🚨XRP - “highly profitable trading strategy”

The crypto market's attention is focused on the imminent ETFs, particularly the looming deadlines for BTC spot ETFs. Fueled by the ETF narrative, speculators were swiftly drawn in by an unexpected filing named ISHARES XRP TRUST.

Shared initially by @SummersThings and prefaced as potentially dubious, this news prompted speculators on both sides to enter the market with haste. This tweet triggered a 37-minute period of intense activity that transformed XRP's price structure into what could be described as a "tall, majestic, cosmopolitan, mixture of glass and steel."

Amidst the chaos, some detail-oriented observers recognized the peculiar use of "XRP" instead of "Ripple" in the filing, raising suspicions about its authenticity. These doubts were later confirmed by a spokesperson from Blackrock.

This event underscored the vulnerability of the alt market during a liquidity event, prompting many to decrease their risk exposure across the board.

ONYX by JPMorgan

A report titled “The Future of Wealth Management” by JPMorgan blockchain arm Onyx began to make headlines on November 15, including some honorable mentions.

“Onyx by J.P. Morgan (Onyx) and Apollo approached this project from a solution-agnostic perspective and consulted with experts and practitioners within wealth management, alternative asset management and fund administration. Onyx and Apollo collaborated with a leading asset manager and pioneer in fund tokenization, WisdomTree, and invited input from several industry experts who are leaders in their respective fields: J.P. Morgan Private Bank, Provenance Blockchain, Ava Labs, Oasis Pro, Axelar, LayerZero, and Biconomy.”

Total report count:

Avalanche: 38

Axelar: 29

LayerZero: 31

Oasis Pro: 9

Biconomy: 14

AVAX, the native token of Avalanche Network, saw total mentions of 38 in the report and rallied as much as 40%.

📈OMG

“Plasma is an underrated design space” wrote Vitalik Buterin in a recent blog post. The article was titled “Exit games for EVM validiums: the return of Plasma“.

In short, Plasma is a means of improving the speed and cost of Ethereum transactions.

Plasma is an off-chain scaling solution for Ethereum.

Child chains process transactions off-chain.

Child chains are backed by the main Ethereum chain.

Users can exit child chains to get their money back.

Plasma is a flexible design that can be adapted to different use cases.

As the market digested Buterin’s article, the native token of OMG Network (which aimed to use Plasma design) began to rally.

From lows of 0.630 to highs of 0.831 in a period of 1.5 hours, an increase of 29%.

Binance Labs Invests In ARKM

A blog post from Binance announced on Wednesday that Binance Labs has invested in ARKM to support On-Chain Insights at scale across the blockchain ecosystem.

The price of ARKM surged by approximately 13% in the next couple of minutes before experiencing a steep decline in open interest, marking the top.

As the news hit the market, traders initially bought causing the price to rise. ARKM couldn't sustain momentum, possibly due to insiders taking profits, as evident from the decline in open interest. Traders should be aware that news trading has become extremely competitive and simply market buying with leverage in the hopes of a follow-through may not yield the expected returns as it did before.

SEI 🤝 USDC

On November 15th, Circle Ventures, the investment branch of Circle, made a strategic investment in the Layer 1 Blockchain Sei. This partnership enables Sei developers and entrepreneurs to benefit from USDC, offering advantages like the stablecoin's network effects, low network costs and instant transaction settlements. This announcement is expected to improve liquidity on the Sei network while also expanding USDC's reach. Sei, which launched its mainnet in August, is backed by several crypto firms and can aid in scaling infrastructure essential for the growth of stablecoins.

From a trader's perspective, it was a highly tradable event. After the news was released, traders had approximately two minutes to position themselves for a potential quick scalp. Many traders at the desk took advantage of this opportunity. Even for those who were late, there was a potential 7% upside to be had after the initial two minutes.

The key is to distinguish between non market-moving news and market-moving news, and this was a major announcement. Another important consideration is whether the news is anticipated or unexpected. If the markets are not expecting news and are caught by surprise, it usually leads to a good trade with significant upside potential. We have the statistics to back this claim up.

