The Weekly

Capricious Market VS Capricious SEC

BNB Liquidation Pin

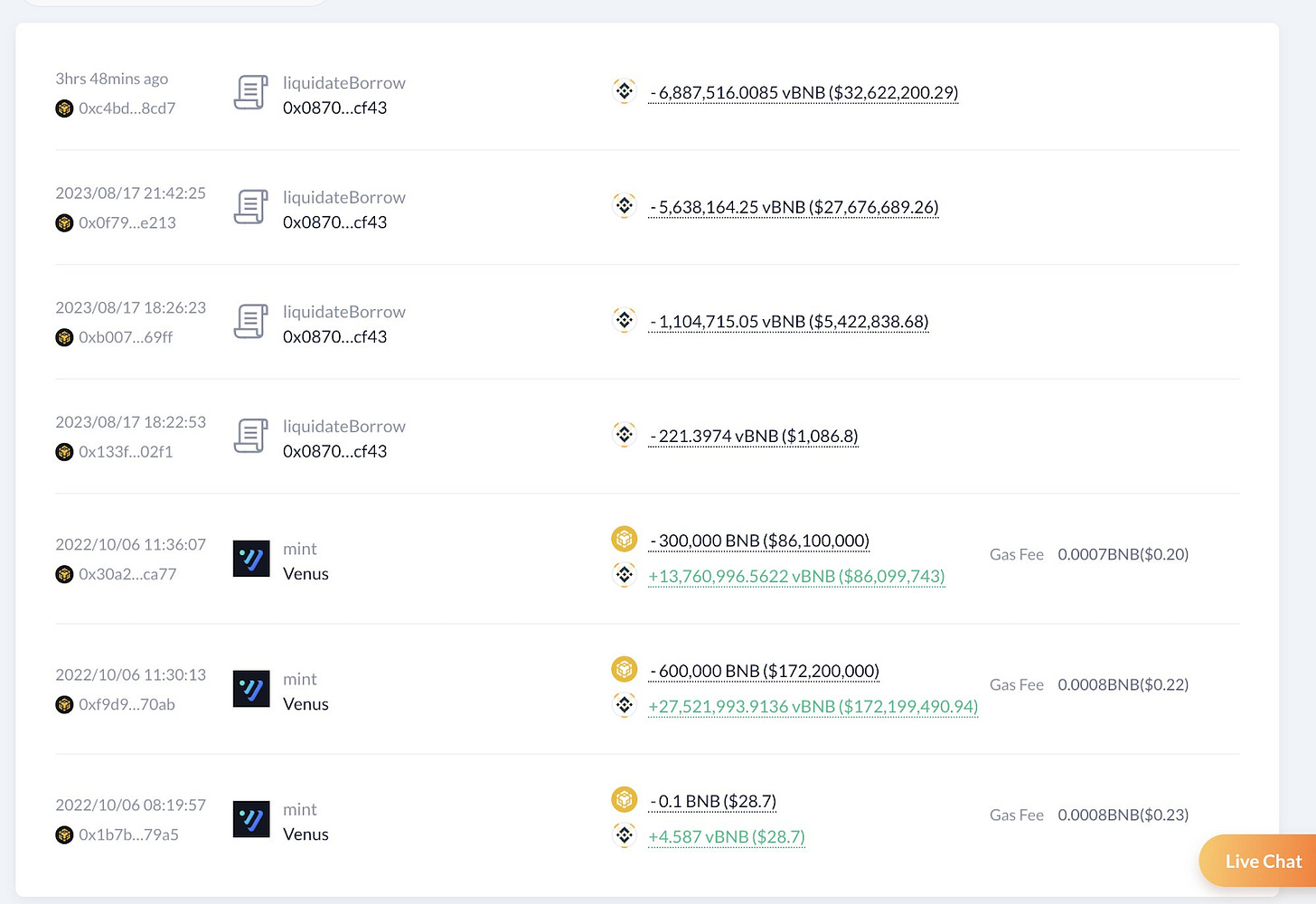

The $220 level has been acting as support for almost 2 months on the BNB/USDT pair. On August 17th we finally saw BNB plow through this level, triggering a market wide sell off. The correlation between BNB and the rest of the altcoin market has always been apparent, but this event really showed how powerful this relationship is. The cross margin leverage from BNB positions, together with the Venus Exploiter liquidation price, caused a “nuke” event across the market, sending Bitcoin below $25000 for a brief period of time.

When the market is in a vulnerable state, and panic spreads, participants rush for an exit as fast as they can and this causes the market to break. This was a clear case of this phenomenon.

