Markets At The Open

DeFi In Trouble?

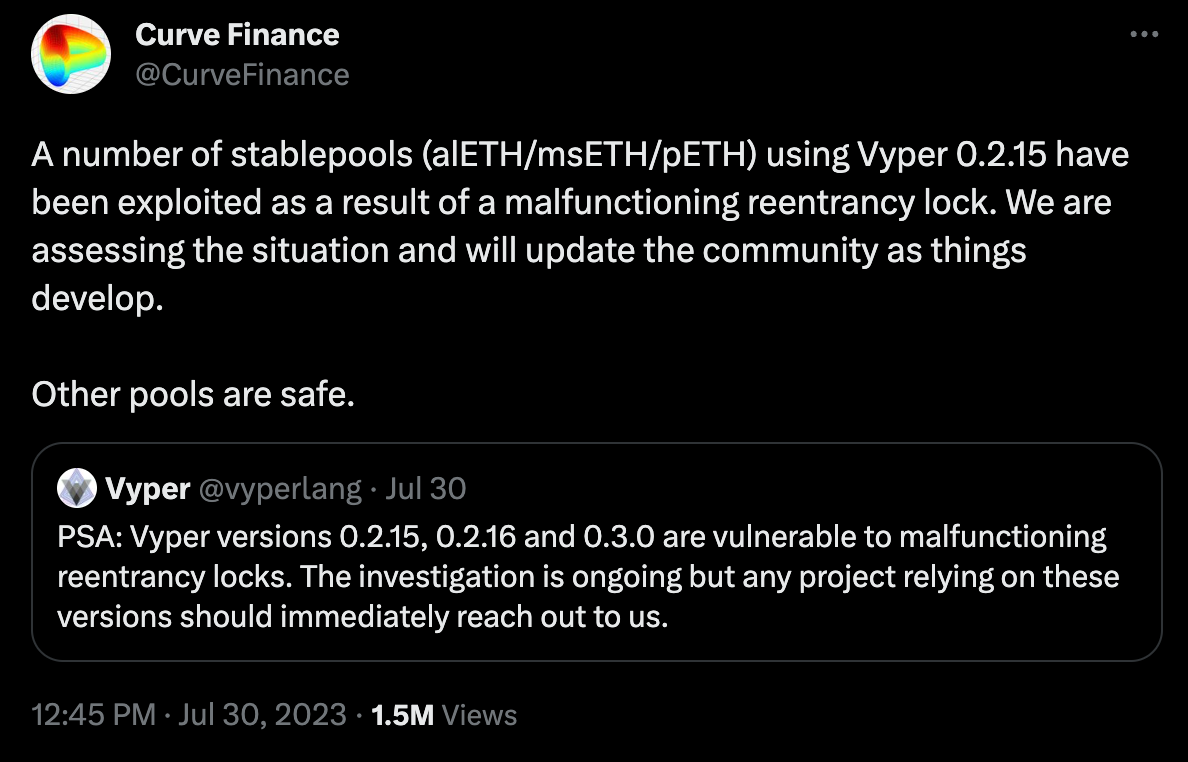

Curve Exploit : Post Mortem

The end of July was marked with a Curve Finance exploit that shook the whole DeFi ecosystem. Now that this event is now in our rearview mirror, here is a detailed summary of everything that happened.

Date of the exploit: July 30 2023

Loss: Approximately $61M in digital assets

Major Affected Assets: Alchemix ($22.47M), JPEG'd ($11.4M), Metronome ($3.34M), CRV-ETH pool ($23.82M)

Recovery: 68% ($40.7M) returned, 32% (~$18.8M) still missing

This event obviously put pressure on the CRV token price, as we usually see during exploits, and the uncertainty led to speculation about Curve Finance’s founder debt position on several lending protocols. As the exploit was unfolding, and the news started spreading, market participants started to worry about the founder’s ability to repay his loans, which in turn led to short interest on the CRV token accelerating upwards.

An interesting point to note is that since the exploit affected one of the main CRV/ETH on chain pools, the spot liquidity for the token was quasi non existent. This led Michael Egorov (Curve Finance’s founder) to start selling CRV tokens at a discount to market price, to keep his debt positions healthy until the dust settled. Multiple entities accepted the deal in a rallying moment for DeFi.