Hashdex Conversion Delayed

On November 15th, during the middle of the NY session, there was news about the Hashdex Bitcoin ETF being delayed until January 1st, 2024. This was the first indication in the probable ETF approval window that there might be delays. The charts have shown a lot of speculation regarding ETF anticipation, with many aggressive market buy positions emerging anytime there is even a hint of news. This instance was no exception. Analysts like Bloomberg's Eric Balchunas and James Seyffart quickly commented on the implications of this delay and the SEC's approach to late filings.

On the lower time frames, we observed a pop and an open interest wipe approximately 15 minutes before the news broke out, with BTC aggressively pushing 2-3% higher within a minute. The exact news prompted a retrace of about 2% within the minute, but it was quickly bought back up as buyers showed no signs of tiring. The day closed near its high of ~$38,000, as traders expected more news on the subject in the coming days. The following day encountered significant resistance from sellers, as a lot of open interest was added at the highs.

Bitcoin and Ethereum

Bitcoin

This week's price action reflected the anticipation of the spot ETF news. After a choppy Monday, BTC saw a ~6% decline on Tuesday, liquidating over $80M in leveraged longs. The price recovered on Wednesday and tested the range highs at ~$38,000 after the Hashdex ETF conversion got delayed. As the week progressed, the market started to derisk going into Friday’s ETF decision deadline. BTC is currently trading at ~$36,000, and the decision this afternoon can be a turning point for these markets.