CRV Continues To Decline

Curve Finance's token, CRV, is nearing the $0.4 price at which the founder, Michael Egorov sold 158 million tokens to investors. Despite the wider crypto market downturn, the price is approaching the discounted OTC rate, causing concerns that buyers might sell their tokens to avoid losses.

Egorov, who sold these tokens to cover shaky loans from DeFi lending protocols, does not seem particularly concerned. He sold the tokens at a 30% discount to the market rate, with a handshake agreement that they wouldn't be sold for 6 to 12 months. Some buyers have locked their tokens in the Curve protocol, turning them into vote escrowed CRV (veCRV) or liquid locked CRV (cvxCRV, yCRV, sdCRV), which provides them with voting power in the protocol. Despite the current price slump, many counterparties still remain optimistic. Since the exploit, the health rate on the positions has stayed in a healthy range.

PEPE Rug?

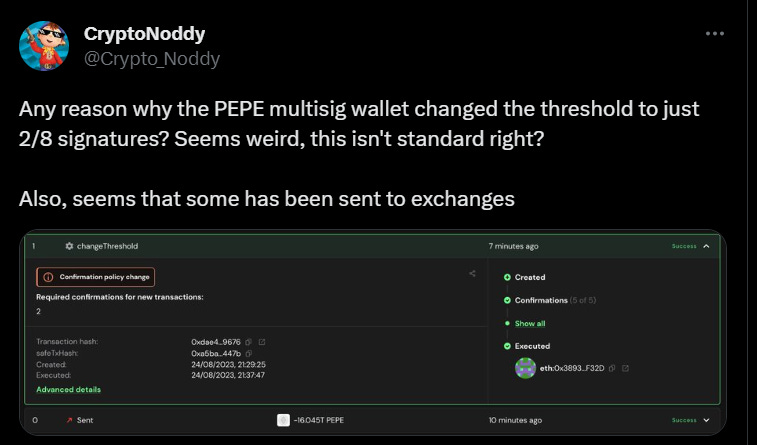

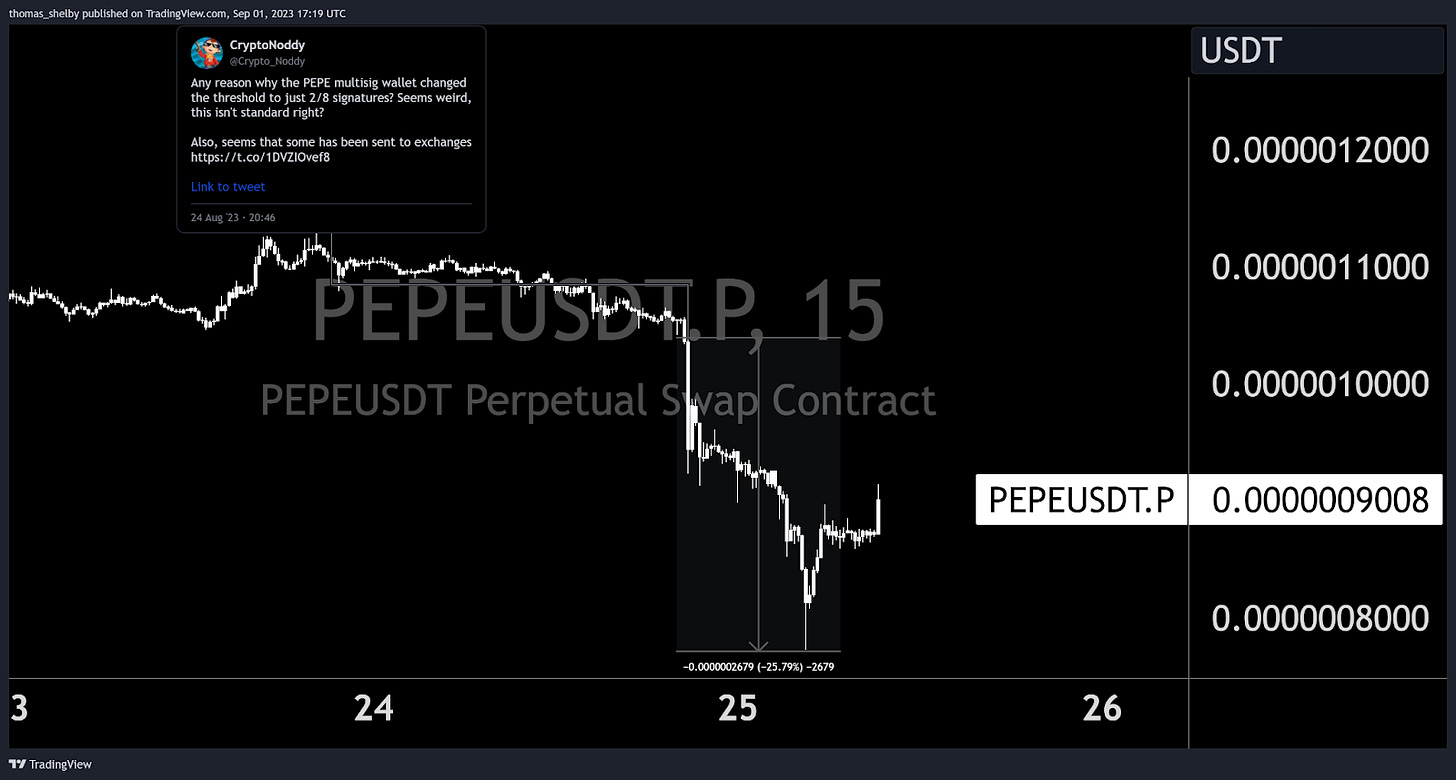

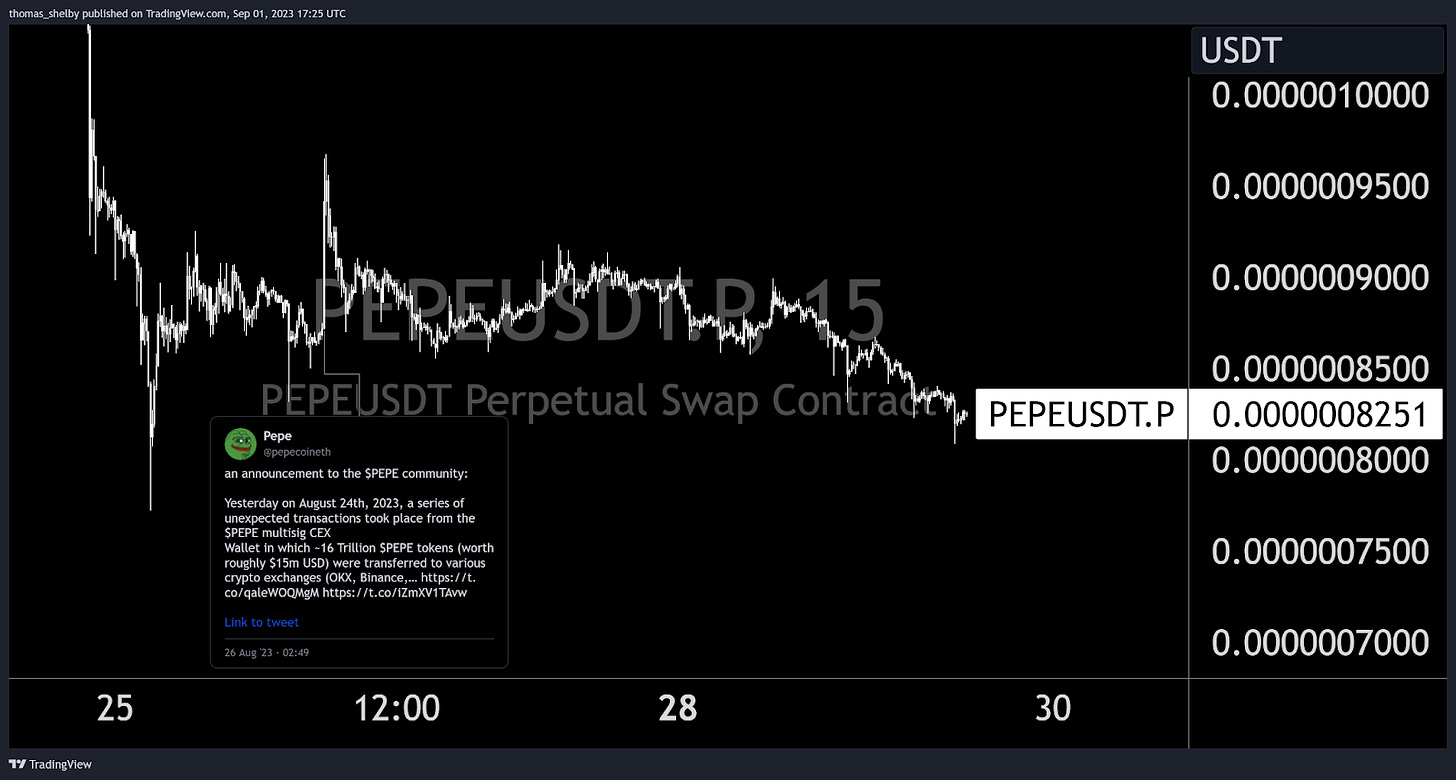

On August 25th, the PEPE multisig sent $15.7 million worth of tokens to various exchanges. Shortly after, the PEPE multisig changed the number of required signatures from 5/8 to 2/8.