Michael Egorov's Address: 0x7a16ff8270133f063aab6c9977183d9e72835428 (Debank)

In the days that followed the event, 142.8M $CRV were sold at an average OTC price of $0.4 to avoid potential liquidation. Major buyers included Binance Labs (5M$), DWF Labs (12.5M $CRV), xDai (6.25M $CRV) and Justin Sun (5M $CRV).

All the OTC transactions can be tracked here.

The market interpreted this news positively as the significant short positioning on the perpetual markets for CRV started covering.

Shortly after the exploit, some exploiters also started returning funds. An MEV bot that was able to frontrun the attacker returned the funds on the same day.

July 30: coffeebabe.eth returned funds ($3.19M) to Metronome DAO and Curve Finance.

August 3: CRV foundation offered a 10% bounty for the return of stolen assets.

August 4-5: Exploiters 0x6ec and 0xdce returned assets totalling $23M.

August 6: 68% of stolen assets were recovered.

On August 6, Curve Finance ended the recovery period. A 10% bounty is now available to the public for help in recovering the remaining stolen assets.

As of August 13, Curve Finance had recovered a significant amount of its post hack TVL, hinting that users are slowly gaining back confidence in the protocol.

In the wake of this exploit, we've witnessed the vulnerabilities but also the resilience of the DeFi community. These setbacks, while challenging, reveal the community's unity and capacity for rapid response, also unveiling the many opportunities that arise from having the capacity to use DeFi tools to navigate these market. As the DeFi ecosystem progresses, we remain dedicated to delivering timely and thorough insights on this growing industry.

