

During the week of July 17th - 21st, BTC had an uneventful week with little price movement, staying between 29700 and 30050. The week opened at around 30200 but faced rejection twice at that level. Throughout the week, BTC couldn't break out of this range, leading to a lackluster performance.

In the following week, BTC opened near 30,000, but market sentiment remained low, with early rejection on Monday. Throughout the week, BTC traded between 29000 and 29500, showing minimal price volatility and limiting trading opportunities.

Correlating to BTC, ETH has also encountered a significant drop in volatility, leading to record-low levels for the year. During the first week, ETH had limited price movements, trading within a narrow range of 1910 to 1880. The following week saw continued downward pressure, with ETH establishing a value range of 1850 to the 1880s.

The declining volatility in both BTC and ETH has left traders with limited opportunities to capitalize on price fluctuations, creating a subdued and less dynamic trading environment in these pairs.

TradFi

Economic Data

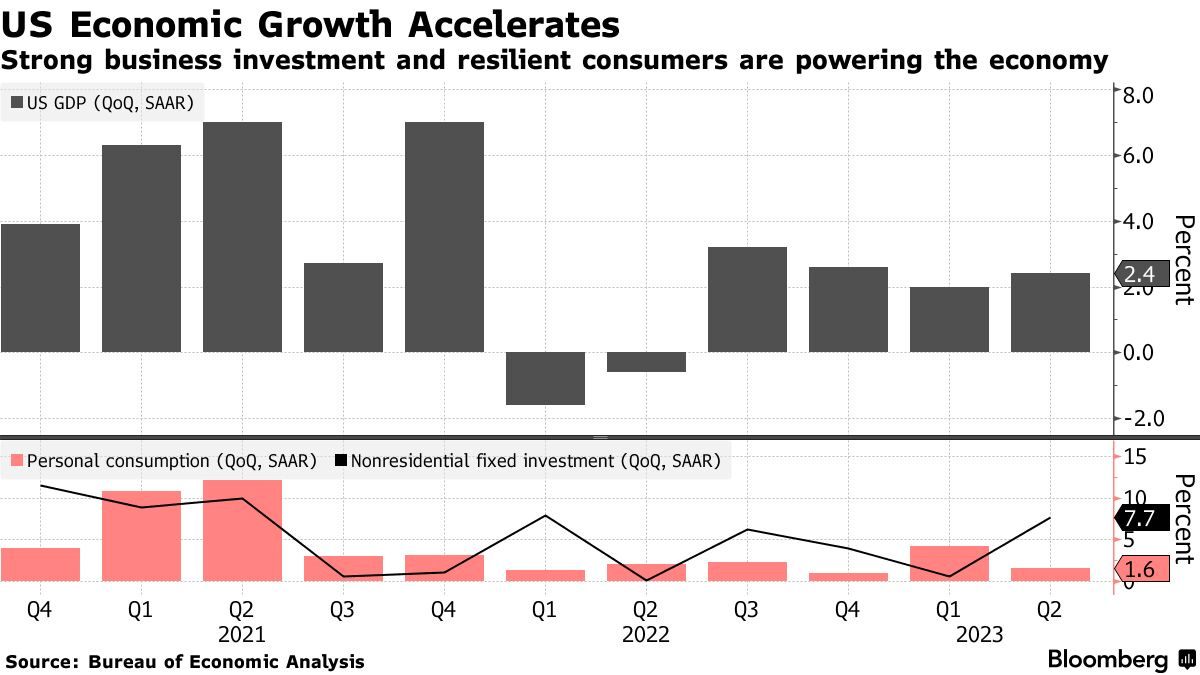

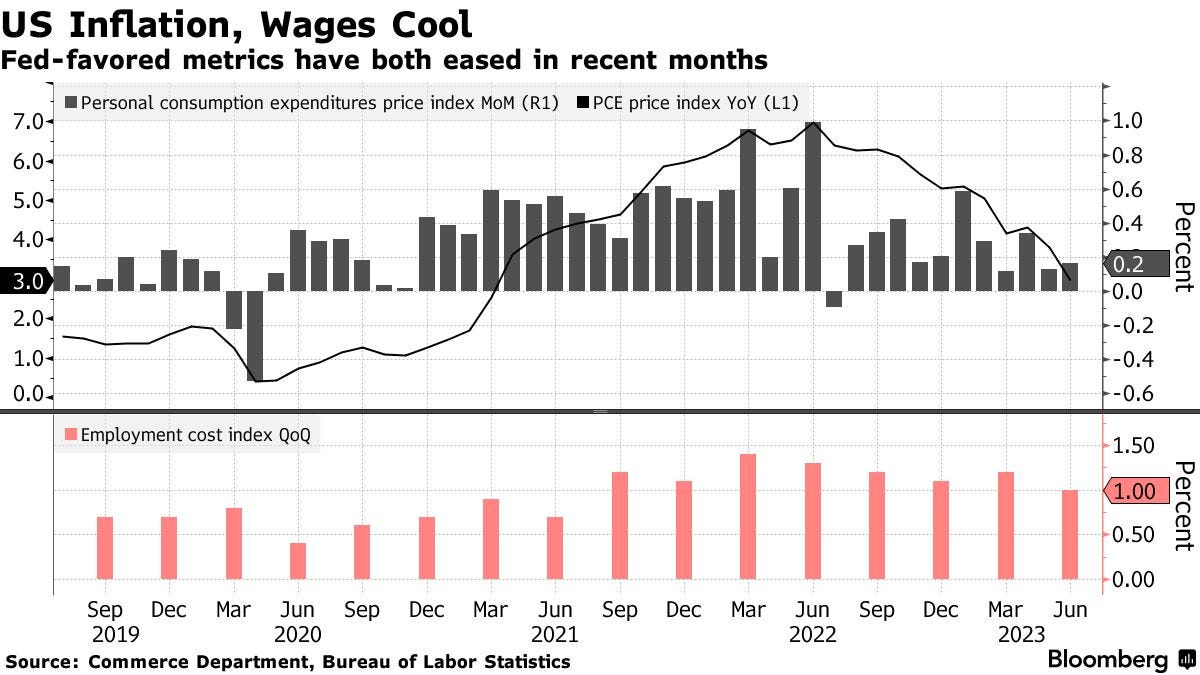

Data from the US keeps surprising and denying recession predictions, showing that the economy is still thriving. The employment cost index on Friday had its lowest advance since Q2 2021, while the Fed’s favorite inflation gauge - PCE, posted its slowest increase in two years.