Ethereum

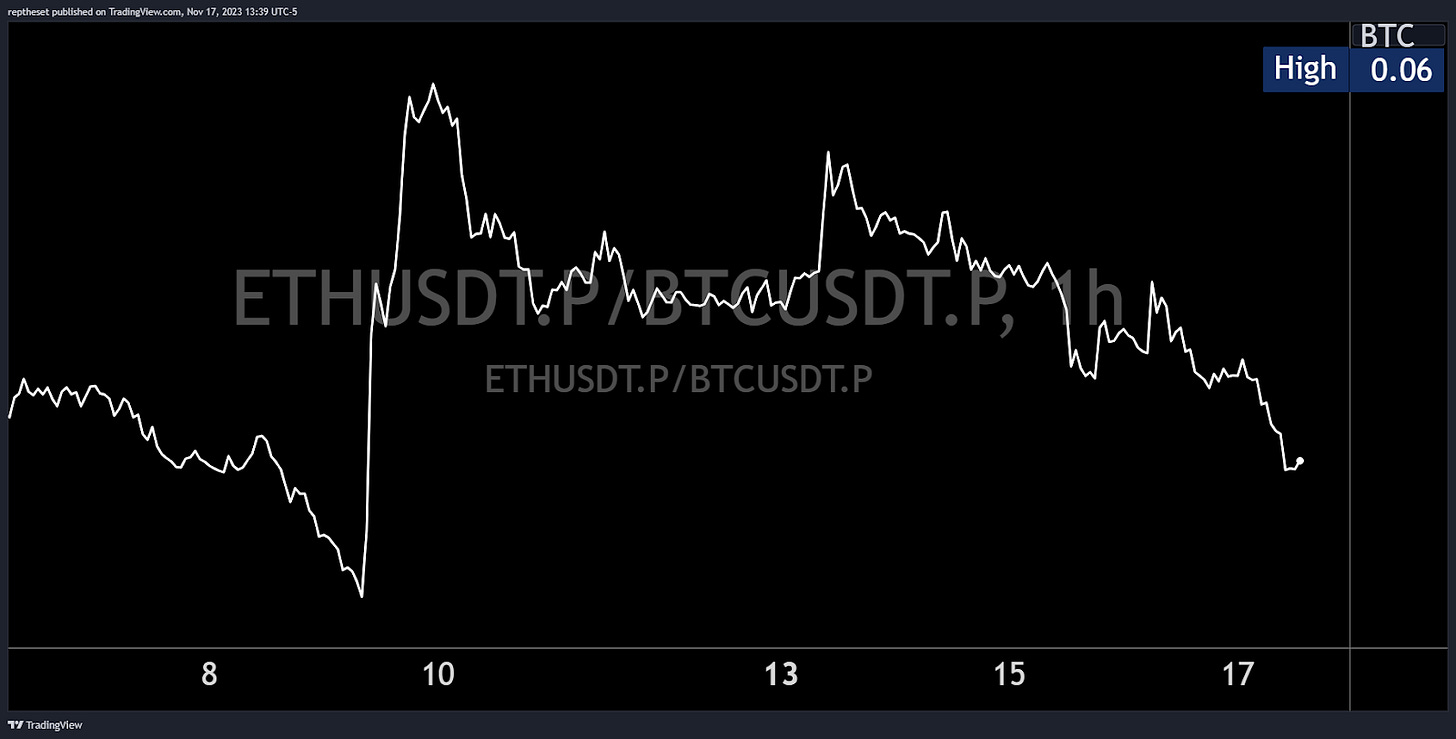

After last week's news of the Ethereum spot ETF filing from Blackrock that pumped ETH to ~$2135, market participants expecting a breakout from the merge highs were left disappointed as ETH failed to continue its momentum and found resistance at ~$2100 before retracing back to the initial spot ETF announcement price at ~$1920.

ETH/BTC has yet again failed to produce two consecutive daily green candles.

Macro/TradFi

Economic Data

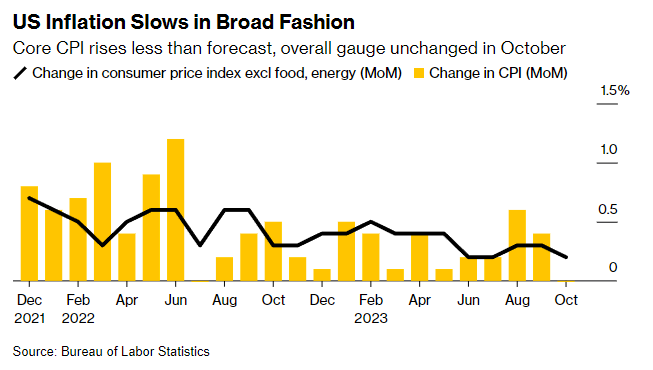

It's been a busy and interesting week with a lot of data to digest, marking the second time this year where we've witnessed macroeconomics fight flows.

All measures of inflation slowed broadly this week and came in below estimates. Consumer prices remained flat on a monthly basis, while core prices increased by 0.2% from September.

Owners' equivalent rent returned to 0.41%, producer prices experienced the largest decline since Covid, and the Fed's favorite inflation gauge, "Super Core," showed the weakest increase on an annual basis since December 2021.