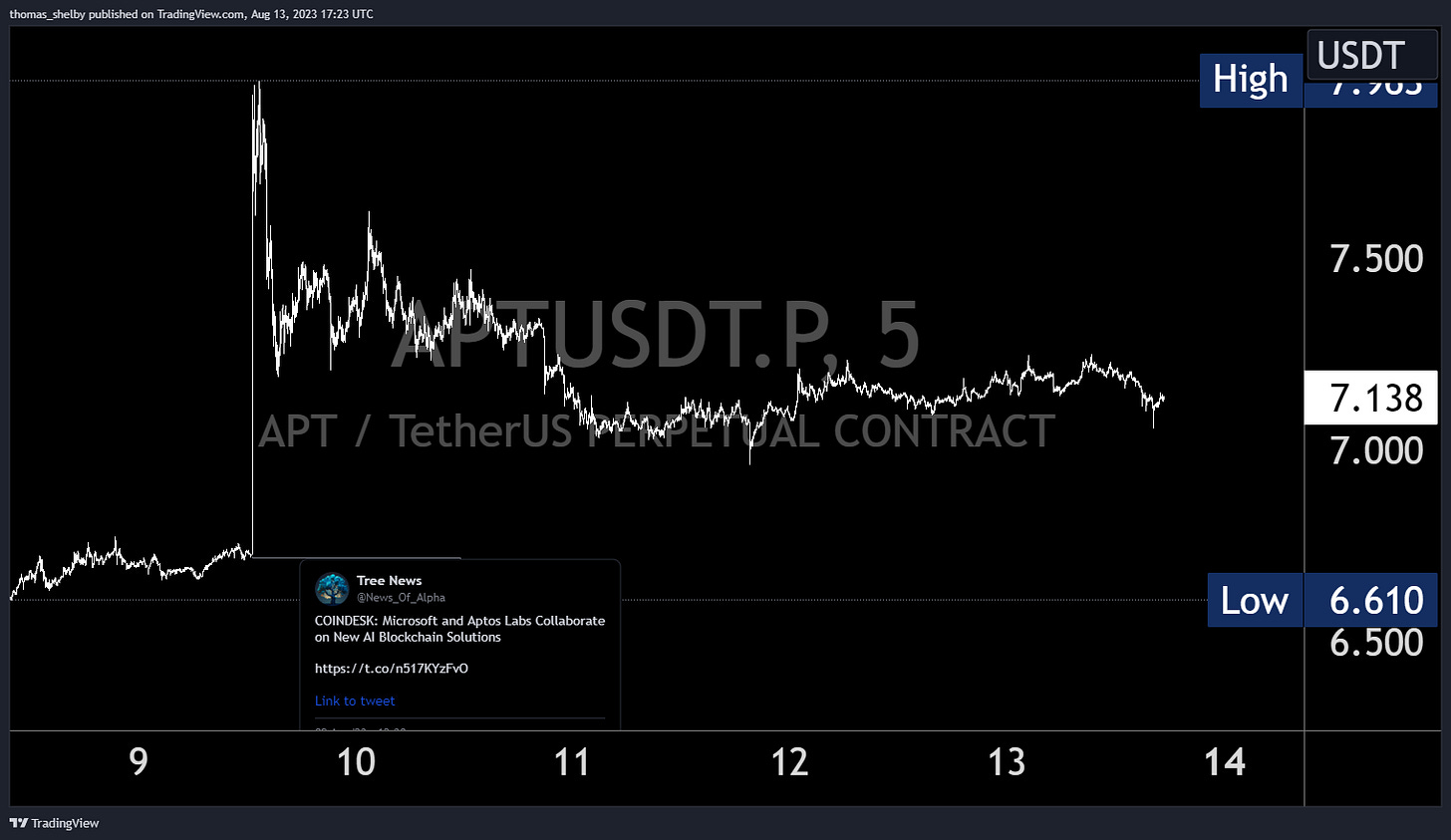

APT / Microsoft

On Wednesday August 9th a news headline was released that Aptos (APT) partnered with Microsoft to build AI tools for banks. This immediately caused the price of APT to rally ~18%. However, upon reading the article, it was easy to notice that the headline was misleading, as Aptos Labs would be using openAI to bring AI solutions to Aptos. At this point, once the market digested this headline, the price retraced ~half of the news pump.

Tree News

DWF and the YGG squeeze

Following the YGG listing on Binance Futures on August 5th, 03:30 UTC, the market saw a strong interest and a lot of trading activity. Price increased and peaked at ~ 135% after only 10 hours of trading.

After the initial rally, Andrei Grachev wrote a small thread about the token listing and buyer's interest. The token activity kept increasing, leading to Binance reducing the maximum leverage (initially listed at 20x, and in the last update, 8x max). Maximum funding cap was also changed from the regular 8h period to 2h interval window. Binance has been quite active in response to recent obvious PnD (pump and dump) schemes on their platform, much more so than in previous years. The YGG incident marked the first time we have seen them make so many changes to the market structure in such a short timeframe.

The squeeze ended with DWF sending coins to Binance, pushing the market one last leg up. From that point on, YGG saw a price decrease of more than 50% in 5 hours.