Second-quarter GDP saw annualized growth of 2.4% vs. the expected 1.8%, also beating all estimates and further raising hopes of a soft landing next year.

One potential concern here is that the year-over-year inflation data comparison (base effects) will start to drop towards the end of the year, proving inflation to be more sticky and forcing the Fed to hold onto tighter monetary policy. Inflation swaps are pricing a 3.2% headline for July and a 3.6% gain in August.

Stock & Bond Market

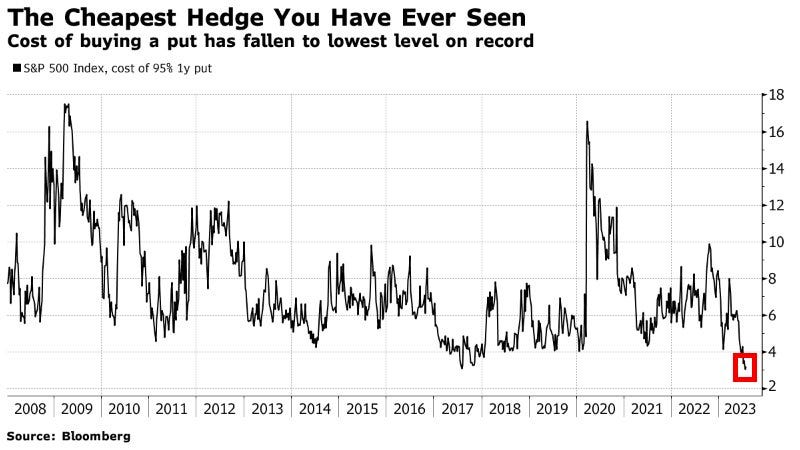

Recent data prints have made investors continue piling into risk assets, and speculative spirits have reached new highs in equity exposure, reaching levels not seen since January 2022. Hedges and protection against downside volatility have fallen to the 'cheapest you likely have ever seen,' according to BofA.

The highest demand for call options since late 2021 and lack of protection could be a danger to the markets, which was observed on Thursday when the Bank of Japan leaked their first step towards tighter monetary policy to the Nikkei magazine. The volatility index of the S&P 500 spiked up 16%, and the index itself declined by 1% intraday. However, markets reversed their losses on Friday and are now on pace for their fifth consecutive monthly gain.