The price subsequently dropped by approximately 25%, as traders realized that pepe devs could be in the process of rugging the token.

Later, the official PEPE Twitter handle tweeted an explanation, which can be summarized as follows: a few team members went rogue, and sent $15 million of $PEPE (60% of the team's supply) to their own wallets, and dumped it on the market. They eventually returned control of the wallet, and the official PEPE twitter account promises PEPE was now in good hands. The price saw a ~12% increase within the hour following this tweet, but slowly reverted over the next few hours.

RUNE Rally

Thorchain had a mini bull run within the bear market in August, pumping roughly 110%. They then came out with an announcement releasing their highly-anticipated new lending protocol and the news sold off, marking a local top.

What sets this protocol apart is that users can borrow without a liquidation price, interest, or expiration. However, seven days after lending started, there is only about $1.1M in collateral, and the price has declined by 33% from its peak.

Thorchain's lending approach is interesting because it essentially burns and mints the difference between collateral and loan. This mechanism presents some fascinating scenarios: If the RUNE price and TVL increases, it would result in a significant burn, as almost 50% of TVL would go towards temporary RUNE burning. However, the absence of liquidations, interest, and expiration, combined with RUNE minting, introduces some risks and concerns. There's a potential for a "death spiral" event for RUNE, though they have a 15M RUNE insurance fund as safety measure, and a circuit breaker that prevents people from minting more than what is in the insurance fund.

To understand the lending mechanism in more detail, check out this comprehensive video.

Thorchain Lending Dashboard

Grayscale Wins Lawsuit Against SEC

X Integrates Crypto Payments

Just minutes after the Grayscale announcement was released, which changed the momentum for the entire market, Twitter aka X took advantage of the bullish sentiment and publicized that their application to integrate crypto payments was approved. This led to a further push in the price on DOGE, Elon’s favorite crypto and Twitter proxy, leading to total gains of almost 7% in 2 hours. After the announcement, the X community started speculating on the type of crypto services X will be offering, however nothing was further revealed.

Spot Bitcoin ETFs Delayed

Six of the eleven recently filed ETFs applications had their first deadline this weekend, including Blackrock and Fidelity. Traders anticipated an update at Friday’s close for the highly sought-after decisions that could dictate the direction of the market for the coming weeks.

However, Thursday afternoon brought a rather unexpected surprise as the SEC’s decisions started coming out one after the other a day earlier than expected.

The SEC decided to keep traders in suspense and released the decisions one by one at approximately 10 minute intervals and decided to leave Fidelity and Blackrock for last.

After the first decision to delay (Wisdomtree) came out, it became apparent that every application decision was likely to follow. However, traders still held their breath until the most important of all was officially released, Blackrock’s iShares Bitcoin Trust. An hour after the first decision, the SEC finally announced that Blackrock was also delayed, confirming 6/6 delays and pushing the decisions to mid October.

The market impact was minimal, roughly 1.5% dip, as the market had already started selling off through the day pricing in a Friday delay announcement across the board.