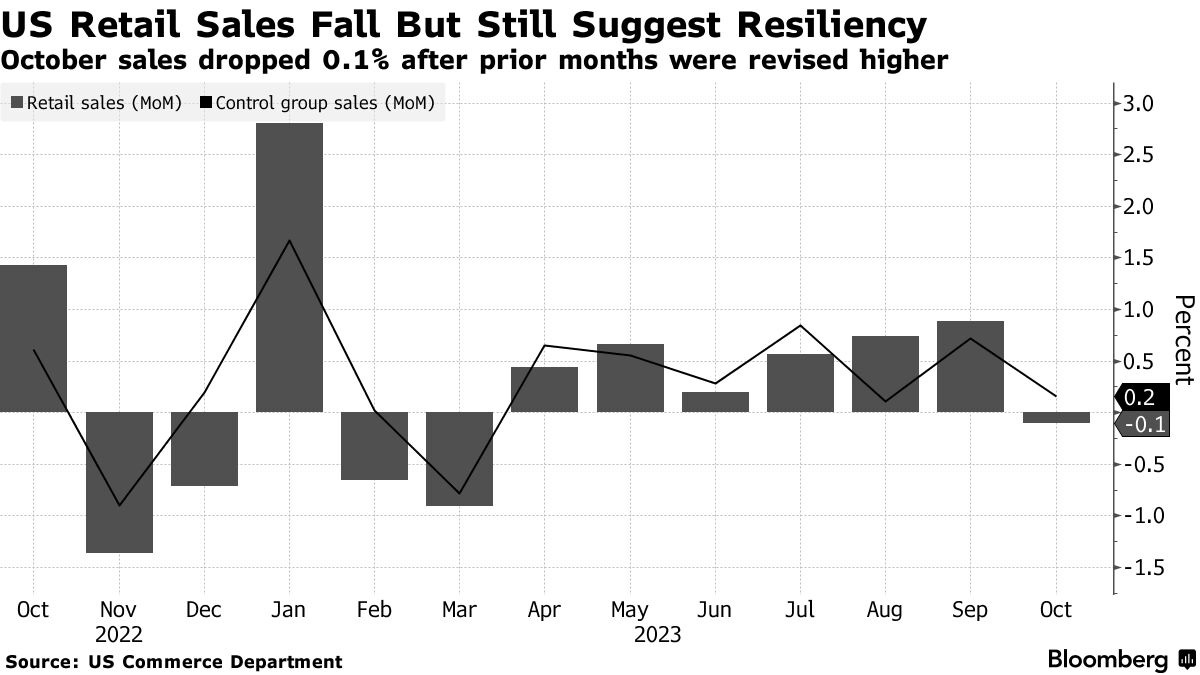

US retail sales decreased by 0.1% compared to last month. Both Target and Walmart experienced sales drops for a second consecutive quarter, indicating that consumers have begun tightening their belts and curbing spending on discretionary items. This trend suggests a potential downturn in economic activity.US retail sales decreased by 0.1% compared to last month.

According to the Labor Department, initial jobless claims rose to 231,000 in the week ending November 11, the highest level since August. Additionally, recurring jobless claims surged to the highest in two years, marking an eighth straight week of increases.

Oil is heading for a fourth consecutive weekly loss, sinking into a bear market and down more than 20% from September's high, signaling a recession ahead.

Stock & Bond Market

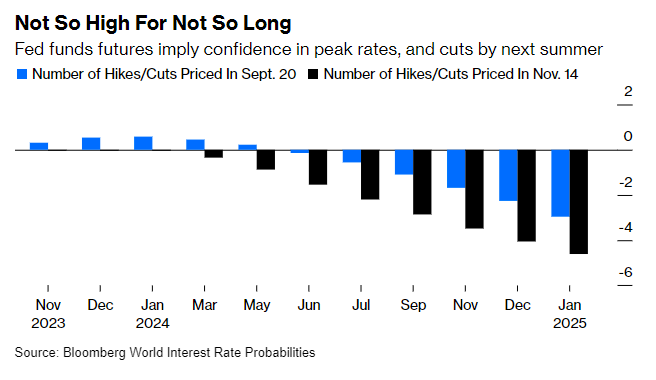

With optimism growing that a recession can be avoided and the Federal Reserve has concluded its rate-hiking campaign, investors have been heartened by this week's inflation data. Stocks and bonds soared after the CPI report, with S&P 500 futures up 1.3%, and yields plunging by as much as 20 bps in the most significant combined move in a year.

CTAs purchased nearly $70 billion in US equities, marking the largest 10-day buying spree on record. BofA saw $23.5 billion flowing into stock funds throughout November 15, the second-biggest inflow of the year.

Swaps have dropped from 14% for another rate hike in December to now 0%, and the first cuts of 50 bps are priced in for June. JPMorgan's treasury clients are the most outright long since 2010, and options linked to SOFR are targeting 50 bps rate cuts as early as March.

Central Banking

Nothing significantly new emerged this week from central bankers; the mantra remains unchanged. Everyone is pleased to witness cooling inflation, optimistic about avoiding a hard landing, but refraining from declaring victory over inflation.

Joachim Nagel from the German Bundesbank sums it up pretty good this morning, stating that interest costs have to remain at a high level for a sufficient time, while it is impossible to predict exactly how long this period will be.

Game of chicken, hold and see what happens, dampening vol.

Outlook For Next Week

With OpEx now completed, investors will be observing whether the significant call gamma wall gets rolled over higher or if traders choose to close their positions. We are entering a period of potential weakness, where markets move more freely, and supportive Vanna & Charm flows take a hiatus for the rest of the month.