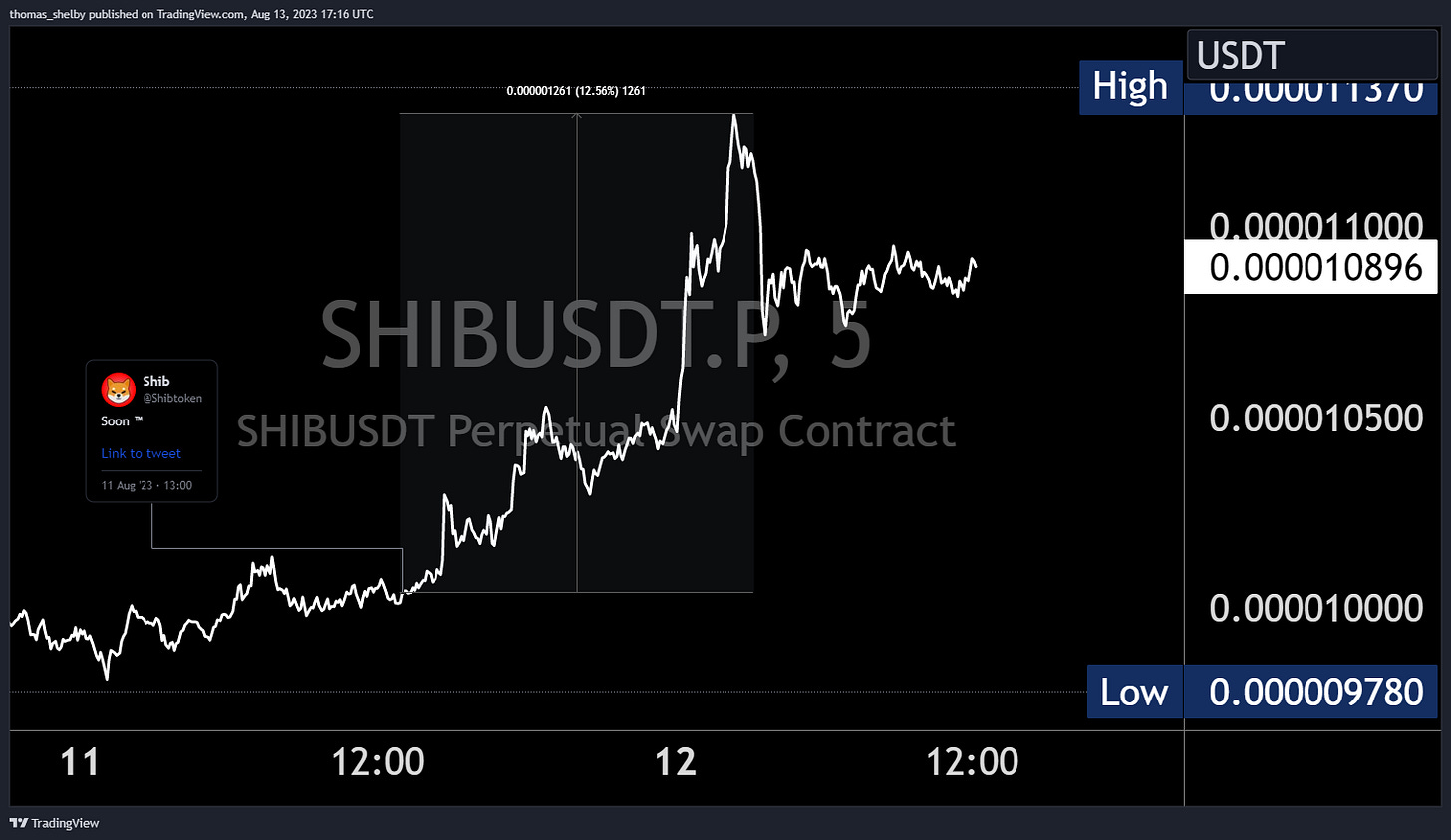

The Shiba FOMO continues

On Friday, @shibatoken tweeted "Soon TM," generating FOMO and pushing the price above the 0.01 resistance level. This move led to a 13% increase within 12 hours, contributing to a total gain of nearly 40% for this month. The impending launch of Shibarium, along with its accompanying features is expected to occur shortly. The narrative continues to remain strong.