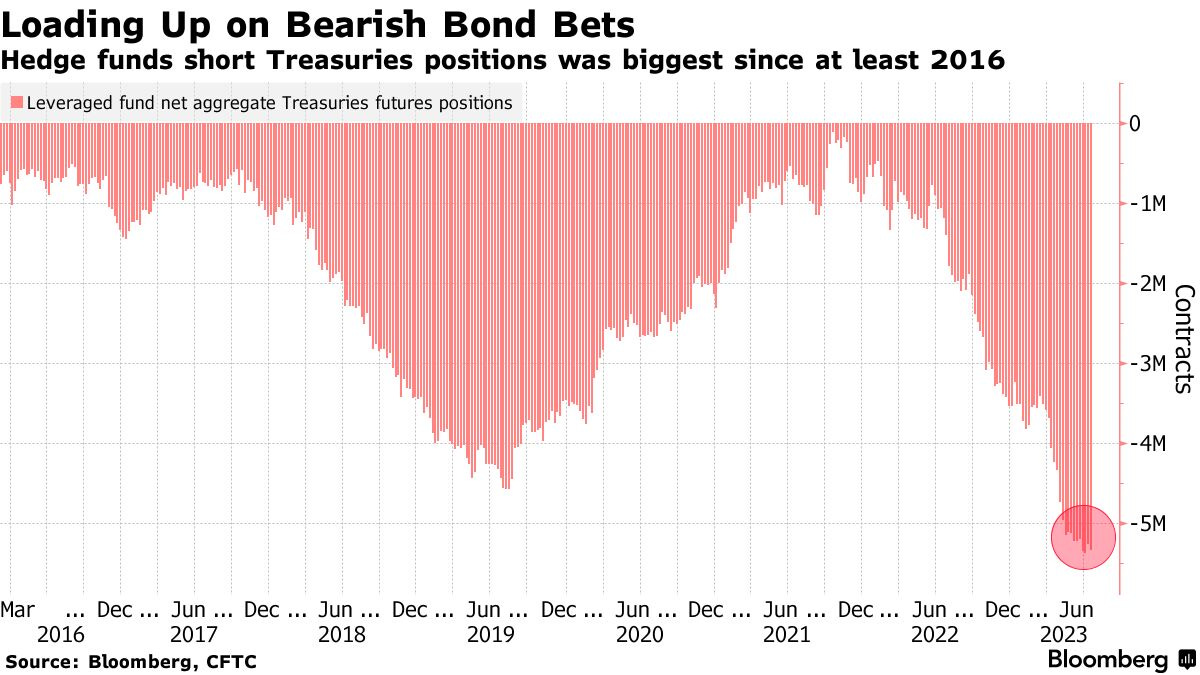

Fueled by bets on a more hawkish Bank of Japan, a better-than-expected economy, and promising labor data, bonds have seen short bets expanding. Aggregated shorts are now back to levels last seen in March before SVB collapsed.

Central Banking

All three major central banks (measured by currency allocation) had a pivotal week. While the Fed and the ECB signaled an end to their hiking cycle and further live meetings (data dependency), the Bank of Japan decided to start controlling yields more flexibly, allowing yields to go as high as 1%, double the previous limit.

On top of Christine Lagarde's dovish performance on Thursday, this further contributed to a sharp decline in all Euro-pairs.

The later decision of the Bank of Japan is a big deal as it was not only done in a scheduled meeting but encourages domestic demand in Japanese bonds and therefore sucks liquidity out of foreign markets.

Outlook For Next Week

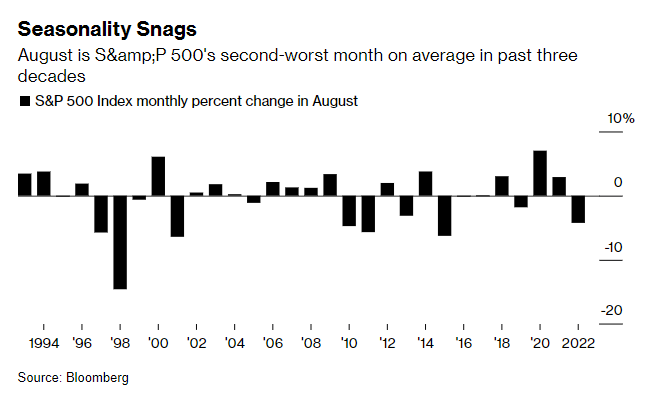

Starting in August next week, we will start to see seasonal tailwinds disappear. Over the past 30 years, August and September have been the worst months for risk assets while July was one of the best.

We are still in the middle of the second-quarter earnings season. While recent corporate earnings delivered surprises, with some companies topping estimates, the first tech giants missed on guidance for H2, and the semiconductor sector showed declines in sales. Microsoft saw AI sales only expanding gradually, while Tesla experienced declines in profitability and lower margins, putting the first lid on the previously hyped-up AI narrative.

With other tech and consumer giants like Amazon, Apple, AMD, PayPal, and Starbucks reporting next week, it will give markets another clue about what to expect in the second half of the year and could indicate turnarounds in trends of consumer spending.

Economic data could also improve or disprove further soft landing hopes:

Monday:

China non manufacturing PMI

EU Q2 GDP prelims

EU CPI prelims

Tuesday:

China Caixin manufacturing PMI

RBA meeting

US manufacturing PMI

Wednesday:

US ADP employment report

Thursday:

China Caixin Services PMI

Bank of England meeting

US services PMI

Friday:

US employment report (Non-farm payrolls, average hourly earnings, labor force participation)

Earnings Calendar For Next Week

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @AVCrypto_ @FoftyOerney @ahoras_ @Wassie2835 @SmartGamblinggg @betsizing @MrObergeil

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

Whale burn

LL62033872F