BTC and ETH

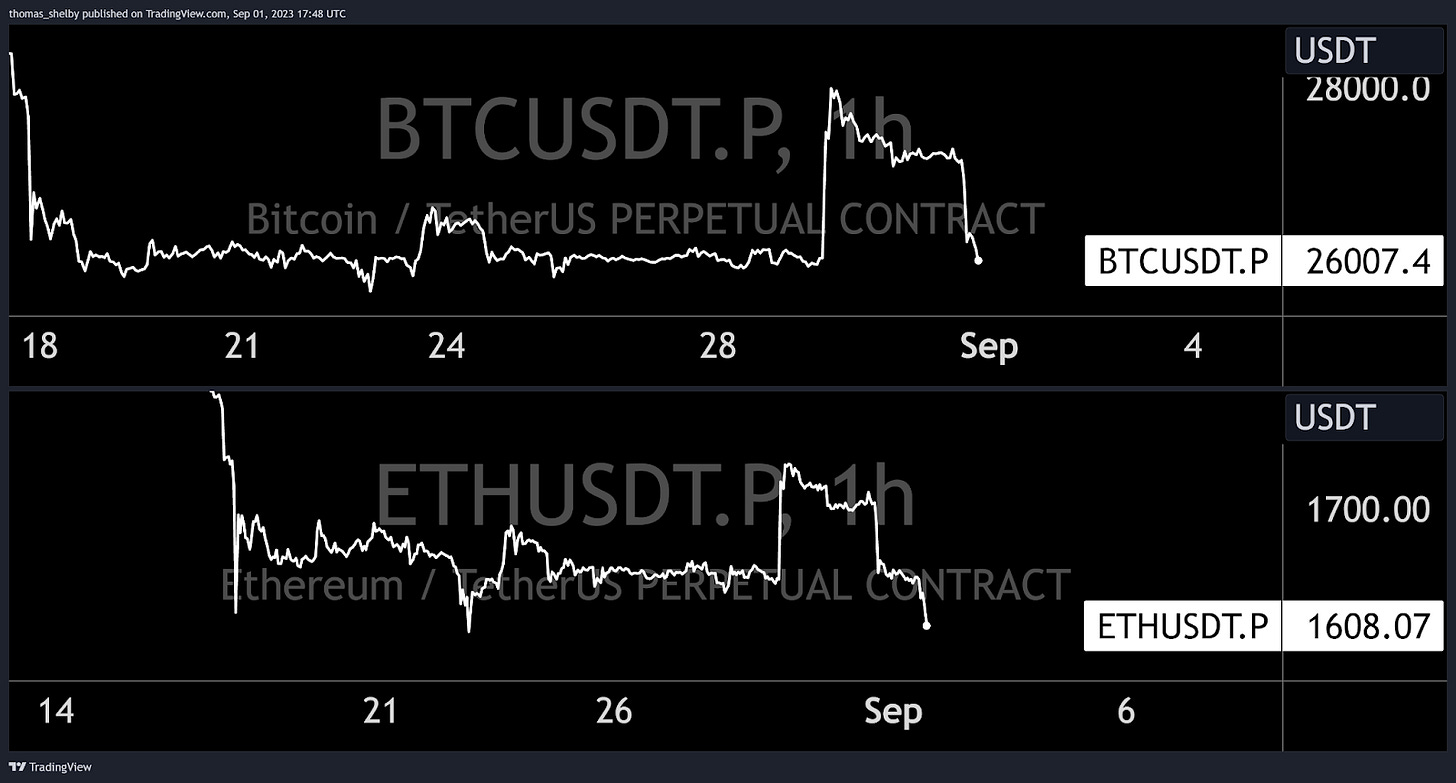

During the week beginning on August 21st, BTC oscillated within a narrow range of $26,200 to $25,850. It then proceeded to seek liquidity and clear positions on both ends. A brief dip to $25,200 was quickly countered, leading to a surge to $26,800 within a few hours. The remainder of the week saw trading within this initial range.

This week was particularly eventful due to updates from Grayscale and the ETF sector. While Monday passed without significant events, the Grayscale announcement sent BTC soaring to 28k within a matter of minutes. Subsequently, anticipation of the ETF delay news led to a gradual decline, with BTC dropping from $27,200 to $26,000 in just 7 hours. As of the end of the month, we find ourselves right back at the week's starting point, echoing a similar pattern from the previous week.

ETH painted a somewhat parallel picture. For the week commencing on August 21st, ETH saw trades within a tight 3% range, with a few exceptions marked by liquidity wicks. Value was established between $1,640 and $1,680, with liquidity extremes touching $1,580 on the lower side and $1,700 on the higher.

In the current week, ETH opened around the midpoint of the previous week's range at $1,660. Following BTC's trajectory, it experienced a sharp increase of over 5% to $1,750. The trend reversed thereafter, and as we approach the end of the month, the price hovers between 1,640 and 1650.

TradFi

Economic Data

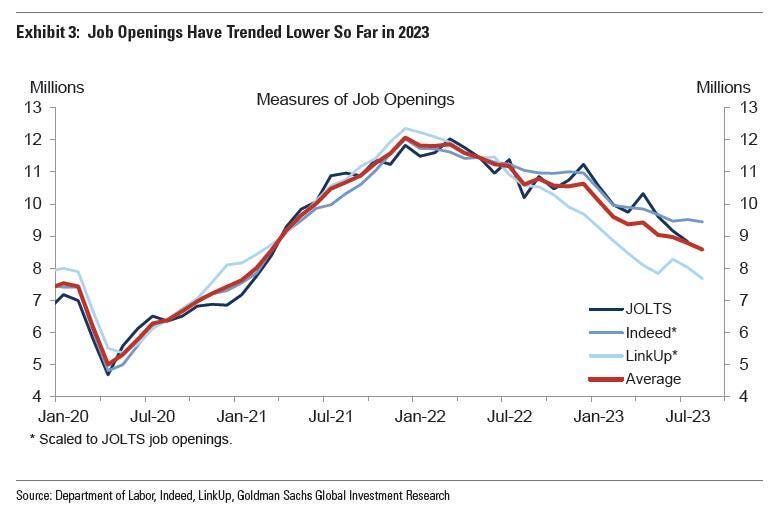

Mixed data emerged from the US this week, which has started to confirm a slowdown in the US economy and a cooling labor market. Hourly earnings and wage growth have slowed back to pre-pandemic levels, flashing the first recession signals. Hiring rates came out back to back just under 200,000 per month. Nonfarm payrolls remained relatively unchanged at 187,000, but prior months were revised down significantly. The unemployment rate rose to 3.8%.