Shibtoken

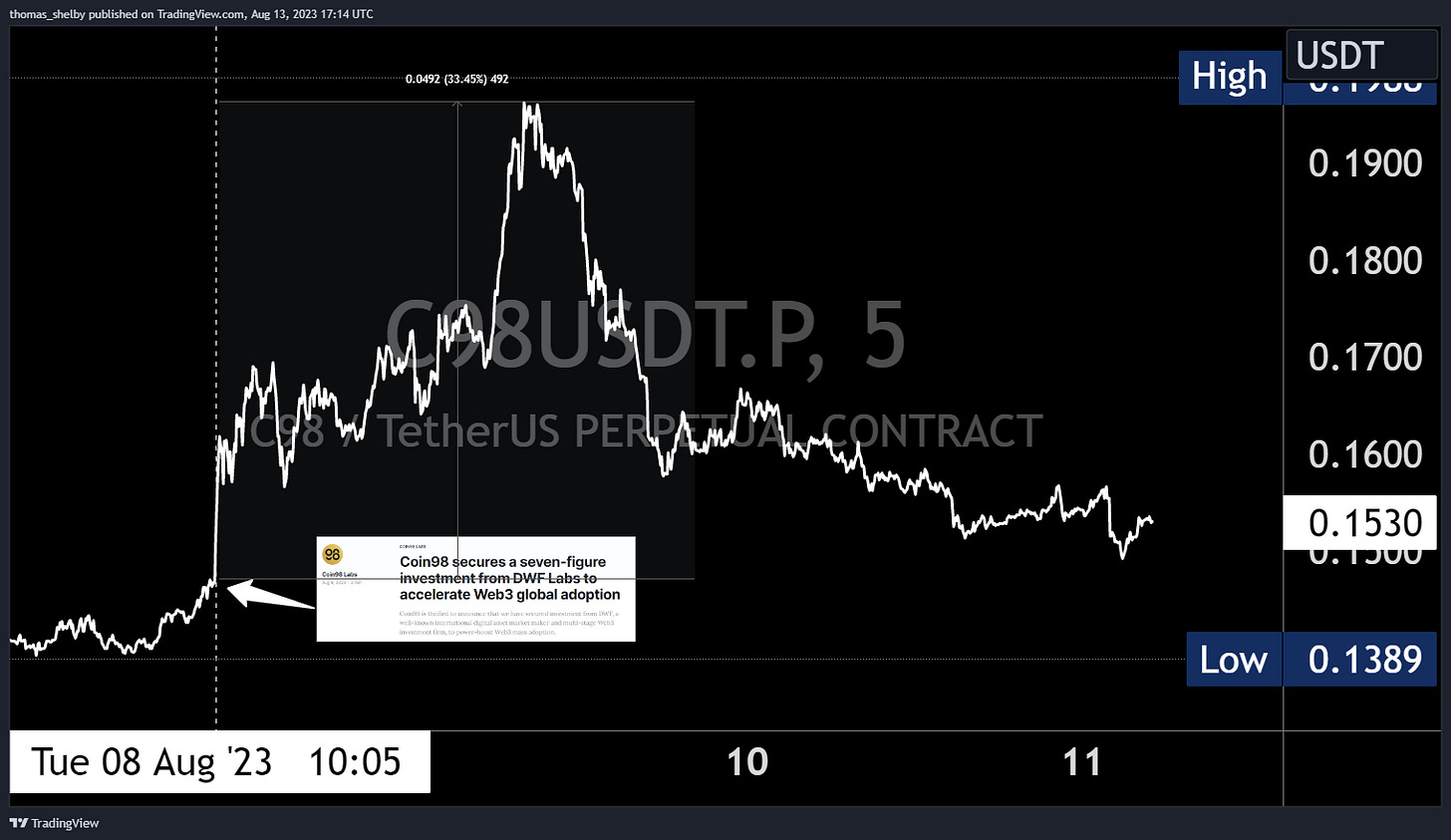

C98 Has Partnered With DWF Labs

DWF Labs is on a shopping spree, incorporating an additional project into their portfolio, and committing a seven-figure sum to expedite the global adoption of Web3. The price responded with a 6% increase on the headline and continued to rally for the following 22 hours, adding up to a total of 35%. However, in the next 48 hours, the price completely retraced to headline release price level.

Coin98 blog

SEC To Appeal XRP Ruling

The SEC announced in a court filing on Wednesday its intention to pursue an "interlocutory appeal" following a federal court ruling in the XRP case. In response to this news, the price of XRP decreased by over 4%.

Zoomerfied

Stuart Alderoty, Chief Legal Officer at Ripple, clarified that the SEC currently lacks the "right" to appeal, prompting them to seek permission for an "interlocutory" appeal. Ripple intends to submit its response to the Court next week.