Although cracks started to show in industrial production and jobless claims, this week again demonstrated that algos and sentiment keep moving alongside rates and haven't yet switched to recession fears — something to watch out for in the upcoming weeks.

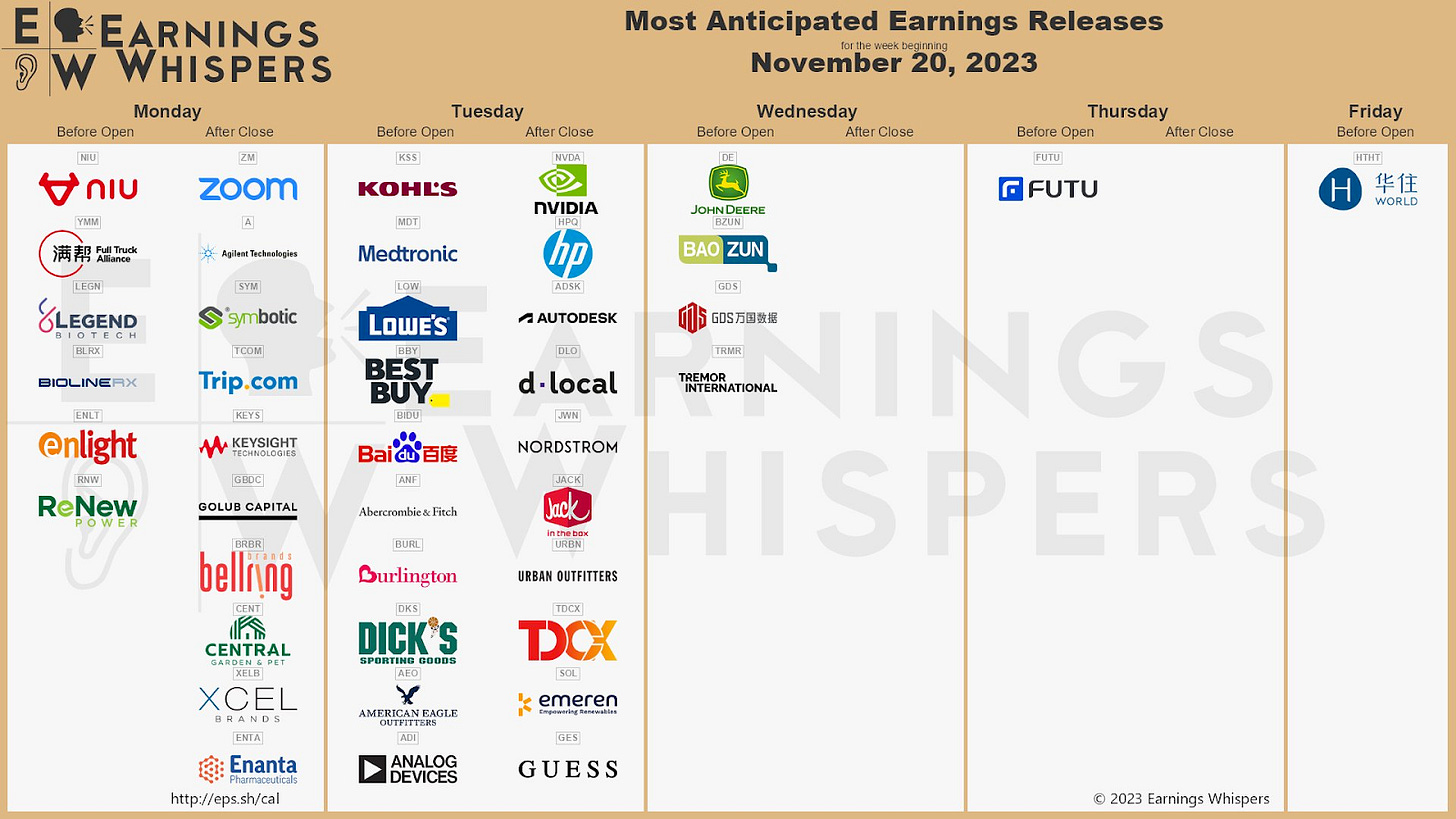

Focus next week will turn to Nvidia, whose quarterly earnings are due on Tuesday after the bell. With their stock closing at a record on Tuesday, the bar is set very high, and a slight disappointment in demand or export outlook will result in a narrative change.