The Q2 GDP was revised down to 2.07% from 2.4%, and personal savings decreased to 3.5% from the recent peak of 4.7%, further indicating a slowdown in the economy.

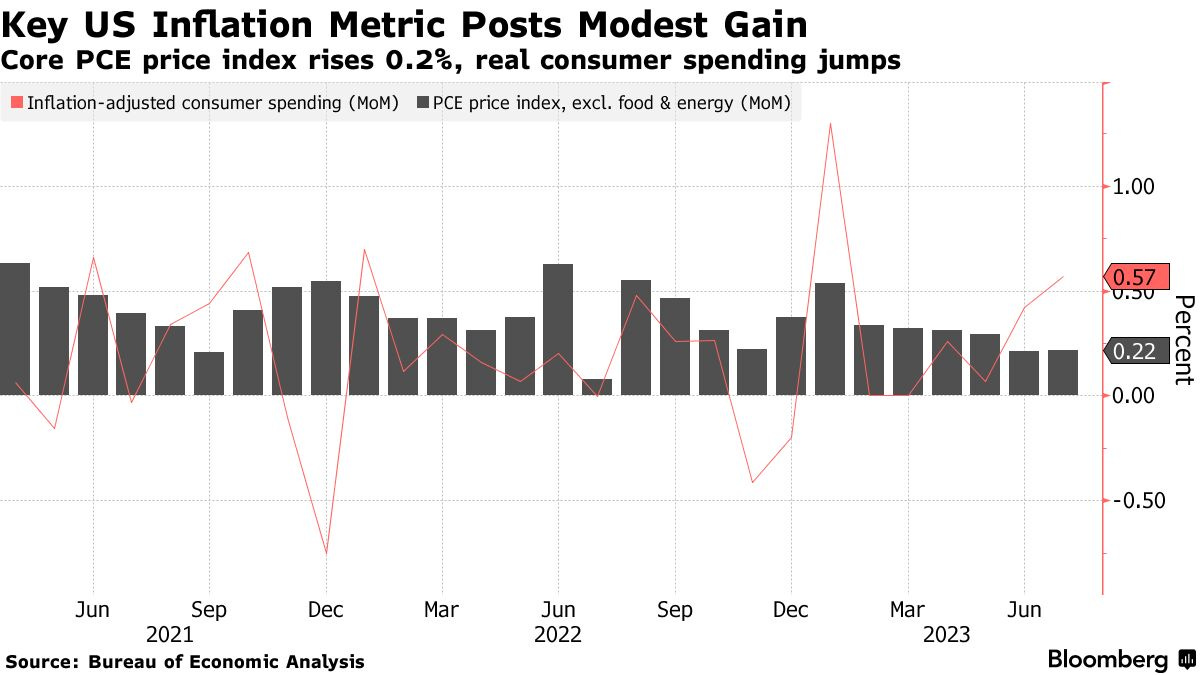

The Fed's preferred measure of inflation, PCE, posted back-to-back increases of 0.2%, in line with expectations and the lowest since late 2020. What kept the markets from rising further, however, was the so-called "supercore services" measure, a gauge that excludes housing and energy. This measure saw its most significant monthly increase since the start of this year. Consumer spending also recorded its strongest advance this year, which is potentially inflationary in the long run but will need confirmation in the coming weeks.