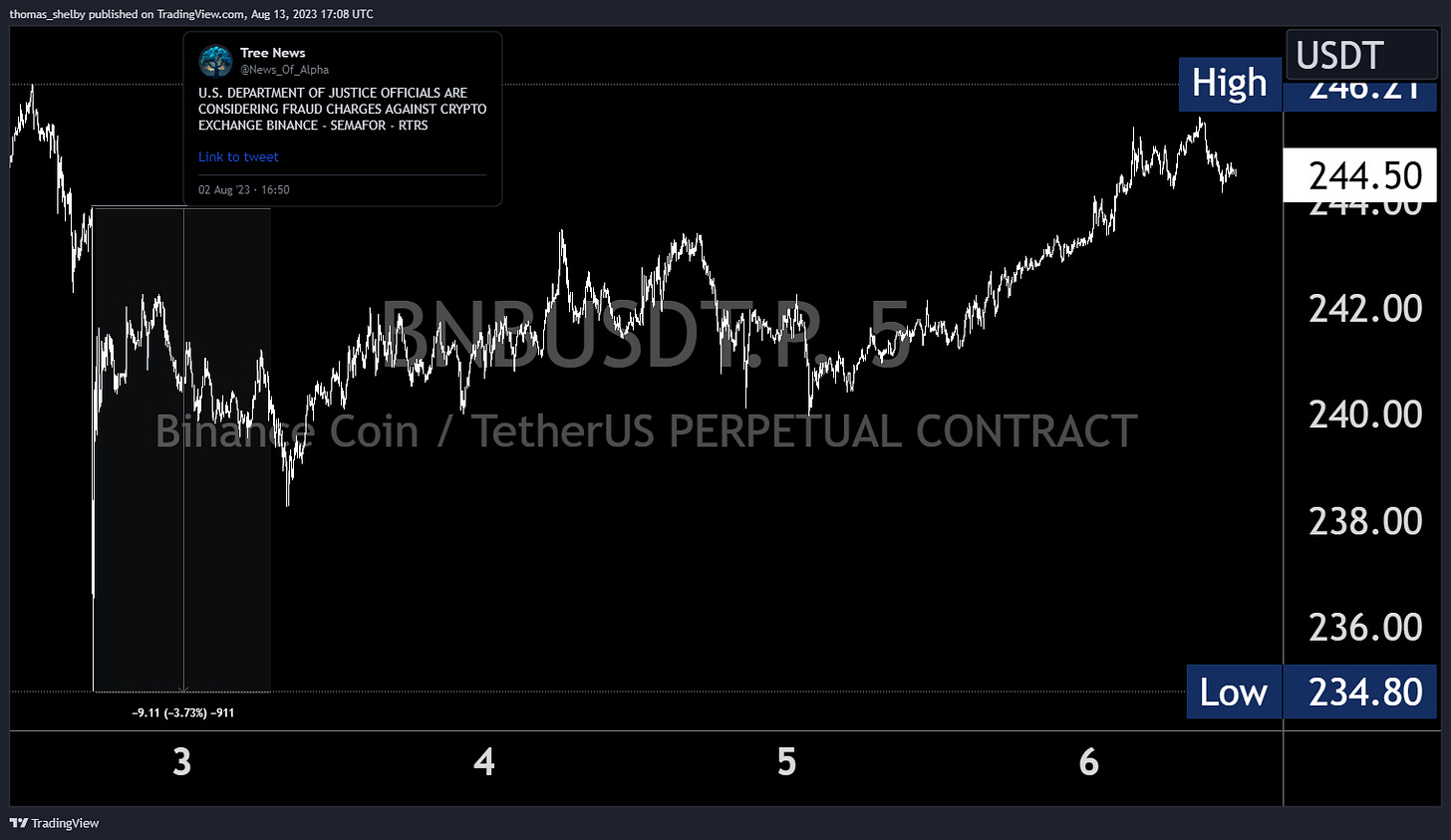

DOJ and Binance Tango

In a whirlwind of developments surrounding the Department of Justice (DOJ) and Binance, insights emerged on August 2nd through Semafor.

According to the article from Semafor, the DOJ seems ready to take on the crypto behemoth Binance. However, the DOJ's apprehension revolves around the potential fallout on customers. It appears that the government agency fears that announcing charges could trigger a chaotic rush for the exit, resulting in significant customer losses. Neither the DOJ nor Binance have officially confirmed these claims.

The news urged a sell-off on BNB and the rest of the crypto markets as well. However, the impact was short lived. BNB dipped 3% before finding stability within the range of 245 to 238.

Tree News

Numerous Twitter accounts, including Elon Musk, have speculated that Semafor is purportedly owned by SBF. However, the accuracy of these claims remains uncertain.

Microstrategy wants more Bitcoin

Last Tuesday, in an SEC filing, Microstrategy announced that they will be liquidating up to $750 million of stock, to eventually use the funds for corporate expenses and to increase their Bitcoin exposure. This headline triggered BTC to rally on that day pushing price above the $30,000 mark, before retracing the move by end of the day.

Bitcoin and Ethereum

For the past two weeks, both BTC and ETH have been trading in a range with no exciting volatile opportunities. The price action is showing true “summer trading” conditions, with BTC dominance grinding up and barely any interest in altcoin activity.

The current support/resistance levels for BTC and ETH are $28800 - $30200 and $1810 - $1880, respectively.