With all call gamma expiring today and the Nasdaq flashing the first overbought signals, we expect more volatility, an unwind of long positions, more consolidation, and advise caution going into next week.

We will eventually get rate cuts, but headwinds from technical and macroeconomics are building. Thus, we watch out for further confirmation in consumer and labor data.

Key Events For Next Week

Monday:

China PBoC meeting

Germany PPI

US 20-Year Bond Auction

Tuesday:

US Existing Home Sales

FOMC Minutes

Wednesday:

US University of Michigan Inflation Expectations

US Durable Goods

Thursday:

Germany HCOB Composite & Services

EU HCOB Composite & Services

EU ECB Minutes

Friday:

Germany Q3 GDP

Germany IFO Expectations

US S&P Global Composite/Manufacturing/Services

Earnings

Trader Take @Dion

What do you think is a personality trait that a professional trader must have?

Patience and discipline.

Lack of patience and discipline can lead to making impulsive decisions and fomo, which results in increased risk. This will eventually hurt you in trading pnl.

If you implement self control into your daily life, good things will happen. The same goes for trading.

What is the best trading advice you’ve been given?

This may sound like a cliché, but the best trading advice I've received is to prioritize risk management over potential profits. Understanding and managing how much risk you are putting behind each trade is key.

What advice would you give to a beginner trader?

Trade a lot of small size trades. Even if it's a $10 position size. Don't be afraid to trade.

Experience only comes with screen time and trading experience. Just look at the chart, See how the market is moving during certain times/events/hours. Take note, and Adapt quickly to sentiment change.

If something isn't working for you, example: news trading, MA/EMA trading, ditch it!

Always have a plan when you enter a trade. What if things go south? ect.

Take notes on your execution after a trade, see where/what went wrong and always seek improvement. Don’t be afraid to ask questions and to learn from others, especially their mistakes.

Bitbit’s Note

My perspective through the week and during our daily market briefs was to minimize risk leading up to Thursday. That's precisely what many traders from our group and I did, staying up to date with the market’s pulse and events. Everyone had their eyes on the SEC's comments deadline today (Friday). This afternoon, we're starting to receive indications that things are returning to normal, SEC’s decision delayed (not yet confirmed), which is seen as a bullish headline. Hope and speculation remain alive as long as the ETF applications are still on the SEC's desk.

There are many events to look forward to in 2024. The Fed's easing and upcoming elections, the Bitcoin halving event, Garry Gensler leaving office,and the ETF’s decision deadline mid-March. All the stars seem to be aligning, and the moon narrative is alive and thriving.

All you need to do is to move slowly and avoid making impulsive decisions, as it won't be a straightforward upward trajectory. There will be a lot of choppy and volatile moments. By proceeding cautiously, you can avoid FOMO (Fear of Missing Out) and give yourself the opportunity to be well positioned when trading these markets.

About Us

Credo is a proprietary trading firm, specialized in digital asset trading and investing. The aim of Credo’s newsletter is to empower traders and investors by providing them with educational insights. In each issue, Credo delivers a concise yet comprehensive weekly recap of the latest developments in the crypto capital markets.

Contributors : @bitbitcrypto @reptheset55 @RealPropTrader @FoftyOerney @ahoras_ @Wassie2835 @marginsmall

Do Your Own Research!

This Newsletter is for educational purposes only. In no way do any of the statements written indicate investment or financial advice from CREDO. Cryptocurrencies are a highly volatile risky market class, and as such caution should be taken when investing in them. CREDO is not responsible for any financial gain or loss incurred by the readers of this newsletter, as its only purpose is to inform readers of events in the crypto capital markets.

Applaus 👏🏻 Dear dion I like your maind set about traiding👌🏼 ,pls share us more information about this stuffs and your experience in this way