Stock & Bond Market

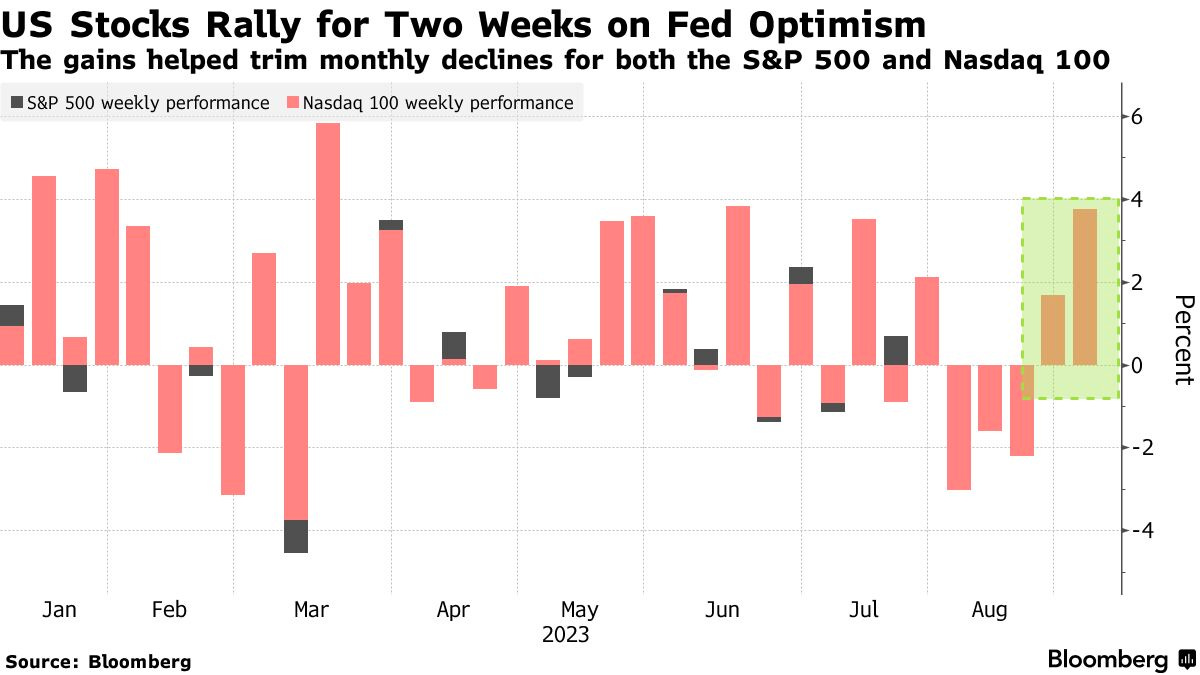

With Jackson Hole off the chest and cooling job market data at the beginning of this week, markets experienced a relief rally, while treasuries headed for their best week since mid-July.

Bad data surprises on job openings and the downward revision in GDP were not seen as reasons to sell off. This indicates that the markets are currently more optimistic about the end of rate hikes and lower yields, rather than being concerned about a potential recession at this time.

China caught some attention as Chinese authorities have reduced payments for homebuyers and down payment on mortgages. Earlier in the week, stamp duties and margin ratios for leverage trades were also cut in half, signaling China's willingness to support its struggling economy and plunging markets going into Golden Week beginning with the first October week.

The employment report has reduced the odds for a November rate hike below 50% in swap contracts, S&P 500 extended its gains with dollar weakening, confirming that the markets are leaning towards the expectation of the Fed cutting rates in early 2024.

Central Banking

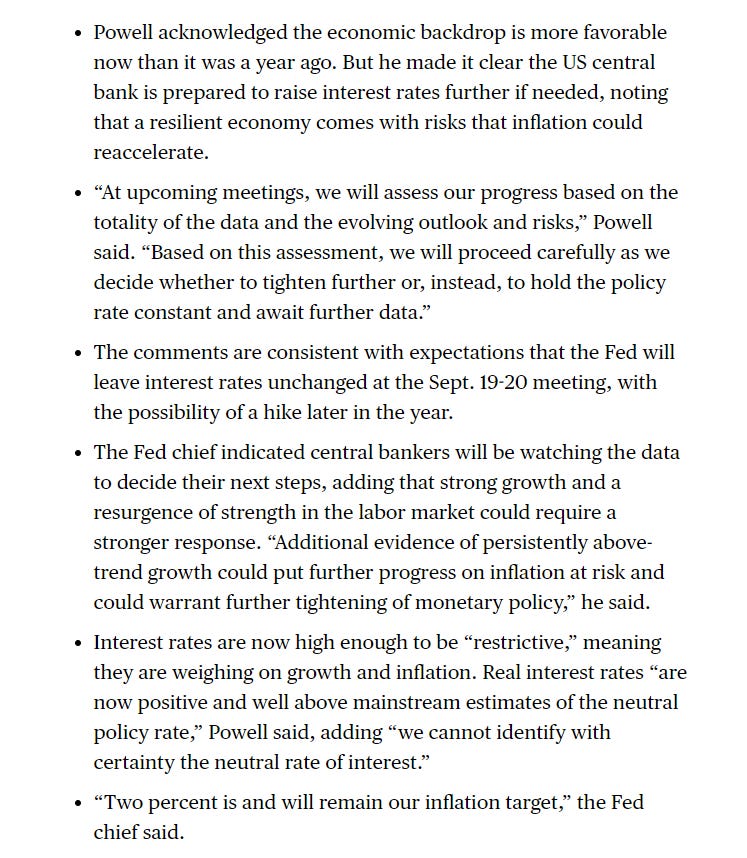

Jackson Hole last week was a nothingburger event, where all central bankers echoed the same mantra of “higher for longer“ and a commitment to implement more rate hikes if necessary.