ETF Update

The SEC provided an update on Friday regarding the ARK Spot Bitcoin ETF, requesting comments from market participants. This essentially implies a delay in the decision-making process. Cathie Wood and Mike Novogratz had previously indicated their anticipation for the approval of all ETF applications simultaneously. The price of BTC remained unaffected by this news, as it was in line with everyone's expectations. The upcoming ETF deadline is September 1st. Additional delay should not be a surprise.

TradFi

Economic Data

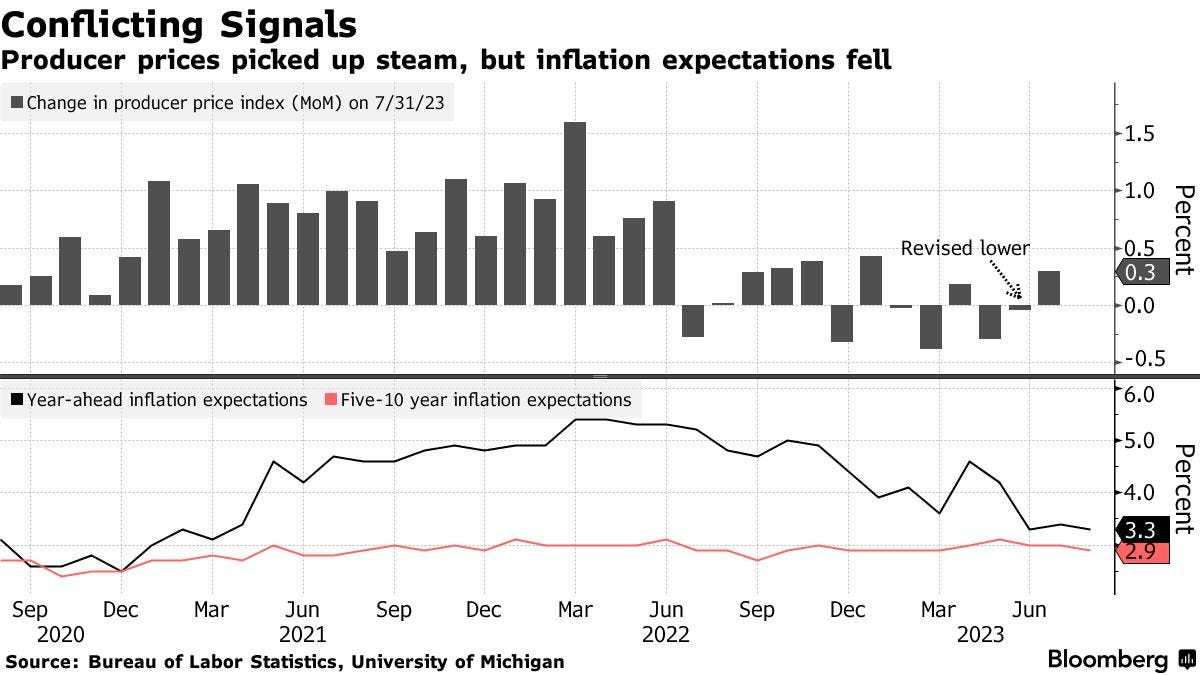

Has disinflation bottomed?

This question caused some turbulence in the markets after PPI data finished the week on Friday, coming hotter than expected, with services picking up steam again and reversing the little relief rally on Thursday when CPI came in line with expectations.

Year ahead inflation expectations came lower than estimated, despite higher gasoline and food prices, which also raises the question whether recent rising energy costs and food prices are yet to be felt by the Americans.

The number of Americans filing for jobless claims rose to 248K from 227K last week. It is not really dramatic as of now as ongoing seasonal distortions were pointed out as the cause.