The only remaining dove and advocate of ultra-ease monetary policy, Kazuo Ueda, refrained from commenting on foreign exchange rates but signaled a commitment to continue their current monetary policy.

Here a short summary of Powell's speech:

Outlook For Next Week

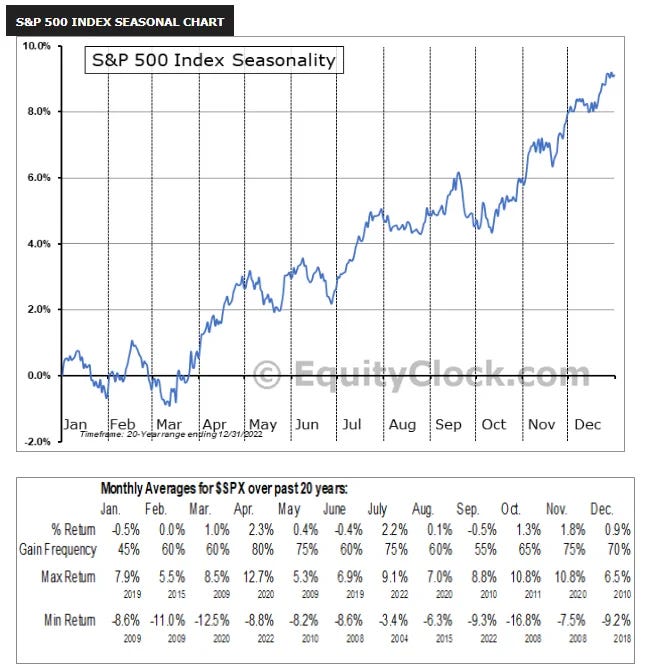

September is approaching, and historically, it is one of the worst months on average for the S&P 500. Coupled with the quarterly OpEx, this month is primed for increased volatility.

This month, attention will shift towards China as calls grow for Chinese authorities to take steps to boost the world's second largest economy.

We anticipate that the upcoming week will be relatively calm yet choppy, as markets keep trying to sniff out Fed’s upcoming policy decisions through proxies from Canada and Australia. Bad data isn't currently priced as bad data, which is an indicator that a direction is yet to be figured out.

Vanna & Charm effects will be back for the next two weeks, protecting markets from downside volatility as market makers start buying back their short put and short stock hedges.

Note: Reverse repo op sits at $1.574T at the end of the week, $220B drawdown from last week, indicating more liquidity in the system. SPX option matrix shows the same, $480B of gamma exposure has been added for September so far.

Key Events For Next Week

Tuesday:

China Caixin Services PMI

Australia RBA meeting

Wednesday:

Canada BOC meeting

US ISM Services

US Fed's Beige Book

Thursday:

China trade data (Imports/Exports/Trade Balance)

Eurozone Q2 GDP

US Unit Labor Cost

Bitbit’s Note

Capricious Market vs Capricious SEC

Now that the summer is over, traders slowly return and search for things to do. The recent up-move on BTC to 28k, and the rest of the crypto capital markets occurred following the headline that Grayscale won its case against the SEC. The judge highlighted their inconsistent actions and forced the SEC to look at Grayscale's application. They (the SEC) have to examine it, but this doesn’t mean they will approve it.

Two days later, the market is back to square one, where bitcoin is now trading slightly below 26k, drawing the infamous Bart pattern after the SEC decided to delay their decision about a list of ETF applications, including the Blackrock’s iShares Bitcoin Trust.

The market can be vicious and unforgiven at times, and for this particular reason, good traders won't miss a good opportunity. The traders I know won’t allow themselves to miss out on trading the CYBER pair, especially after returning from summer vacation. It’s not the up move; it’s the volatility and the volume - Juicy markets don't last forever, you snooze you lose.

Going forward, I still think we’re going to enter another cycle before the end of this year. Many reasons point to this : The FED’s tightening, the US elections, and BTC halving. Never forget, traders that survived until now will be the ones able to pick up the fruits of what's about to come. Survive.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @tradeboicarti16 @EdwinTheDealer @cryptoalle @FoftyOerney @ahoras_ @Wassie2835 @SmartGamblinggg @betsizing

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.