Stock & Bond Market

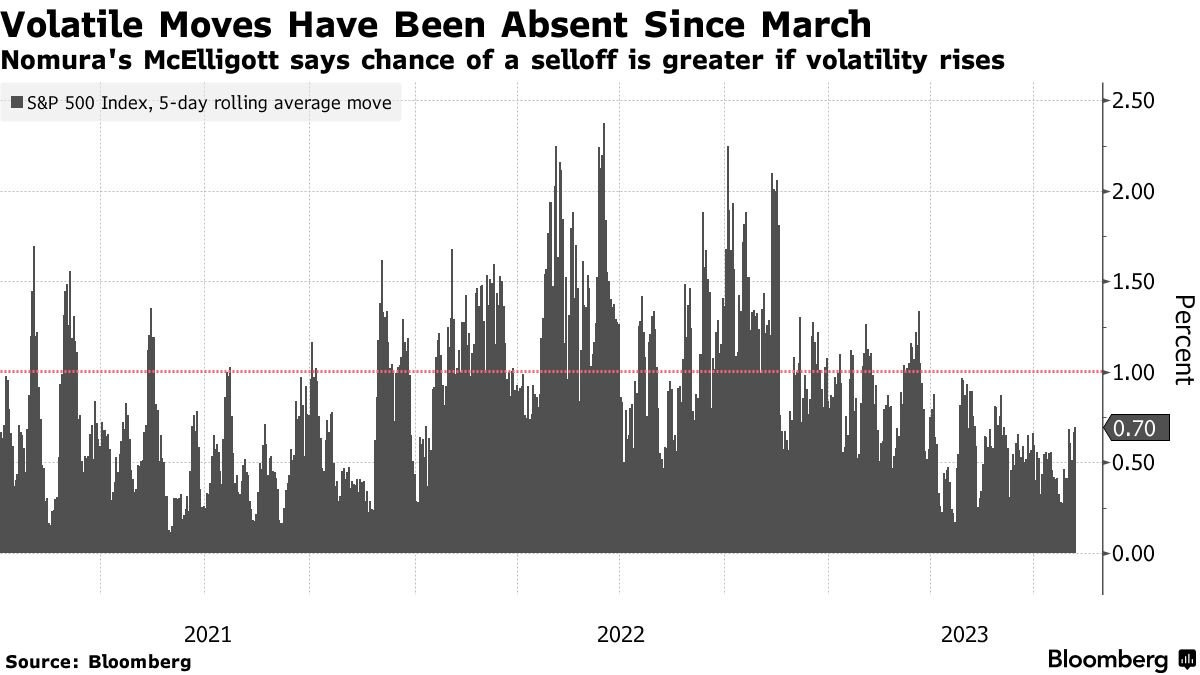

Market swings are picking up steam and are no longer muted, supported by seasonality, ongoing uncertainty about the economy and incoming bond issuance, tech giants kept a lid on the major indexes for the last two weeks, while yields reached yearly highs.

Dealers are short gamma for the first time this year and there is evidence in a shift of positioning where market makers will keep selling into a down tape.

The S&P 500 is down 3% at the start of August, and is off to its worst start of a month since March. The trend line for CTAs to observe for a potential unwind is the 50-day moving average at around 4438 points. A dip below 4300 could flip these momentum and trend traders into selling programs.

Bond market and Fed Swaps are now also in line to what we have seen earlier, the Fed is done with their hiking cycle but the probability of rate cuts got pushed into Q3 next year, bracing for a longer pause than previously priced in.

Outlook For Next Week

Volatility has been a big contributor to this year's rally in stocks. Low volatility has led to people willing to take risks. Increased fluctuations, especially intraday movements exceeding 1%, have the potential to trigger an unwinding of $28.8 billion of positions that volatility control funds have accumulated this year.

We are heading into August Vix expiration on Wednesday and monthly options expiration on Friday, which will keep the markets protected from more downside as dealers that are short put and short stocks will need to buy back, contributing to volatility compression.

As August expires, we then go into a quarterly cycle in September where all structural products expire and more volatility is expected.

The ongoing war between soft landing hopes and recession fears will go into another round next week, where markets will watch out for more direction:

Tuesday:

China Retail Sales

US Retail Sales

Wednesday:

UK CPI

Eurozone GDP prelims

US FOMC

Friday:

Eurozone harmonized index of consumer prices

Bitbit’s Note

Experienced traders know the importance of taking a break; even here, timing is everything.

You don’t want to be on a halt when the market is hot and juicy. Summer trading occurs because most players are taking the time off, and the market liquidity isn’t as efficient. This makes the risk bigger and the reward smaller.

As summer trading is coming to an end, I’m optimistic for multiple reasons; 2024 elections in the US, Fed’s tightening is almost done, and Blackrock’s ETF is still on the table.

All these narratives should support the buying pressure through the second half of the year. Cheer up; good times are coming.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @EdwinTheDealer @cryptoalle @FoftyOerney @ahoras_ @Wassie2835 @SmartGamblinggg @betsizing

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

Thanks for this, was a great read